Preamble

“How Trump’s Policies Are Reshaping Global Higher Education” This report examines the accelerating redistribution (poaching) of more than one million international students away from the United States as President Donald Trump’s second‑term immigration agenda intensifies. It assesses the immediate policy shocks—most notably the May 2025 Department of Homeland Security freeze on Harvard University’s ability to issue new I‑20 certificates—and maps the emerging opportunities for Canada, the United Kingdom, Australia, the European Union and a potential new entrant, China.

Key insights include:

• A data‑driven projection of enrolment shifts and their economic ramifications.

• An analysis of overt and covert recruitment tactics deployed by competitor nations.

• Actionable recommendations for universities and governments during the 2025–2028 window.

For deeper structural analysis and implementation, refer to the Appendix 2:

• Appendix A – PESTLE Analysis (2025–2028)

• Appendix B – Porter’s Five Forces assessment of global higher education

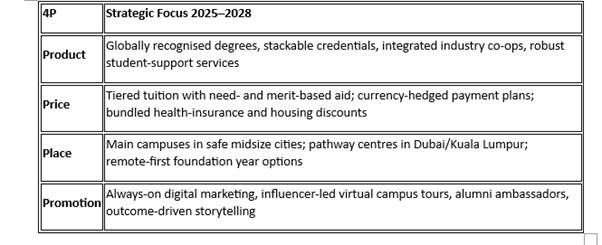

• Appendix C – Marketing Mix (4Ps) for international‑student recruitment

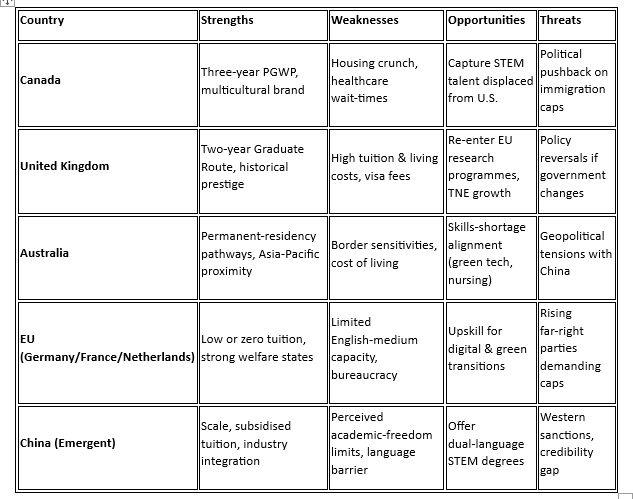

• Appendix D – SWOT comparison of major host nations

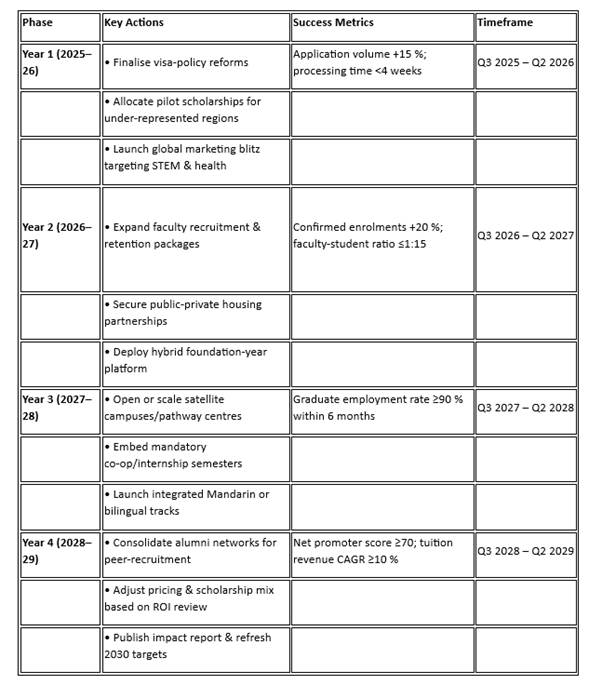

• Appendix E – Four‑Year Implementation Framework & Timeline (2025–2029 cohorts)

Together, the main report and its appendices form a comprehensive roadmap for policymakers, institutional leaders, and investors navigating the new international‑student gold rush.

See Substack article: The New International Student Gold Rush

Introduction : The Perfect Storm in American Higher Education

Donald Trump, now firmly into his second term, has moved from campaign‑trail warnings to concrete executive action. The latest jolt arrived on Thursday, when the Department of Homeland Security froze Harvard University’s authority to enrol new international students after the university pushed back against a sweeping federal records request. The unprecedented move underscores just how fragile the U.S. pathway has become for families abroad—and how quickly a single directive can upend even the most prestigious institutions. A prescient YouTube post by Kevin Walmsley on inside China Business US universities are recruiting Indian and Nigerian students to replace Chinese. It is not working. or Substack is a good summation of USA student enrolment situation.

The American Deterrent

Immediate risks now shaping student decisions

· Visa fragility: Harvard’s enrolment freeze serves as a cautionary tale. Expanded background vetting, stepped‑up site inspections and proposals to restrict Optional Practical Training (OPT) and H‑1B pathways amplify uncertainty.

· Social climate: Heightened anti‑immigration rhetoric and campus culture‑war flashpoints erode the sense of safety that once drew many international students.

· Financial exposure: Full‑fee students (often paying two to three times in‑state rates) face the prospect of sunk costs if sudden policy shifts force an early return home or cap work prospects.

· Academic‑freedom chill: Foreign students increasingly self‑censor on sensitive geopolitical topics following high‑profile incidents and federal scrutiny of research ties.

· Parental concern : Cost, Child safety, Possible Currency exchange instability, viable alternatives ,

Preapproval: At stake is international students in USA: The numbers were 1,057,188 in the 2022/2023 and increased in 2024. These student have been vetted by the united states on behalf of other countries, who will still vet but it speeds up process.

Spotlight: The Harvard Enrolment Freeze

On Thursday, Homeland Security delivered a blunt message: until Harvard complies with a contested records demand, no new I‑20 certificates may be issued. The freeze does not deport current students, but it blocks incoming cohorts for at least the 2025–26 cycle—sending shock waves through admissions offices worldwide. Competitor nations lost no time framing the episode as evidence that, under Trump, even elite U.S. campuses cannot guarantee continuity for international learners.

Why International Students Matter

Summary (See appendices: Appendix A for detailed analysis )

Beyond revenue, international cohorts fuel research output, start‑up formation and soft‑power networks. A sustained decline would widen skills gaps in AI, biotech and engineering while weakening American influence among future business and political leaders.

The Three‑Year Opportunity for Competitor Nations

The 2025–2028 electoral window offers a predictable period in which Trump‑era deterrence will likely persist. Parents who hesitate today will commit their children elsewhere by late 2026. Canada, the United Kingdom, Australia, Germany, France and the Netherlands are already tailoring recruitment campaigns that stress stability, post‑graduation work rights and—crucially—predictable visa regimes.

Overt strategies now visible

- Post‑study work guarantees: Canada’s three‑year PGWP and the UK’s two‑year Graduate Route headline marketing efforts.

- Streamlined visa processing: “Express study permits” in Canada and Australia promise decisions in as little as 20 days for low‑risk applicants.

- Targeted scholarships: Germany’s DAAD has doubled its budget for English‑language master’s programs; France’s “Bienvenue en France” fund covers living stipends for STEM admits.

Covert or softer tactics

• Faculty poaching from U.S. campuses—especially in semiconductor design, quantum computing and public‑health disciplines—to reassure students of world‑class teaching outside America.

• Satellite campuses and pathway programs that allow a first year in Dubai or Kuala Lumpur with an automatic transfer to a European degree once credits accumulate.

• Bundled immigration incentives—for example, Australia fast‑tracking permanent residency for graduates in nursing, IT security and green engineering.

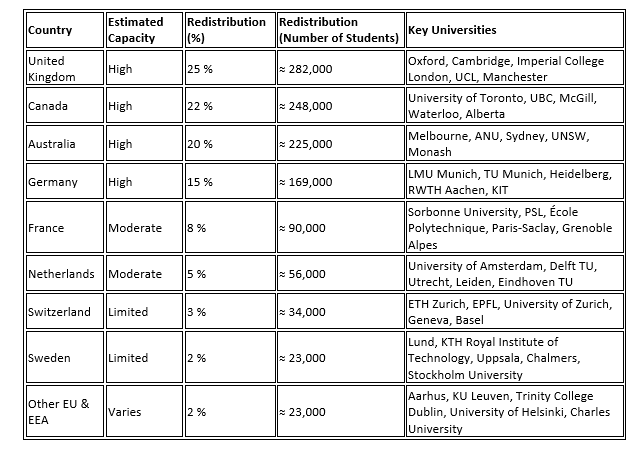

Potential Redistribution of 1.13 Million Students Currently in the U.S.

Capacity estimates combine existing infrastructure, government expansion pledges and private‑sector housing pipelines.

The China Factor

Can China take advantage ? Imagine China creating a “Global Talent Track” in select tier‑two cities. The concept pairs Western faculty on three – five‑year contracts with compulsory Mandarin coursework, giving graduates dual language fluency and direct exposure to China’s industrial ecosystem. Empty residential complexes offer ready‑made dormitories, underutilised office infrastructure and low tuition could undercut Western rivals by 40–60 %. Faculty poaching from U.S. and other countries campuses of English speaking or bilingual staff. If Beijing executes at scale, it could tilt the soft‑power balance by educating a generation of leaders with positive China experience.

Infrastructure and Quality Constraints

Even the most aggressive plans face bottlenecks:

• Faculty supply: Poaching from the U.S. solves quality but risks political backlash over talent raids.

• Housing inflation: Canada and Australia already face domestic criticism over student‑driven rent spikes.

• Language barriers: Non‑Anglophone Europe must expand English‑taught programs without degrading native‑language offerings.

• Political headwinds: Voters in several host nations are pressuring governments to cap international numbers, forcing a delicate balance between economic benefit and social cohesion.

Strategic Recommendations for Institutions

- Diversify recruitment beyond a single source market post recruitment from USA: Reliance on one country—whether China, India or Nigeria—exposes universities to geopolitical swings.

- Invest in holistic student support. Visa certainty must be matched by mental‑health services, career guidance and pathways to immigration.

- Leverage hybrid delivery. First‑year online or branch‑campus models expand capacity rapidly while major construction catches up.

- Forge industry partnerships. Co‑op placements with global firms make non‑U.S. degrees more attractive and ease employability worries.

Conclusion: A Transformative Moment

The Harvard enrolment freeze is a watershed, signalling that even storied U.S. universities are at the mercy of shifting federal priorities. Trump‑era deterrence has catalysed the most significant reshuffling of global student flows since the post‑9/11 visa clampdown. Nations that act decisively during the 2025–2028 window stand to capture billions in tuition, plug skills shortages and accrue enduring diplomatic capital. Those that hesitate may find the “new gold rush” claimed by more agile competitors—potentially including China, whose scale and resources could redefine where the world’s brightest students choose to learn.

Appendices

Appendix 1: Why International Students Matter

The Value Proposition: Why International Students Matter

International students represent a triple win for any country willing to welcome them:

· Economic Impact: These students bring substantial financial resources, often paying full tuition rates that subsidize domestic education systems.

· Talent Pipeline: They represent a pre-vetted pool of high-achieving individuals who could become valuable long-term residents and workers.

· Competitive Advantage: The United States has already invested in screening these students, demonstrating their academic capability, financial resources, and English proficiency.

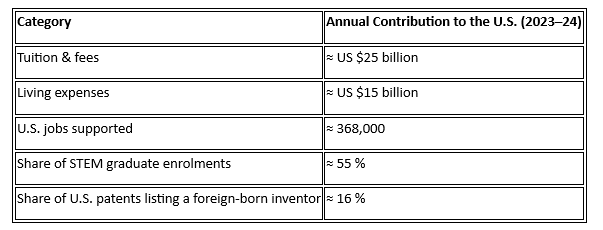

1. Financial Contributions (Tangible Benefits)

A. Direct Economic Impact (2023-2024 Estimates)

- Total Contribution:$40.1 billion (NAFSA, 2023)

- Tuition & Fees: ~$25 billion

- Living Expenses (housing, food, transportation): ~$15.1 billion

- Jobs Supported: ~368,000 (from education-related spending)

- State-Specific Gains:

- California: $6.1 billion (highest)

- New York: $5.3 billion

- Texas: $2.2 billion

B. Tuition Revenue for Universities

- Public Universities: Int’l students often pay 2-3x domestic tuition (e.g., $30K–$50K vs. $10K–$15K for in-state).

- Private Universities: Major revenue source (e.g., 20% of Harvard’s student body is international).

C. Additional Financial Benefits

- Startup Economy: ~25% of U.S. unicorn startups (valued at $1B+) have immigrant founders, many of whom were int’l students (NFAP, 2023).

- Tax Contributions: Optional Practical Training (OPT) participants pay income/Social Security taxes.

2. Intangible Benefits

A. Academic & Research Excellence

- STEM Workforce: ~55% of international students study STEM, filling critical gaps in tech/engineering.

- Research Output: Int’l students contribute to 30%+ of U.S. research publications (NSF data).

- University Rankings: Diversity boosts global rankings (QS/THE weigh int’l student ratios).

B. Soft Power & Diplomacy

- Alumni Influence: Leaders educated in the U.S. (e.g., IMF’s Kristalina Georgieva, NVIDIA’s Jensen Huang) foster pro-U.S. ties.

- Cultural Exchange: Promotes mutual understanding (e.g., Fulbright Program).

C. Innovation & Entrepreneurship

- Patent Filings: Int’l students and alumni are named on 16% of U.S. patents (2022 USPTO data).

- Job Creation: Immigrant-founded firms employ millions (e.g., Google, Tesla, Zoom).

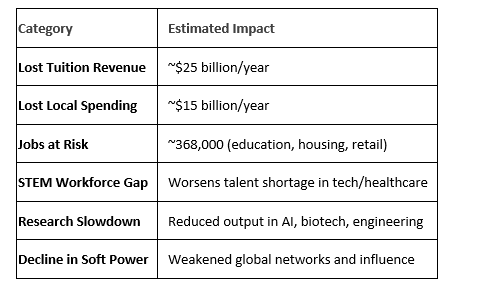

3. Potential Losses If Students Leave

2. Economic & Enrolment Consequences

A. Decline in International Student Numbers

- Projected Drop: Similar to 2016–2020, when new int’l enrolment fell by ~20% (IIE data).

- Shift to Canada/UK/Australia: Students may choose more welcoming destinations.

B. Financial Losses for Universities

- Lost Revenue: Public universities relying on out-of-state tuition could face budget cuts.

- Program Closures: Some graduate STEM programs (dependent on int’l students) may shrink.

C. Local Economic Impact

- Reduced Spending: Fewer students = less revenue for housing, retail, and transportation sectors.

- Job Losses: Universities and related industries may lay off staff.

3. Geopolitical & Diplomatic Effects

A. U.S. Soft Power Decline

- Fewer Future Leaders with U.S. Ties: Reduced influence in global business/politics.

- China/Russia Benefit: Competitors may attract talent with friendlier policies.

B. Impact on Research & Innovation

- STEM Brain Drain: Fewer international researchers in AI, biotech, engineering.

- Slower Patent Growth: Since 16% of U.S. patents involve foreign-born inventors.

Note: There was a very good video on YouTube on inside China business two weeks ago calledUS universities are recruiting Indian and Nigerian students to replace Chinese. It is not working. By Kevin Walmsley this was before the latest Trump Havard policies

Appendix 2: Analysis and Roadmap

Appendix A: PESTLE Analysis (2025–2028)

Political – U.S. visa volatility under Trump; competitor nations liberalising study‑migration routes; rising nationalist parties in Europe pressuring intake caps.

Economic – International tuition remains a counter‑cyclical revenue stream; foreign exchange swings and inflation squeeze family budgets; housing shortages drive living‑cost spikes.

Social – Safety perceptions, mental‑health expectations and DEI commitments shape destination choice; Generation Z and Alpha prioritise social impact and peer networks.

Technological – AI‑driven admissions, predictive analytics for retention, hybrid delivery platforms and VR campuses lower physical‑capacity constraints.

Legal – Tightened export‑control rules, data‑privacy mandates (GDPR, CPRA) and research‑security audits complicate collaborations; evolving ESG disclosure rules affect campus sustainability.

Environmental – Climate‑risk rankings and net‑zero pledges influence campus selection; extreme‑weather events create new seasonal disruption risks.

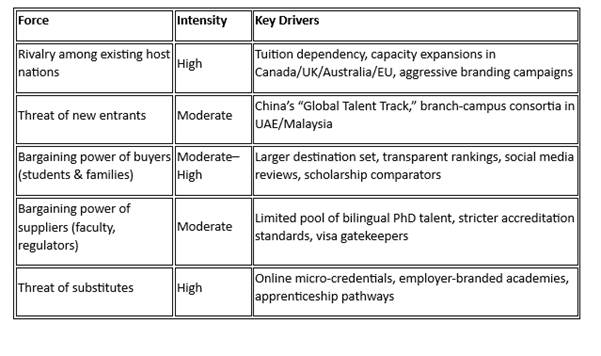

Appendix B: Porter’s Five Forces – Global Higher‑Education Market for International Students

Appendix C: Marketing Mix – 4Ps for International‑Student Recruitment

Appendix D: SWOT Analysis – Competitor Nations vs. United States

Appendix E: Four‑Year Implementation Framework & Timeline (2025–2029 Cohorts)

Governance: Steering committee meets quarterly; KPIs reviewed semi‑annually with mid‑course corrections authorised at dean/provost level.