Preamble,

This paper turns a simple idea into a plan. You visited Soho House, Soho House |Members’ Clubs you saw what works, and you want to build a stronger competitor. The pages that follow benchmark the category, outline a differentiated concept, and set clear financial and operating guardrails to move from idea to investable venture. The analysis and the Atelier Club blueprint was drafted to anchor this work.

Analysis: Soho House Market Analysis below and Competitor framework (appendices) and outline proposal: The Atelier Club , Atelier Micro : Atelier Micro

Analysis: Soho House Market Analysis: Investment & Strategic Assessment

Executive Summary

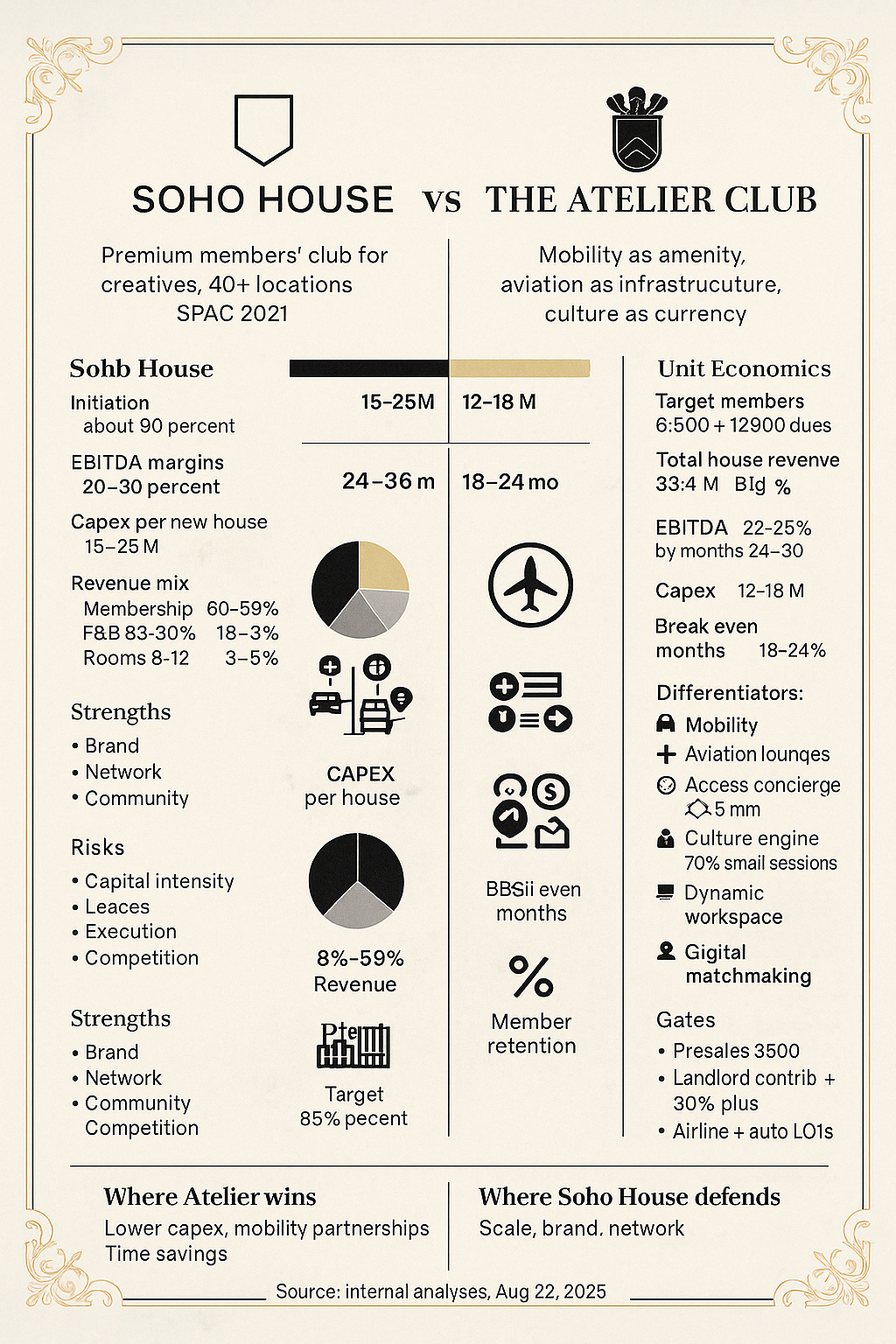

Soho House operates a premium members’ club concept targeting creative professionals, with 40+ global locations and a market capitalization of approximately $400M (as of recent trading). The company went public via SPAC merger in 2021, providing transparency into a traditionally opaque luxury hospitality sector.

Market Position Analysis

Core Business Model

- Revenue Streams: Membership fees (recurring), food & beverage, accommodation, events

- Target Demographics: Creative professionals, media executives, entrepreneurs (ages 25-45)

- Geographic Footprint: Major global cities with creative economies (London, NYC, LA, Berlin, Mumbai)

- Pricing Strategy: Premium positioning with initiation fees ($1,800-$3,200) and annual dues ($2,400-$4,800)

Financial Performance Metrics

- Revenue Growth: Strong pre-pandemic trajectory, recovery post-2022

- Member Retention: High retention rates (~90%+) indicating strong value proposition

- Unit Economics: Mature houses show strong EBITDA margins (20-30%)

- Expansion Costs: High upfront capital requirements ($15-25M per new house)

Competitive Landscape Analysis

Direct Competitors

1. Traditional Private Clubs

- Examples: The Yale Club, Union Club, Country clubs

- Advantages: Established prestige, lower operational costs, property ownership

- Disadvantages: Aging membership, limited geographic reach, outdated amenities

2. Co-working/Social Clubs

- Examples: WeWork, The Wing, NeueHouse

- Advantages: Lower membership fees, flexible terms, tech-forward approach

- Disadvantages: Less exclusive, limited F&B offerings, weaker community bonds

3. Luxury Hotels/Hospitality

- Examples: Edition Hotels, 1 Hotels, boutique properties

- Advantages: No membership barriers, broader market appeal

- Disadvantages: Less community aspect, higher per-visit costs

Competitive Advantages

- First-mover advantage in creative professional segment

- Global network effect – membership works across all locations

- Curated community creates significant switching costs

- Integrated hospitality offering (clubs + hotels + restaurants)

- Strong brand recognition in target demographic

Market Opportunities

1. Geographic Expansion

Untapped Markets:

- Asia-Pacific: Tokyo, Sydney, Singapore expansion opportunities

- Secondary US Cities: Austin, Nashville, Portland – growing creative hubs

- Emerging Markets: Mexico City, São Paulo, Cape Town

Revenue Potential: Each new market represents $20-40M annual revenue opportunity

2. Demographic Expansion

Adjacent Segments:

- Tech Entrepreneurs: Overlapping but distinct from traditional creatives

- Luxury Travelers: Premium nomadic professionals

- Corporate Partnerships: Company memberships for creative agencies

3. Digital/Virtual Offerings

Opportunities:

- Virtual events platform for global member engagement

- Digital content creation and member-generated content

- E-commerce platform for Soho House branded products

- Soho House streaming service leveraging screening room content

4. Ancillary Revenue Streams

New Concepts:

- Soho House Residences: Long-term luxury housing for members

- Soho House Wellness: Spa and fitness concept expansion

- Soho House Workspace: Day-use co-working for non-members

- Event Hosting Services: Corporate retreats and private events

Novel Applications & Innovation Opportunities

1. Hybrid Membership Models

- Tiered Access: Different membership levels with varying privileges

- Flexible Memberships: Seasonal or project-based memberships for freelancers

- Corporate Packages: Team memberships for creative agencies

2. Technology Integration

- AI-Powered Matching: Connect members with similar interests/projects

- Augmented Reality: Virtual house tours and remote participation

- Blockchain/NFT Integration: Digital membership tokens and exclusive content

3. Sustainable Luxury

- Carbon-Neutral Operations: Appeal to environmentally conscious creatives

- Local Sourcing: Community-focused F&B and art curation

- Circular Economy: Furniture rental and sustainable design practices

Profitability Analysis

Revenue Drivers

- Membership Fees: 60-65% of revenue, highly predictable

- Food & Beverage: 25-30% of revenue, higher margins

- Accommodation: 8-12% of revenue, premium pricing

- Events & Other: 3-5% of revenue, high-margin services

Cost Structure

- Real Estate: 30-35% of revenue (rent/property costs)

- Labor: 25-30% of revenue (service-intensive model)

- F&B Costs: 8-12% of revenue

- Marketing/Member Acquisition: 3-5% of revenue

Path to Profitability

Mature Houses: 20-30% EBITDA margins after 2-3 years of operation New Openings: Break-even typically achieved in year 2-3 Scale Benefits: Corporate overhead leverage improves with expansion

Investment Thesis

Bull Case Arguments

- Recession-Resilient Model: High-income creative professionals maintain memberships

- Global Network Effects: Each new location increases value for existing members

- High Switching Costs: Strong community bonds create member loyalty

- Expanding Creative Economy: Growing target demographic globally

- Multiple Expansion Opportunities: Geographic, demographic, and service expansion

Bear Case Considerations

- Economic Sensitivity: Luxury spending vulnerable in downturns

- High Capital Requirements: Significant upfront investment for expansion

- Execution Risk: Maintaining culture and quality across global expansion

- Competition: WeWork and co-working spaces targeting similar demographics

- Real Estate Risk: Long-term lease commitments in premium locations

Strategic Recommendations

For Soho House Management

- Accelerate Asia-Pacific Expansion: Capitalize on growing creative economies

- Develop Digital Platform: Create virtual community engagement tools

- Introduce Flexible Memberships: Capture gig economy professionals

- Expand Ancillary Services: Wellness, co-working, and residential offerings

For Investors

- Long-term Growth Play: Strong fundamentals but requires patient capital

- Monitor Unit Economics: Focus on mature house performance metrics

- Real Estate Strategy: Evaluate lease vs. ownership decisions

- Competitive Positioning: Track market share in key creative hubs

Market Valuation Framework

Key Valuation Metrics

- EV/Revenue Multiple: 2-3x revenue (comparable to premium hospitality)

- EV/EBITDA Multiple: 15-20x (reflecting growth premium)

- Price per Member: $8,000-$12,000 per member globally

Fair Value Range

Based on discounted cash flow analysis and comparable company multiples: Base Case: $600-800M enterprise value Bull Case: $1.0-1.2B (successful global expansion) Bear Case: $300-400M (limited growth, competitive pressure)

Conclusion

Soho House represents a unique investment opportunity in the luxury hospitality sector, with a differentiated business model targeting an underserved but affluent demographic. The company’s global expansion potential, strong unit economics at mature locations, and significant barriers to entry create a compelling long-term investment thesis, albeit with meaningful execution risks and capital requirements.

Appendices : Competitor : Venture Blueprint: A New Competitor to Soho House

1) Concept and Positioning

- Name placeholder: Atelier Club. see

- Core idea: A travel‑grade, partnership‑driven members club that blends hospitality, workspace, culture, and mobility. You get a curated network of houses, transit perks, and premium brand access in one membership.

- Target member: 27 to 50, creative leaders, founders, investors, culture shapers. Global, high intent travelers.

- Promise: Save members time, expand access, and increase serendipity. Deliver best‑in‑city spaces, movement, and moments.

2) Differentiators and Novel Services

- Mobility as an amenity

- Premium auto partners for on‑demand test drives, airport transfers, and weekend escapes.

- EV fast charging in‑garage. Valet and detailing credits.

- Micro‑pavilions in clubs where partners rotate new models with interactive brand labs.

- Aviation stack

- Airline status matches, mileage boosts, priority waitlist, and irregular‑ops recovery line.

- Co‑curated airport suites in key hubs with day‑use work pods and showers.

- Seasonal member fly‑ins that anchor club pop‑ups and residencies.

- Concierge for access

- Citywide access layer that books private galleries, studios, rehearsal spaces, chef tables, and hidden venues.

- 24 by 7 messaging. Guaranteed doors‑open inventory across a partner grid.

- Curated culture engine

- Weekly small‑format sessions. Craft, critique, and collaboration labs.

- Patron tier funds emerging artists, chefs, and makers in residence.

- Workspace that breathes

- Quiet carriages by day, salon energy by night. Booking controls that turn over space with intent.

- Project rooms with gear closets, podcast suites, mini edit bays, maker corners.

- Digital layer

- Interest graph that matches people to people, projects, and perks.

- Member‑only marketplace for commissions, pop‑ups, and collabs.

3) Product and Amenities

- Houses: 35 to 60 thousand square feet. Restaurant, library, studio, wellness, roof or garden, 30 to 60 keys of rooms when viable.

- Wellness: Heat and cold therapy, PT and recovery lab, sunrise and nightcap classes.

- F&B: Two outlets per site. One all‑day, one chef‑led concept with seasonal residencies.

- Events: 12 to 18 touchpoints per week per house. 50 percent member‑generated.

- Family and youth windows: Select weekend blocks. Clear noise and flow rules.

4) Membership and Pricing

- Tiers:

- Core, access to one city cluster.

- Global, all houses and travel perks.

- Patron, culture fund, concierge priority, private dining inventory.

- Add‑ons: Partner garage plan. Airline elite accelerator. Room credits pack.

- Controls: Invite and referral gating. Trial via hosted salons.

5) Partnerships and Synergies

- Premium auto

- Co‑branded urban mobility credits. Member test days. Track and off‑road experiences.

- Performance labs, design talks, and heritage showcases.

- Airlines

- Fare class upgrades, route launches with member previews, and content partnerships.

- Joint airport suites and disruption support line.

- Hospitality and venues

- Overflow room blocks with boutique hotels. Private venue share for concerts and screenings.

- Creators and institutions

- Museum after‑hours, university labs, and studio residencies.

6) Site Selection Strategy

- City tiers and entry logic

- Tier A global hubs with high creative GDP and strong air connectivity.

- Tier B rising hubs with favorable rents and fast talent growth.

- Resort satellites that fill seasonal calendars and sponsor patron trips.

- Micro‑location filters

- Ten minute walk to art, media, and design clusters.

- Existing or convertible parking for the mobility program.

- Ceiling height, roof or courtyard potential, acoustic control, venting for two kitchens.

- Mixed use zoning, later trading hours, licensing path inside 6 months when possible.

- Launch path suggestion

- Wave 1: London East, Austin South Central, Singapore Downtown Core.

- Wave 2: Mexico City Roma Norte, Dubai Design District, Berlin Kreuzberg.

7) Unit Economics and Model Guardrails

- CapEx per house target: 12 to 18 million through landlord contributions, asset‑light interiors, modular fit‑out.

- Revenue mix at scale: 55 to 60 percent membership, 20 to 25 percent F&B, 10 to 15 percent experiences and events, 5 to 10 percent partnerships and brand activations.

- Membership base per house: 5,000 to 8,000 paying members depending on size and city.

- EBITDA target: 22 to 28 percent in months 24 to 30 post‑opening.

- Break‑even: Months 18 to 24 with staged ramp of floors and outlets.

- Cash discipline: Pre‑sold founder lots. Partner funded showrooms. Dynamic opening calendar to load demand.

8) Weaknesses to Exploit in Incumbent Models

- High upfront capital and heavy lease liabilities.

- Limited mobility and aviation integration.

- Digital community underused versus physical footprint.

- Event calendars skew to social, less to making and collaboration.

- Brand dilution risk when scaling quickly.

Countermoves

- Asset‑light real estate and revenue share with landlords.

- Partner‑financed mobility and aviation layers that also acquire members.

- A strong digital matchmaker that converts to real projects and commissions.

- Member‑generated programming tracked to outcomes, not only attendance.

9) Stakeholder Map and Analysis

- Members: Seek access, time savings, status, and output. Segment by creator type and travel intensity.

- Investors: Seek moderate risk with steady cash yields, and brand equity growth.

- Landlords and cities: Seek activation, footfall, and safe night‑time economy.

- Premium auto and airlines: Seek qualified demand, data, and halo effects.

- Staff and creators in residence: Seek careers, credits, and audiences.

- Neighbors and regulators: Seek noise and traffic control, and community access windows.

Engagement plans

- Member councils per house. Quarterly investor open books.

- Local hiring and creator residencies tied to neighborhoods.

- Mobility and noise covenants, with annual reports.

10) Operating Model

- General Manager triad: Hospitality lead, culture lead, partnerships lead.

- Concierge desk: Hybrid human plus software. Citywide inventory pipes. SLA backed.

- Programming studio: 3 to 5 curators per region. 70 percent small rooms, 30 percent headline moments.

- Data and CRM: Interest graph, partner tags, and project boards. Privacy by design.

- Safety and compliance: Clear guest rules, digital incident logging, quarterly drills.

11) Financial Plan Snapshot

- Per house steady state

- Members: 6,500 at blended 2,900 annual dues.

- Membership revenue: 18.9 million.

- F&B revenue: 8.0 million.

- Experiences and events: 4.0 million.

- Partnerships and activations: 2.5 million.

- Total: 33.4 million.

- EBITDA at 25 percent: 8.4 million.

- Corporate layer

- Lean HQ, regional pods. Overhead below 8 percent of revenue at 6 houses.

12) Go‑to‑Market and Rollout

- Phase 0: Shadow community building, pop‑ups, and supper clubs.

- Phase 1: First house, full partner stack in one city. Target 4,000 pre‑sold members.

- Phase 2: Two houses in complementary time zones. Airport suite pilot.

- Phase 3: Six houses and three airport suites. Introduce Patron trips.

13) KPIs

- Paid members, ARPU, and retention.

- Utilization by room type and daypart.

- Event yield and member‑generated share.

- Partner activation revenue and NPS.

- Time to wait for concierge access.

- Staff engagement and creator placements.

14) Risk and Mitigation

- Macro slowdown: Pre‑sold tiers, flexible dues, and partner offsets.

- Culture dilution: Member councils, curator tenure, and acceptance rate guardrails.

- Lease risk: Break clauses, variable rent, and ownership options case by case.

- Safety and nuisance: Acoustic build, traffic plans, and family windows.

- Partner conflicts: Category exclusivity with performance gates.

15) Next Steps

- Build partner pipeline brief for two premium auto brands and one airline alliance.

- Run a pop‑up month to validate demand, capture 1,000 deposits, and prove concierge SLAs.

- Lock first site term sheet with landlord contribution and revenue share.

- Stand up data and CRM with consented profiles and project boards.