Vision: Textile Circularity 2.0

To transform the UK and EU’s discarded textile waste from an environmental liability into a premium, profitable resource. By leveraging advanced automation and data-rich traceability, we will become the leading producer of high-value, certified circular materials for the built environment, automotive, and consumer goods industries. Our vision is a world where every garment has a next life engineered into a valuable product, creating local jobs, reducing carbon footprints, and setting a new global standard for textile circularity.

The Playbook: A Tiered, Tech-Driven Strategy

This playbook outlines the core strategic pillars to execute the vision.

Pillar 1: Tech-Enabled Feedstock Security

- Action: Secure a consistent, low-cost supply by positioning as a waste solution. Offer councils, charities, and brands an intake fee significantly below the landfill tax (£126.15/tonne in 2025) and Energy-from-Waste gate fees.

- Tool: Use MOUs and long-term contracts to guarantee volume.

Pillar 2: Automated & Data-Rich Processing

- Action: Implement a modular technology stack that scales with site size.

- Sorting: Near-Infrared (NIR) sorters (e.g., Fibersort-class) for fibre type and colour at ~900 kg/hr.

- Tracking: QR/barcode batch logging from intake to final product.

- Manufacturing: Hot-press systems for panels/boards, cold-press for hybrid blocks.

- Tool: Invest in the core kit outlined for micro-hubs, city plants, and regional campuses.

Pillar 3: Product-Market Fit with Premium Positioning

- Action: Prioritize products with proven demand, strong margins, and a compelling sustainability story. Avoid commodity markets where price is the only differentiator.

- Tool: Focus on the “Priority Products” list: Acoustic Panels, Design Boards, Packaging Pads, and Automotive Felts.

Pillar 4: Digital Product Passports (DPP) as a Competitive Advantage

- Action: Embed DPP (QR codes) into every product from day one. Store data on composition, carbon footprint (CO2e), and certification results.

- Tool: This future-proofs for EU Ecodesign regulations (2027) and is a powerful marketing tool for B2B clients and conscious consumers.

Pillar 5: Phased Scaling for De-risked Growth

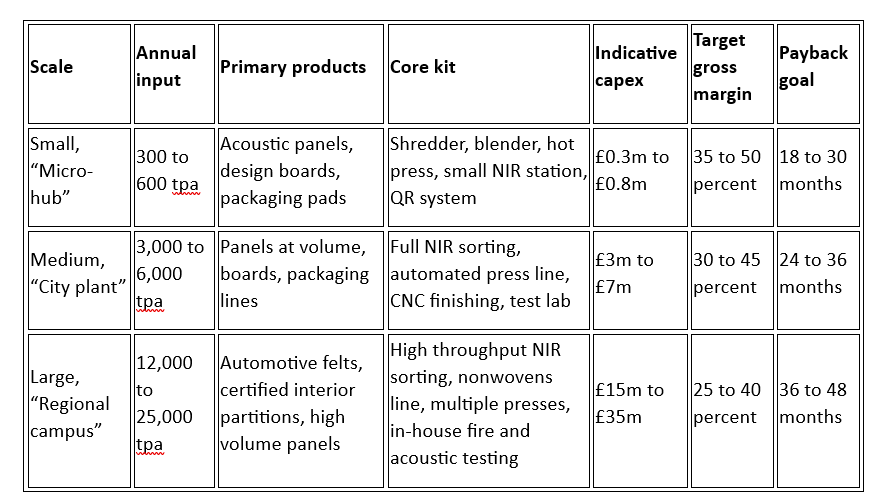

- Action: Start small with a “Micro-hub” to prove technology, product quality, and unit economics. Use the profits and data to fund expansion to medium and large sites.

- Tool: Follow the scale options table, focusing on rapid payback (18-30 months) at the small scale first.

Input Selection Criteria

Use these criteria to evaluate and prioritize opportunities.

1. Feedstock Selection:

- Quality: Prioritize consistent, high-volume streams from councils and national charities. Avoid heavily contaminated streams initially.

- Fibre Type: Cotton and denim are ideal for non-woven products (panels, boards). Polyester is key for fibre-to-fibre recycling partnerships.

- Cost: Must be available at a fee ≤ £60/tonne to protect margin, well below the landfill tax.

2. Product Selection:

- Margin Potential: Target gross margins of 35-50%. Favour products with value-added design and performance stories (e.g., acoustic panels over industrial wipes).

- Market Demand: Prioritize products with existing, large markets (e.g., UK office fit-out, e-commerce packaging).

- Regulatory Alignment: Products that help customers meet sustainability targets and future DPP requirements are preferred.

- Technical Feasibility: Start with products that can be made with the core “shred-blend-press” technology stack.

3. Offtake Partner Selection:

- Creditworthiness: Stable, established businesses.

- Volume Commitment: Preference for partners willing to sign rolling call-off orders or annual contracts.

- Value Alignment: Partners who value and will market the recycled content and DPP story, not just price.

- Channel Access: Distributors with existing routes to market (e.g., acoustic installers) are ideal.

4. Site Location Selection:

- Proximity to Feedstock: Minimize transport costs by being near urban centres or charity sorting hubs.

- Proximity to Market: For bulky products like panels, being near construction and manufacturing hubs reduces logistics expense.

- Utilities & Space: Ensure adequate power (for presses) and space for feedstock storage and expansion.

Product Selection Criteria

To maximize profitability and de-risk the business, potential products should be evaluated against the following four criteria:

1. Margin Potential

- What it is: The ability to generate high gross profit margins (targeting 35-50%+).

- How to measure:

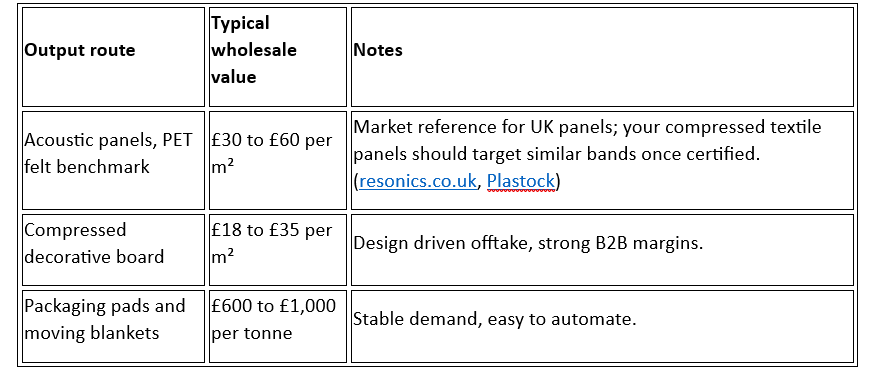

- High Value per m²/kg: Products like acoustic panels (£30-£60/m²) and decorative boards (£18-£35/m²) are preferred over low-value products like industrial rags.

- Low Variable Costs: The cost of binders, energy, and processing should be low relative to the selling price (aiming for variable costs of £400-£700 per tonne of input).

- Why it matters: High margins protect the business from market fluctuations, cover operational costs, and provide capital for reinvestment and scaling.

2. Market Demand & Scalability

- What it is: The existence of a proven, large-scale market with consistent demand.

- How to measure:

- Proven Buyers: Target industries with existing offtake partners, such as:

- Built Environment: Office fit-out, education, and construction for acoustic and wall panels.

- Packaging: E-commerce, grocery, and logistics for insulation pads and moving blankets.

- Automotive: Tier 1 suppliers for interior felts and panels (at large scale).

- Scalable Volume: The market should be able to absorb increasing volumes as you scale from a micro-hub to a regional campus.

- Proven Buyers: Target industries with existing offtake partners, such as:

- Why it matters: Building a product no one wants to buy in volume is the fastest path to failure. Proven demand reduces commercial risk.

3. Regulatory & Compliance Alignment

- What it is: The product’s ability to meet existing regulations and leverage upcoming policy shifts as a competitive advantage.

- How to measure:

- Certifiability: Can it be easily tested and certified to required standards?

- Acoustic Performance: BS EN ISO 354

- Fire Safety: EN 13501-1 for interior use.

- DPP Readiness: Does the product benefit from the “story” told by a Digital Product Passport (DPP)? Can its ESG credentials (CO2e savings, composition) be marketed to B2B buyers and help them comply with EU Ecodesign rules (2027)?

- Certifiability: Can it be easily tested and certified to required standards?

- Why it matters: Compliance is non-negotiable for market access. Proactively embracing DPP transforms a regulatory cost into a unique selling proposition.

4. Technical Feasibility

- What it is: How well the product fits with the core “shred-blend-press” technology stack and available feedstock.

- How to measure:

- Process Fit: Can it be made efficiently with automated sorting (NIR), shredding, blending with binders, and pressing?

- Feedstock Fit: Is it best made from the dominant fibres in the waste stream (e.g., cotton, denim, polyester) that NIR sorters can identify?

- Capital Efficiency: Does producing it require minimal additional, specialized equipment at the pilot stage?

- Why it matters: Complex, untested manufacturing processes increase technical risk, capex, and time to market. The initial focus should be on products that leverage the core technology.

Application of the Criteria: Priority Products

Using these criteria, the business case clearly identifies the winning products to launch first:

- Interior Acoustic Panels & Baffles

- Margin: High (£30-£60/m²).

- Market: Large, proven demand from offices, schools, studios.

- Compliance: Clear pathway to certification (ISO 354, EN 13501-1).

- Feasibility: Perfect fit for the shred-press process; competes with existing PET felt panels.

- Compressed Decorative Boards (for furniture & walling)

- Margin: High (£18-£35/m²), design-driven.

- Market: Strong B2B demand for sustainable building materials.

- Compliance: Benefits hugely from DPP storytelling (QR codes with batch data).

- Feasibility: Uses the same core process as acoustic panels.

- Packaging Pads & Moving Blankets

- Margin: Good (£600-£1,000/tonne), stable.

- Market: Large, consistent demand from e-commerce and logistics.

- Compliance: Less stringent than building materials.

- Feasibility: Very easy to automate and produce.

- Automotive Interior Felts & Panels (at large scale)

- Margin: Competitive (25-40% at scale), volume-driven.

- Market: Massive offtake potential from Tier 1 suppliers.

- Compliance: Must meet strict automotive industry standards.

- Feasibility: Requires high-volume nonwovens line; a goal for Phase 3.

Products to Avoid (Initially):

- Fashion-to-Fiber Recycling (e.g., new yarns): High technical complexity and capex. Better to partner with specialists like Project Re:claim.

- Low-Value Goods (e.g., industrial wipes): Commoditized market with low margins, fails the Margin Potential criterion.

Profitability Pathway

A phased approach to building a profitable and scalable operation.

Phase 1: Micro-Hub Pilot (Months 0-12)

- Goal: Prove unit economics, secure supply/offtake, and generate cash flow.

- Scale: 300-600 tonnes/year input.

- Products: High-margin Acoustic Panels & Design Boards.

- Financials:

- Capex: £0.3m – £0.8m.

- Revenue: £3,000 – £5,000/tonne of input.

- Target: Achieve 35-50% gross margin and positive cash flow for a 18-30 month payback.

- Key Actions: Secure 2 council MOUs, lock in 2 offtake partners, complete fire and acoustic certifications.

Phase 2: City Plant Scale-Up (Year 2-3)

- Goal: Achieve volume efficiency and expand product lines.

- Scale: 3,000-6,000 tonnes/year input.

- Products: Add Packaging Insulation lines and volume panel production.

- Financials:

- Capex: £3m – £7m (funded by Phase 1 profits and debt/investment).

- Target: Maintain 30-45% gross margin with a 24-36 month payback on new capital.

- Key Actions: Install full-scale NIR sorting, automate press lines, begin DPP data collection for EU market.

Phase 3: Regional Campus Dominance (Year 4+)

- Goal: Become a key supplier to major industries and capture maximum value from feedstock.

- Scale: 12,000-25,000+ tonnes/year input.

- Products: Add Automotive Felts, Certified Interior Partitions, and Textile-to-Fiber recycling.

- Financials:

- Capex: £15m – £35m (likely requires significant project financing).

- Target: 25-40% gross margin on high-volume, competitive products, with a 36-48 month payback.

- Key Actions: Secure contracts with automotive Tier 1 suppliers, achieve full DPP compliance for EU sales, integrate in-house testing labs.

Continuous Profitability Levers:

- Intake Revenue: Maintain intake fees below landfill tax, turning a cost centre into a revenue line.

- Premium Pricing: Use certification (fire, acoustic), DPP data, and design to avoid commodity price compression.

- Yield Optimization: Continuously refine shredding, blending, and pressing to maximize m² output per tonne of input.

- Product R&D: Develop higher-value “Novel Products” (e.g., structural blocks, composites) to future-proof margins.

Appendices

Outline Business case, UK: Profitable reuse of discarded textiles with tech and automation

Executive summary

The UK generated about 1.45 million tonnes of used textiles in 2022. About 711,000 tonnes still went to landfill or incineration. This is both a supply of feedstock and a cost burden for councils and brands. You can monetise this stream by converting low grade textiles into higher value products with automated sorting, data rich batch tracking, and modular manufacturing. (wrap.ngo)

Your fastest, most profitable path in the UK uses a tiered plant model:

- Small sites sell high margin interior acoustic panels and boards to office fit out and education.

- Medium sites add packaging insulation and furniture boards.

- Large sites add automotive interior felts and certified interior partitions.

You also create an intake revenue stream by pricing below landfill. The standard landfill tax rises to £126.15 per tonne on 1 April 2025, before any site gate fee. That makes councils and brands price sensitive to cheaper, credible alternatives. (GOV.UK)

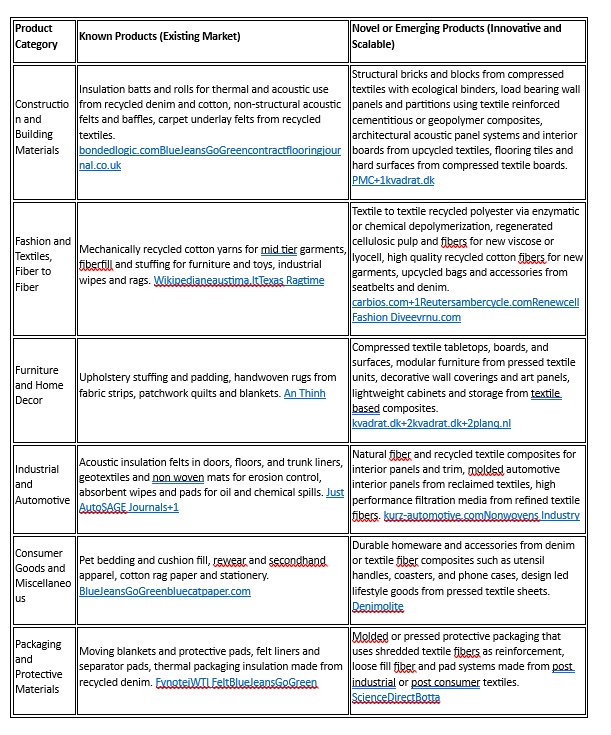

Product roadmap and references are already outlined below:

Demand and policy tailwinds

- Volumes exist. UK used textiles were about 1.45 million tonnes in 2022. Exports were about 421,600 tonnes, which is under pressure. The UK still landfills or incinerates hundreds of thousands of tonnes. (wrap.ngo)

- DPP will matter for EU sales. The EU Ecodesign regulation brings digital product passports from 2027 for textiles, so UK sellers into the EU will need batch data and traceability. Build this once and market it as a buyer feature. (European Commission, Intertek, segura.co.uk)

- UK textiles EPR is expected but not final. WRAP’s 2025 FAQ confirms the consultation did not open in 2024 and details remain unclear. Plan for producer led funding once it lands. (letsrecycle.com)

- New domestic capacity is real. Project Re:claim, the UK’s first commercial scale post consumer polyester plant in Kettering, targets thousands of tonnes per year. This proves automated, UK based textile recycling can scale. (Salvation Army Trading Company, productsofchange.com, The Guardian)

What to make first, backed by your playbooks

Priority products with proven buyers and strong margins:

- Interior acoustic panels and baffles, recycled felt or compressed textile boards. UK buyers include offices, schools, studios, and retrofit. Typical PET felt panels sell widely in the UK market. Your compressed textile variant competes on story and verified data. Test to BS EN ISO 354 for absorption. Fire classify to EN 13501-1 for interiors. (resonics.co.uk, Plastock, bcta.group, Klassegroup)

- Compressed boards for furniture cores and decorative walling. Position as design grade, with QR batch data and end of life guidance.

- Thermal and acoustic packaging pads, and moving blankets, for e-commerce, cold chain, and relocation.

- Automotive interior felts and molded panels at large scale. Sell to Tier 1s once you hit volume and process control.

Technology and automation stack

- Intake and sorting. Automated NIR sorting by fibre type and colour at up to about 900 kg per hour with Fibersort class technology. Use vision picking to remove trims and hardware. (Circle Economy)

- Shred and blend. Closed loop moisture control, binder dosing, barcode or QR tracking by batch.

- Forming. Hot press plates for panels and boards, or cold press for mineral hybrid blocks. Distinct from FabBRICK’s patented cycle, as your documents outline.

- Quality and compliance. Acoustic tests to BS EN ISO 354, reaction to fire to EN 13501-1. Store results in the product passport. (bcta.group, Klassegroup)

- Digital product passport. QR per batch with composition, tests, and CO2e. Prepare for EU DPP buyers from 2027. (Intertek)

Unit economics, per tonne of input textiles

Use ranges and mix to protect margin. Prices are wholesale, conservative.

Illustrative base case per tonne of input:

- Product mix. 50 percent to acoustic panels, 30 percent to boards, 20 percent to packaging.

- Yield assumptions. 25 mm acoustic panels at medium density deliver roughly 100 to 130 m² per tonne input after binder and trim. Boards at 18 mm deliver roughly 55 to 70 m² per tonne.

- Revenue band. £3,000 to £5,000 per tonne of input across the mix, depending on panel price and yields.

- Variable costs. Energy, binders, packaging, consumables, and distribution often sit in the £400 to £700 per tonne range for this mix.

- Intake upside. Price intake below landfill tax to unlock paid feedstock. Even a £30 to £60 per tonne intake fee shifts margin. The landfill tax alone is £126.15 per tonne in 2025. (GOV.UK)

Scale options for the UK

Notes:

- Sorting throughput of about 900 kg per hour is achievable with Fibersort class systems. That supports medium and large sites. (Circle Economy)

- You secure feedstock by offering councils and charities a price under landfill and EfW disposal options, documented in WRAP’s gate fee work. (wrap.ngo)

Go to market and offtake

- Built environment. Office fit out, education, health, and cultural venues buy acoustic and decorative boards. Use UK acoustic installers and distributors already selling PET felt panels as your channel partners. (resonics.co.uk)

- Packaging. E-commerce, grocery, and biotech use thermal pads and moving blankets.

- Automotive. Tier 1 suppliers for interior felts once you have volume and quality data.

- Brands. Offer take back and branded panels from their own waste, with QR storytelling. Your FabBRICK references show buyer appetite for this model.

Compliance pathway

- Test acoustic performance to BS EN ISO 354 in a certified lab. Fire test to EN 13501-1 to meet spec for interior use. Build a technical file for each SKU. (bcta.group, Klassegroup)

- Prepare DPP data fields now to serve EU buyers from 2027. (Intertek)

Risks and how you reduce them

- Policy timing. UK textiles EPR timing is uncertain. Design a business that stands without it, then capture producer funding if and when it arrives. (letsrecycle.com)

- Fire classification. Engineer facings and mineral hybrids to hit target classes for interiors. Validate early. (Klassegroup)

- Price compression. Defend margins with design grade finishes, QR data, and verified acoustic performance. Position against PET felt benchmarks. (resonics.co.uk)

100 day plan

- Secure supply. Sign MOUs with two councils and two national charities. Offer intake pricing below landfill tax. Track volumes and contamination. (GOV.UK)

- Lock two offtake lanes. One acoustic distributor and one packaging customer with rolling call offs. (resonics.co.uk)

- Stand up a micro-hub. Shred, blend, press, finish, and ship two panel SKUs. Start EN 13501-1 fire tests and ISO 354 acoustic tests. (bcta.group, Klassegroup)

- Automate sorting. Install a compact NIR unit and integrate QR batch logging. Prepare for a Fibersort class upgrade at the medium site. (Circle Economy)

- Publish data. Monthly diversion, test pass rates, and CO2e per m² on a simple web dashboard. Prepare DPP fields for EU buyers. (Intertek)