Preamble

You can already hear it. A steady quieting in workshops, foundries, studios, and small plants across Japan, South Korea, and parts of Europe. Not because markets have vanished, but because people have. Apprentices did not arrive. Owners delayed retirement until there was no one left to hand the keys to. The equipment waits, underused, and the craft knowledge thins with each exit.

This is not a trend we want. It carries a low ache, because these industries hold identity, cultural relevance, technique, and place. Yet demographics do not negotiate. When a country has too few young workers, and those who are available prefer service roles, the pipeline collapses. Calls to adapt up the value chain are real, but they already shape the landscape, and they can deepen isolation for the shops left behind.

Consolidation offers scale, but it can also strip away brand character, local IP, and technique. Automation can protect margins, but it often erases the very qualities that make these goods valuable. The politically clean fix would be large-scale migration into shrinking countries, but that path is blocked or difficult. So, the likely movement in the next 10 to 20 years is outward. Not only products, but entire capabilities. Machines, moulds, recipes, jigs, and the last masters or their disciples themselves will relocate to labour-rich regions willing to learn, and able to care.

Even then, demand alone cannot save a craft. You can attract buyers from across borders, but if you lack hands, institutional memory, and capacity, you cannot deliver. Innovation can help, and investors have tried, but demographics still set the limits. The hard question is not whether to keep making these goods. The hard question is where and how to keep the knowledge alive, without losing what makes it distinct.

This piece explores that question as a warning and a map. A warning about sudden drops in productivity, income, and culturally iconic output. A map of practical pathways that preserve quality, protect identity, and keep livelihoods intact, even if the workshop moves. It’s a precursor to one of many solutions

But wait a minute: How overseas Japanese, Taiwanese, and Korean and other affected communities can preserve, adapt, or relaunch at-risk industries and if it works the rest of this blog is mute: see The last master Part 2: Diaspora As Carrier Wave .The Human cultural, value, cost and the role of New technology (including AI) is desribed in this post The Last Masters, Part 3: The human, cultural preservation and the role of new technology .What are some outline Alternatives to this post: Outline Alternatives

Market value and possible loss

The aggregate market value is about 134 to 175 billion dollars in 2024 terms. Key anchors are luxury watches at 45 to 54 billion, ceramics at 12 to 19 billion, precision optics at 26 to 29 billion, denim heritage at about 2.1 billion, vinyl at 1.9 to 2.2 billion, soy sauce at 38 to 56 billion, and sake at 9 to 13 billion by 2030. Your serviceable slice is the premium heritage segment within each, which is smaller but carries higher margins and strong brand premiums. See outline market analysis but the valuation might be overstated it needs further refinement and reserach see: Outline Market Analysis and an outline of possible Benefits

When Demographics Become Destiny

In a small workshop outside Kyoto, a 72-year-old master dyer prepares indigo vats using techniques perfected over forty years. His hands move with practiced precision through processes that cannot be fully automated the temperature adjustments, the timing judgments, the subtle corrections that distinguish exceptional fabric from merely good fabric. He has no successor. In two years, when he retires, this particular knowledge stream will likely disappear.

Multiply this scene across Japan, South Korea, Taiwan, and increasingly across Europe, and you glimpse a quiet industrial crisis unfolding in real time. Nations that deliberately evolved into high-service economies now face an uncomfortable reality: the specialized, labor-intensive sectors that once formed their industrial backbone are hemorrhaging expertise faster than they can replace it.

This is not just about nostalgia. It is about the potential extinction of entire capability ecosystems custom ceramics, precision metalwork, artisanal textiles, small-batch brewing, fountain pens, high value custom inputs, ornaments, food items and analog audio equipment manufacturing that still command global markets but cannot sustain themselves domestically.

The Demographic Trap

The mathematics are unforgiving. Japan’s population is projected to decline from 125 million to under 100 million by 2050. South Korea’s fertility rate has plummeted to 0.72 the lowest in the world. These aren’t just numbers; they represent collapsing talent pipelines.

The problem compounds in specialized sectors. Young workers, when available, gravitate toward service sector jobs that offer better compensation without the years of apprenticeship required for artisanal mastery. A textile specialist might spend five to seven years learning their craft, yet earn less than an entry-level office worker. The long-term apprenticeship model once a cultural cornerstone has become economically unsustainable.

Meanwhile, the machinery itself ages. These aren’t standardized production lines that can be replaced with updated models. Custom looms, specialized dyeing equipment, precision metalworking tools—often decades old and irreplaceable because modern equivalents don’t exist or can’t replicate the same quality. When the last operator retires, the equipment becomes inert metal.

The irony: global demand for these products remains robust, even growing. International fashion houses still seek Japanese selvedge denim. Audiophiles prize precision-crafted turntable components. Custom ceramic ware commands premium prices. But even premium pricing cannot solve a missing workforce.

The Immigration Impasse

The obvious solution importing skilled workers faces insurmountable political resistance. Japan’s immigration policies remain among the world’s most restrictive. South Korea, despite acute labor shortages, maintains stringent cultural and linguistic barriers. The service sector has seen some immigration for low-wage positions, but specialized manufacturing sectors requiring years of training see virtually none.

This leaves a stark choice: watch these capabilities vanish, or find another way.

A Radical Reframe: Industrial Diaspora

What if the solution isn’t bringing workers to the machinery, but bringing the machinery and the masters or disciple to the workers?

Consider this speculative framework: aging economies establish industrial training zones in countries with surplus skilled labor, demographic growth, and latent infrastructure. Retiring masters spend final working years as trainers. Salvaged or relocated machinery gets new life. Intellectual property transfers under controlled licensing. New markets emerge. Legacy capabilities survive.

This isn’t outsourcing in the conventional sense. It’s closer to industrial diplomacy a structured methodology for preserving cultural and technical heritage while adapting to demographic reality.

The Precedent: Vinyl’s Resurrection

The model isn’t entirely unprecedented. When vinyl records experienced their unexpected revival, manufacturers faced a problem: virtually no pressing plants remained operational in developed markets. The solution? Companies scoured South America, Africa, and parts of Asia for defunct vinyl pressing equipment, purchased it, refurbished it, and in some cases reactivated entire dormant facilities.

Some simply relocated the assets. Others invested in training local workforces and established new production facilities. The result: vinyl production capacity expanded globally while meeting renewed Western demand. Quality remained high because the equipment and core processes were authentic.

The vinyl example suggests this approach could work, but also reveals its limitations. Vinyl pressing is relatively standardized skilled, yes, but not requiring years of artisanal training. More complex sectors present steeper challenges.

Geographic Strategy: Beyond the Obvious

The initial instinct might focus exclusively on Africa and South America regions with demographic growth and labor cost advantages. But the framework’s viability expands significantly when considering other Asian nations with complementary resource mixes.

Countries like Vietnam, Indonesia, Thailand, Bangladesh, and the Philippines present compelling advantages: existing manufacturing ecosystems, technical education infrastructure, cultural proximity to origin countries (reducing friction in knowledge transfer), and in some cases, related artisanal traditions that provide foundation skills.

The geographic question isn’t binary it’s a spectrum of readiness, compatibility, and strategic fit.

Framework Architecture: The Salvage Corp Model

This is a take on The World Asset Salvage Corp but a specialist application: A viable framework would require several interconnected components:

1. Asset Registry and Matching System

Create comprehensive inventories of at-risk equipment, expertise, and brands across aging economies. Match these with potential host countries, assessing infrastructure readiness, workforce education levels, and market access. Vietnam’s growing industrial capacity, Nigeria’s manufacturing zones, Bangladesh’s textile expertise, Thailand’s precision manufacturing capabilities, and Ghana’s processing infrastructure represent viable candidates across different sectors.

The registry wouldn’t just catalogue machinery it would score assets based on salvageability, training requirements, supply chain dependencies, and market value sustainability.

Country Selection Criteria: A Scoring Framework

Not all potential host countries offer equal viability. A robust selection methodology must assess multiple dimensions:

Infrastructure Readiness (Weight: 25%)

Power Reliability: Baseline 16+ hours daily power availability, with zone-specific guarantees preferred

- Tier 1: 24/7 reliability with backup systems (Vietnam, Thailand, Malaysia)

- Tier 2: 18+ hours with manageable gaps (Indonesia, Philippines, Bangladesh)

- Tier 3: 12-16 hours requiring significant investment (Nigeria, Ghana, Pakistan)

Logistics Infrastructure: Port access, customs efficiency, internal transport networks

- Export processing time under 72 hours preferred

- Container handling capacity and refrigerated storage (for certain sectors)

- Road/rail connectivity to production zones

Digital Infrastructure: Internet reliability for quality monitoring, supply chain coordination, and remote master consultation

Human Capital Quality (Weight: 30%)

Technical Education Base:

- Engineering and technical school enrollment rates

- Vocational training system maturity

- Literacy rates and language capabilities (relevant language e.g English/Japanese/Korean proficiency)

Existing Manufacturing Competency:

- Related industry presence (e.g., existing textile sector for fabric dyeing transfer)

- Quality management system familiarity (ISO certifications, export standards)

- Manual dexterity and precision work culture

Learning Agility Indicators:

- Technology adoption rates

- Workforce adaptation to previous industrial transfers

- Educational attainment trends among working-age population

Examples:

- Vietnam: Strong technical education, rapid manufacturing competency growth, high learning agility (Score: 85/100)

- Bangladesh: Deep textile expertise, improving technical education, established quality systems (Score: 75/100)

- Indonesia: Diverse manufacturing base, moderate technical education, variable regional quality (Score: 70/100)

- Nigeria: Growing technical schools, entrepreneurial culture, inconsistent quality systems (Score: 60/100)

Economic and Regulatory Environment (Weight: 20%)

Special Economic Zone Maturity:

- Track record of zone-based manufacturing success

- Tax incentives and duty-free import of equipment

- Streamlined licensing and compliance frameworks

Labor Cost vs. Quality Balance:

- Not just cheapest, but best value wages relative to productivity and quality outcomes

- Labor law flexibility for training-intensive models

Currency Stability and Repatriation:

- Exchange rate volatility impacts profit repatriation

- Capital control frameworks

IP Protection Framework:

- Trademark enforcement capability

- Contract law reliability

- Historical respect for licensed production agreements

Cultural and Linguistic Compatibility (Weight: 15%)

Cultural Proximity to Origin Country:

- Shared work culture elements (precision, hierarchy, craftsmanship values)

- Historical trade or migration connections

- Similar business communication norms

Language Bridges:

- Availability of Japanese/Korean speakers (for Asian transfers)

- English as common working language

- Diaspora communities that can serve as cultural translators

Aesthetic Sensibility Alignment:

- Existing appreciation for craftsmanship and quality

- Design traditions that complement rather than clash with transferred techniques

Regional Analysis:

- Vietnam/Thailand: High cultural compatibility with Japan/Korea, existing manufacturing relationships

- Philippines: Strong English capability, some cultural alignment, growing manufacturing

- Bangladesh/Pakistan: Moderate cultural distance, strong textile traditions, language challenges manageable

- Nigeria/Ghana: Greater cultural distance, but entrepreneurial energy and English fluency offset this

Market Access and Strategic Position (Weight: 10%)

Regional Market Penetration Potential:

- Access to growing regional consumer markets (ASEAN, African Continental Free Trade Area)

- Trade agreement frameworks (CPTPP, RCEP participation)

Export Logistics to Major Markets:

- Shipping routes and times to US, EU, East Asia

- Free trade agreements reducing tariff barriers

Local Market Sophistication:

- Domestic demand for premium/quality goods (reduces dependence on export-only model)

- Retail infrastructure for test marketing

Composite Scoring Examples

Vietnam (Total: 82/100)

- Infrastructure: 22/25 (excellent power, good ports, strong digital)

- Human Capital: 27/30 (high technical education, proven manufacturing, strong learning agility)

- Economic/Regulatory: 16/20 (mature SEZs, stable environment, moderate IP protection)

- Cultural Compatibility: 12/15 (high alignment with Japan/Korea, language bridges exist)

- Market Access: 5/10 (CPTPP member, good regional position, limited domestic luxury market)

Best Fit Sectors: Precision metalwork, electronics components, ceramics, textile finishing

Bangladesh (Total: 72/100)

- Infrastructure: 16/25 (power challenges, good port access, adequate digital)

- Human Capital: 25/30 (exceptional textile expertise, improving technical education)

- Economic/Regulatory: 14/20 (established export zones, competitive labor costs, IP concerns)

- Cultural Compatibility: 10/15 (moderate alignment, manageable language barriers)

- Market Access: 7/10 (strong garment export infrastructure, EU trade preferences)

Best Fit Sectors: Textile dyeing, fabric production, artisanal clothing manufacture

Thailand (Total: 79/100)

- Infrastructure: 23/25 (reliable power, excellent logistics, mature digital)

- Human Capital: 24/30 (good technical base, precision manufacturing culture, moderate learning agility)

- Economic/Regulatory: 17/20 (sophisticated SEZs, stable economy, better IP protection)

- Cultural Compatibility: 11/15 (good cultural alignment, some language challenges)

- Market Access: 4/10 (ASEAN hub, but saturated local market, competitive manufacturing landscape)

Best Fit Sectors: Precision components, small-batch food production, specialty ceramics

Indonesia (Total: 68/100)

- Infrastructure: 15/25 (variable power by region, port congestion issues, improving digital)

- Human Capital: 22/30 (large labor pool, variable technical education, diverse skill base)

- Economic/Regulatory: 13/20 (developing SEZ framework, bureaucratic complexity, moderate IP protection)

- Cultural Compatibility: 11/15 (some cultural alignment, language capabilities growing)

- Market Access: 7/10 (massive domestic market potential, ASEAN access, improving trade position)

Best Fit Sectors: Batik and textile arts (natural synergy), food production, medium-complexity manufacturing

Nigeria (Total: 63/100)

- Infrastructure: 12/25 (significant power deficits, port delays, adequate digital in zones)

- Human Capital: 20/30 (entrepreneurial talent, growing technical schools, variable quality systems)

- Economic/Regulatory: 12/20 (emerging SEZs, currency volatility, IP enforcement weak)

- Cultural Compatibility: 10/15 (entrepreneurial culture strong, language advantage, greater cultural distance)

- Market Access: 9/10 (AfCFTA access, huge domestic market, growing middle class)

Best Fit Sectors: Textile production (existing base), food processing, brewing/distilling

Sector-Specific Weighting Adjustments

The base criteria should be adjusted by sector:

For Textile/Fabric Production:

- Increase Human Capital weight to 35% (existing textile expertise critical)

- Reduce Infrastructure weight to 20% (more forgiving of power gaps)

For Precision Metalwork/Components:

- Increase Infrastructure weight to 30% (power critical, equipment sensitive)

- Increase Cultural Compatibility to 20% (precision culture essential)

For Food/Beverage Production:

- Increase Market Access to 15% (perishability and local consumption important)

- Increase Economic/Regulatory to 25% (food safety regulations critical)

Multi-Country Strategies

The framework need not be monolithic. Sophisticated approaches might include:

Regional Clustering: Establish connected facilities across multiple countries

- Vietnam for precision components + Bangladesh for textile assembly

- Thailand for master training hub + Indonesia for scale production

- Nigeria for African market access + Ghana for West African logistics

Sector Diversification: Different countries for different sectors based on optimal fit

Phased Expansion: Prove concept in highest-scoring country, then expand to others as model matures

2. Special Economic Zones with Aligned Incentives

Deploy these initiatives within export processing zones offering power service level agreements, customs fast-tracking, and infrastructure guarantees. This model already works: Dangote’s massive Nigerian refinery operates in an infrastructure-challenged country yet maintains world-class standards through zone-based infrastructure investment.

The zone approach creates controlled environments where infrastructure deficits don’t doom operations, while limiting disruption to local markets.

3. Structured Knowledge Transfer Programs

Design 12-18 month intensive apprenticeships combining retiring masters with younger diaspora members and local talent. The curriculum wouldn’t just teach techniques it would transmit the quality standards, material judgment, and process refinement that separate adequate from exceptional output.

Training programs would produce certified practitioners capable of maintaining brand standards across borders. Quality control data would be transparent, published, and auditable.

4. Intellectual Property Frameworks

Develop modular IP transfer mechanisms allowing SMEs to license methodologies and brand identities while maintaining oversight. This could involve:

- Tiered licensing (training rights, production rights, brand usage rights)

- Quality certification systems with periodic audits

- Co-branded products that acknowledge both heritage and new production contexts

- Revenue sharing models that sustain original brand owners

The goal: preserve brand value while preventing complete dilution or loss.

5. Cross-Fertilization Rather Than Replication

The most sophisticated version doesn’t merely recreate Japanese textile production in Nigeria. It enables creative adaptation new patterns, local material integration, hybrid techniques under established quality frameworks. This transforms heritage preservation into living tradition rather than museum reproduction.

Candidate Industries: Identifying Salvage-Worthy Sectors

Not every declining industry justifies the complexity of cross-border asset salvage and knowledge transfer. The framework works best for sectors meeting specific criteria: high artisanal skill requirements, specialized non-replicable equipment, sustained global demand, and imminent succession gaps. Here are the prime candidates:

High-Priority Sectors

1. Specialized Textile Production and Finishing

Why This Sector:

- Equipment is portable but irreplaceable (vintage looms, specialized dyeing vats)

- 5-7 year apprenticeship requirement creates acute succession problems

- Global fashion houses actively seeking authentic production capacity

- Premium pricing sustainable ($200-800/meter for specialty fabrics)

- Existing textile infrastructure in potential host countries provides foundation

Specific Sub-Sectors:

- Indigo and natural dyeing: Japanese aizome, traditional Korean dyeing

- Selvedge denim production: Vintage shuttle looms increasingly rare

- Silk weaving: Specialized jacquard and complex pattern work

- Kimono fabric production: Yuzen dyeing, shibori techniques

- Technical finishing: Mercerization, sanforization with vintage equipment

Succession Crisis Severity: Critical (5-10 year window before major capability loss)

2. Precision Analog Audio Components

Why This Sector:

- Vinyl revival created unexpected demand surge

- CNC cannot replicate tolerances achieved by skilled manual finishing

- Audiophile market pays premium prices ($500-5000+ per component)

- Equipment exists but operators retiring with no replacements

- Quality differences measurable and valued by customers

Specific Sub-Sectors:

- Turntable platters and tone arms: Precision bearing work

- Cartridge bodies: Micro-tolerance metalwork

- Vacuum tube manufacturing: Specialized glass work and assembly

- Transformer winding: Manual precision winding for audio specifications

- Wooden speaker cabinet joinery: Traditional woodworking meeting acoustic requirements

Succession Crisis Severity: High (10-15 year window, already experiencing capacity constraints)

3. Artisanal Ceramics and Porcelain

Why This Sector:

- Kiln knowledge and firing techniques developed over decades

- Clay body formulation requires deep material understanding

- Global collector and design markets remain robust

- Equipment (specialized kilns) transportable and long-lived

- Hand-finishing skills transferable with intensive training

Specific Sub-Sectors:

- Arita and Imari porcelain: Japanese traditions dating to 1600s

- Celadon ceramics: Korean and Japanese glazing techniques

- Raku ware: Specialized firing and rapid cooling processes

- Tea ceremony ceramics: Specific aesthetic and functional requirements

- Architectural ceramics: Custom tile and facade work

Succession Crisis Severity: Moderate-High (15-20 year window but accelerating)

4. Precision Mechanical Watchmaking

Why This Sector:

- Swiss and Japanese independent watchmakers facing succession crisis

- Hand-finishing of movements cannot be fully automated

- Ultra-premium market ($10,000-100,000+ per piece) justifies investment

- Equipment requires climate control but is relocatable

- Existing horological education infrastructure in some Asian countries

Specific Sub-Sectors:

- Movement finishing: Geneva striping, anglage, hand-polishing

- Complications assembly: Chronographs, perpetual calendars, minute repeaters

- Case making: Specialized forming and finishing

- Dial production: Traditional guilloche, enamel work

- Spring manufacture: Precision coiling and heat treatment

Succession Crisis Severity: Moderate (20+ year window but skills extremely rare)

5. Traditional Fermentation and Brewing

Why This Sector:

- Artisanal sake, soy sauce, miso production facing labor shortages

- Koji cultivation and fermentation management are learned skills

- Equipment (cedar vats, fermentation rooms) can be replicated

- Growing global market for authentic fermented products

- Local ingredients in host countries enable adaptation not just replication

Specific Sub-Sectors:

- Sake brewing: Small-batch premium sake (ginjo, daiginjo grades)

- Soy sauce production: Traditional barrel fermentation (3+ year processes)

- Miso and fermented paste: Multiple regional varieties and techniques

- Artisanal vinegar: Traditional static fermentation methods

- Traditional distillation: Small-batch shochu, Korean soju variants

Succession Crisis Severity: Moderate (15-25 year window, regional variations)

6. Specialty Paper and Printing

Why This Sector:

- Washi (Japanese paper) and similar artisanal papers require specialized skills

- Letterpress and traditional printing equipment being abandoned

- Premium stationery and art markets sustaining demand

- Equipment requires maintenance knowledge being lost

- Book arts and luxury packaging markets growing

Specific Sub-Sectors:

- Handmade paper production: Washi, Korean hanji

- Letterpress printing: Vintage presses requiring manual operation

- Traditional bookbinding: Japanese stab binding, Korean bound books

- Block printing: Woodblock carving and printing

- Marbling and decoration: Traditional paper decoration techniques

Succession Crisis Severity: Moderate-High (10-20 year window depending on technique)

7. Specialized Food Production Equipment and Techniques

Why This Sector:

- Manual food production skills declining despite premium market demand

- Equipment often vintage but irreplaceable for quality outcomes

- Shorter training cycles (2-4 years) make knowledge transfer more feasible

- Local ingredient adaptation creates new market opportunities

- Food culture tourism provides additional revenue stream

Specific Sub-Sectors:

- Noodle making: Hand-pulled, knife-cut techniques and specialized equipment

- Confectionery: Wagashi (Japanese sweets), specialized molds and techniques

- Charcuterie: Traditional curing, smoking, aging processes

- Cheese aging: Cave-style aging, specialty cultures and techniques

- Chocolate tempering: Small-batch bean-to-bar production with vintage equipment

Succession Crisis Severity: Moderate (varies by technique, 10-25 year window)

8. Precision Optical and Lens Grinding

Why This Sector:

- Manual lens grinding for specialty optics increasingly rare

- Camera lens, telescope, and microscope collectors sustaining demand

- Skills require years to develop (4-6 year apprenticeship)

- Equipment exists but maintenance knowledge disappearing

- Photography renaissance creating unexpected demand

Specific Sub-Sectors:

- Manual lens grinding: Specialty optics, custom prescriptions

- Camera lens assembly: Vintage and reproduction lenses

- Telescope mirror making: Large format astronomical optics

- Microscope optics: Research-grade manual grinding

- Optical coating: Specialized thin-film application

Succession Crisis Severity: High (skills becoming extinct, 5-10 year window)

Medium-Priority Sectors

9. Traditional Metalwork and Bladesmithing

- Japanese knife making (both kitchen and traditional swords)

- Korean blade forging techniques

- Specialized tool making for woodworking and other crafts

- Premium pricing sustainable but smaller market volume

- Crisis Severity: Moderate (some succession happening domestically)

10. Wooden Boat and Traditional Furniture Construction

- Traditional joinery without metal fasteners

- Specialized wood bending and shaping

- Japanese tansu chests, Korean furniture traditions

- Smaller market but extremely high-end pricing possible

- Crisis Severity: Moderate-Low (some craft revival happening)

11. Traditional Textile Printing and Dyeing

- Katazome (Japanese stencil dyeing)

- Batik (synergy with Indonesian traditions)

- Block printing traditions

- Screen printing with hand-mixed colors

- Crisis Severity: Moderate (overlaps with broader textile sector)

12. Specialty Glass Work

- Hand-blown scientific glassware

- Architectural stained glass

- Traditional glass bead making

- Neon tube bending (experiencing revival)

- Crisis Severity: Moderate (niche but stable markets)

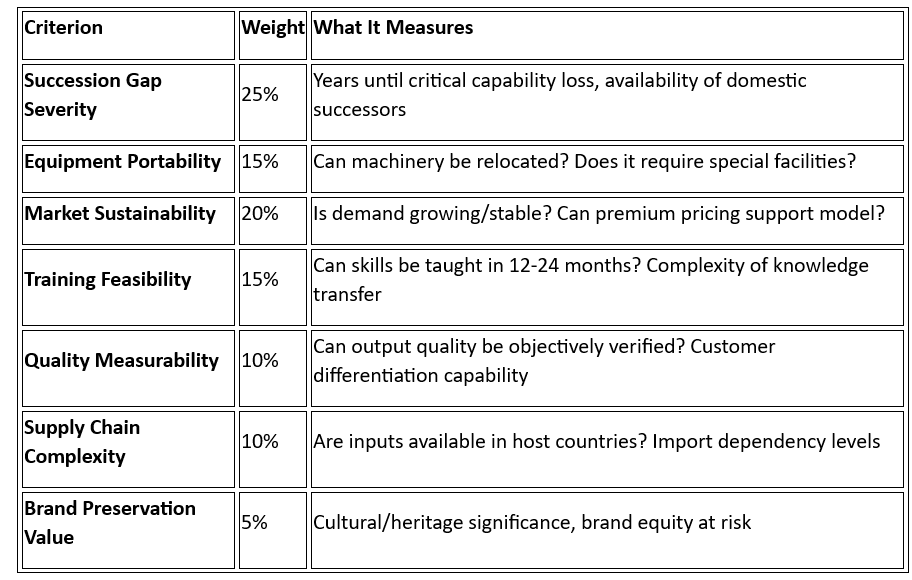

Selection Criteria Matrix

Industries qualify as high-priority candidates when they score highly across these dimensions:

High-Priority Example: Indigo Dyeing

- Succession Gap: 9/10 (critical, 5-year window)

- Equipment Portability: 9/10 (vats relocatable, facility requirements moderate)

- Market Sustainability: 8/10 (fashion houses actively seeking, premium pricing)

- Training Feasibility: 7/10 (18-month intensive possible)

- Quality Measurability: 8/10 (color fastness, consistency testable)

- Supply Chain: 7/10 (indigo cultivated in many countries)

- Brand Value: 9/10 (centuries of tradition, high cultural significance)

- Total Score: 82/100 → High Priority

Medium-Priority Example: Wooden Boat Building

- Succession Gap: 6/10 (declining but some domestic revival)

- Equipment Portability: 5/10 (workspace requirements significant)

- Market Sustainability: 6/10 (niche market, limited scale)

- Training Feasibility: 5/10 (3+ year training typical)

- Quality Measurability: 7/10 (seaworthiness testable)

- Supply Chain: 6/10 (specialty woods may require import)

- Brand Value: 7/10 (cultural value high but market smaller)

- Total Score: 61/100 → Medium Priority

Why These Sectors and Not Others

Excluded Categories and Reasons:

- Fully Automated Manufacturing: No succession crisis, equipment replaceable

- Service-Only Skills: Cannot be packaged for transfer without physical assets

- Commodity Production: No premium pricing to justify complexity

- Highly Regulated Industries: Pharmaceutical, medical device (regulatory barriers insurmountable)

- Digital/Software: No geographic constraints or equipment dependencies

- Construction Trades: Skills needed locally, cannot be exported meaningfully

The selected sectors share common characteristics: they sit at the intersection of artisanal skill, specialized equipment, sustainable markets, and imminent loss. They represent the sweet spot where intervention is both necessary and potentially viable.

Sector-Specific Applications

Textile and Fabric Production

Japanese indigo dyeing, Korean silk production, and Italian wool finishing all face succession crises. Relocating dyeing equipment to Bangladesh a country with deep textile heritage, established export infrastructure, and extensive garment manufacturing expertise could preserve techniques while creating new markets. Vietnam offers similar advantages with superior infrastructure and growing technical sophistication. Nigeria provides access to local cotton production and the emerging African market.

Pilot Structure: Two master dyers, specialized vat equipment, 12-month program, target output of limited-edition fabric runs with published quality metrics.

Optimal Country Pairing: Bangladesh (primary production) + Vietnam (quality control hub) + Nigeria (African market variant)

Precision Metalwork for Audio Equipment

Turntable component manufacturing requires precision metalworking that’s increasingly rare. Vietnam’s growing manufacturing sophistication, existing metalwork capabilities, and cultural alignment with Japanese quality standards make it a logical candidate for preserving these skills. Thailand offers similar advantages with more mature infrastructure but higher costs.

Pilot Structure: Relocate specialized lathes and finishing equipment, train precision metalworkers in tolerance standards specific to audio components, establish quality certification partnership with original Japanese or European brands.

Optimal Country Selection: Vietnam (primary), with Thailand as alternative for premium tier production

Artisanal Ceramics and Pottery

Small-batch ceramic production in Japan faces acute succession problems. Vietnam and Thailand both offer existing ceramic traditions, technical capabilities, and quality consciousness. Indonesia’s rich pottery heritage (particularly in Java and Bali) provides natural synergies, while Ghana’s existing ceramic traditions and growing design sector could absorb transferred knowledge while maintaining local aesthetic sensibilities.

Pilot Structure: Establish kiln facilities in processing zones, combine master ceramicists with local artisans, develop co-branded product lines serving both traditional and new markets.

Optimal Country Selection: Vietnam or Thailand (Asian aesthetic alignment), Indonesia (cultural ceramic traditions), Ghana (African market access)

The Hard Questions

This framework provokes legitimate concerns:

Brand Authenticity: Will customers distinguish between Japanese-made and Nigerian-made products carrying Japanese brand heritage? Market research suggests quality and provenance matter, but authentication and transparency become crucial. Digital tracking, production documentation, and honest marketing about “trained in Kyoto tradition, produced in Lagos under master supervision” might work or might trigger rejection.

Cultural Loss vs. Cultural Preservation: Does moving production abroad constitute loss or adaptation? If techniques survive but context changes, what’s preserved? This philosophical question has practical implications for marketing and cultural acceptance.

Local Market Disruption: Could relocated industrial capacity harm existing local industries? The zone-based approach minimizes this risk, but competition concerns remain valid. Counter-argument: exposure to new quality standards and techniques often elevates local capabilities rather than destroying them.

Infrastructure Deficit Reality: Even within zones, power reliability, supply chain logistics, and skilled maintenance pose challenges. Nigeria’s electricity issues, Ghana’s logistics constraints, Vietnam’s regulatory complexity these aren’t trivial obstacles. The Dangote precedent shows they’re surmountable with sufficient investment, but success isn’t guaranteed.

Scale Economics: Can small-batch, high-labor artisanal production justify the infrastructure investment required? Unit economics matter. Premium pricing helps, but market size limitations remain real.

Governance Models: Who Drives This?

Three potential approaches emerge:

Government-Led Industrial Diplomacy: National governments in aging economies establish bilateral agreements with host countries, providing infrastructure investment, tax incentives, and regulatory frameworks. This ensures coordination but risks bureaucratic inefficiency.

Entrepreneurial Salvage Corps: Private entities aggregate stranded assets, secure zone access, arrange training, and manage operations commercially. More nimble but potentially extractive without proper safeguards.

Hybrid Cooperative Model: SME consortiums pool resources under shared infrastructure arrangements, maintaining individual brand identities while sharing logistics, training facilities, and regulatory navigation. This preserves entrepreneurial control while achieving scale benefits.

The hybrid model appears most viable, balancing autonomy with efficiency.

Measuring Success: What Does Victory Look Like?

Any serious framework requires clear metrics:

- Capability Preservation: Number of production lines maintained vs. lost

- Quality Maintenance: Objective quality metrics meeting original standards

- Economic Viability: Unit economics showing sustainable margins within 24 months

- Knowledge Transfer: Number of certified practitioners produced per master trainer

- Market Acceptance: Customer satisfaction and price premium retention

- Brand Evolution: New product lines developed vs. pure replication

- Local Impact: Skills development and supply chain integration in host countries

Success shouldn’t mean perfect preservation of status quo it means adaptation that keeps core capabilities alive while enabling evolution.

The 12-Month Pilot Roadmap

To move from concept to proof:

Months 1-3: Asset Selection and Zone Securing

- Identify one specific sector (textile dyeing recommended due to equipment portability and training timelines)

- Select one Special Economic Zone with reliable power and export logistics

- Secure first equipment lot and spare parts inventory

- Score assets using registry rubric

Months 4-6: Human Capital and Training Design

- Recruit two master trainers willing to relocate temporarily

- Identify one diaspora fellow as cultural bridge

- Design curriculum with explicit quality benchmarks

- Establish housing and support logistics

Months 7-9: Production Validation

- Run intensive 12-week apprenticeship

- Produce first certified batch under master supervision

- Conduct rigorous quality control testing

- Document entire process with video for transparency

Months 10-12: Market Testing and Iteration

- Ship limited-edition drop to test markets

- Publish quality data and production documentary

- Gather customer feedback on pricing and authenticity perception

- Assess unit economics and refine model

If this pilot demonstrates quality maintenance and economic viability, expansion becomes defensible.

The Larger Strategic Context

This framework sits at the intersection of multiple global trends:

- Deglobalization and Regional Manufacturing: Growing interest in distributed production reduces concentration risk

- Sustainability and Circular Economy: Salvaging existing assets rather than building new capacity aligns with resource conservation

- Cultural Heritage Preservation: UNESCO and similar bodies increasingly recognize industrial heritage value

- South-South Cooperation: Emerging economies seeking to build capability through partnerships rather than pure extraction

- Aging Economy Adaptation: Developed nations must find pragmatic responses to demographic reality

The salvage approach offers one potential pathway through these converging pressures.

Is It Worth contemplating or Building?

The fundamental question remains: does this justify the complexity and investment required?

Arguments in favor:

- Irreplaceability: Lost capabilities cannot be rebuilt from scratch at acceptable cost or timeframe

- Market Viability: Demonstrated demand for these products at prices that could support the model

- Win-Win Potential: Both aging and host economies gain preserved capabilities and new capacity respectively

- Precedent Success: Limited examples (vinyl, some textile operations) show feasibility

- Demographic Inevitability: Without intervention, losses are certain; this offers a fighting chance

Arguments against:

- High Complexity: Multiple coordination challenges across borders, cultures, and regulatory systems

- Uncertain Returns: No guarantee of market acceptance or economic sustainability

- Scale Limitations: Small-batch artisanal production has inherent size constraints

- Cultural Resistance: Both in origin countries (loss anxiety) and host countries (neo-colonial concerns)

- Infrastructure Dependency: Success requires sustained investment in often-unreliable contexts

The honest answer: it’s worth building selectively, not universally.

Not every at-risk sector justifies this intervention. But for sectors with:

- Clear successor capability gaps

- Strong existing market demand

- Portable equipment and teachable techniques

- Brand value worth preserving

- Willing masters and receptive host environments

…the framework offers a pragmatic pathway forward.

Conclusion: Use It or Lose It

The aging economy industrial crisis isn’t hypothetical it’s happening now. Each year, more masters retire, more equipment goes idle, more capabilities disappear. The window for structured intervention is closing.

The salvage framework outlined here won’t save everything. It’s complex, expensive, and uncertain. But it offers something increasingly rare: a practical alternative to passive loss.

The choice facing Japan, South Korea, and similar nations isn’t between perfect preservation and change. It’s between managed adaptation and unmanaged decline. Between cultural evolution and cultural extinction. Between pragmatic partnership and slow-motion collapse.

The last masters are still working. The equipment still functions. The knowledge still exists. But not for long.

The question isn’t whether this framework is ideal it clearly isn’t. The question is whether it’s better than doing nothing while watching irreplaceable capabilities vanish.

For societies that value craftsmanship, quality, and industrial heritage, the answer should be clear: salvage what can be salvaged, adapt what must be adapted, and preserve what matters most.

The alternative is silence empty workshops, idle machines, and the permanent loss of human achievement that took generations to build.

That loss would be worth preventing.