Preamble

Parts 1 and 2 of The New New Design established a revolutionary premise: in an era of ubiquitous quality, value migrates from material excellence to meaning architecture. We demonstrated how personalization, narrative coherence, and engineered scarcity close the branding gap between quality-equivalent products and luxury incumbents. We explored how design intelligence and cultural participation redefine value creation in post-quality-parity markets.[1][2]

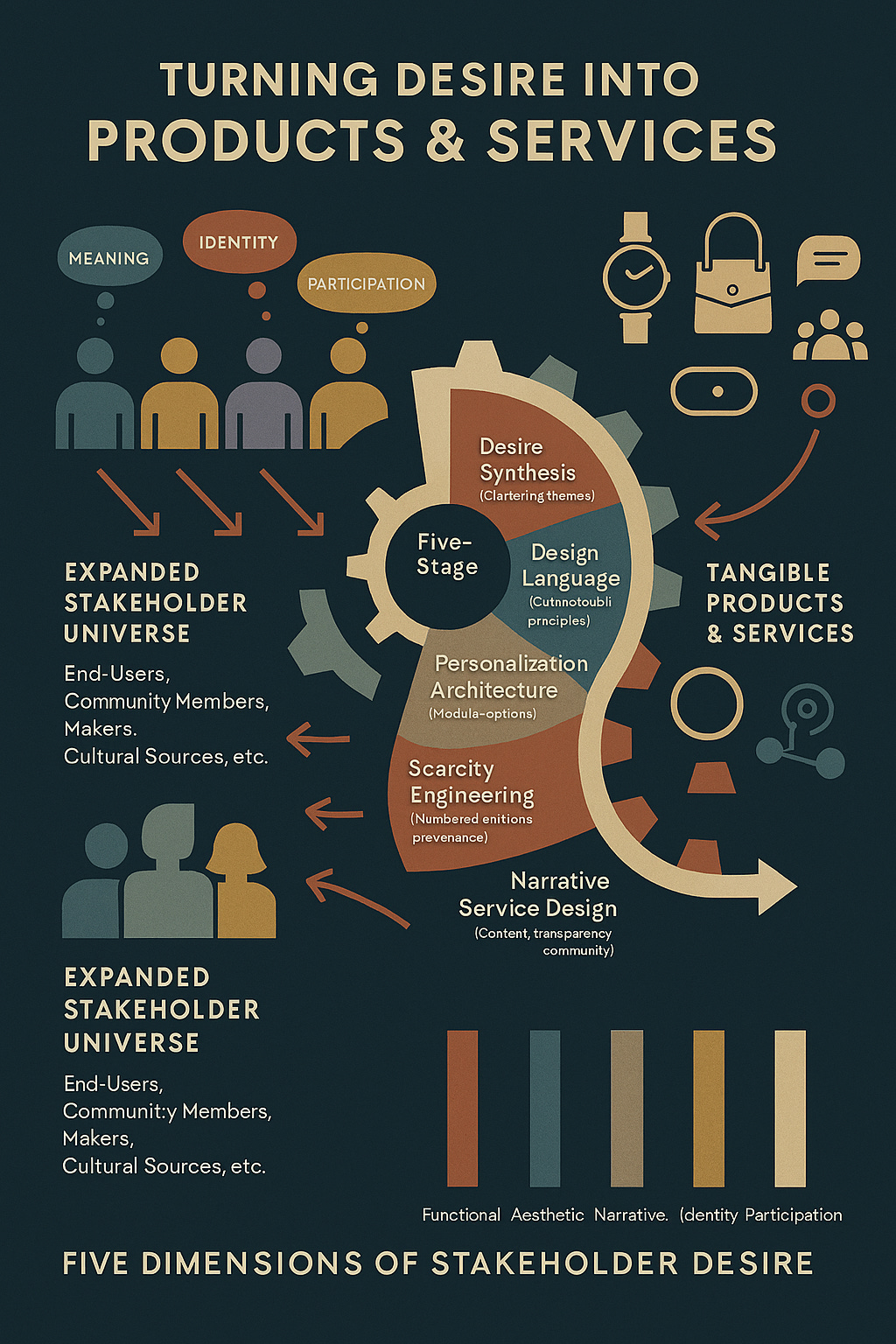

But a critical question remains: How do we systematically transform stakeholder desires the complex, often contradictory wants of customers, creators, communities, and culture into actual products and services that embody these principles?[3][4]

This is not a trivial translation. Traditional product development assumes stakeholders want functional solutions to defined problems. The New New Design operates in a fundamentally different paradigm: stakeholders want meaning, identity, participation, and cultural conversation. They want objects that tell their stories, products that signal their values, experiences that let them co-author brand narratives.[2][5][1]

Part 3 provides the operational framework for this transformation. We move from theory to practice, from philosophy to process, from cultural analysis to production reality. This is the architecture for turning desire into design, aspiration into artifact, cultural hunger into commercial offering.[4][6]

Previous parts

The New New Design Part 1: Closing the Branding Gap in a World Where Quality is Ubiquitous

The New New Design Part 2: The Architecture of Meaning in the Age of Quality Parity

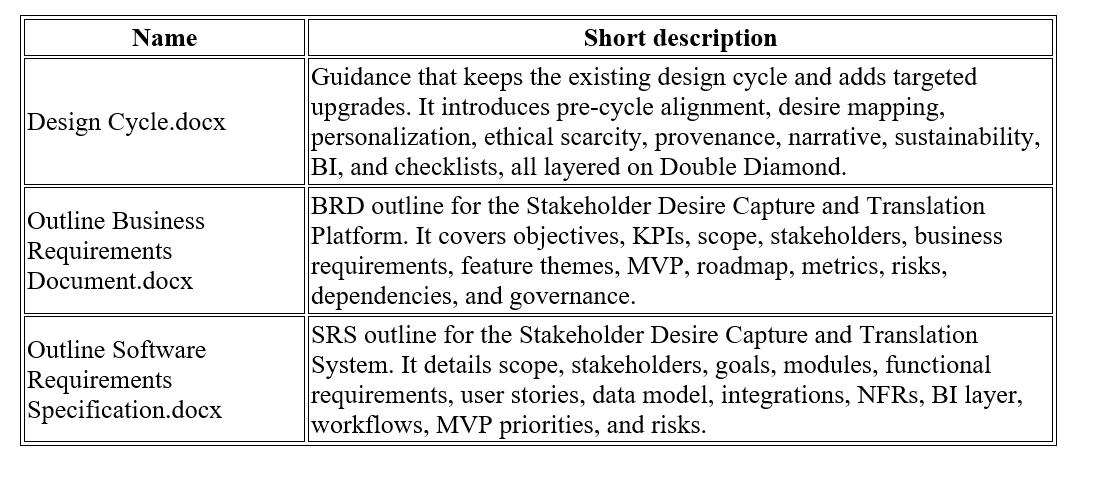

As usual some artifacts : New New Design Part 3 artifacts

Understanding Stakeholder Desire in the New New Design Context

The Expanded Stakeholder Universe

Traditional product development recognizes a narrow stakeholder set: customers who buy, investors who fund, manufacturers who produce. The New New Design requires a fundamentally expanded understanding of who holds stakes in product meaning.[7][8][6][4]

Primary Stakeholders:

• End Users: Not just buyers, but meaning-seekers who want products that participate in their identity construction[2]

• Community Members: Early adopters and brand advocates who co-create cultural narrative around products[1]

• Makers and Artisans: The invisible creators whose craft and story become part of product value[2]

• Cultural Sources: Design movements, geographical traditions, and historical aesthetics that products reference[2]

Secondary Stakeholders:

• Distribution Partners: Retailers and platforms who curate meaning, not just inventory[9]

• Media and Influencers: Narrators who interpret and amplify product stories[1]

• Competitors and Category: The ecosystem that validates or challenges your positioning[1]

• Future Collectors: Secondary market participants who determine long-term value[1][2]

Tertiary Stakeholders:

• Environmental Systems: Sustainability as non-negotiable baseline, not premium feature[2]

• Cultural Movements: Broader conversations your product joins (right-to-repair, democratic luxury, conscious consumption)[1]

• Design Legacy: The future cultural conversation your work will enter[1]

Each stakeholder group harbors distinct desires that must be identified, prioritized, and translated into design decisions.[3][4]

________________________________________

Mapping Desire Across Multiple Dimensions

Stakeholder desire in The New New Design operates across five dimensions simultaneously:[6][4]

Functional Desire: The baseline utility requirement. A watch must tell time, a bag must carry objects. Quality parity means this dimension is table stakes, not differentiator.[2][1]

Aesthetic Desire: The hunger for design intelligence coherence, resolution, visual sophistication that demonstrates considered thought. This desire responds to formal excellence independent of brand heritage.[2][1]

Narrative Desire: The craving for story authentic origin tales, maker visibility, cultural referencing, transparent production. Consumers want to know the “why” behind every design decision.[1][2]

Identity Desire: The need for products that signal values, affiliations, and self-conception. Not conspicuous consumption, but meaning declaration.[2][1]

Participation Desire: The longing to co-author, customize, contribute to product evolution and community narrative. This transforms consumers from buyers into collaborators.[5][1][2]

Effective New New Design products must address all five dimensions coherently. A beautifully designed watch (aesthetic) with transparent maker story (narrative) that can be personalized (participation) and signals sustainability values (identity) while functioning flawlessly (functional) closes the branding gap.[4][1][2]

________________________________________

The Desire Mapping Framework

To systematically capture stakeholder desires across these dimensions, we employ a three-stage mapping process adapted from systemic design methodologies:[6][4]

Stage 1: Iceberg Desire Mapping

Using the iceberg model, we distinguish between visible desires (what stakeholders explicitly request) and invisible desires (underlying motivations and values).[4]

Visible Layer — “I want a leather bag that lasts 20 years and costs under $400”

Invisible Layer — “I want to reject wasteful consumption, own something with timeless design, and avoid paying for logo recognition I don’t value”

The invisible layer reveals the true opportunity for New New Design differentiation.[4][2]

Stage 2: Bullseye Stakeholder Relationship Mapping

Position stakeholders in concentric circles based on their proximity to the core problem your product addresses:[4]

• Center: Directly impacted end-users who experience the primary pain point or desire

• Middle Ring: Community members and cultural participants who influence meaning

• Outer Ring: Ecosystem players (media, distributors, competitors) who shape context

This mapping ensures you prioritize desires of those most impacted while acknowledging ecosystem influences.[10][4]

Stage 3: Journey-Based Desire Evolution Mapping

Stakeholder desires change across time and engagement depth:[11][4]

• Pre-Purchase: Discovery desires (finding brands that align with values, understanding design story)

• Purchase: Transaction desires (customization options, transparent pricing, community access)

• Ownership: Experience desires (product performance, maker connection, service quality)

• Post-Ownership: Legacy desires (resale value, collector status, brand evolution participation)

Map desires across this journey to ensure your product and service architecture addresses evolving needs.[5][4]

________________________________________

The Translation Architecture: From Desire to Design

The Five-Stage Translation Process

Transforming mapped stakeholder desires into New New Design products requires a systematic translation architecture that maintains meaning coherence while ensuring commercial viability.[9][3]

Stage 1: Desire Synthesis and Prioritization

Objective: Convert raw desire mapping data into actionable design priorities.[11]

Process:

1. Cluster desires by theme: Group similar desires across stakeholder types. Example: “transparent pricing,” “maker visibility,” and “cost breakdown” all cluster under “radical transparency”.[2]

2. Identify desire conflicts: Surface contradictions. Example: “affordable pricing” vs. “artisan wages” vs. “sustainable materials” creates a three-way tension requiring strategic resolution.[10][3]

3. Apply the Five-Dimension Filter: Ensure every high-priority desire maps to at least one of the five desire dimensions (functional, aesthetic, narrative, identity, participation).[4]

4. Prioritize using the Value-Feasibility Matrix:[3][11]

o High Value / High Feasibility: Core product features that must be included

o High Value / Low Feasibility: Aspirational features for future iterations

o Low Value / High Feasibility: Quick wins for early releases

o Low Value / Low Feasibility: Eliminate from consideration

5. Create Desire Personas: Develop 3-5 composite stakeholder profiles that embody clustered desires. Example: “The Conscious Collector” values sustainability, design heritage referencing, and future appreciation potential.[5][11][2]

Deliverable: Prioritized Desire Map—a visual representation of stakeholder desires ranked by importance, organized by the five dimensions, with clear persona assignments.[6][4]

Stage 2: Design Language Development

Objective: Translate aesthetic and narrative desires into coherent visual and material languages.[1][2]

Process:

1. Cultural Source Audit: Based on narrative desires, identify authentic design movements or historical aesthetics to reference. Conduct deep research into chosen references—read original manifestos, study period objects, understand philosophical underpinnings.[1]

2. Principle Extraction: Distill design principles from cultural sources without copying specific products. Example: From 1960s aerospace instrumentation → “functional materiality, precision without ornament, tool-like purposefulness”.[1]

3. Material Narrative Mapping: Select materials that simultaneously satisfy functional desires and tell authentic stories. Document the “why” for every material choice—sourcing story, maker relationship, sustainability credentials.[2]

4. Design Resolution Workshop: Iterate designs until they achieve “resolution”—the quality where every element feels necessary and coherent, like the Eames Lounge Chair. Test designs with desire personas for resonance.[2][1]

5. Differentiation Validation: Ensure designs reference without replicating, inspire without imitating. Legal review for IP compliance is mandatory, not optional.[1]

Deliverable: Design Language Brief—comprehensive documentation of cultural references, extracted principles, material narratives, and finalized designs with rationale for every decision.[2][1]

Stage 3: Personalization Architecture Design

Objective: Translate participation desires into customization systems that create uniqueness at scale.[1]

Process:

1. Modularity Mapping: Identify which product elements can be customized without compromising production efficiency or design coherence:[1]

o Material Swaps: Leather colors, metal finishes, textile patterns

o Component Configuration: Modular elements that can be mixed and matched

o Applied Personalization: Engravings, monograms, numbering

o Bespoke Elements: Made-to-order features for premium tiers

2. Tiered Personalization Strategy:[1]

o Base Tier: Standard configuration at accessible price point (cost + 2-3x margin)

o Customized Tier: User-selected options from menu (base + 30-50% premium)

o Limited Edition Tier: Seasonal or collaborative releases (base + scarcity premium)

o Bespoke Tier: Fully custom co-creation (premium pricing)

3. Digital Configuration Interface Design: Create online tools or consultation processes that make personalization delightful, not overwhelming. Balance choice abundance with decision fatigue prevention.[9][5]

4. Production Workflow Integration: Ensure personalization options integrate smoothly with manufacturing capabilities. Partner with makers who can deliver customization at quality-parity with base product.[1]

Deliverable: Personalization Playbook detailed menu of customization options, pricing structure for each tier, digital interface specifications, and production workflow documentation.[1]

Stage 4: Scarcity and Legacy Engineering

Objective: Translate identity and participation desires into designed scarcity that creates collector culture and future value.[2][1]

Process:

1. Production Cadence Strategy: Determine release rhythm that balances accessibility with exclusivity:[1]

o Evergreen Core: Base products available continuously

o Seasonal Limited Editions: Quarterly or biannual releases tied to cultural moments

o Collaborative Drops: Partnership collections with aligned designers or brands

o Version Evolution: When products improve, retire previous versions officially

2. Scarcity Signaling Systems:[1]

o Numbered Editions: Serial numbers with production run documentation

o First Edition Advantages: Special features or pricing for early adopters

o Community First Access: Exclusive pre-release for engaged community members

o Retirement Announcements: Clear communication when editions close

3. Provenance Infrastructure: Create systems that enable secondary market validation:[1]

o Certificates of Authenticity: Detailed documentation for each piece

o Production Records: Transparent manufacturing histories

o Resale Facilitation: Official or partner platforms for authenticated resale

4. Secondary Market Cultivation: Monitor resale markets, celebrate appreciation, consider official trade-in programs. A healthy secondary market validates your scarcity strategy and creates collector confidence.[1]

Deliverable: Scarcity Strategy Document—production calendar, numbering system, provenance tracking methodology, and secondary market engagement plan.[1]

Stage 5: Narrative Service Design

Objective: Translate narrative desires into content, transparency, and community services that make story the product.[2][1]

Process:

1. Content Pillar Development:[1]

o Design Education: Articles, videos explaining design principles and historical references

o Maker Stories: Profiles of artisans, designers, and manufacturing partners

o Radical Transparency: Cost breakdowns, sourcing documentation, production processes

o Community Spotlights: Customer stories, customization showcases, collector profiles

o Cultural Conversation: How your products participate in broader movements

2. Transparency Infrastructure:[2]

o Open Cost Modeling: Published breakdowns showing materials, labor, overhead, margin

o Supply Chain Mapping: Visual documentation of where and how products are made

o Decision Documentation: “Why we chose this” explanations for design and business choices

o Impact Reporting: Sustainability metrics, maker welfare, community contributions

3. Community Platform Architecture:[1]

o Digital Gathering Spaces: Forums, Discord servers, or exclusive social channels

o Co-Creation Opportunities: Input mechanisms for future designs, voting on editions

o Events and Experiences: Maker visits, design talks, community meetups

o Ambassador Programs: Pathways for passionate customers to become brand advocates

4. Content Calendar Integration: Develop 6-12 month calendars that align content releases with product drops, seasonal moments, and cultural conversations. Story should always lead, never follow, product releases.[1]

Deliverable: Narrative Service Blueprint—content strategy, transparency documentation templates, community platform specifications, and integrated calendar.[2][1]

________________________________________

From Design to Market: The Go-to-Market Translation

Positioning for Meaning, Not Price

The critical error in translating New New Design products to market is positioning them as “affordable alternatives”. This undermines the entire meaning architecture and triggers commodification.[2][1]

The Positioning Principles:

1. Story First, Always: Marketing leads with design intelligence and narrative coherence, not price comparison.[1]

2. Standalone Legitimacy: Your product is a legitimate, independent offering that happens to be accessible, not a derivative of luxury incumbents.[1]

3. Value Articulation: Clearly communicate what customers pay for design story, personalization, community, transparency not what they’re not paying for (brand overhead).[2][1]

4. Cultural Alignment: Position products as participants in contemporary movements (sustainability, democratic luxury, conscious consumption) rather than reactions to legacy brands.[2][1]

Channel Strategy for Meaning-Based Products

Distribution channels must align with meaning architecture, not just maximize reach.[9]

Direct-to-Consumer Primary: DTC allows full control over narrative, personalization experience, and community building. E-commerce platforms must support configuration tools, story-rich content, and community access.[1]

Curated Retail Secondary: Select partners who curate meaning, not just inventory. Design-focused retailers (Museum stores, concept shops, design galleries) validate your cultural positioning.[9][1]

Wholesale Avoided Initially: Traditional wholesale relationships compress margins and dilute narrative control. Only pursue once brand story is firmly established.[9][1]

Pop-Up and Experiential Tertiary: Temporary physical presence creates community moments and media opportunities without permanent overhead.[1]

Pricing Strategy That Reflects Meaning

Pricing in The New New Design must balance accessibility with perceived value.[2][1]

The Pricing Architecture:

1. Cost-Plus-Story Baseline: Calculate true costs (materials + manufacturing + fulfillment), then add margin that funds story infrastructure (content, community, transparency).[1]

2. Personalization Premiums: Charge 30-50% above baseline for customized options. Customers self-select based on uniqueness desire.[1]

3. Scarcity Multipliers: Limited editions command 2-3x baseline, reflecting exclusivity and future value potential.[1]

4. Transparency Publication: Consider publishing cost breakdowns as radical transparency that builds trust and differentiates from opaque luxury incumbents.[2]

________________________________________

Technology Stack for Translating Desire into Service

Consideration of Tools for New New Design Operations

The technology infrastructure must support personalization, transparency, narrative, and community while remaining accessible to emerging brands.[1]

E-Commerce and Configuration:

• Shopify Plus or Custom Solutions: Support for product customization, variant management, and narrative-rich presentation

• Configuration Tools: Zakeke, Customily, or custom-built interfaces for personalization

• Inventory Management: Systems that track numbered editions, limited runs, and custom orders

Content and Narrative:

• Content Management: Headless CMS (Contentful, Sanity) for story-rich content across platforms

• Video Production: In-house or partner capabilities for maker stories, process documentation

• Transparency Dashboards: Custom tools for cost breakdowns, supply chain visualization

Community and Engagement:

• Community Platforms: Discord, Circle, or custom forums for gathering spaces

• CRM and Email: Klaviyo, Customer.io for personalized communication at scale

• Co-Creation Tools: Voting platforms, design feedback systems, collaborative ideation spaces

Production and Maker Coordination:

• Manufacturing Partnership Management: Systems for coordinating with distributed makers, quality control, customization workflows

• Provenance Tracking: Blockchain or database solutions for authenticity certification, production documentation

Analytics and Intelligence:

• Behavior Analytics: Understanding which stories resonate, which customization options drive value

• Community Sentiment: Tools for monitoring community health, desire evolution

• Secondary Market Tracking: Platforms for monitoring resale values, collector trends

________________________________________

Case Translation: Applying the Framework

Hypothetical Case: “Horizon Watch Co.”

To illustrate the framework in action, let’s translate stakeholder desires into a New New Design watch brand.[2][1]

Stakeholder Desire Mapping Results:

End Users: Want accessible luxury-quality timepieces with meaningful design stories, without paying for brand heritage they don’t value.[2]

Community Members: Seek opportunities to customize watches, participate in design evolution, connect with other design enthusiasts.[1]

Makers: Desire recognition for their craft, fair compensation, visible attribution.[2]

Cultural Sources: 1960s aerospace instrumentation aesthetics (precision, functionality, tool-like purposefulness).[1]

Translation Application:

Design Language Development: Horizon references 1960s NASA instrument panels—matte black dials with high-contrast white indices, tool-watch functionality, precision without ornament. Uses Swiss automatic movements available to any manufacturer, paired with aerospace-grade titanium cases sourced from same suppliers as luxury incumbents. Every material choice documented with sourcing story.[2][1]

Personalization Architecture: Base model at $495 with standard black dial. Customization menu allows dial color selection (6 options), hands configuration (3 styles), case finish (brushed or polished), and caseback engraving. Customized watches priced at $645 (30% premium). Quarterly limited editions with unique dial designs at $795.[1]

Scarcity Engineering: First 500 units numbered “Founders Edition” with special caseback engraving and first access to future limited releases. Quarterly limited editions produced in runs of 100, retired when sold out. All watches come with numbered certificate of authenticity documenting exact production date, artisan signatures, component sources.[1]

Narrative Service: Launch content series “Instrument Design History” exploring 1960s aerospace aesthetics. Publish full cost breakdown showing $180 materials + $95 manufacturing + $65 fulfillment/overhead + $155 margin that funds content, community, and maker attribution. Create Discord community for design discussion, customization showcases, collector connection. Monthly “Maker Monday” video series profiling watchmakers, movement technicians, case manufacturers.[2][1]

Market Positioning: “Horizon creates instrument-inspired timepieces for the design-conscious. We reference 1960s aerospace precision without copying any specific watch, using the same Swiss movements and materials as luxury brands, at accessible prices. Our margin funds transparent making, maker recognition, and community—not century-old advertising campaigns”.[2][1]

Result: Horizon closes the branding gap not by being a “cheap Rolex,” but by offering standalone design legitimacy, authentic narrative, personalization, and community at an accessible price point.[2][1]

________________________________________

Metrics of Translation Success

Measuring Whether Desire Became Product

Translation success requires metrics beyond traditional sales KPIs.[2][1]

Meaning Metrics:

1. Narrative Engagement Rate: Time spent with content, story page views relative to product pages, community participation levels[1]

2. Personalization Adoption: Percentage of customers choosing customization (target: 40%+)[1]

3. Community Vitality: Active members, user-generated content volume, organic advocacy[1]

4. Secondary Market Health: Resale values relative to retail, transaction volume, collector appreciation[2][1]

5. Maker Recognition: Direct requests to work with specific artisans, maker social following growth[2]

Commercial Metrics:

1. Customer Lifetime Value: Repeat purchase rates, community tenure, advocacy behaviors[9]

2. Margin by Tier: Profitability across base, customized, and limited tiers[1]

3. Brand Equity Growth: Unprompted awareness, cultural conversation share, media coverage quality[1]

4. Acquisition Cost Efficiency: CAC relative to LTV, organic versus paid traffic ratio[9]

Cultural Metrics:

1. Design Recognition: Industry awards, museum acquisitions, design publication features[2]

2. Movement Participation: Citations in conversations about sustainability, democratic luxury, conscious consumption[2]

3. Category Influence: Competitors adopting transparency, personalization, or narrative strategies[2]

The true measure of translation success is when stakeholder desires—for meaning, identity, participation, and cultural conversation—become inseparable from the product itself.[2][1]

________________________________________

Navigating Translation Challenges

Common Pitfalls in Desire-to-Product Translation

Pitfall 1: Desire Dilution Through Compromise

When conflicting stakeholder desires arise (affordable pricing vs. artisan wages vs. sustainable materials), the temptation is to compromise on all fronts, satisfying no one.[10]

Solution: Make clear strategic choices. Decide which desires are non-negotiable based on your core meaning architecture, and communicate trade-offs transparently. Example: “We chose to pay above-market artisan wages, which means our base price is $50 higher than competitors. Here’s why we believe maker welfare is worth it”.[3][10][2]

Pitfall 2: Personalization Overwhelm

Offering unlimited customization creates decision paralysis and production complexity.[9]

Solution: Curate personalization menus thoughtfully. Offer 3-6 options per customizable element, not 50. Use digital configuration tools that visualize choices in real-time to reduce cognitive load.[5][1]

Pitfall 3: Narrative Fabrication

When authentic design stories are difficult to articulate, brands invent heritage or exaggerate cultural connections.[1]

Solution: Build narrative from genuine inspiration, even if modest. “We’re a two-year-old brand inspired by our founder’s love of 1970s hiking gear” is more compelling than fabricated century-old heritage. Authenticity always wins.[2][1]

Pitfall 4: Scarcity Manipulation

Creating artificial scarcity through dishonest “limited” claims destroys trust.[1]

Solution: Engineer scarcity ethically. True limited runs based on realistic production capacity, seasonal editions that genuinely retire, numbered series with verifiable production records. Never lie about scarcity—community will discover and punish deception.[2][1]

Pitfall 5: Community Extraction

Treating community as free marketing rather than genuine co-creation partnership.[2]

Solution: Provide real value and agency to community members. Exclusive access, design input that actually influences decisions, revenue sharing for ambassadors, transparent acknowledgment of community contributions.[2][1]

________________________________________

Future Translation: Evolving Desire Over Time

Designing for Desire Evolution

Stakeholder desires evolve as products mature, markets shift, and culture changes. The translation architecture must accommodate evolution without losing coherence.[5][4][2][1]

Year 1-2: Establishment Phase

Stakeholder Desires: Validation that quality matches luxury incumbents, authentic design story, accessible entry points.[1]

Translation Focus: Prove material and manufacturing parity, establish design language credibility, build initial community, demonstrate transparency.[2][1]

Year 3-5: Expansion Phase

Stakeholder Desires: Product line breadth, deeper personalization, exclusive access to innovations, visible maker recognition.[2][1]

Translation Focus: Expand product line within coherent design universe, introduce bespoke tier, elevate maker profiles, increase community co-creation opportunities.[1]

Year 5+: Legacy Phase

Stakeholder Desires: Cultural landmark status, collector appreciation, sustainable brand evolution, generational continuity.[2][1]

Translation Focus: Museum-quality archival pieces, official heritage documentation, secondary market cultivation, succession planning that maintains meaning architecture.[2][1]

At each phase, return to the desire mapping framework to capture evolved stakeholder needs and translate them into product and service updates.[5][4]

________________________________________

Conclusion: The Discipline of Translation

Turning stakeholder desire into New New Design products and services is neither art nor science it is disciplined translation. It requires systematic desire mapping across expanded stakeholder universes, rigorous translation through the five-stage architecture, and continuous evolution as desires shift.[6][3][4][9]

The framework presented in Part 3 provides the operational reality behind the philosophical principles established in Parts 1 and 2. Meaning architecture, design intelligence, and cultural participation are not abstract ideals they are concrete outcomes of systematic translation processes.[2][1]

For Entrepreneurs: You now possess an outline methodology for building brands that close the branding gap through meaning rather than marketing budgets. The path from stakeholder desire to market-ready product is clear, documented, and replicable.[9][1]

For Designers: Your work is elevated from styling to cultural contribution. Every design decision translates specific stakeholder desires into tangible form, creating products that earn their place through excellence rather than logo recognition.[2][1]

For Consumers: You become visible stakeholders whose desires shape products, not passive buyers of pre-determined offerings. Your participation desires translate into real co-creation opportunities; your narrative hunger translates into radical transparency; your identity desires translate into customization architecture.[2][1]

For Culture: When stakeholder desires are systematically translated into products, we build a more democratic design economy. Value creation is no longer gatekept by capital or century-old heritage it flows from design intelligence, authentic narrative, and genuine community.[1][2]

The New New Design is complete. Part 1: revealed the branding gap and the three pillars that close it. Part 2: explored the architecture of meaning in the age of quality parity. Part 3 provides the operational framework for turning desire into reality.[3][9][2][1]

The question now is not whether this paradigm works it is who will build it, how they will maintain integrity throughout the translation process, and what new forms of value they will create in a world where quality is ubiquitous and meaning is negotiable.[2][1]

The tools are here. The framework is documented. The stakeholders are waiting to participate.[6][4]

Begin translation.

The revolution is operational. The future belongs to those who translate desire into meaning, and meaning into products that matter.

References

1. The-New-New-Design-Part-1.docx 2. The-New-New-Design-Part-2-rewrite.docx

3. https://www.launchnotes.com/glossary/stakeholder-expectation-framework-in-product-management-and-operations

4. https://rsdsymposium.org/stakeholder-needs-for-systemic-design/

5. https://gocious.com/blog/capturing-your-customers-needs-and-turning-them-into-actionable-solutions-for-prioritization

6. https://www.mightybytes.com/blog/stakeholder-mapping/

7. https://productschool.com/blog/skills/product-management-skills-stakeholder-management

8. https://www.productplan.com/learn/stakeholder-types-product-managers/

9. https://www.boundaryless.io/blog/responding-to-different-customer-needs-with-products-and-services/

10. https://makeiterate.com/how-to-identify-stakeholders-for-a-design-thinking-workshop/

11. https://www.wellspring.com/blog/turn-user-needs-into-feature-product-ideas

12. https://www.romanpichler.com/blog/stakeholder-buy-in-product-strategy-roadmap/

13. https://productdesign-scotland.com/wp-content/uploads/2022/06/Filament-Toolkit-final.pdf

14. https://digitalhealthcanada.com/stakeholders-identify-them-and-keep-them-engaged-for-optimal-product-development/

15. https://productside.com/5-tips-for-getting-stakeholders-on-board-with-product/

16.https://www.reddit.com/r/ProductManagement/comments/1b9esu9/how_do_you_efficiently_transform_raw_information/

17. https://www.linkedin.com/advice/0/how-can-you-involve-stakeholders-product-development-npfie

18. https://www.interaction-design.org/literature/article/map-the-stakeholders

19. https://www.productboard.com/blog/3-best-practices-for-building-stakeholder-alignment-as-a-product-leader/

20. https://www.sciencedirect.com/science/article/pii/S2590252025000236

21. https://www.linkedin.com/pulse/transforming-customer-needs-technical-specifications-our-zarish-amjad-zrqcf

22. https://dovetail.com/product-development/stakeholder-engagement/