Preamble

I like ARIA, The Advanced Research & Invention Agency has been refreshingly open its approach to engage with a wide range of voices inclusive of idea brokers or wild cards like me. Secondly in its communications with me, I appreciate both their clarity and candour. I think they are necessary and should be supported .This article is not meant as a critique for critique’s sake; it is an invitation to stretch further. Britain needs a bolder, uniquely UK approach to breakthrough R&D, and outsider perspectives can help spark that journey. It should be noted that I expect this post to be disregarded an filed under the heading this is not our charter or statutory remit which is a British thing. (UK risk profile means that seed capital is usually excluded from investment we will invest at later stages)

Think of the points that follow as idea triggers: catalysts that may confirm your current course, expose blind spots, or ignite an unexpected line of inquiry. I hope they also encourage other ‘wild‑cards’ and creative brokers outside the usual research and venture circles to plug into ARIA’s growing ecosystem. Meaningful contribution is not always rewarded with a grant or a headline, but a well‑timed insight can set off a cascade of innovations that benefits us all. I have responded to a few of their Opportunity spaces and will share those responses in future posts

Executive Summary

ARIA was established in 2023 with a £700 million budget to fund high‑risk, high‑reward R&D. While its mission is laudable and its governance model deliberately lean, the agency currently lacks two critical ingredients for long‑term impact: (a) funding scale commensurate with its ambitions, and (b) a mechanism to capture a fraction of the upside it helps create. This paper synthesises lessons from DARPA (US), SPRIN‑D (DE), and the European Innovation Council (EU) and proposes a two‑tier operating model that pairs ARIA’s grants with a national IP & equity participation fund. Additional recommendations include an AI‑driven “reverse funding” platform and a structured repository for discarded but valuable ideas. Are other agencies models a mental ceiling or should they be a refence model?

1 Context

- Mandate: Catalyse breakthrough research that typical grant or venture channels ignore.

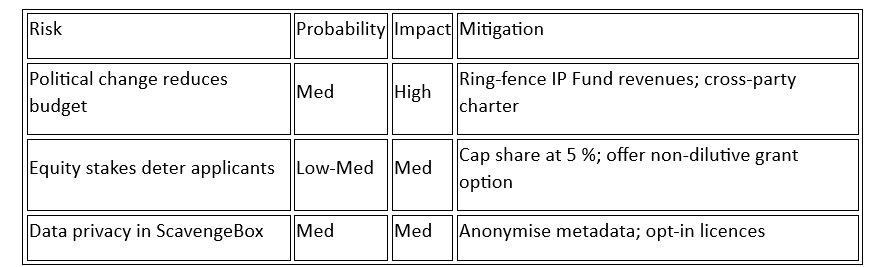

- Current tools: Time‑boxed programmes led by autonomous Programme Directors; rapid contracting; minimal reporting.

- Constraint: £700 m over four years (~£175 m p.a.), c.0.02 % of UK public spending on R&D.

2 Key Observations

2.1 Funding Scale & Leverage

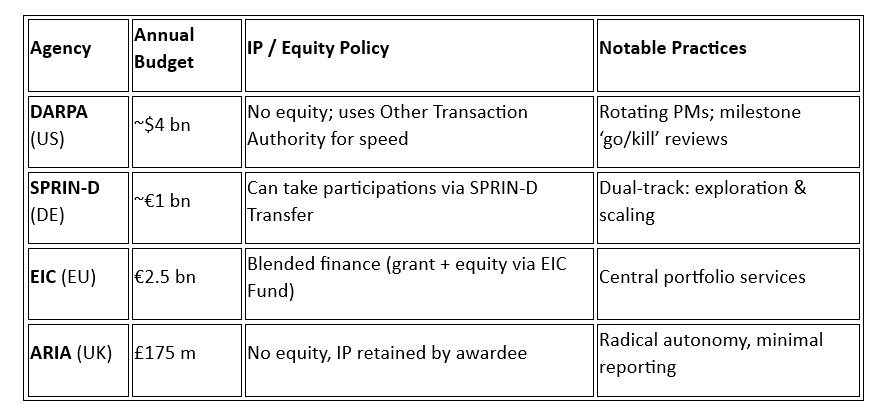

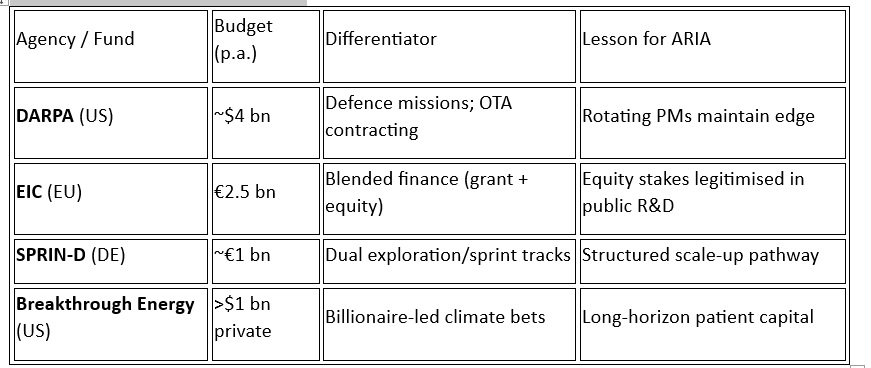

- Relative to peers (DARPA c.$4 bn p.a.; EIC €2.5 bn p.a.), ARIA’s budget is modest.

- Reliance on single‑source Treasury allocations leaves programmes exposed to fiscal cycles.

2.2 Intellectual‑Property & Value Capture

- ARIA currently takes no equity or royalty positions in the ventures it funds.

- Historical precedent (e.g., Tesla’s $465 m DoE loan converted to equity could have yielded >$15 bn) shows missed public upside.

2.3 Access & Diversity of Applicants

- Traditional networks dominate awareness; “cold” applicants face low hit‑rates despite strong prototypes.

- Under‑represented founders and cross‑disciplinary “wildcards” lack pathways to Programme Directors.

2.4 Idea Lifecycle Management

- Programme teams discard partial concepts that do not fit immediate objectives.

- Today these fragments sink into private archives instead of feeding future innovation.

2.5 Alternative Fund Proposal: Establish a fund open to contributions from both individuals and corporations, governed by clear rules to ensure investments serve national interests. The fund should reflect distinctly British values and priorities in its investment criteria, adopt a higher-risk profile to stimulate innovation, and operate with transparent, measurable KPIs to track impact and accountability.

3 Comparative Benchmarking

Key insight: blended finance and selective equity stakes are becoming standard among peer agencies.

4 Proposed Model Enhancements

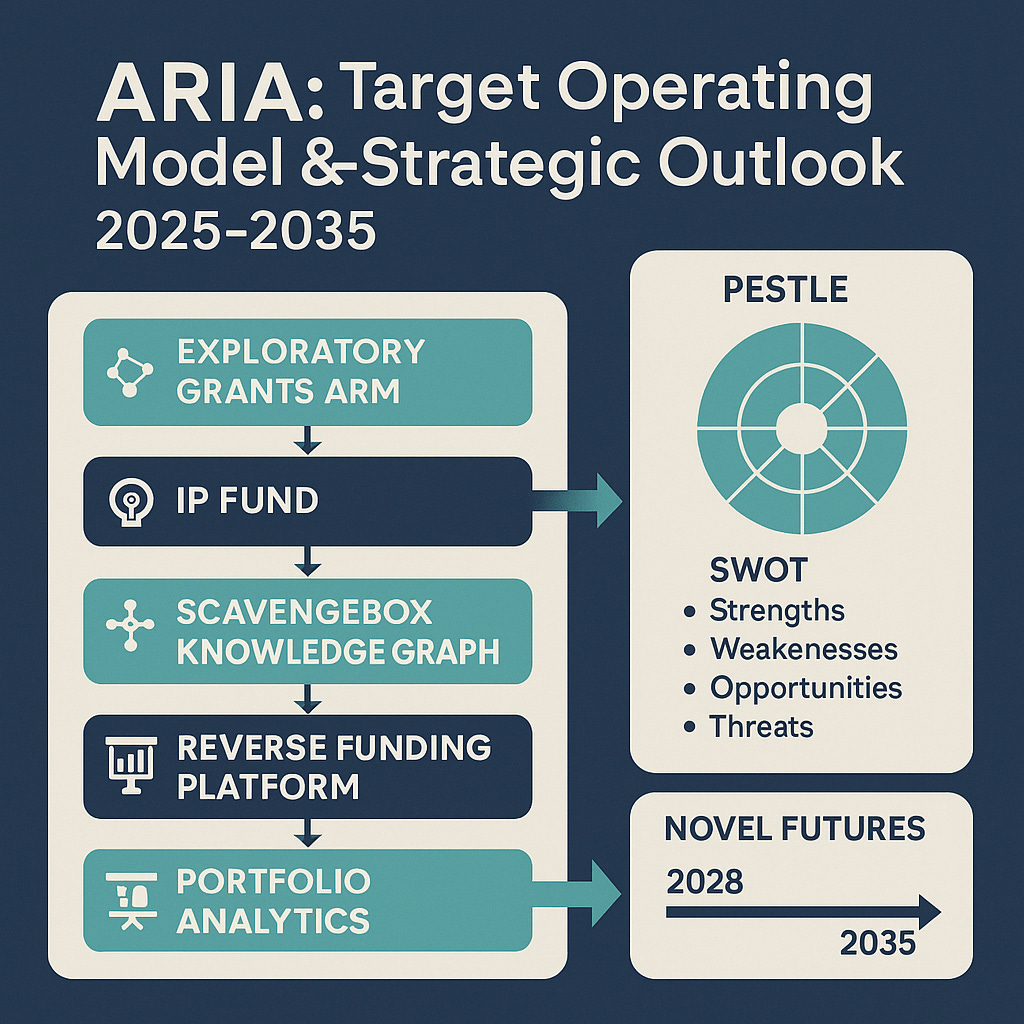

4.1 Two‑Tier Architecture

- Exploratory Grants Arm (existing): Preserve speed, autonomy, and risk tolerance.

- Participation & IP Fund (new): Take 1–5 % equity or capped royalty positions in downstream ventures. Surpluses recycle into future ARIA programmes.

- Participation or owner in Alternative Fund Proposal: Establish a fund open to contributions from both individuals and corporations, governed by clear rules to ensure investments serve national interests. The fund should reflect distinctly British values and priorities in its investment criteria (they will say this is not their statutory foundation but they should lobby for changes)

4.2 AI‑Driven Reverse Funding Platform

- Input: Applicant uploads a vision deck into a structured template.

- Engine: LLM ranks alignment with >2,000 UK/EU/Global public & private funding calls.

- Output: Curated funding pathway report and warm introductions.

4.3 Idea Salvage Repository (“ScavengeBox”)

- Lightweight knowledge graph of discarded sub‑ideas, tagged by TRL, domain, keywords, and blockers.

- Open to universities, SMEs, and citizen‑scientists under permissive licence.

4.4 Network Openness Measures

- Quarterly “Open Office Hours” with Programme Directors streamed online.

- Blind initial proposal screening to reduce network bias.

4.5 Open source Seeding: Create or seed some open source platforms to grow inventions and entrepreneurship in UK

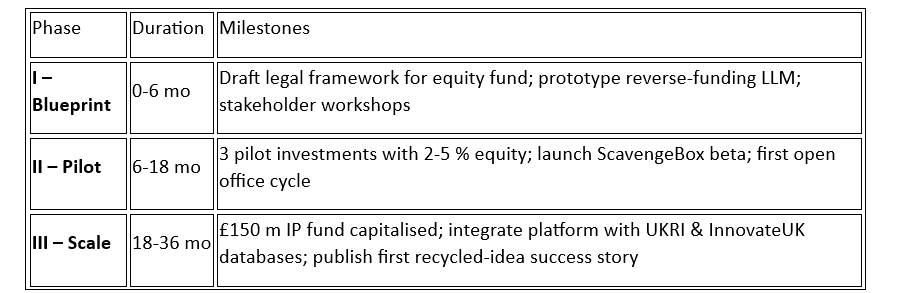

5 Implementation Roadmap

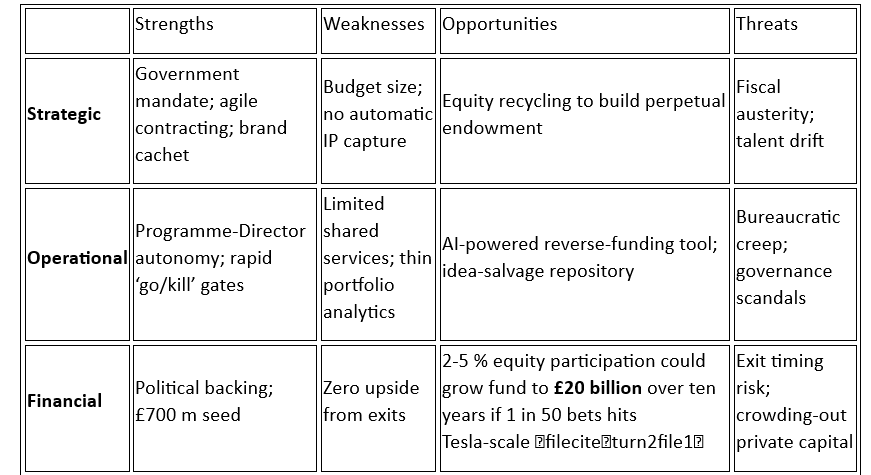

6 SWOT Analysis

- Strengths: Government mandate, agile contracting, brand credibility.

- Weaknesses: Small budget, zero upside capture, limited visibility outside elite networks.

- Opportunities: Equity recycling, AI‑powered matchmaking, global collaboration on mega‑projects.

- Threats: Fiscal austerity, bureaucratic creep, talent attrition to private funds.

7 Risks & Mitigations

8 Immediate Next Steps for the Ideas Brokerage Team

- Validate appetite – Conduct 5 expert interviews (ARI A Board, SPRIN‑D, venture LPs, start‑up founders) on equity participation tolerance.

- Quantify upside – Model historical UKRI grant exits to estimate potential recycling returns.

- Prototype platform – Use off‑the‑shelf LLM (GPT‑4o+) and open UK/EU call datasets to build an alpha demo within 4 weeks.

- Draft policy brief – 2‑page note for DSIT summarising Two‑Tier model benefits.

9 Further Development Suggestions

- Data deep‑dive: Commission analysis of 50 largest publicly funded UK tech successes vs. government return.

- Collaboration sandbox: Partner with one university to populate ScavengeBox with archived project artefacts.

- Global lens: Explore sovereign patent funds in Japan & Korea as analogues for the IP‑Fund governance.

- Public narrative: Publish op‑ed framing equity recycling as a “perpetual innovation endowment.”

Appendices

Appendix A – Strategic Analysis

A1. Market Landscape Overview

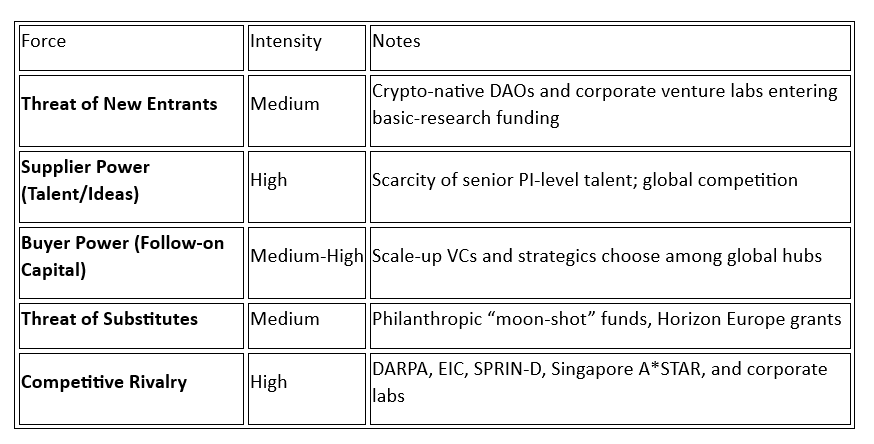

The global spend on advanced research agencies now exceeds US $50 billion annually, yet the UK captures barely 4 % of that total. ARIA’s current allocation—£175 million per year—is < 5 % of the DARPA budget and only ~7 % of the European Innovation Council’s annual outlay . The deep‑tech funding market is therefore both crowded (multiple public and corporate labs) and underserved at the highest‑risk, pre‑venture end—precisely where ARIA is positioned.

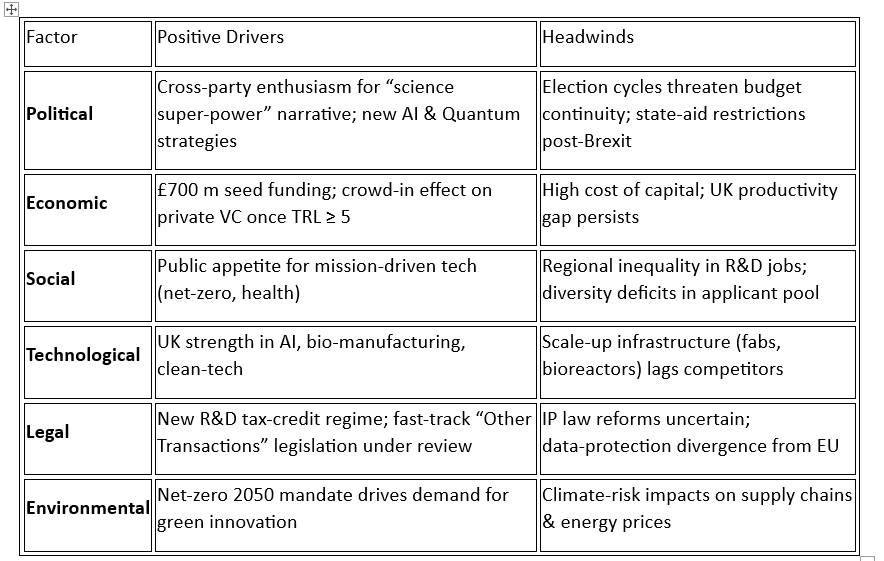

A2. P E S T L E Snapshot

A3. Refreshed SWOT

A4. Porter’s Five Forces (UK Deep‑Tech R&D Funding)

A5. Competitor & Peer Landscape

Appendix B – Future Target Operating Model (TOM)

B1. Structural Layers

- Exploratory Grants Arm – unchanged; 40 % of annual outlay for TRL 1‑3.

- Participation & IP Fund – new corporate vehicle taking 2‑5 % equity or capped royalties in downstream spin‑outs; target 60 % of outlay

- ScavengeBox Knowledge Graph – open repository for discarded concepts; permissive licence.

- Reverse‑Funding Platform – LLM‑powered matching of applicant visions to >2k global calls.

- Portfolio Data & Impact Analytics – dashboards for economic, societal, and environmental KPIs.

B2. Operating Flow

Idea → Reverse Funding Triage → Grant or Equity Track → Programme ‘Go/Kill’ Gates → IP & Equity Fund → Exit/Licence → Returns recycled into fund.

B3. Governance & Metrics

- Ring‑fenced Returns ensure surplus capital can only fund future ARIA missions .

- Impact KPIs: £ leverage ratio, diversity index, carbon‑abated per £, patent‑to‑exit velocity.

- Risk Controls: Portfolio diversification, staged dilution caps, transparent exit playbook .

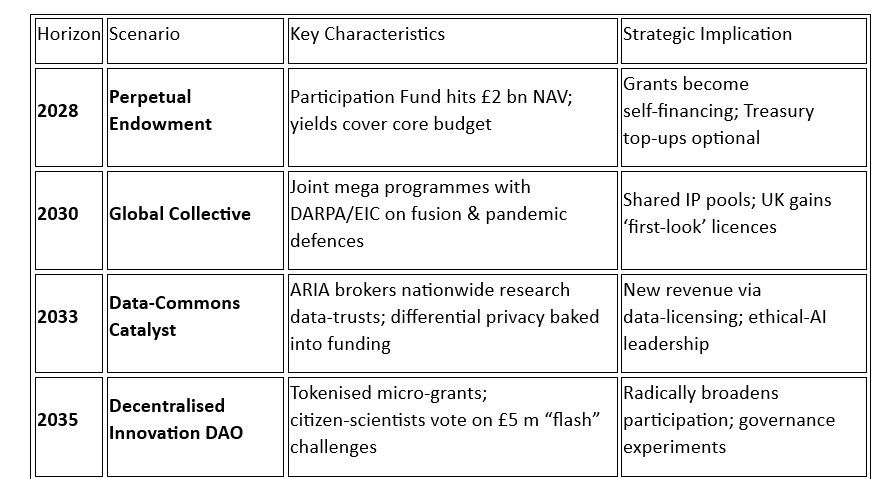

Appendix C – Novel Futures of ARIA

Each scenario expands on the participatory, high‑leverage ethos while retaining ARIA’s core agility. Early pilots—such as blockchain‑verified micro‑grants or cross‑agency ‘grand challenge’ coalitions—can de‑risk these futures.