Preamble

Part one of a recurring Substack series that injects high-level business concepts, emerging industry shifts, and idea-provoking triggers designed to spark new ventures. Each post acts as a catalyst—not a fully fleshed-out plan, but the seed of something bold, timely, and market-aware.

Thanks for reading! Subscribe for free to receive new posts and support my work.

Concept Summary:

Over 46 million homes sit empty across Europe and the U.S., while 1.5 million people are homeless. What if the next unicorn is not a landlord—it is a liquidity layer for housing equity? Are there other non-fintech or Hybrid solutions.

Why now and triggers

“The Triggers: Why This Explodes in _____”

Trigger Questions → “The Idea Sparks” : “Fuel for Your Brainstorm”)

See appendices for detailed Why now and Triggers questions : do not try to answer all take a few and ideate:

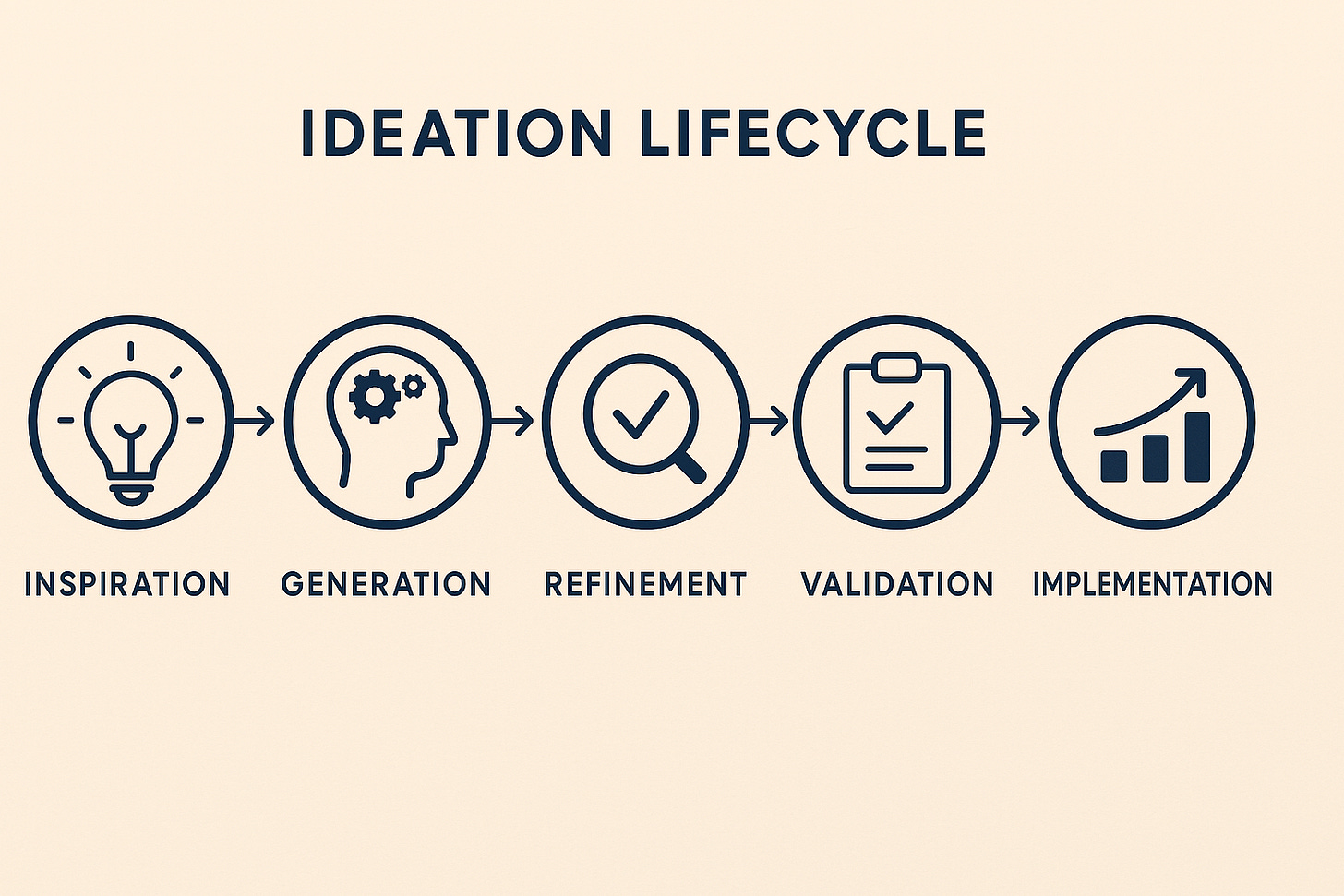

Ideation is the process of generating, refining, and validating ideas to solve problems or innovate.

Lifecycle:

- Inspiration – Identifying opportunities.

- Generation – Brainstorming solutions.

- Refinement – Filtering viable ideas.

- Validation – Testing concepts.

- Implementation – Executing and scaling.

Why Now?

- AI-enabled property management = lower repurposing costs

- Zoning reform + ESG incentives unlock new conversions

- Governments seeking public-private affordable housing models

- The financialization of real estate is losing public trust

- Opportunities to create public private financial entities

Trigger Questions:

- What would a “Stripe for social housing” look like?

- Could tokenized micro-ownership replace rent for low-income families?

- How could AI match homeless populations with vacant buildings dynamically?

- What is the new business model for vacant commercial properties?

- How do we onboard VCs to housing-as-infrastructure thinking?

- Cost and ethics?

- Rent or buy ?

- Affordability infrastructure?

Wildcard:

“Imagine if Zillow became the Robinhood of social housing—what’s the retail investing platform for community land trusts?”

Call to Action:

What is your spin on this paradox? Know a dead mall, a great retrofit tech, or a legal hack? Hit reply or drop a link—top ideas get featured next week.

Appendices

Appendix 1: Why Now and Triggers

Ideas Trigger 1: “There Are More Vacant Homes Than Homeless People. Here is the Fintech Fix No One’s Building.”

Expanded Why Now?

Technology Convergence

- AI-enabled property management = lower repurposing costs

- Computer vision + IoT sensors can assess building habitability at scale

- Smart contracts enable automated rent-to-equity transitions

- Digital identity systems streamline tenant verification for vulnerable populations

- Satellite imagery + machine learning can identify vacant properties faster than city inspectors

Regulatory & Policy Shifts

- Zoning reform + ESG incentives unlock new conversions

- Right-to-shelter laws spreading across major cities create government demand

- Opportunity Zones still have $75B in unrealized tax benefits waiting to be unlocked

- Social impact bonds gaining traction as governments seek measurable outcomes

- Anti-speculation taxes on vacant properties creating pressure for productive use

Market Conditions

- The financialization of real estate is losing public trust

- Interest rate volatility making traditional real estate investment less attractive

- Commercial real estate crisis (30%+ vacancy in some metro areas) creating distressed asset opportunities

- Municipal budget shortfalls driving need for public-private partnerships

- ESG mandates forcing institutional investors to seek impact investments

Social & Cultural Momentum

- Housing as a human right movement gaining mainstream political support

- Gen Z wealth inequality creating demand for alternative ownership models

- Corporate social responsibility budgets seeking tangible local impact

- Climate resilience requirements favouring adaptive reuse over new construction

- Work-from-home permanently reducing commercial space demand

Capital Market Evolution

- Crypto liquidity seeking real-world utility beyond speculation

- Retail investor democratization via fractional ownership platforms

- Impact investing growing 42% annually, seeking scalable opportunities

- Government stimulus still flowing toward housing initiatives

- Family office money seeking direct community investment

Expanded Trigger Questions

Business Model Innovation

- What would a “Stripe for social housing” look like?

- Could tokenized micro-ownership replace rent for low-income families?

- What if homeless individuals could “mine” housing equity through property maintenance work?

- How do we create a “Robinhood for community land trusts” that makes social impact investing accessible to millennials with $50?

- What is the “Shopify for housing cooperatives” – the infrastructure that lets communities easily spin up ownership models?

Technology & Matching

- How could AI match homeless populations with vacant buildings dynamically?

- What if Tinder’s algorithm optimized housing matches instead of dates?

- Could computer vision identify which empty buildings are “housing-ready” versus “tear-down”?

- How might IoT sensors in vacant properties automatically trigger conversion workflows?

- What is the “Google Maps for housing equity” – the navigation system for finding pathways from homelessness to ownership?

Market Disruption

- What is the new business model for vacant commercial properties?

- How do we make “housing landlords” as obsolete as “video rental stores”?

- What if we treated housing like public infrastructure – how would financing change?

- Could vacant property speculation become as socially unacceptable as smoking?

- What is the business case for making homelessness literally unprofitable?

Capital & Investment

- How do we onboard VCs to housing-as-infrastructure thinking?

- What if pension funds could invest in “guaranteed homeless housing returns”?

- How might cryptocurrency whales be incentivized to fund housing conversions?

- What is the “Y Combinator for social housing startups”?

- Could we create a “housing equity index fund” that outperforms traditional REITs?

Policy & Legal Innovation

- How do we hack zoning laws to make adaptive reuse the default?

- What if cities offered “housing conversion IPOs” where residents could buy equity in neighbourhood improvements?

- Could vacant property taxes fund a “universal basic housing” pilot?

- How might we use eminent domain as a feature, not a bug, in housing equity?

- What is the legal framework for “community mortgage” where neighbourhoods collectively own housing?

Ethical & Social Impact

- Cost and ethics – how do we avoid gentrification while solving homelessness?

- What if solving homelessness became a profitable video game?

- How do we measure “housing dignity” as a KPI alongside financial returns?

- Could formerly homeless individuals become equity partners rather than just tenants?

- What is the business model were helping one homeless person automatically funds helping the next?

Operational & Scale

- Rent or buy – what if the choice itself was the wrong question?

- How do we create “housing assembly lines” for converting vacant properties?

- What if property conversion became a “franchise opportunity” for contractors?

- Could we gamify vacant property identification with crowd-sourced mapping?

- How might we make housing conversion as simple as “one-click ordering”?

Infrastructure & Systems

- What is the “AWS for affordable housing” – the infrastructure layer everyone builds on?

- How do we create a “housing credit score” that measures community impact?

- What if utility companies became housing equity partners?

- Could transportation networks (Uber/Lyft) integrate housing placement as a service?

- How might we make housing mobility as frictionless as job mobility?

Wildcard Questions

- What if every vacant property automatically became available to homeless families after 90 days?

- How could we make “property guardian” a legitimate, well-paid profession?

- What if housing speculation required a “social impact license” like medical practice?

- Could AI property managers reduce housing costs to near-zero while maintaining quality? -What if solving homelessness was reframed as “unlocking stranded real estate assets”?

Meta Questions

- Which of these questions makes you most uncomfortable – and why might that discomfort signal the biggest opportunity?

- What assumptions about property ownership are we not questioning?

- How might someone in 2034 look back on our current housing crisis as obviously solvable?

- What would happen if we designed housing policy like we design software – with rapid iteration and user feedback?

Call to Action Expansion: Pick the trigger question that sparked the strongest reaction – positive or negative. That emotional response often signals where the biggest market opportunity (or blind spot) exists. The solutions that make traditional real estate investors slightly nervous might be exactly what makes them inevitable.

Appendix 2: Novel ideas Zone:

1. “Fractional Stewardship” Platform (Fintech + Social Impact)

Concept: A blockchain-powered platform where investors buy “stewardship tokens” representing fractional ownership of vacant properties. These tokens fund the conversion of empty homes into affordable housing, and token holders earn returns via:

- Micropayments from tenants (below-market rent)

- Government ESG subsidies

- Tax incentives tied to social impact metrics

Why it works: Aligns profit with purpose—VCs and retail investors gain exposure to real estate while solving homelessness.

2. AI-Powered “Adaptive Reuse” Matchmaker

Concept: An AI platform that dynamically matches homeless populations with vacant properties by analysing:

- Zoning loopholes (e.g., churches → shelters)

- Building layouts (e.g., offices → modular housing)

- Local subsidy programs

Revenue model: SaaS for municipalities, kickbacks from construction firms for retrofit projects.

3. “Reverse REIT” (Real Estate Income Trust for the Homeless)

Concept: A publicly traded REIT that acquires vacant properties and leases them to nonprofits/NGOs at $1/year, monetizing through:

- Social impact bonds

- Corporate sponsorship (e.g., “This shelter powered by Patagonia”)

- Voluntourism stays (pay to volunteer in housing rehab)

Wildcard: Add a Layer-2 crypto token where holders vote on which cities to expand into.

4. “Rent-to-Own Squatters” (Legal Hack)

Concept: Partner with cities to legally classify homeless families as “property guardians” (a la Dutch anti-squatting laws). They occupy and maintain vacant homes in exchange for:

- Credit-building rent payments

- Equity shares after 5 years

Legal hack: Use adverse possession laws to transfer titles after a period of stewardship.

5. Dead Mall → Micro-Village Conversion Kits

Concept: Prefab retrofit kits to turn vacant malls into mixed-use homeless housing with:

- Modular sleeping pods in former retail spaces

- On-site clinics/job training in anchor stores

- Revenue from pop-up markets (farmers’ markets, artisan stalls)

Funding: Crowdfunded via TikTok tours of prototype conversions.

6. “Airbnb for Empty Homes” (But Ethical)

Concept: A sublet platform where homeowners with vacant properties (e.g., inherited, between tenants) can “donate” temporary housing to homeless families.

- Incentives: Tax breaks, maintenance coverage by nonprofits

- Tech twist: AI lease agreements that auto-terminate when the owner needs the property back.

7. “Zillow for Zombie Properties” (Distressed Asset Flip)

Concept: A marketplace tracking bank-owned/abandoned homes, with a one-click “convert to shelter” option that bundles:

- Title transfers

- Modular renovation loans

- Tenant matching via housing NGOs

Profit: Fees from local governments clearing blight.

8. “Social Housing SPAC”

Concept: A blank-check company that raises $500M to acquire vacant single-family homes, then partners with community land trusts to transition them to permanently affordable housing.

- Exit strategy: Governments buy the portfolio at a capped ROI.

9. “Homelessness Impact Tokens” (DeFi)

Concept: A crypto token backed by vacant properties. Holders earn yield when:

- A home is occupied (rent flows into treasury)

- Zoning reforms pass (land value appreciates)

Governance: Token holders vote on which cities to target next.

10. “The Vacant Property ETF” (Wall Street Meets Social Good)

Concept: An exchange-traded fund of vacant-property-heavy REITs, shorting traditional landlords while long on adaptive reuse firms.

- Hook: 1% of fees fund homeless legal aid to fast-track occupancy.

Call to Action:

Which of these could be 1) legally viable, 2) politically palatable, and 3) profitably scalable? The best solutions will thread all three. For example, #3 (Reverse REIT) could attract ESG funds, while #5 (Dead Mall Kits) might win over local governments with jobs creation.

Wildcard Pitch:

“What if we gamified solving homelessness? A mobile app where you ‘unlock’ vacant homes by recruiting local sponsors, with leaderboards for cities reducing homelessness fastest.”