Executive Summary & Preamble

In March 2023 the Post The Diaspora Funded Development Company proposed a vehicle capable of channelling the US $626 billion annual remittance flow from workers in high‑income countries into large‑scale, transparent and profitable development projects across the Global South. Two years of thinking research consultation with bankers, etc has refined that concept into the Diaspora‑Funded Development Finance Entity (DFDFE). DFDFE 2.0 is a modular, country‑adaptable platform leveraging artificial intelligence, tokenised securities and data‑driven governance to convert diaspora capital into infrastructure, SME growth and social‑impact programmes while delivering market‑competitive risk‑adjusted returns. This paper updates the original vision, details the operating model, assesses geopolitical risks, and provides an implementation toolkit. Note idea mentioned in this document is negotiable and please critique (I started see appendices). For an outline Business plan of article see: DFDFE 2.0

1. Vision

- Catalyse a virtuous loop where diaspora savings fuel sustainable domestic growth, reducing brain‑drain and enhancing national resilience.

- Evergreen blended‑finance fund issuing Development Participation Notes (DPNs) to diaspora investors and co‑investing alongside local DFIs, sovereign funds and NGOs.

- Radical transparency through real‑time project ledgers on a permissioned blockchain, AI‑driven monitoring and quarterly open‑data dashboards.

2. Strategic Business Case

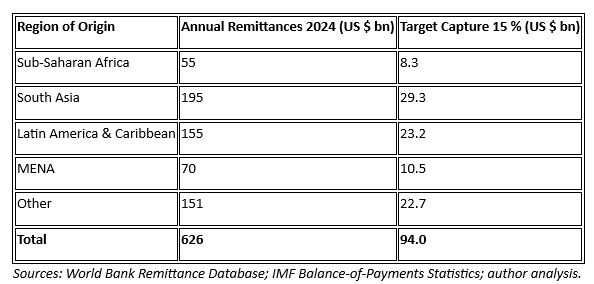

Diaspora households save approximately 20 % of disposable income. Redirecting 15 % of that saving into productive assets over ten years would mobilise > US $450 billion — quadruple the World Bank’s annual lending volume — without raising sovereign debt.

3. Market Context & Diaspora Capital Flows

4. Operating Model

- Legal form: Luxembourg umbrella SICAV‑RAIF with country‑specific compartments regulated locally.

- Capital structure: Diaspora DPNs (equity‑like), local pension‑fund mezzanine, senior DFIs/IFI debt, and catalytic first‑loss guarantees from philanthropic foundations.

- Origination themes: Renewable power, Agritech value‑chains, affordable housing, digital public infrastructure, health‑tech, plus an Innovation Window for frontier ventures.

- Return profile: 10–14 % IRR target, tenor 8–12 years, USD‑linked with optional local‑currency hedging pool.

- Reward mechanics: Profit participation, tokenised dividend‑bearing development shares, spin‑off equity allocations for project champions, and a social returns wallet for philanthropic contributors.

- Nonprofit : Break-even, social Good and maintainable

5. Governance & Transparency Framework

- Board composition: Diaspora investor representatives (40 %), independent experts (30 %), host‑country institutions (20 %), NGO/CSO observers (10 %).

- AI‑driven audit: Machine‑learning anomaly detection across spend patterns, automated ESG scoring, smart‑contract release of funds on milestone verification.

- Assurance: Open‑Data Charter compliance; quarterly audits by a Big Audit firm plus a civil‑society review panel and creation of Country independent Programme ,Project and measurement , audit and validation and inspection Firms

6. Technology Stack

- Mobile onboarding via Tier‑1 remittance apps (M‑Pesa, GCash, Wise) or new solution as needed.

· Permissioned Ethereum‑compatible chain (e.g., Quorum) for token issuance and immutable audit trails. or new solution as needed.

- AI/ML modules: Credit‑scoring for informal‑sector borrowers; satellite‑derived project‑progress analytics; natural‑language risk‑scans of local media.

- Interoperability layer: CBDC and stable‑coin rails; ISO‑20022 messaging; API gateway for DFIs and banks.

7. Partnership & Cooperation with Global South DFIs, Investment Banks & NGOs

Consider:

- Co‑lending MOUs with Afreximbank, IDB Invest, Asian Infrastructure Investment Bank.

- Syndication desks of Standard Bank, Itaú BBA, Kotak Mahindra to structure local‑currency tranches.

- NGO role: Community engagement, last‑mile beneficiary verification, post‑investment capacity‑building.

8. Project Selection & Execution

- Concept Note — preliminary screening.

- Feasibility Score ≥ 75 / 100 — technical, environmental, social.

- Investment Committee approval — final sanction.

Hybrid regional‑country model: Core risk management is centralised; localisation layers address legal, tax and cultural adaptation. Each project is housed in an SPV with DFDFE majority ownership until exit.

Note: Do you create another entity that considers development ideas like a hybrid Venture capital finance firm and who carries project and programme analysis and research?

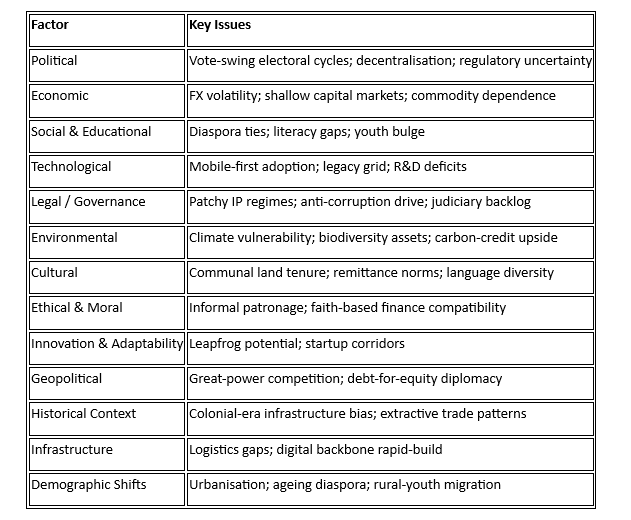

9. Analytical Frameworks

9.1 PESTLE Snapshot (Global‑South Focus)

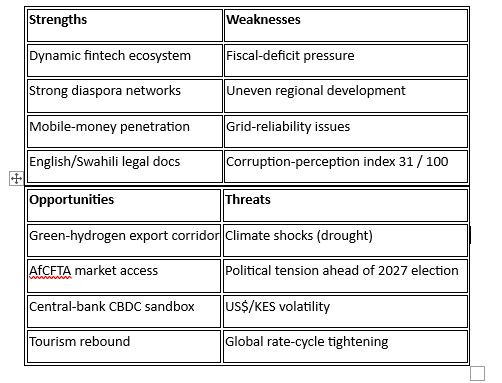

9.2 Localisation SWOT — Example: Kenya

9.3 Porter’s Five Forces (DFDFE vs. Traditional DFIs)

- Threat of new entrants: Medium — crypto‑fund platforms are emerging.

- Supplier power: High — limited pool of investable large‑ticket projects.

- Buyer power: Medium — diaspora investors fragmented yet price‑sensitive.

- Threat of substitutes: High — remittances flow into real estate and consumption.

- Industry rivalry: Medium — DFIs compete for co‑financing mandates.

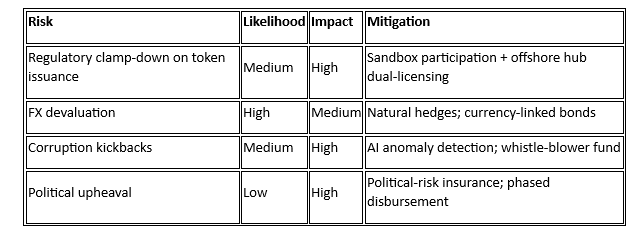

9.4 Risk Matrix (Illustrative)

10. Metrics & KPIs

- Gross capital mobilised (disaggregated by diaspora cohort).

- Jobs created (direct/indirect) per US $1 million invested.

- Carbon‑adjusted IRR (CA‑IRR).

- Gender‑smart capital ratio.

- Transparency index score (audits published within 15 days of quarter‑end).

Measuring Success

- Financial: ROI on diaspora investments (target: 8-12% IRR).

- Social: Jobs created, GDP growth in funded regions.

- Governance: Reduction in corruption (via blockchain audits).

11. Stakeholder Map

- Diaspora investors → Capital + governance voice.

- Host‑country governments → Policy alignment, fiscal support.

- DFIs / Investment banks → Leverage, syndication, local‑currency credit.

- NGOs & CSOs → Social licence, monitoring, beneficiary insight.

- Tech partners → Blockchain infrastructure, AI analytics, mobile interfaces.

- Academia → Impact research, capacity‑building.

- People → (Local Entrepreneurs, Everyone ) Project Executors, Funding, mentorship

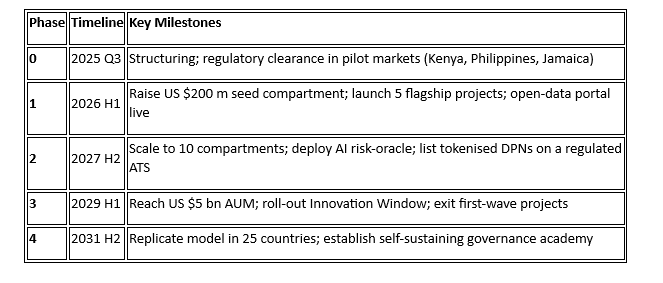

12. Implementation Roadmap

13. Conclusion: A New Paradigm

DFDFE is a decolonized development finance model—leveraging diaspora capital, blockchain transparency, and AI efficiency to break cycles of aid dependency and corruption. Resistance is expected, but the combination of mobile banking, crypto dividends, and spin-off equity creates a compelling case for diaspora investors.

Next Steps:

- Secure anchor diaspora investors.

- Partner with fintech/crypto compliance firms.

- Pilot in a crypto-friendly jurisdiction (e.g., Kenya, El Salvador).

Appendices

Appendices 1:

A. Critique of DFDFE

- Challenge: Regulatory hostility (e.g., crypto bans).

- Rebuttal: Use hybrid fiat/crypto to comply where needed.

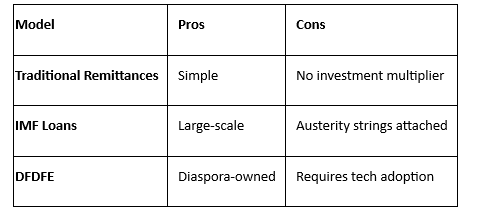

B. Alternative Models

C. Selectable Implementation Framework

- Option 1: Country-by-country (slow but secure).

- Option 2: Continent-wide (faster, higher risk).

- Option 3: Hybrid (start with countries, scale to regions).

A. Financial Model Template & Modelling Guidance

- Cash‑flow waterfall; scenario macros; sensitivity wizard.

B. Illustrative Business Plan

- Solar‑agri micro‑grid cluster (Ghana) with capital budget, revenue‑share parameters, IRR 13.8 %.

C. Critique & Alternative Models Matrix

- Diaspora bonds (Israel/India precedents); remittance‑securitisation SPVs; migration‑linked development visas.

D. Selectable Implementation Frameworks

- Centralised Liquidity Hub vs. Distributed Country Funds; Build‑Operate‑Transfer vs. Public‑Private‑Community Partnership.

E. References & Further Reading

- World Bank KNOMAD Remittance Flows (2024).

- UN DESA International Migration Report (2023).

- McKinsey Global Institute Harnessing Diaspora Capital (2024).

- OECD Tokenisation in Development Finance Working Paper (2025).

- Khan & Moyo (2024) “AI for Development Project Monitoring”, Journal of Development Finance.