Smart Sampling Business Concept: Strategic Analysis & Business Plan

Executive Summary

Core Concept: A tech-enabled micro-packaging and sampling ecosystem that allows consumers to discover, trial, and purchase products through small-format packaging integrated with digital tracking and social sharing capabilities.

Value Proposition: Reduces consumer risk, minimizes waste, enables product discovery, and creates data-driven customer acquisition channels for brands.

Analysis Artifacts and Critique (outline):Analysis Artifacts and Idea Analysis

Extending the concept: As a business concept to sell only micro packaged products:Micro package framework

1. CONCEPT CLARIFICATION & ORGANIZATION

1.1 Core Components

- Physical: Micro-packaging in sachets, small bottles, tubes

- Digital: QR code integration, mobile app, social sharing

- Data: Taste profiles, usage tracking, preference analytics

- Social: Community reviews, sharing capabilities

1.2 Target Industries (Priority Order)

- Food & Beverages: Hot sauces, spices, teas, coffee

- Personal Care: Skincare, cosmetics, fragrances

- Home & Lifestyle: Cleaning products, air fresheners

- Health & Wellness: Supplements, functional foods

2. STRATEGIC ANALYSIS

2.1 PESTLE Analysis

Political

- Food safety regulations (FDA, FSSAI, NAFDAC)

- Import/export restrictions on food products

- Data privacy laws (GDPR, local equivalents)

- Packaging waste regulations

Economic

- Rising disposable income in emerging markets

- Cost pressures on marketing/customer acquisition

- Supply chain inflation affecting full-size products

- Growing subscription economy

Social

- Experience-driven consumption trends

- Social media influence on purchasing

- Sustainability consciousness

- FOMO and discovery culture

Technological

- QR code ubiquity post-COVID

- AI-powered recommendation engines

- Advanced packaging technologies

- Blockchain for authenticity

Legal

- Product liability for samples

- Intellectual property on packaging designs

- Cross-border e-commerce regulations

- Consumer protection laws

Environmental

- Plastic pollution concerns

- Circular economy initiatives

- Carbon footprint regulations

- Biodegradable packaging development

2.2 Porter’s Five Forces

Threat of New Entrants: MEDIUM

- Low initial capital for app development

- High complexity in multi-brand partnerships

- Regulatory barriers in food/cosmetics

Supplier Power: HIGH

- Brands control product access

- Specialized packaging requirements

- Quality control dependencies

Buyer Power: MEDIUM-LOW

- Low switching costs for consumers

- High perceived value of discovery

- Network effects create stickiness

Threat of Substitutes: MEDIUM

- Traditional retail sampling

- Subscription boxes

- Online reviews/social proof

Competitive Rivalry: LOW-MEDIUM

- Few direct competitors in integrated model

- Fragmented sampling industry

- High differentiation potential

2.3 SWOT Analysis

Strengths

- First-mover advantage in integrated model

- Lower consumer commitment barrier

- Rich data generation capability

- Multi-industry applicability

- Sustainability angle

Weaknesses

- Complex supply chain coordination

- High operational overhead

- Regulatory compliance across categories

- Technology integration challenges

Opportunities

- Emerging market expansion

- Corporate partnership revenue

- Data monetization

- White-label solutions

- Sustainability premium

Threats

- Regulatory restrictions

- Economic downturns affecting discretionary spending

- Major tech platforms entering space

- Counterfeiting/quality issues

3. MARKET ANALYSIS

3.1 Market Size Estimation

Global Sampling Market: $4.2B (2024)

- Beauty sampling: $1.8B

- Food & beverage sampling: $1.2B

- Growing at 12% CAGR

Target Addressable Market: $500M-1B

- Focus on premium/artisanal brands

- Tech-enabled sampling premium

3.2 Customer Segmentation

Primary: Urban millennials/Gen Z (25-40)

- High disposable income

- Social media active

- Experience-oriented

- Sustainability conscious

Secondary: Affluent Gen X (40-55)

- Quality-focused

- Time-constrained

- Brand-curious

- Health-conscious

3.3 Competitive Landscape

Direct Competitors

- Birchbox (beauty focus)

- Blue Apron samples (food)

- Scentbird (fragrance)

Indirect Competitors

- Traditional retail sampling

- Subscription boxes

- E-commerce try-before-buy

4. BUSINESS MODEL CANVAS

4.1 Revenue Streams

- B2B Revenue (70% of total)

- Sampling service fees: $0.50-2.00 per sample

- Data insights packages: $10K-50K annually

- Marketing campaign management: 15-25% commission

- B2C Revenue (20% of total)

- Premium app subscriptions: $9.99/month

- Curated discovery boxes: $19.99-39.99/month

- Full-size product commissions: 5-15%

- Data & Analytics (10% of total)

- Anonymous trend reports

- Market research partnerships

- Predictive analytics licensing

4.2 Cost Structure

- Packaging & Fulfillment: 35%

- Technology Development: 25%

- Marketing & Partnerships: 20%

- Operations & Staff: 15%

- Regulatory & Compliance: 5%

5. IMPLEMENTATION STRATEGY

5.1 Phase 1: MVP Development (Months 1-6)

- Focus on hot sauces (as specified)

- Single-market launch (e.g., Nigeria, India, or UK)

- Basic app with QR scanning and journaling

- 10-20 partner brands

5.2 Phase 2: Market Validation (Months 7-18)

- Expand to 3-5 product categories

- Add social sharing features

- Implement recommendation engine

- Scale to 100+ partner brands

5.3 Phase 3: Geographic Expansion (Months 19-36)

- Enter 3-5 new markets

- White-label solutions for retailers

- Advanced analytics platform

- Strategic partnerships

6. CRITICAL SUCCESS FACTORS

6.1 Technology Requirements

- Robust QR code system with offline capability

- AI-powered taste/preference matching

- Secure data handling and privacy protection

- Seamless social media integration

- Real-time inventory management

6.2 Operational Excellence

- Quality control across all samples

- Efficient micro-packaging operations

- Cold chain management for perishables

- Customer service excellence

- Regulatory compliance framework

6.3 Partnership Strategy

- Exclusive sampling rights negotiations

- Co-marketing agreements

- Data sharing partnerships

- Influencer collaboration programs

7. RISK ANALYSIS & MITIGATION

7.1 High-Risk Factors

Regulatory Compliance

- Risk: Food safety violations, packaging regulations

- Mitigation: Expert regulatory team, certified facilities, insurance

Quality Control

- Risk: Contaminated/expired samples

- Mitigation: Blockchain tracking, third-party testing, batch controls

Brand Partnership Dependencies

- Risk: Key brands withdrawing

- Mitigation: Diversified portfolio, long-term contracts, value demonstration

7.2 Medium-Risk Factors

Technology Failures

- Risk: App crashes, QR code issues

- Mitigation: Redundant systems, rigorous testing, gradual rollouts

Market Acceptance

- Risk: Low consumer adoption

- Mitigation: Extensive user testing, iterative development, strong marketing

8. FINANCIAL PROJECTIONS (5-Year)

Year 1: $500K Revenue

- 10K active users

- 50 average samples per user

- $1 average revenue per sample

Year 3: $15M Revenue

- 150K active users

- Multiple markets

- Premium services launched

Year 5: $75M Revenue

- 500K active users

- Data analytics revenue significant

- International expansion complete

9. STAKEHOLDER ANALYSIS

9.1 Primary Stakeholders

CONSUMERS (End Users)

- Interests: Product discovery, value for money, convenience, sustainability

- Power: HIGH (drive adoption and revenue)

- Influence: HIGH (social media amplification, word-of-mouth)

- Engagement Strategy: Superior user experience, community building, loyalty programs

- Potential Conflicts: Privacy concerns, packaging waste, product quality issues

- Success Metrics: App engagement, repeat usage, social sharing, conversion to full-size purchases

BRAND PARTNERS (Product Manufacturers)

- Interests: Customer acquisition, market testing, data insights, brand awareness

- Power: VERY HIGH (control product access and pricing)

- Influence: HIGH (can make or break partnerships)

- Engagement Strategy: Demonstrate ROI, provide detailed analytics, co-marketing opportunities

- Potential Conflicts: Channel conflict with existing distributors, data ownership disputes

- Success Metrics: Lead generation, conversion rates, brand lift, customer lifetime value

INVESTORS/SHAREHOLDERS

- Interests: ROI, scalability, market leadership, exit opportunities

- Power: HIGH (funding and strategic decisions)

- Influence: HIGH (board representation, strategic direction)

- Engagement Strategy: Regular reporting, milestone achievements, market expansion updates

- Potential Conflicts: Growth vs. profitability timeline, international expansion pace

- Success Metrics: Revenue growth, user acquisition cost, lifetime value ratios, market share

9.2 Secondary Stakeholders

PACKAGING SUPPLIERS

- Interests: Volume orders, long-term contracts, sustainable solutions

- Power: MEDIUM (multiple suppliers available but switching costs exist)

- Influence: MEDIUM (can impact costs and sustainability credentials)

- Engagement Strategy: Partnership agreements, innovation collaboration, volume commitments

- Potential Conflicts: Cost pressures, sustainability requirements, quality standards

- Success Metrics: Cost per unit, defect rates, sustainability metrics, delivery reliability

LOGISTICS PARTNERS (Last-Mile Delivery)

- Interests: Volume, predictable routes, efficient operations

- Power: MEDIUM (alternatives exist but integration effort required)

- Influence: MEDIUM (impacts customer experience and costs)

- Engagement Strategy: Volume commitments, technology integration, performance incentives

- Potential Conflicts: Delivery speed vs. cost, rural area coverage, temperature-sensitive products

- Success Metrics: Delivery times, damage rates, cost per delivery, geographic coverage

RETAILERS (Potential Partners/Competitors)

- Interests: Foot traffic, customer data, exclusive partnerships

- Power: MEDIUM-HIGH (access to consumers but changing retail landscape)

- Influence: MEDIUM (can amplify or compete with model)

- Engagement Strategy: White-label solutions, revenue sharing, data partnerships

- Potential Conflicts: Channel competition, margin pressures, customer data ownership

- Success Metrics: Store traffic, conversion rates, customer acquisition, revenue per square foot

TECHNOLOGY PARTNERS (App Development, Analytics, Payment Processing)

- Interests: Long-term contracts, technology showcasing, scalable solutions

- Power: MEDIUM (alternatives exist but switching costs high)

- Influence: MEDIUM (impacts user experience and operational efficiency)

- Engagement Strategy: Strategic partnerships, co-innovation, performance-based contracts

- Potential Conflicts: Technology lock-in, cost escalation, performance issues

- Success Metrics: System uptime, user satisfaction scores, processing speeds, security incidents

9.3 Regulatory & Institutional Stakeholders

REGULATORY BODIES (FDA, FSSAI, NAFDAC, etc.)

- Interests: Public safety, compliance, industry standards

- Power: VERY HIGH (can shut down operations)

- Influence: HIGH (sets operational parameters)

- Engagement Strategy: Proactive compliance, industry association participation, transparency

- Potential Conflicts: Changing regulations, cross-border compliance complexity, interpretation differences

- Success Metrics: Zero violations, approval timelines, compliance audit results

ENVIRONMENTAL AGENCIES & NGOs

- Interests: Waste reduction, sustainable packaging, circular economy

- Power: MEDIUM (public pressure, policy influence)

- Influence: HIGH (can impact brand reputation and regulatory environment)

- Engagement Strategy: Sustainability certifications, environmental partnerships, transparent reporting

- Potential Conflicts: Packaging waste concerns, lifecycle analysis disputes, greenwashing accusations

- Success Metrics: Packaging recycling rates, carbon footprint reduction, sustainability certifications

INDUSTRY ASSOCIATIONS

- Interests: Industry growth, standards development, member advocacy

- Power: MEDIUM (collective voice, standard setting)

- Influence: MEDIUM (industry best practices, regulatory input)

- Engagement Strategy: Active membership, thought leadership, standard development participation

- Potential Conflicts: Competitive concerns, standard interpretation, membership politics

- Success Metrics: Association leadership roles, standard adoptions, industry recognition

9.4 External Influencers

SOCIAL MEDIA INFLUENCERS

- Interests: Authentic content, audience engagement, monetization

- Power: MEDIUM-HIGH (audience reach and trust)

- Influence: HIGH (can drive viral adoption or criticism)

- Engagement Strategy: Authentic partnerships, exclusive access, co-created content

- Potential Conflicts: Authenticity vs. commercial interests, content control, exclusivity demands

- Success Metrics: Reach, engagement rates, conversion attribution, brand sentiment

MEDIA & JOURNALISTS

- Interests: Newsworthy stories, industry trends, public interest

- Power: MEDIUM (public opinion influence)

- Influence: HIGH (can shape public perception and regulatory attention)

- Engagement Strategy: Thought leadership, exclusive access, industry insights sharing

- Potential Conflicts: Negative coverage, investigative scrutiny, competitive information

- Success Metrics: Media mentions, sentiment analysis, thought leadership positioning

ACADEMIC RESEARCHERS & INSTITUTIONS

- Interests: Research opportunities, student projects, industry collaboration

- Power: LOW (no direct business impact)

- Influence: MEDIUM (credibility, long-term trends, policy input)

- Engagement Strategy: Research partnerships, internship programs, data sharing for studies

- Potential Conflicts: Intellectual property, research timeline vs. business needs, publication restrictions

- Success Metrics: Research publications, student placement, innovation partnerships

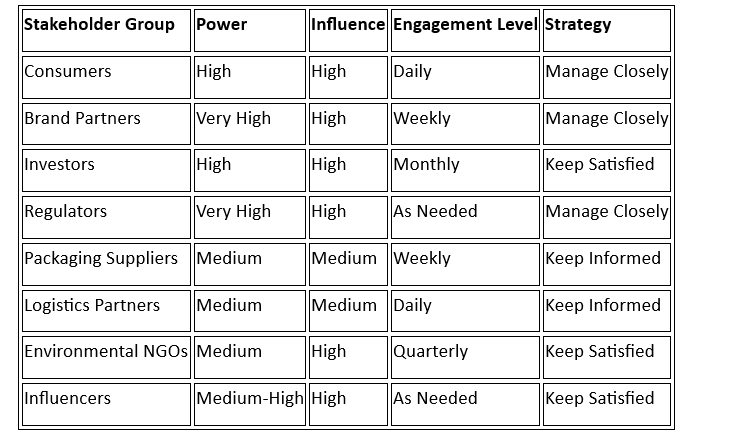

9.5 Stakeholder Engagement Matrix

9.6 Stakeholder Risk Assessment

HIGH RISK STAKEHOLDERS

- Regulatory Bodies: Non-compliance can shut down operations

- Key Brand Partners: Loss of major brands can collapse revenue

- Lead Investors: Funding withdrawal can halt growth

MEDIUM RISK STAKEHOLDERS

- Consumer Groups: Negative sentiment can damage brand

- Environmental NGOs: Sustainability criticism can impact reputation

- Major Packaging Suppliers: Quality issues can disrupt operations

LOW RISK STAKEHOLDERS

- Academic Institutions: Limited direct business impact

- Individual Influencers: Diversified influencer portfolio reduces risk

- Industry Associations: Supportive but not critical to operations

9.7 Stakeholder Communication Plan

QUARTERLY COMMUNICATIONS

- Investor updates with KPIs and strategic progress

- Brand partner performance reviews and planning sessions

- Environmental impact reports to NGOs and sustainability-focused stakeholders

MONTHLY COMMUNICATIONS

- Regulatory compliance updates and proactive issue reporting

- Consumer community updates and feature announcements

- Supply chain partner performance reviews

ONGOING COMMUNICATIONS

- Daily operational communications with logistics and technology partners

- Real-time customer service and community management

- Continuous social media engagement and influencer relationship management

10. RECOMMENDATIONS FOR DEVELOPMENT

9.1 Immediate Actions

- Conduct detailed market research in target country

- Develop MVP app with core functionality

- Secure initial brand partnerships (5-10 brands)

- Create packaging prototypes and test sustainability options

- Establish regulatory compliance framework

9.2 Critical Improvements Needed

- Sustainability Strategy: Develop biodegradable packaging options

- Data Privacy: Implement GDPR-compliant data handling

- Quality Assurance: Create comprehensive testing protocols

- Scalability Planning: Design for multi-market operations from start

- Monetization Clarity: Define exact pricing models and commission structures

9.3 Innovation Opportunities

- AR Integration: Virtual taste/scent experiences

- IoT Packaging: Smart labels with freshness indicators

- Blockchain Authentication: Anti-counterfeiting measures

- AI Personalization: Advanced recommendation algorithms

- Circular Economy: Packaging return and refill programs

10. CONCLUSION

This concept addresses a real market gap with strong potential for scalability and profitability. The combination of physical sampling with digital engagement creates a powerful customer acquisition and data generation tool for brands while providing genuine value to consumers.

Success depends on: Exceptional execution of quality control, strategic brand partnerships, and creating genuine consumer value beyond novelty.

Next Steps: Validate core assumptions through market research, develop MVP, and secure initial brand partnerships to test product-market fit.

APPENDICES

APPENDIX A: ECOSYSTEM BREAKDOWN – PACKAGING MAKERS & DESIGNERS

A.1 Packaging Design & Development Ecosystem

TIER 1: GLOBAL PACKAGING GIANTS

- Amcor (Australia) – Flexible packaging, sustainability focus

- Sonoco (USA) – Consumer packaging, tubes, rigid containers

- Constantia Flexibles (Austria) – Flexible packaging, pharmaceutical grade

- Berry Global (USA) – Rigid packaging, bottles, closures

TIER 2: SPECIALIZED MICRO-PACKAGING COMPANIES

- Unipac Group (UK) – Sachet packaging, single-serve solutions

- Scholle IPN (USA) – Flexible packaging, portion control

- Parkside Flexibles (UK) – Small format flexible packaging

- Starpac (UK) – Tubes, small containers, beauty packaging

TIER 3: REGIONAL/LOCAL PACKAGING SUPPLIERS

- Essel Propack (India) – Tubes, laminated packaging

- Uflex (India) – Flexible packaging, multi-layer films

- Huhtamaki (Finland) – Food service packaging, portion packs

- DS Smith (UK) – Sustainable packaging solutions

PACKAGING DESIGNERS & CONSULTANTS

- Pearlfisher – Premium brand packaging design

- Design Bridge – Consumer goods packaging

- Bulletproof – Innovative packaging concepts

- Independent Studios: 200+ specialized packaging design firms globally

A.2 Technology Integration Partners

QR CODE & SMART PACKAGING

- Digimarc – Digital watermarking, smart packaging

- EVRYTHNG – IoT platform for smart products

- Thin Film Electronics – Smart labels, NFC integration

- Avery Dennison – Intelligent labels, RFID solutions

PACKAGING EQUIPMENT MANUFACTURERS

- Bosch Packaging – Filling and sealing equipment

- IMA Group – Small format packaging machinery

- Oystar – Tube filling and sealing systems

- Coesia Group – Automated packaging solutions

APPENDIX B: PRODUCT MAKERS ECOSYSTEM

B.1 Target Product Categories & Key Players

HOT SAUCES & CONDIMENTS

- Artisanal Producers: 2,000+ small-batch hot sauce makers globally

- Regional Leaders: Cholula, Valentina, Sriracha variants

- Specialty Importers: Companies importing authentic regional sauces

- Private Label Manufacturers: Co-packers for custom formulations

PERSONAL CARE & COSMETICS

- K-Beauty Innovators: 500+ Korean beauty brands

- Clean Beauty Brands: Glossier, Drunk Elephant, The Ordinary

- Indie Skincare: 1,000+ small-batch skincare producers

- Fragrance Houses: Maison Margiela, Le Labo, Byredo

SPECIALTY FOOD & BEVERAGES

- Craft Tea Companies: 300+ specialty tea blenders globally

- Spice Merchants: Regional spice companies, specialty blends

- Artisanal Coffee: 5,000+ micro-roasters worldwide

- Functional Foods: Nootropic drinks, superfood powders

HEALTH & WELLNESS

- Supplement Manufacturers: 2,000+ companies globally

- CBD/Hemp Products: 1,500+ licensed producers

- Adaptogen Brands: Mushroom supplements, herbal blends

- Probiotic Producers: Specialty gut health companies

B.2 Manufacturing & Supply Chain Partners

CONTRACT MANUFACTURERS (CO-PACKERS)

- Food: 3,000+ FDA-registered food co-packers in US alone

- Cosmetics: 500+ cosmetic contract manufacturers globally

- Supplements: 200+ GMP-certified supplement manufacturers

INGREDIENT SUPPLIERS

- Flavor Houses: Givaudan, Firmenich, IFF, Symrise

- Active Ingredients: Specialty chemical suppliers

- Natural Extracts: Botanical ingredient suppliers

- Packaging Materials: Film, closures, labels, QR codes

APPENDIX C: USER ECOSYSTEM ANALYSIS

C.1 Consumer Segments & Behavior Patterns

PRIMARY USERS

- Discovery Seekers (35% of market): Ages 25-35, high social media usage

- Quality Conscious (25% of market): Ages 30-45, premium brand preference

- Sustainability Focused (20% of market): Ages 25-40, environmental concerns

- Convenience Driven (20% of market): Ages 35-50, time-constrained professionals

SECONDARY USERS

- Gift Buyers: Purchasing sample sets as gifts

- B2B Buyers: Restaurants, hotels, spas testing products

- Retailers: Small retailers testing products before stocking

- Influencers: Content creators seeking authentic experiences

C.2 User Journey & Touchpoints

DISCOVERY PHASE

- Social media ads/influencer content

- Word-of-mouth recommendations

- Retail partnership displays

- Online search and reviews

TRIAL PHASE

- App download and onboarding

- QR code scanning and product receipt

- Product testing and evaluation

- In-app journaling and rating

DECISION PHASE

- Full-size purchase consideration

- Price comparison and availability check

- Social sharing and validation seeking

- Subscription or repeat purchase

ADVOCACY PHASE

- Social media sharing and reviews

- Friend recommendations

- User-generated content creation

- Community participation and feedback

APPENDIX D: DETAILED ECOSYSTEM EXAMPLES

Example 1: Hot Sauce Sampling Ecosystem

D.1 PACKAGING ECOSYSTEM

Primary Packaging Partner: Unipac Group (UK)

- Capabilities: 2ml-10ml sachets, tamper-evident seals

- Materials: Multi-layer barrier films, recyclable options

- Production Capacity: 50 million sachets/month

- Quality Certifications: BRC, FDA, HACCP

- Customization: QR code integration, branded designs

Backup Packaging Partner: Essel Propack (India)

- Capabilities: 5ml-15ml tubes, squeeze applications

- Cost Advantage: 30% lower than European suppliers

- Regional Expertise: Understanding of Indian market preferences

- Sustainability: Developing bio-based tube materials

Design Partner: Pearlfisher (London)

- Project Scope: Sample packaging design system

- Deliverables: Visual identity, QR code integration design

- Timeline: 12 weeks for complete design system

- Investment: £50,000-100,000 for comprehensive design package

D.2 PRODUCT MAKER ECOSYSTEM

Tier 1 Partner: Pain 100% (UK Artisanal Hot Sauce)**

- Product Range: 15 unique hot sauce varieties

- Production Volume: 10,000 bottles/month current capacity

- Sampling Potential: 2,000 samples/month (2ml sachets)

- Partnership Terms: 60% margin on samples, exclusive sampling rights

- Quality Specs: Scoville ratings 1,000-100,000, all-natural ingredients

Tier 1 Partner: Butterfly Bakery of Vermont (USA Specialty Sauces)**

- Product Range: 8 gourmet hot sauces, seasonal varieties

- Production Volume: 5,000 bottles/month

- Sampling Potential: 1,000 samples/month

- Partnership Terms: Fixed fee $2,000/month + 40% sample margins

- Unique Value: Story-driven branding, farm-to-bottle narrative

Tier 2 Partners: Regional Hot Sauce Producers (5-8 partners)

- Nigeria: Scotch Bonnet specialists (3 varieties)

- India: Regional chili sauce producers (4 varieties)

- Mexico: Artisanal salsa makers (6 varieties)

- Thailand: Traditional chili paste producers (3 varieties)

D.3 USER ECOSYSTEM

Primary User Profile: Sarah Chen (32, London)

- Demographics: Marketing manager, £45K income, lives in Zone 2

- Behavior: Orders takeaway 3x/week, active on Instagram (2K followers)

- Motivation: Loves trying authentic international flavors

- Usage Pattern: Orders 3-4 samples/month, converts to full-size 40% of time

- Value: Willing to pay £8-12/month for curated discovery box

- Social Sharing: Posts food photos 2-3x/week, influences 50+ purchase decisions annually

Secondary User Profile: James Okonkwo (28, Lagos)

- Demographics: Software developer, ₦3.5M income, tech-savvy early adopter

- Behavior: Cooks at home 5x/week, active foodie community member

- Motivation: Supporting local producers while discovering international flavors

- Usage Pattern: Orders 2-3 samples/month, focuses on artisanal/premium products

- Value: Price-sensitive but quality-focused, pays ₦2,000-3,500/month

- Social Sharing: WhatsApp status updates, local foodie group recommendations

B2B User Profile: Spice Route Restaurant (Birmingham, UK)

- Business Type: 45-seat Indian fusion restaurant

- Decision Maker: Head Chef Raj Patel

- Usage: Tests 10-15 sauce samples/month for menu development

- Value Proposition: Cost-effective way to test suppliers before bulk orders

- Purchase Pattern: Bulk orders 2-3 sauces/quarter based on sample testing

- Annual Value: £15,000 in full-size purchases traced to sampling program

Example 2: Personal Care Sampling Ecosystem

D.1 PACKAGING ECOSYSTEM

Primary Packaging Partner: Starpac (UK)**

- Capabilities: 1ml-5ml airless pumps, leak-proof seals

- Materials: PCR (post-consumer recycled) plastics, glass options

- Production Capacity: 25 million units/month

- Specialization: Skincare, serums, premium cosmetics

- Innovation: Bio-based materials, refillable micro-containers

Secondary Packaging Partner: Quadpack (Spain)**

- Capabilities: Premium sampling kits, travel-size containers

- Materials: Sustainable packaging options, luxury finishes

- Production Capacity: 10 million units/month

- Customization: Branded sample sets, multi-product kits

- Target Market: Premium and luxury cosmetic brands

Design Partner: Design Bridge (Multiple locations)**

- Project Scope: Luxury sampling experience design

- Deliverables: Packaging system, unboxing experience, digital integration

- Timeline: 16 weeks for premium sampling system

- Investment: £75,000-150,000 for comprehensive luxury design system

D.2 PRODUCT MAKER ECOSYSTEM

Tier 1 Partner: The Ordinary (Deciem)**

- Product Range: 40+ affordable skincare actives

- Sampling Potential: 15 core products in 2ml-3ml formats

- Partnership Terms: White-label sampling program, co-marketing

- Quality Specs: Clinical-grade actives, detailed usage instructions

- Market Position: Science-based, transparency-focused brand

Tier 1 Partner: Fenty Beauty (Regional distributor partnership)**

- Product Range: 8 skincare products suitable for sampling

- Sampling Potential: Foundation shades, skincare trial kits

- Partnership Terms: Exclusive sampling rights in specific regions

- Quality Specs: Inclusive shade range, diverse skin type formulations

- Market Position: Celebrity-backed, diversity-focused brand

Emerging Brand Partner: Typology (French Clean Beauty)**

- Product Range: 25 minimalist skincare products

- Sampling Potential: 12 products suitable for 1-week trials

- Partnership Terms: Revenue sharing, exclusive launch sampling

- Quality Specs: Clean ingredients, dermatologically tested

- Market Position: Transparent formulations, sustainable packaging

D.3 USER ECOSYSTEM

Primary User Profile: Aisha Patel (29, Mumbai)

- Demographics: Digital marketing specialist, ₹8L income, beauty enthusiast

- Behavior: Spends ₹5,000/month on skincare, YouTube beauty content consumer

- Motivation: Finding products that work for Indian skin tones and climate

- Usage Pattern: Orders 4-5 skincare samples/month, detailed app reviews

- Value: Willing to pay ₹800-1,200/month for curated beauty discoveries

- Social Sharing: Instagram beauty posts, influences 200+ followers’ purchases

Secondary User Profile: Emma Thompson (42, Manchester)

- Demographics: Senior accountant, £55K income, sensitive skin concerns

- Behavior: Cautious with new products, prefers trying before committing

- Motivation: Finding effective anti-aging solutions without irritation

- Usage Pattern: Orders 2-3 samples/month, focuses on proven ingredients

- Value: Premium price tolerance for quality, pays £15-25/month

- Social Sharing: Private Facebook groups, word-of-mouth recommendations

B2B User Profile: Glow Beauty Spa (London)

- Business Type: High-end facial spa, 8 treatment rooms

- Decision Maker: Senior Therapist & Spa Manager

- Usage: Tests 20+ product samples/month for treatment protocols

- Value Proposition: Risk-free way to evaluate products for spa menu

- Purchase Pattern: Bulk orders 3-4 product lines/quarter for spa retail

- Annual Value: £25,000 in full-size purchases traced to sampling program

APPENDIX E: FUTURE SPECULATION & NOVEL APPLICATIONS

E.1 VISIONARY APPLICATIONS & EMERGING USE CASES

E.1.1 Next-Generation Smart Packaging (2026-2030)

MOLECULAR PACKAGING

- Concept: Packaging that changes properties based on product interaction

- Application: Hot sauce sachets that change color based on Scoville rating when opened

- Technology: Thermochromic inks, pH-responsive materials

- User Benefit: Visual spice level indication before tasting

BIOMETRIC INTEGRATION

- Concept: Packaging that adapts to individual biological markers

- Application: Skincare samples that adjust concentration based on skin moisture sensors

- Technology: Micro-sensors, controlled release mechanisms

- User Benefit: Personalized dosing without waste

TEMPORAL PACKAGING

- Concept: Time-release sample experiences

- Application: Fragrance samples that reveal different notes over 24-hour period

- Technology: Controlled-release polymers, micro-encapsulation

- User Benefit: Complete scent profile evaluation in single sample

E.1.2 AI-Driven Product Development (2025-2028)

PREDICTIVE FORMULATION

- Concept: AI creates new product formulations based on sample feedback

- Application: Hot sauce AI creates new flavor profiles based on user taste data

- Technology: Machine learning, chemical compound analysis

- Business Model: AI-generated exclusive formulations for sampling platform

DYNAMIC PERSONALIZATION

- Concept: Real-time product customization based on user data

- Application: Tea blends that adjust based on weather, mood, health data

- Technology: IoT sensors, wearable integration, automated blending

- User Experience: Products that evolve with user’s changing needs

SYNTHETIC BIOLOGY INTEGRATION

- Concept: Lab-grown ingredients tailored to individual preferences

- Application: Cultured meat samples with personalized taste profiles

- Technology: Synthetic biology, cellular agriculture

- Market Impact: Democratization of personalized nutrition

E.1.3 Extended Reality (XR) Enhancement (2026-2030)

VIRTUAL TASTE EXPERIENCES

- Concept: AR/VR that simulates taste/smell before physical sampling

- Application: Virtual wine tasting with haptic feedback and aroma simulation

- Technology: Haptic gloves, olfactory displays, brain-computer interfaces

- User Benefit: Risk-free exploration of extreme or expensive products

AUGMENTED PRODUCT STORYTELLING

- Concept: AR overlay showing product journey from source to sample

- Application: Coffee sample showing AR visualization of farm, processing, roasting

- Technology: Computer vision, blockchain provenance, AR glasses

- Brand Value: Transparency and authenticity verification

SOCIAL XR SAMPLING

- Concept: Virtual sampling parties with friends in different locations

- Application: Synchronized wine tasting sessions with remote participants

- Technology: VR platforms, synchronized delivery, biometric sharing

- Market Opportunity: Event experiences, corporate team building

E.2 SUSTAINABILITY & CIRCULAR ECONOMY INNOVATIONS

E.2.1 Zero-Waste Ecosystem (2025-2027)

EDIBLE PACKAGING

- Concept: Packaging that becomes part of the product experience

- Application: Flavored films for sauce samples, dissolvable tea packaging

- Technology: Seaweed-based films, edible polymers

- Environmental Impact: 100% waste elimination for certain categories

RETURN-TO-REFILL NETWORKS

- Concept: Sample containers designed for infinite reuse

- Application: Premium glass micro-bottles with cleaning/refill stations

- Technology: RFID tracking, automated cleaning systems

- Business Model: Container-as-a-service, subscription refills

PACKAGING-TO-PRODUCT TRANSFORMATION

- Concept: Used packaging becomes input for new products

- Application: Cosmetic sample containers ground into new product pigments

- Technology: Chemical recycling, upcycling processes

- Circular Value: Waste becomes raw material input

E.2.2 Regenerative Packaging (2027-2030)

LIVING PACKAGING

- Concept: Packaging that grows and biodegrades naturally

- Application: Mycelium-based containers that biodegrade into soil nutrients

- Technology: Fungal mycelium, controlled decomposition

- Environmental Benefit: Carbon negative packaging lifecycle

CARBON-CAPTURING PACKAGING

- Concept: Packaging that removes CO2 from atmosphere during use

- Application: Algae-based films that continue photosynthesis post-production

- Technology: Engineered algae, photosynthetic polymers

- Climate Impact: Packaging becomes carbon sink rather than emission source

E.3 NOVEL BUSINESS MODELS & MARKET APPLICATIONS

E.3.1 Democratized Innovation Platforms (2025-2028)

CONSUMER-CREATOR ECOSYSTEM

- Concept: Users create and sample each other’s formulations

- Application: Home perfume makers selling micro-batches through platform

- Technology: DIY formulation kits, community validation systems

- Market Disruption: Elimination of traditional R&D gatekeepers

MICRO-MANUFACTURING NETWORKS

- Concept: Distributed production of sample-size quantities

- Application: 3D printing of personalized supplement combinations

- Technology: Desktop manufacturing, blockchain quality control

- Economic Impact: Hyper-local production reducing transport emissions

E.3.2 Data-as-Product Evolution (2026-2029)

TASTE GENOME MAPPING

- Concept: Comprehensive individual taste/preference profiling

- Application: Personal taste DNA used across multiple industries

- Technology: Genetic testing, sensory analysis, machine learning

- Value Creation: Taste data becomes portable consumer asset

PREDICTIVE HEALTH SAMPLING

- Concept: Samples selected based on health prediction algorithms

- Application: Nutritional supplements recommended before deficiencies develop

- Technology: Continuous health monitoring, preventative analytics

- Healthcare Integration: Sampling becomes part of preventative medicine

E.4 CRITICAL CONCEPTS & BLIND SPOTS ANALYSIS

E.4.1 Missing Considerations from Original Thread

ACCESSIBILITY & INCLUSION

- Blind Spot: Limited consideration of disabled users, visual/taste impairments

- Solution: Audio descriptions, tactile indicators, accessible app design

- Market Opportunity: 15% of population with accessibility needs underserved

CULTURAL SENSITIVITY

- Blind Spot: Assumption of universal taste preferences and sampling behaviors

- Solution: Culturally-adapted product curation, local taste expert partnerships

- Risk Mitigation: Avoid cultural appropriation in product positioning

ECONOMIC INEQUALITY

- Blind Spot: Pricing model may exclude lower-income consumers

- Solution: Tiered pricing, community sampling programs, product subsidies

- Social Impact: Ensure discovery experiences aren’t luxury-only

DIGITAL DIVIDE

- Blind Spot: Assumption of smartphone/internet access for all users

- Solution: Offline sampling programs, basic phone compatibility

- Market Expansion: Capture non-digital-native segments

E.4.2 Philosophical & Ethical Considerations

CONSUMPTION PSYCHOLOGY

- Critique: May encourage endless novelty-seeking over satisfaction

- Counterpoint: Enables informed purchasing, reduces buyer’s remorse

- Balance: Promote mindful discovery over compulsive sampling

AUTHENTICITY PARADOX

- Critique: Sampling experience may not represent full product experience

- Risk: User disappointment when full-size product differs from sample

- Solution: Clear expectations setting, contextual sampling instructions

DATA OWNERSHIP & PRIVACY

- Critique: Extensive taste/preference data creates privacy vulnerabilities

- Protection: User-owned data wallets, anonymous aggregation options

- Empowerment: Users control and monetize their own preference data

E.5 INDUSTRY DISRUPTION SCENARIOS

E.5.1 The Sampling-First Economy (2030-2035)

SCENARIO: Sampling becomes primary product discovery method across all categories

- Market Structure: Traditional retail becomes fulfillment-only

- Consumer Behavior: No full-size purchases without sampling validation

- Business Impact: Marketing budgets shift entirely to sampling experiences

- Economic Result: Dramatic reduction in product returns, increased satisfaction

E.5.2 The Personalization Singularity (2032-2037)

SCENARIO: AI creates unique products for each individual based on sampling data

- Market Structure: Mass production replaced by mass personalization

- Consumer Behavior: Expectation of bespoke products as standard

- Business Impact: Traditional brands compete with AI-generated alternatives

- Economic Result: Elimination of one-size-fits-all products

E.5.3 The Post-Ownership Society (2035-2040)

SCENARIO: Consumers access product experiences without owning products

- Market Structure: Experience subscription models dominate

- Consumer Behavior: Preference for access over ownership

- Business Impact: Manufacturers become experience providers

- Economic Result: Circular economy achieved through shared access models

APPENDIX F: SPECULATIVE CASE STUDY – PHARMACEUTICAL SAMPLING REVOLUTION

F.1 INDUSTRY CONTEXT: PHARMACEUTICAL & NUTRACEUTICAL SAMPLING

Market Opportunity: Global pharmaceutical market $1.5 trillion, nutraceuticals $432 billion Current Pain Points:

- Patients can’t try medications before committing to full prescriptions

- High medication waste due to adverse reactions or ineffectiveness

- Limited patient feedback during drug development phases

- Poor adherence due to unknown medication experience

F.2 REVOLUTIONARY CONCEPT: “PharmaSample” – Precision Medicine Discovery Platform

F.2.1 Core Innovation

MICRO-DOSE TRIAL SYSTEM

- Product: 3-7 day medication samples with biometric monitoring

- Technology: Micro-dosing technology, continuous health monitoring, AI analysis

- Safety: FDA “investigational use” pathway, physician oversight required

- Patient Value: Risk reduction, informed treatment decisions

F.2.2 Ecosystem Architecture

PHARMACEUTICAL PARTNERS

- Tier 1: Pfizer, Johnson & Johnson, Novartis (established medications)

- Tier 2: Biotech companies (novel therapies in development)

- Tier 3: Nutraceutical companies (supplements, functional foods)

HEALTHCARE INTEGRATION

- Primary Care Physicians: Prescription sampling platform integration

- Specialists: Condition-specific sampling protocols

- Digital Health: Wearable device integration for continuous monitoring

- Health Systems: Population health sampling programs

REGULATORY FRAMEWORK

- FDA Pathway: Investigational Device Exemption (IDE) applications

- EMA Compliance: European Medicines Agency approval processes

- Clinical Oversight: Board-certified physician supervision requirements

- Data Protection: HIPAA-compliant health data management

F.2.3 User Journey & Experience

PATIENT PROFILE: Maria Santos (54, Type 2 Diabetes, San Antonio)

Phase 1: Medical Consultation

- Physician identifies need for new diabetes medication

- Reviews PharmaSample platform options with patient

- Selects 3 candidate medications for micro-dose trial

- Orders 7-day sample packages with monitoring kit

Phase 2: Supervised Trial Period

- Receives sample medications with smart pill bottles

- Wears continuous glucose monitor and fitness tracker

- Takes micro-doses while maintaining current medication

- Reports side effects and efficacy daily through app

Phase 3: Data-Driven Decision

- AI analyzes glucose patterns, side effects, adherence data

- Physician reviews comprehensive trial results

- Patient and doctor collaboratively select optimal medication

- Full prescription issued with confidence and informed consent

Phase 4: Outcomes & Feedback

- 90% medication adherence (vs. 50% industry average)

- 60% reduction in adverse reactions

- Patient satisfaction score: 9.2/10

- Healthcare cost reduction: $3,400/year per patient

F.2.4 Technology Infrastructure

MICRO-DOSING TECHNOLOGY

- Controlled Release: Time-release formulations for safe micro-dosing

- Smart Packaging: Temperature-controlled, tamper-evident containers

- Dosing Precision: Exact micro-dose delivery mechanisms

- Safety Monitoring: Real-time adverse event detection

AI ANALYTICS PLATFORM

- Biomarker Analysis: Continuous health data interpretation

- Efficacy Prediction: Machine learning models for treatment outcomes

- Personalization Engine: Individual response pattern recognition

- Safety Algorithms: Early warning systems for adverse reactions

HEALTHCARE INTEGRATION

- EMR Connectivity: Electronic medical record integration

- Provider Dashboards: Real-time patient monitoring for physicians

- Clinical Decision Support: Evidence-based treatment recommendations

- Regulatory Reporting: Automated FDA/EMA compliance reporting

F.2.5 Business Model Innovation

REVENUE STREAMS

- Pharmaceutical Sampling Fees: $150-500 per patient trial

- Data Analytics Licensing: $50M-100M annually from pharma companies

- Healthcare System Partnerships: $10-25 per patient per month

- Regulatory Consulting: $1M-5M per drug development program

COST STRUCTURE

- Technology Development: 35% (AI platform, integration systems)

- Regulatory Compliance: 25% (FDA liaison, clinical oversight)

- Healthcare Partnerships: 20% (physician training, system integration)

- Operations & Fulfillment: 15% (sample production, logistics)

- Research & Development: 5% (continuous innovation)

MARKET IMPACT PROJECTIONS

- Year 3: 100,000 patients, $75M revenue, 12 pharmaceutical partners

- Year 7: 2 million patients, $800M revenue, 45 pharmaceutical partners

- Year 10: 10 million patients, $3.5B revenue, global healthcare integration

F.2.6 Transformative Outcomes

PATIENT BENEFITS

- 70% reduction in medication trial-and-error cycles

- 85% improvement in treatment adherence

- 60% reduction in adverse drug reactions

- $2,000-5,000 annual healthcare cost savings per patient

HEALTHCARE SYSTEM BENEFITS

- 40% reduction in medication-related hospitalizations

- 50% improvement in treatment efficacy rates

- $50 billion annual healthcare system savings (US market)

- Enhanced patient-physician relationships through shared decision-making

PHARMACEUTICAL INDUSTRY TRANSFORMATION

- Accelerated drug development through real-world evidence

- Reduced clinical trial costs by 30-40%

- Enhanced post-market surveillance capabilities

- Improved drug safety and efficacy profiles

SOCIETAL IMPACT

- Democratization of precision medicine access

- Reduced healthcare inequality through improved treatment matching

- Enhanced trust in pharmaceutical industry through transparency

- Foundation for AI-driven personalized medicine ecosystem

F.2.7 Critical Success Factors & Risks

SUCCESS FACTORS

- Regulatory approval and physician adoption

- Robust safety protocols and adverse event management

- Seamless healthcare system integration

- Strong pharmaceutical industry partnerships

RISK MITIGATION

- Regulatory Risk: Early FDA engagement, phased approval strategy

- Safety Risk: Physician oversight, continuous monitoring, immediate intervention protocols

- Adoption Risk: Pilot programs with leading health systems, physician education

- Technology Risk: Redundant systems, cybersecurity excellence, data backup protocols

COMPETITIVE ADVANTAGES

- First-mover advantage in regulated pharmaceutical sampling

- Network effects from multi-sided platform (patients, physicians, pharma)

- Regulatory moat through FDA approvals and clinical protocols

- Data advantages through longitudinal patient outcomes tracking

This speculative case study demonstrates how the core sampling concept could revolutionize healthcare by enabling personalized medicine discovery while dramatically improving patient outcomes and reducing healthcare costs. The pharmaceutical application showcases the platform’s potential to transform entire industries through technology-enabled micro-experimentation and data-driven decision making.