Preamble

How Global North textile tech can be legally adapted into a Southern playbook for circular building materials, without infringing IP, and while shifting value to receiving markets

Millions of garments move from the Global North to the Global South every week. A large share becomes local waste. Beaches clog with fabric, wetlands trap synthetics, and municipalities carry disposal costs they did not create. The scale is measurable. Global discarded clothing reached about 120 million tonnes in 2024, while global fibre production hit 124 million tonnes in 2023. Less than 1 percent returns as inputs for new textiles. EU countries discard about 5 million tonnes a year, and only around 1 percent becomes new clothing. These numbers define the opportunity and the responsibility.

This feature asks a practical question. Can receiving regions build local, scalable industries that turn this waste into useful building materials, using safe chemistry, simple equipment, and an IP-safe path. The short answer is yes, if we treat technology transfer as design, not copying, and if we design for local value capture from the start. The attached playbook shows what this looks like in practice, including recipes, testing, AI data systems, and a Ghana pilot roadmap.

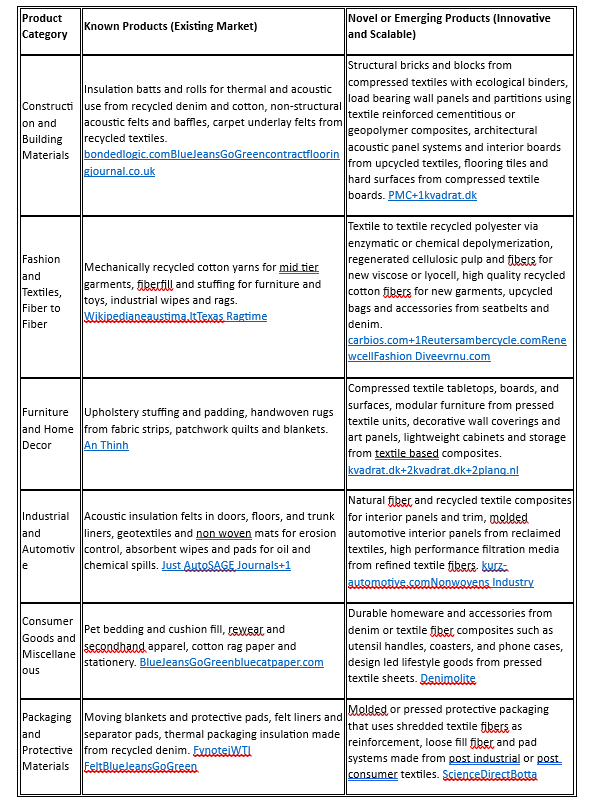

Possible reuse of textile production waste and used garments

My usual analysis stuff: Textiles Artifacts

The Example case

What FabBRICK proves, and what you must not copy

FabBRICK sits in the public imagination as proof that textile waste can become furniture, partitions, and wall features. The process sorts textiles by colour, shreds them to specific lengths, mixes in an ecological glue, then compresses in a patented machine for around 30 minutes. Bricks dry in ambient air for 10 to 15 days, then move to finishing. The studio sells bricks in multiple sizes and uses inherent textile colour rather than new dyes. This is useful precedent, but it sets red lines. If you build a local process, avoid the same compression cycle, avoid proprietary tooling, and do not replicate protected claims.

Callout: Red lines to respect

• Do not copy a patented compression cycle.

• Do not claim equivalence if your chemistry, machine, and curing differ.

• You can match outcomes like partition walls or furniture, but reach them through distinct binders and forming routes.

[Graphics note: Create Side-by-side diagram. Left, FabBRICK summary flow with colour sorting, glue mix, 30 minute compression, 10 to 15 day air dry. Right, IP-safe routes showing hot-press and cold-press alternatives, with distinct temperatures, pressures, and cure times.]

The IP-safe alternative: local chemistry, different forming, open data

The playbook proposes two main routes that do not mirror FabBRICK’s protected steps. The first uses hot-press plates with locally sourced bio-binders. The second uses cold-pressed mineral systems for heavier partition bricks. Both lean on local supply chains and small tools most regions already know how to maintain.

Binder families to prioritise

• Bio-based systems: cassava starch with kaolin and tannin, plant proteins, lignin derivatives, and natural latex.

• Mineral systems: laterite or clay fines plus lime, with optional geopolymer variants.

• Hybrid approaches: cassava starch for green strength with mineral for long-term durability. Use shea derivatives or a small cashew nut shell liquid fraction as hydrophobes.

Why this avoids conflict: The recipes, processing temperatures, pressures, and cures are different from the FabBRICK cycle. The hot-press route runs 110 to 140 Celsius at 2 to 6 MPa for 8 to 15 minutes, then conditions without a long ambient air cure. The cold-press route uses 5 to 15 MPa with moist and dry cure stages.

Testing targets to prove fitness

For acoustic panels and furniture cores, aim for densities between 250 and 900 kg per cubic metre and NRC values up to 0.65. For non-structural partition bricks, target 2 to 5 MPa compressive strength, 1000 to 1400 kg per cubic metre density, and water absorption under 15 percent. The playbook provides tables and methods for fire, moisture, acoustic, thermal, and mechanical testing.

[Graphics note: Create Table graphic showing three product classes with density, strength, NRC, and water absorption ranges, sourced from the playbook.]

The dumping problem, reframed as feedstock planning

Post-consumer flows dominate in mature markets. Pre-consumer waste is substantial in manufacturing hubs. Large secondhand flows move to the Global South, and studies estimate that up to 40 percent of items handled at Accra’s Kantamanto market become waste locally. This justifies building local processing capacity matched to the real composition and contamination profile of incoming goods.

Policy is changing the economics. The EU now requires separate collection of textiles from January 2025 and is building Extended Producer Responsibility schemes that shift costs to producers. California has passed the first US textile EPR with milestones through 2030. Digital Product Passports will roll out for textiles from 2027. These measures will push funding and traceability into the system, which a Southern playbook can leverage for sorting, quality, and proof of impact.

Callout: Why now

• Policy is moving costs upstream to producers.

• Brands need high quality recycled content with data.

• Receiving markets can claim funded roles for sorting, reuse, and local remanufacture.

[Graphics note: Create Small map plus bar chart. Map shows flows from donor markets to receiving hubs, with a Ghana callout. Bar chart shows discarded clothing and fibre production figures with less than 1 percent textile-to-textile recycling.]

Material science and process, in the lab and on the line

Start with feedstock characterisation. Identify cotton, polyester, and blends. Assess colour retention, fibre integrity, and trims. Shred to 7 to 20 millimetres. Keep fines under control for acoustic grades. The playbook details a process flow that your team can run in a modest workshop, with a shredder, ribbon mixer, hot press or hydraulic block press, curing space, and basic test rigs.

Health and safety

Treat dust at the source. Manage dyes, finishing chemicals, and fungal growth through PPE, local exhaust, and wet cleaning where needed. The project framework sets out risk controls and the validation tests to confirm that panels and blocks are fit for their specific indoor uses.

Product formats that match local construction

Use Ghana compatible sizes as a guide, then localise for other markets. 200 by 100 by 60 millimetre acoustic units, 300 by 150 by 75 millimetre partition blocks, and 400 by 200 by 50 millimetre panels. Interlocking edges reduce fasteners and speed assembly. Treat the face to preserve colour or emboss with local motifs.

[Graphics note: Exploded diagram of a partition wall using 300 by 150 by 75 blocks in a light gauge channel, with callouts for fixings and QR labels.]

AI and data that make the system trustworthy

A blend optimisation engine speeds learning. Start with 15 to 25 initial recipes generated by Latin hypercube sampling. Test them for compressive strength, density, water absorption, and acoustic performance. Train a surrogate model, for example a random forest or XGBoost, and run Bayesian optimisation to select the next round. Repeat until you hit targets and cost constraints. This is achievable with open source tools and a clean lab workflow.

A digital product passport keeps you honest and investable. Each brick or panel gets a QR or NFC tag that links to batch composition, origin, performance, maker group, and end of life instructions. The playbook includes a data schema example and shows how to store origin notes like Kantamanto residuals or a named workshop. This supports compliance, customer trust, and impact reporting.

Callout: Treat data as part of the product

• Without batch data, you cannot certify or improve.

• With batch data, you can sell into projects that demand proof.

[Graphics note: Create Sample QR screen showing composition, test results, and a short maker story. Include schema fields from the playbook.]

Strategy that meets the market where it is

Use PESTLE to localise. Energy cost, code enforcement, import rules, labour markets, and informal sector dynamics differ by region. Build a policy map and a testing ladder for each country. Start with interior use. Move to assembly tests for partitions. Publish your results as part of a simple technical datasheet. The market report and the localisation files give you the structure.

Porter’s Five Forces clarifies risk. Municipalities and Producer Responsibility Organisations control supply. Brands and builders exert buyer power. Virgin materials remain cheap. Rivalry is fragmented and regional. Your moat is reliable supply, predictable quality, and proof of impact. The KPIs to track include tonnes diverted per year, carbon saved per unit, jobs created, and community engagement through workshops. The playbook provides targets and a financial view that gets you to break-even after the pilot.

Callout: The KPI set that matters

• Waste diverted, carbon saved, jobs created.

• On-time certification milestones.

• Stable cost per unit across seasons.

[Graphics note: Create Dashboard mockup with four tiles. Tonnes diverted, carbon saved per kilogram, headcount, and pass rates for fire and moisture tests.]

Ethics and environmental outcomes, judged over time

Some critics argue that any new use for imported waste legitimises dumping. The opposite can also be true if standards, fees, and capture rules change incentives. The solution is governance, not slogans. Tie import permissions to minimum capture and safe processing. Publish monthly diversion and test results through your digital passports. Design for disassembly so components can be repaired or recycled. Use lifecycle assessment to compare your panels and blocks to gypsum, MDF, or concrete where relevant. The market report and playbooks give you templates to start.

Callout: Guardrails against harm

• Minimum capture targets tied to import licences.

• Proof of safe processing through QR linked tests.

• Procurement that favours certified upcycled materials for schools and clinics.

[Graphics note: Create Policy ladder graphic. Step 1, import rules and thresholds. Step 2, indoor safety certification. Step 3, public procurement pilots. Step 4, regional standards alignment.]

From plan to pilot: Ghana as a ground truth

Ghana provides a clear test case. The roadmap sets five phases over 36 months. Phase 1 establishes feasibility and partners in months 0 to 3. Phase 2 builds a 50 kilogram per day pilot line in Accra and trains the AI model by month 9. Phase 3 runs certification tests and scales to 200 kilograms per day by month 18. Phase 4 reaches 1 tonne per day with a Kumasi hub by month 30. Phase 5 adds a node in Tamale and replicates the model by month 36.

The production model is hybrid. An R&D hub holds the press and testing gear. Distributed micro workshops, often inside maker spaces or fashion cooperatives, focus on sorting, shredding, and first forming. The hub finishes and certifies. This spreads income, lowers transport costs, and builds a pipeline of trained operators.

Callout: Equipment that fits a pilot budget

• Hot-press platen system with 600 by 600 millimetre plates.

• Hydraulic block press for mineral bricks.

• Shredder, ribbon mixer, moisture balance, small oven, QR printer.

[Graphics note: Create Gantt style chart reproduced from the roadmap with five phases and capacity targets.]

A maturation pathway that grows with capability

The materials portfolio outlines a four phase path. In the first two years, focus on basic composite materials like acoustic panels, interior cladding, medium density blocks, and non structural partitions. In years two to five, move to advanced systems such as sandwich panels and moisture resistant variants, as automation and formulations improve. In years five to eight, pursue engineered performance like gradient acoustics, sensor embedded panels, and phase change materials. In the long horizon, explore nano enhanced or bio integrated systems if the market warrants it. This ladder aligns R&D ambition with real cash flow.

[Graphics note: Create Ladder graphic, Phase 1 through Phase 4, with example products and acceptance tests listed per rung.]

How to write the investment case

Investors respond to clear unit economics and risk controls. The playbook offers a starting point. Target break even 18 to 24 months after pilot. Aim for revenue per tonne between 800 and 1200 dollars depending on applications. Design for gross margins of 35 to 50 percent at scale. Secure multi year offtakes with local developers and brand partners who value visible circular stories. Share a simple monthly dashboard that shows diversion, carbon savings, pass rates, and job numbers.

Callout: The IP strategy in one page

• Run a freedom to operate scan.

• Anchor novelty in binder chemistry and forming.

• Publish open documentation for community scale variants, which also strengthens your defence against later claims.

The blueprint you can act on now

- Use the playbook to select one acoustic panel, one partition block, and one furniture block. Adopt the test targets as your go or no go criteria.

- Build the first 25 recipes and log them with the data schema. Train a surrogate model and start optimisation cycles.

- Stand up a Ghana style pilot or its local analogue using the five phase roadmap. Publish a quarterly report with QR linked batch data and test results.

- Negotiate offtakes tied to visible impact metrics. Price fairly, protect quality, and use standards to unlock public procurement.

Closing image suggestion

A split visual with a secondhand market pile on the left and a QR tagged, embossed partition wall on the right. The caption links the QR to batch origin, composition, and test performance.

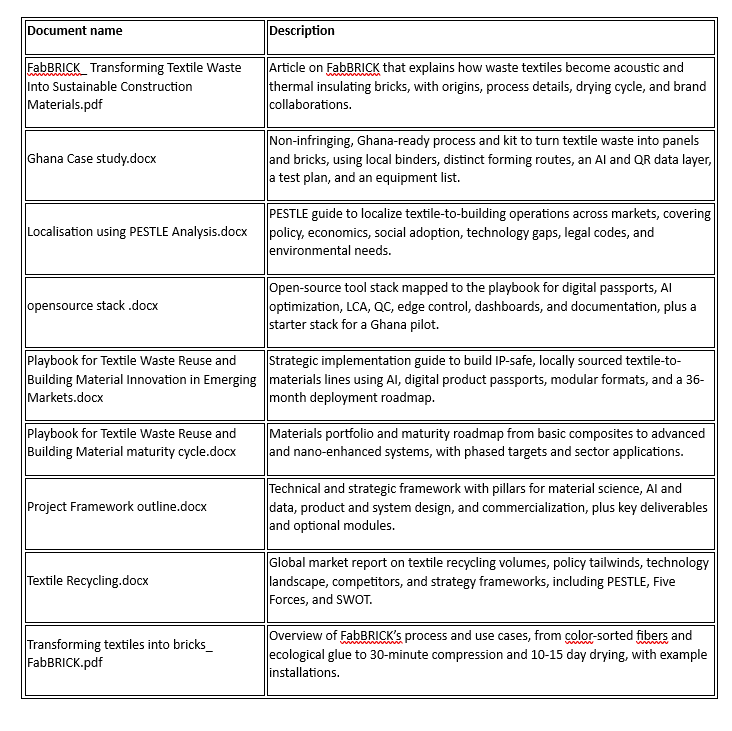

References and source materials

• FabBRICK process summaries, including colour sorting, ecological glue, 30 minute compression, and 10 to 15 day air drying.

• Strategic Implementation Playbook for Textile Waste Reuse and Building Material Innovation in Emerging Markets. Binders, process differentiation, product formats, AI optimisation, digital passport schema, and regional deployment model.

• Ghana deployment roadmap, five phase timeline with capacity milestones.

• Materials portfolio and maturity pathway, phase based product evolution and acceptance tests.

• Textile Recycling market report, global volumes, EU policy, EPR and DPP timelines, and the Kantamanto waste share context.

• Project framework outline, risk and safety considerations, AI and LCA framing, and modular product philosophy.