Ideas Trigger# 10: The Aquatic Farming Revolution: Strategic Framework & Business Plan

Executive Summary: The Blue-Green Economy Opportunity

The Vision: Transform aquatic farming from niche agriculture into a trillion-dollar bio-economy that simultaneously feeds the world, reverses climate change, and creates regenerative ecosystems.

The Thesis: We’re approaching a convergence moment where marine and freshwater plant cultivation can scale exponentially through AI-driven precision farming, robotic automation, and novel processing technologies. This isn’t just about seaweed snacks—it’s about creating a new industrial paradigm. Update, 09/10/2025: this post #SUSScoop | So the Ocean is Finally Getting a Treaty 🌊 identifies a critical gap in my analysis please subscibe to SUS it Out.

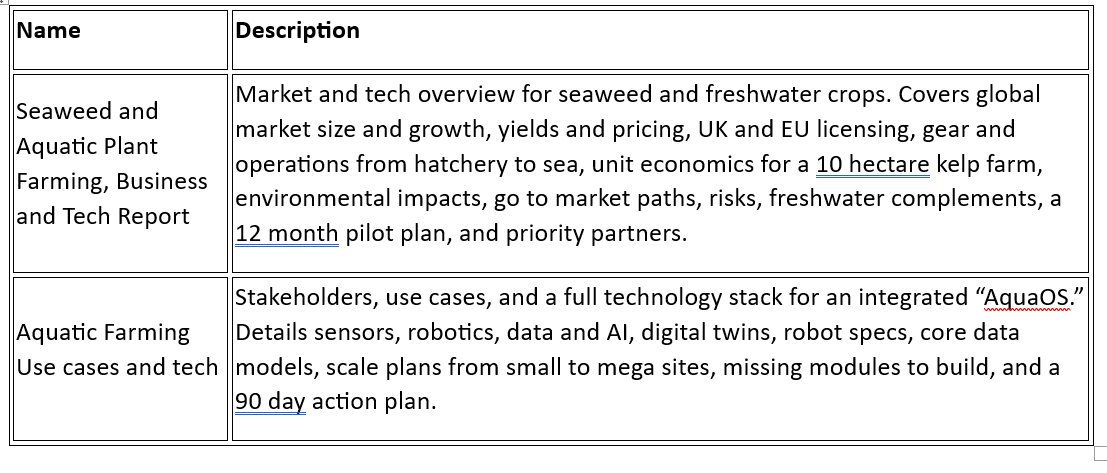

As usual some outlines Artefacts

1. Market Categorization & Size Analysis

Primary Markets (Current)

- Global Seaweed Market: $9-18.4B (2024) → $18-36B (2032)

- Hydroponics Market: $6.2B (2025) → $18B (2034)

- Aquaponics Market: Growing at 12-15% CAGR

Emerging Mega-Markets (Next Decade)

- Bioremediation Services: $100B+ potential (oil spill cleanup, water treatment)

- Carbon Credits & Climate Services: $50B+ potential

- Plastic Alternative Materials: $300B market displacement opportunity

- Agricultural Biostimulants: $4B growing to $8B by 2030

Market Classification Framework

Tier 1: Foundation Markets (Proven)

- Food ingredients & whole foods

- Hydrocolloids (agar, carrageenan, alginate)

- Animal feed supplements

Tier 2: Growth Markets (Scaling)

- Biostimulants & fertilizers

- Packaging materials

- Nutraceuticals & cosmetics

Tier 3: Transformation Markets (Emerging)

- Carbon sequestration services

- Bioremediation contracts

- Synthetic biology platforms

- Precision fermentation feedstock

2. Technology Stack: The “AquaOS” Platform

Core Technology Components

AI & Marine Data Integration

- Predictive yield modeling using satellite data, water temperature, nutrient levels

- Disease detection through computer vision

- Optimal harvest timing algorithms

- Supply chain optimization and demand forecasting

Robotics & Automation

- Automated seeding and harvesting systems

- Underwater ROVs for farm maintenance

- Processing line automation (washing, drying, packaging)

- Quality control systems using spectroscopy

Controlled Environment Systems

- Land-based recirculating aquaculture systems (RAS) for premium production

- Modular “farming pods” for consistent year-round growth

- Precision nutrient delivery systems

- Climate-controlled processing facilities

The “Artificial Farm” Concept

Land-Based Marine Systems: Think Tesla Gigafactory for seaweed

- Controlled environment eliminates weather risk

- 5x higher yields than ocean farming

- Zero contamination, organic certification ready

- Year-round production cycles

- Perfect for high-value products (pharmaceuticals, food ingredients)

3. Species Portfolio & Applications

Marine Species (High Priority)

- Sugar Kelp (Saccharina latissima): Food, biostimulants, packaging

- Dulse: Premium food market, high protein content

- Nori: Established food market, processing expertise available

- Wakame: Asian cuisine expansion opportunities

Freshwater Species (Complementary)

- Duckweed: 42% protein, complete amino acids, fastest growing

- Azolla: Nitrogen-fixing, integrated with rice systems

- Water Spinach: High-value vegetable crop

- Lotus: Cultural significance, multiple product streams

Undiscovered/Underutilized Species

- Arctic kelp species with unique compounds

- Deep-water macroalgae with pharmaceutical potential

- Hybrid cultivars for specific applications

- Extremophile algae for bioremediation

4. Sustainability & Environmental Impact

Positive Impact Mechanisms

- Carbon Sequestration: 31-214g C/m²/year (conservative estimates)

- Nitrogen Removal: Up to 1.2t N/ha/year in nutrient-rich sites

- Habitat Creation: Underwater forests supporting marine biodiversity

- Zero Inputs: No fertilizers, pesticides, or fresh water required

Bioremediation Business Model

Revenue from Ecosystem Services:

- Municipal contracts for nutrient capture near wastewater outfalls

- Industrial cleanup projects (heavy metals, hydrocarbons)

- Fishery restoration partnerships

- Carbon credit generation and trading

Risk Mitigation Strategies

- Native species only to prevent ecosystem disruption

- Seasonal farming aligned with natural cycles

- Integrated monitoring systems for early problem detection

- Insurance products for extreme weather events

5. Scale-Appropriate Strategies

Small Scale (1-10 hectares): Community & Premium

- Target: Local food systems, premium restaurants, organic markets

- Technology: Simple longlines, basic processing

- Investment: $50K-500K

- Example: Scottish coastal communities farming native kelp

Medium Scale (10-100 hectares): Regional Processing

- Target: Food manufacturers, biostimulant companies

- Technology: Mechanized harvesting, processing facilities

- Investment: $500K-5M

- Example: Ocean Rainforest model across multiple sites

Large Scale (100+ hectares): Industrial Platforms

- Target: Global food companies, materials manufacturers

- Technology: Fully automated systems, AI optimization

- Investment: $5M-50M+

- Example: Integrated biorefinery producing multiple product streams

6. Novel Features & Competitive Advantages

The “Operating System for Water” Approach

- Platform business model selling farming-as-a-service

- Data monetization from farming operations

- Continuous improvement through machine learning

- Standardized modules for rapid scaling

Breakthrough Innovations

- Multi-Trophic Integration: Kelp + shellfish + fish in optimized ratios

- Precision Breeding: Using CRISPR for enhanced nutritional profiles

- Circular Processing: Zero-waste biorefineries

- Climate Adaptation: Resilient species for changing ocean conditions

Differentiation Strategy

- Not just farming, but ecosystem engineering

- Software-driven optimization vs. traditional agriculture approach

- Integrated value chain from seed to shelf

- Climate-positive positioning vs. neutral or negative

7. Regulatory Framework & Market Entry

Current Regulatory Landscape

- UK: Marine licensing through MMO/Marine Scotland (improving clarity)

- EU: Strong policy support through algae sector strategy

- US: State-by-state approach, Maine leading the way

Recommended Regulatory Strategy

- Start in friendly jurisdictions (Scotland, Maine, Norway)

- Partner with regulators on pilot programs

- Build compliance-by-design into technology platform

- Advocate for streamlined permitting based on proven results

Policy Opportunities

- Carbon credit mechanism development

- Bioremediation service frameworks

- Food safety standards for new species

- International trade facilitation

8. Go-to-Market Strategy

Phase 1: Proof of Concept (Years 1-2)

- Pilot farms: 3 sites across different conditions

- Product development: Focus on 2-3 high-value applications

- Market validation: Secure 5 key customer partnerships

- Technology development: MVP of monitoring and processing systems

Phase 2: Market Expansion (Years 3-5)

- Scale operations: 10-20 farm sites

- Geographic expansion: Enter 3 new markets

- Product diversification: 10+ product lines

- Platform development: License technology to other operators

Phase 3: Global Platform (Years 6-10)

- International expansion: Operations on 4 continents

- Technology leadership: Industry-standard platform

- Market creation: Drive development of new applications

- IPO readiness: $1B+ valuation potential

9. Investment Thesis & Unit Economics

Revenue Model

- Direct sales: Premium food and ingredient products (40% margin)

- Platform licensing: SaaS model for farming operations (80% margin)

- Environmental services: Carbon credits and bioremediation (60% margin)

- Data services: Market intelligence and optimization (90% margin)

Investment Requirements

- Seed Round: $2-5M for pilot operations and technology development

- Series A: $10-20M for scale-up and market expansion

- Series B: $50-100M for international expansion and platform development

Exit Strategy

- Strategic acquisition by food/agriculture giant (Unilever, Cargill)

- IPO as platform leader in blue economy

- Spin-offs of specialized technology or service divisions

10. Third World & Development Strategy

Community-Scale Farming Model

- Low-tech, high-impact systems for coastal communities

- Training and certification programs for local farmers

- Aggregation and processing hubs for value addition

- Microfinance partnerships for equipment and working capital

Impact Metrics

- Jobs created per hectare of farming

- Protein security improvement in target communities

- Ecosystem restoration measurable outcomes

- Carbon sequestration verified through monitoring

Partnership Strategy

- NGOs and development agencies for program funding

- Government partnerships for regulatory support

- Academic institutions for research and training

- Corporate buyers for fair trade product offtake

11. Next Steps & Implementation Roadmap

Immediate Actions (Next 90 Days)

- Site selection: Identify and assess 3 pilot locations

- Partnership development: Secure hatchery and processing partners

- Regulatory engagement: Begin permit application processes

- Team building: Recruit key technical and business talent

- Fundraising: Complete seed round for pilot operations

Key Success Metrics

- Technical: Achieve 150+ tonnes/hectare yields in pilot farms

- Commercial: Secure $1M+ in customer commitments

- Operational: Demonstrate 25%+ EBITDA margins at small scale

- Environmental: Verify carbon sequestration claims through third-party monitoring

Critical Risks & Mitigation

- Weather/climate risk: Diversified geographic operations

- Regulatory risk: Early engagement and compliance focus

- Market risk: Multiple application development

- Technology risk: Phased development and testing approach

Conclusion: The Trillion-Dollar Opportunity

This isn’t just about farming seaweed—it’s about creating the infrastructure for a new bio-economy that can help solve climate change while generating massive economic returns. The convergence of climate urgency, technological capability, and market demand creates a once-in-a-generation opportunity to build a transformative business.

The key insight is that aquatic farming is not just an agricultural business—it’s a platform for ecosystem services, materials innovation, and climate solutions. By thinking beyond traditional farming to create an “operating system for water,” we can build a company that becomes as essential to the blue economy as Microsoft was to the digital revolution.

The question isn’t whether this market will scale to trillion-dollar size—it’s who will build the platform to capture it.