Preamble

Everyone talks about “the drone industry” as if it is one coherent market. If you are a founder, investor, or policymaker, that framing quietly sabotages your decisions. Capital goes to the wrong places. Startups pitch the wrong story. Regulators design the wrong rules.

What we call “the drone industry” is really a cluster of dozens of separate markets, each with its own economics, regulations, and success recipes. Treating them as one category is like talking about “the car industry” without distinguishing between Formula 1 teams, Amazon delivery vans, and ambulances.

This essay argues that the “drone industry” does not exist in any useful strategic sense. It focuses on mainly on commercial drone. It sets out a different way to think: vertical intelligence platforms, robotic ecosystems, and Global South testbeds. If you work in tech, investing, policy, or any sector that touches infrastructure, agriculture, logistics, or security, this is your wake up call and your playbook. See The Drone Industry Reimagined inartifacts below for a comprehensive document beyond this post.

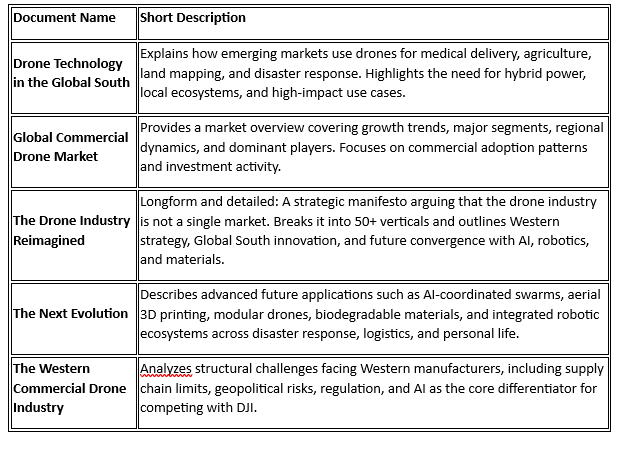

As usual some artifacts : Drone industry analysis

Here is a clear table listing all five outline documents with short, direct descriptions.

1. The industry that does not exist

Most market maps and conference agendas treat drones as a single category. In reality, you already have distinct markets that rarely overlap in practice:

- Precision agriculture

- Infrastructure inspection

- Emergency response and disaster assessment

- Last mile and medical logistics

- Media and entertainment

- Hobbyist, and Gaming

- Construction and mining

- Defense, security, and border monitoring

Each one differs on four critical axes:

- Hardware

- Endurance vs payload vs speed

- Fixed wing vs multirotor vs VTOL hybrids

- Sensors

- Thermal, LiDAR, multispectral, gas detection, high zoom RGB

- Software

- Photogrammetry vs defect detection vs crop analysis vs security workflows

- Regulation

- Different approvals and waivers, different liability and risk profiles

Someone who is world class in LiDAR mapping for construction will often know very little about NDVI crop analytics or thermal search patterns in rescue missions.

So the label “drone expert” hides the only thing that actually matters for strategy: vertical mastery. The winners will not be “drone companies”. They will be construction intelligence platforms, agricultural advisory platforms, resilient logistics operators, and defense partners that use drones as one node in a larger system.

2. Why the West keeps losing to DJI

You cannot understand strategy in this space without dealing with DJI. Across many segments, DJI holds roughly 70 to 80 percent of the global market. That dominance is not an accident and not a short term blip. It sits on three structural advantages:

- The Shenzhen hardware ecosystem

- Dense supply chains

- Fast iteration cycles

- Prototyping at a fraction of Western cost

- Vertical integration

- Control from component design to retail channels

- Tight hardware, firmware, and basic software integration

- Speed to market

- Product cycles in the range of roughly 18 months

- Western equivalents often take double that

On the Western side, a few repeated mistakes show up:

- Capital mismatch

Hardware needs patient capital, long R&D, and complex ops. Many founders pitch drones like pure software plays and then live under the wrong investor expectations. - Regulatory drag

BVLOS approvals arrive slowly. Many high value use cases depend on BVLOS, so investors see a risk they cannot price. Note: BVLOS, or Beyond Visual Line of Sight, is a type of drone operation where the operator flies the unmanned aircraft without being able to see it directly. This is different from standard Visual Line of Sight (VLOS) flying and requires specific authorization, often involving advanced technology like a detect-and-avoid system to ensure safety. BVLOS operations have the potential for greater efficiency and are used for tasks like long-distance deliveries or inspections. - The “DJI alternative” trap

Startups pitch “we are the Western DJI” and then try to fight on DJI’s strengths: low cost, broad feature sets, and scale. That is a losing battle.

If you try to win as a general purpose hardware vendor at volume, you are choosing the game DJI already solved.

3. Where Western founders can actually win

The good news is that Western companies do not need to beat DJI at Chinese manufacturing economics. They need to play a different game entirely.

There are three clear lanes where Western players can build durable advantage.

3.1 Security and sovereignty

- Trusted supply chains for government and critical infrastructure

- Local data residency and secure data pipelines

- Compliance with “trusted origin” frameworks and defense standards

This is where companies like Skydio, Parrot, and others already work: security conscious customers who value trusted hardware and software over lowest price.

3.2 AI and autonomy as the core product

Hardware becomes a delivery device for:

- Autonomous navigation and sense and avoid

- Actionable analytics instead of raw imagery

- Swarm coordination and fleet management

The value story becomes:

“We detect defects, we measure stockpiles, we track progress. The drone is simply the way we collect data.”

3.3 Hyper specific vertical niches

Instead of “we do drones”, think like this:

- Fixed wing mapping for mining and large infrastructure

- Solar farm defect detection as a service

- Construction progress tracking plugged into project management tools

- Medical delivery networks with strong reliability SLAs

The pattern is simple:

- Pick one vertical.

- Understand the workflow better than your customers do.

- Turn drones, sensors, and AI into a single packaged answer to that workflow.

Pitch not as “a drone company”, but as an industry intelligence company that happens to use drones.

4. The Global South as innovation lab, not afterthought

Many of the most powerful drone use cases are not in San Francisco or Berlin. They are in Kigali, Accra, Nairobi, Dhaka, and small towns far from capital cities.

In these places you see a pattern:

- Poor roads, unreliable power, thin logistics networks

- High stakes for health, food security, and land rights

- Fewer legacy systems to rip and replace

This creates several advantages for ambitious operators.

4.1 Use cases with obvious impact and clear ROI

Examples that are already proven:

- Medical supply delivery

- Blood, vaccines, and antivenom delivered in minutes instead of hours or days

- Government or donor funding because the link to lives saved is visible

- Precision agriculture for smallholders

- Drone as a service models

- Improved yields, less input waste, greater resilience for small farmers

- Land rights and mapping

- Survey data that can support property rights, planning, and access to credit

4.2 Why battery only is not enough

In many Global South settings, pure battery fleets hit hard limits:

- Unreliable grid power

- High temperatures that degrade cells

- Long distances between points of care

That opens space for hybrid powertrains. Small generators plus batteries, or flexible fuels including local biofuels. These systems trade absolute “green purity” for real reach and resilience. They can also create exportable designs for Western operators who need longer range.

4.3 What a healthy ecosystem needs

You cannot just drop drones into a village and expect magic. You need:

- Local entrepreneurs who can own and operate fleets

- Training, repair, and parts networks on the ground

- Government champions in aviation and health ministries

- Community engagement so that people trust the service

If you design for these realities from day one, the Global South stops being “a CSR story” and becomes a core strategic market and testbed.

5. From “a drone doing a job” to robotic ecosystems

Most current thinking still imagines a single drone going out to do a single task. The real frontier is multi agent systems.

5.1 Heterogeneous robotic teams

Think about a disaster response stack:

- Scout drones build a live 3D map of the area

- Ground robots or snake robots move into unsafe spaces

- Heavy lift platforms transport supplies

- An AI orchestrator assigns tasks and routes across the team

In this picture, “the drone” is just one actor in a mixed robotic fleet. The strategic value sits in:

- The shared data model

- The orchestration layer

- The domain specific playbooks

5.2 Mobile manufacturing and repair

Combine drones with 3D printing and advanced materials and you get systems that can:

- Print temporary shelter segments after disasters

- Patch pipelines, dams, or towers in place

- Use local material where possible

Again, the drone is now a flying tool head in a broader construction and repair system.

5.3 New classes of materials

Future fleets will include:

- Biodegradable single use drones for ecological missions

- Platforms that use self healing polymers to extend lifespan

- Energy harvesting skins that stretch flight time significantly

The point is not the material itself. The point is the new business models that become possible: pay per mission, sacrificial platforms for sensitive environments, fleets with much lower total cost of ownership.

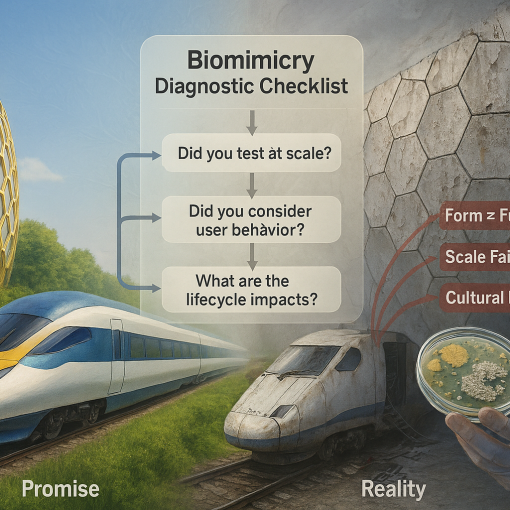

6. The Flex Drone case: why “custom drones” are not enough

Imagine a startup project called “Flex Drone” that focuses on customizable recreational drones for teenagers, with a companion app and some basic compliance awareness.

At first glance, this looks creative. In practice, it runs into three big problems that many real startups share.

- No real differentiation

Cosmetic customization rarely builds a moat. A big incumbent could copy the concept in one product cycle. - Commoditized target market

Recreational drones already live in a price war. Competing there without fresh economics or deep community lock in is tough. - No platform thinking

If the app is only a remote control or shop front, you have no recurring revenue, no network effects, and no data flywheel.

A more interesting version of Flex Drone flips the logic. Instead of “cool drones for teens”, it becomes:

“A modular drone platform with vertical specific AI mission packs for play and business users.”

It enables the creation of education platform and markets for teenagers

For example teenagers can look at use cases, for example implementation for small construction firms:

- A base airframe at a modest cost

- A monthly subscription that delivers:

- Site mapping

- Progress tracking vs BIM or CAD plans

- Simple volumetrics for stockpiles

- Optional software modules for thermal scans or richer 3D modeling

This turns Flex Drone from a toy into a hybrid of play and industry tool, and turns the drone itself into the smallest part of the business. This also extends the use case to competitive gaming and use of drone video see: Open Aerial: A Crowdsourced Aerial Media Drone Footage Platform with AI Stitching & Monetization ,Gaming Dynamics: Interactive Entertainment Elevated

7. Where the real money and impact sit

If you look across the ecosystem described in the deatiled analysis artifacts you see a few clusters of opportunity that show up again and again. Think of these as patterns rather than a strict list.

7.1 Vertical intelligence platforms (SaaS first)

These are B2B platforms that:

- Take imagery or sensor data from any compatible drone

- Process it into clear, actionable outputs

- Integrate into existing tools used by that industry

Examples:

- Construction: automated progress reports connected to project management tools

- Solar farms: panel level defect detection and maintenance planning

- Insurance: instant roof or property assessment after a claim

Economically, these platforms look like normal SaaS businesses, with high gross margins and recurring revenue. The drone piece is a funnel and a data source.

7.2 Drone as a service networks

Instead of selling hardware, operators sell outcomes like:

- “You will get blood to rural clinics in under 40 minutes.”

- “Your farm will get X percent uplift in yield with less pesticide.”

Customers pay per delivery or per hectare. Capital goes into building dense routes and hubs, not into speculative features.

This model works especially well in the Global South and in remote or infrastructure poor regions everywhere. For logistics and last mile delivery See: Using Rivers for inventory management and as Drone landing Pads

7.3 Modular platforms and component marketplaces

Here you see an “Android for hardware” mindset:

- A small number of standard airframes with open attachment points and APIs

- Marketplaces for payloads, mission software, and accessories

- Certification and testing as a premium service

The business earns margin on the marketplace and services, not only on the airframe sale.

7.4 Autonomous DiaB (drone in a box) systems

Think of fenced industrial sites, remote infrastructure, and large facilities. These buyers do not want to think about pilots at all. They want:

- A box that lives on site

- Automated flights on schedules or on alarms

- AI outputs plugged into their maintenance or security tools

Here, revenue comes from hardware plus high value recurring service contracts.

7.5 Enablers and infrastructure

Many of the best opportunities are not visible to the casual observer because they sit one layer down:

- Certification labs and standardization bodies for safety and quality

- Drone data marketplaces for training AI and change detection

- Per flight micro insurance and risk scoring

- Workforce training platforms for industry specific operator skills

- Financing and leasing products for fleets

These plays do not depend on picking the “one true vertical” and often serve multiple segments at once.

8. What you should actually do, based on who you are

This is where the manifesto becomes a checklist.

8.1 If you are a Western founder

Do not:

- Build a general purpose hardware platform that tries to mirror DJI

- Compete on price alone

- Pitch yourself as “a drone company”

Do:

- Choose one vertical and obsess over its workflows and constraints

- Lead with software and AI, treat hardware as a means to an end

- Design for regulatory alignment and security conscious buyers from day one

- Think in terms of intelligence platforms, not products

A simple reframing helps:

“We are a solar asset intelligence company that uses drones for data capture.”

is a healthier story than

“We are a drone startup for solar farms.”

8.2 If you are a Global South entrepreneur

Do not:

- Wait for perfect regulations

- Copy Western models without adaptation

- Ignore community trust and local politics

Do:

- Start with one clear, high impact use case such as medical delivery or agricultural support

- Build a local workforce that can maintain and operate systems

- Design for repairability and rough conditions

- Partner early with government and development actors

You can turn local constraints into exportable expertise in time. For example, hybrid power, rugged designs, and offline capable software built for African or South Asian conditions often work very well in remote parts of rich countries too.

8.3 If you are an enterprise buyer

Do not:

- Start with “we should buy a drone”

- Fixate on drone specs and ignore data, security, and workflow fit

- Expect instant ROI without process changes

Do:

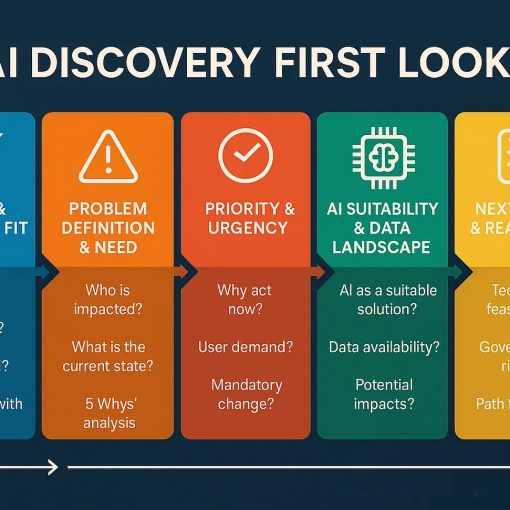

- Start from the business problem and define clear success metrics

- Run structured pilots with before and after comparisons

- Evaluate vendors on the complete stack: hardware, software, support, and regulatory expertise

- Plan for data management, integration, and internal skills development

Drones will not save money if you bolt them onto broken processes. They create value when they reshape those processes.

8.4 If you are an investor

Avoid getting stuck in the old pattern of “cool flying hardware plus sizzle video”. Look for:

- Deep vertical expertise in the founding team

- A clear path to recurring revenue, not just project work

- Thoughtful regulatory and security positioning

- Evidence that customers care about the problem enough to pay

Portfolio level, consider spreading exposure across:

- One or two vertical SaaS plays

- One or two DaaS networks with strong unit economics

- Selected infrastructure bets such as UTM, data platforms, or hybrid power

You are not betting on drones. You are betting on the reshaping of work in hard, physical sectors.

9. A ten year snapshot

If this strategic reframing takes hold, the world in the mid 2030s looks less like “more drones in the sky” and more like “robotic ecosystems around every asset that matters”.

- Construction sites where drones map, ground robots move material, and humans supervise and decide

- Farms where drones scout, autonomous tractors act, and analytics platforms advise

- Emergency response where mixed fleets react faster than any single human team could

New roles emerge: swarm coordinators, robotic fleet managers, UTM operators, aerial construction technicians. The language of “drone pilot” fades into the background.

The key shift is mental:

Stop asking “how do we build a better drone”.

Start asking “which valuable problem can we solve if drones are just one tool inside an intelligent, integrated system”.

Once you make that shift, the “drone industry” disappears, and a far larger landscape of opportunity comes into focus.