Preamble

When evaluating investment proposals or analysing emerging sectors, traditional financial metrics often fall short of capturing the full value proposition of circular economy and sustainable technology ventures. This limitation became particularly evident during my analysis of Repurposing End-of-Life EV Batteries for Stationary Energy Storage (detailed in supporting articles A, B, and Summary).

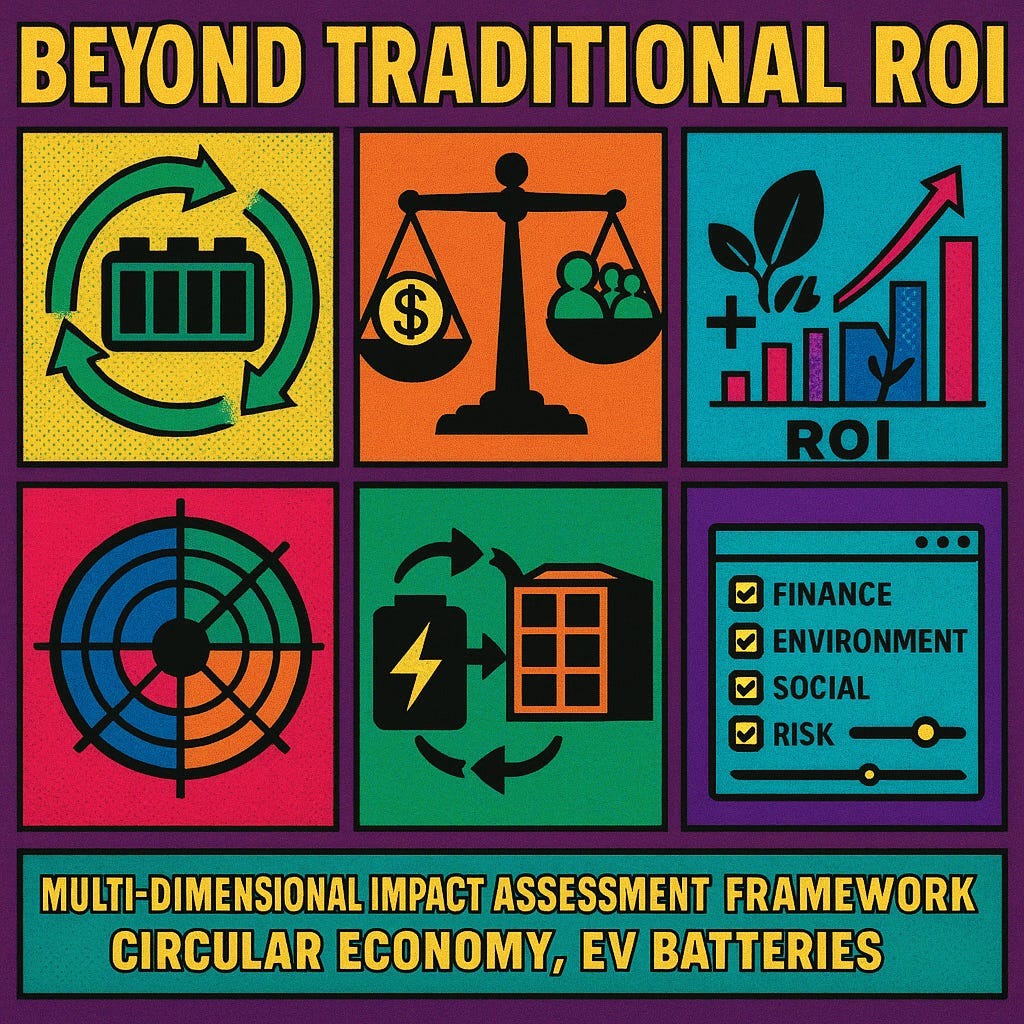

Traditional return-on-investment analysis, while providing essential financial insights, failed to adequately quantify the environmental benefits, social impact, and systemic risks inherent in circular economy business models. This analytical gap highlighted the urgent need for more sophisticated evaluation frameworks that can capture the multi-dimensional value creation of sustainable technologies.

The challenge is clear: how do we develop robust, data-driven methodologies that evaluate both financial returns and broader societal impact while maintaining the rigor expected in investment decision-making?

Introduction

This post addresses the limitations of conventional financial analysis by developing and applying a Multi-Dimensional Impact Assessment Framework (MDIAF) specifically designed for circular economy and emerging technology investments. The framework integrates traditional financial metrics with environmental impact assessment, social return analysis, and advanced risk modelling to provide a more comprehensive evaluation methodology.

Research Methodology and Scope

My approach involved three parallel development streams:

- Framework Development: Creation of the Multi-Dimensional Impact Assessment Framework (MDIAF) – a comprehensive evaluation system that addresses the analytical gaps in traditional investment assessment

- Technical Implementation: Development of a detailed Software Requirements Specification (SRS) for automated framework application, enabling scalable and consistent analysis across multiple investment opportunities

- Comparative Analysis: Systematic comparison between the new methodology and Traditional Analysis Techniques, demonstrating the enhanced decision-making capability of multi-dimensional approaches

The Case Study Application

The EV battery repurposing sector serves as an ideal test case for this enhanced analytical approach due to its complex value proposition spanning financial, environmental, and social dimensions. Traditional analysis methods struggled to capture:

- Circular Economy Value: Extended lifecycle benefits and resource conservation impacts

- Environmental Externalities: Carbon footprint reduction and waste minimization benefits

- Social Return Metrics: Community resilience, job creation, and energy security contributions

- Risk Complexity: Multi-layered technical, regulatory, and market uncertainties

Key Research Outcomes

The analysis revealed significant limitations in traditional ROI-focused methodologies when applied to sustainable technology investments. While conventional approaches suggested marginal attractiveness, the multi-dimensional framework demonstrated substantially higher value creation when environmental and social benefits were properly quantified and integrated.

This research contributes to the growing need for sophisticated analytical tools that can guide capital allocation toward sustainable technologies while maintaining rigorous investment discipline. The framework developed here provides a replicable methodology for evaluating complex, multi-stakeholder value propositions inherent in the circular economy.

The initial analysis Document Structure and Intent

The following comprehensive analysis demonstrates both the application of this enhanced evaluation framework and serves as a proof-of-concept for more nuanced investment decision-making in the sustainable technology sector. The detailed market analysis, technical specifications, and comparative assessments provide a template for applying similar methodologies to other emerging circular economy opportunities.

This work aims to encourage further development of AI-augmented analytical techniques for investment evaluation, recognizing that the complexity of sustainable technology investments requires equally sophisticated assessment methodologies to unlock their full potential and guide effective capital deployment.

Analysis using The Multi-Dimensional Impact Assessment Framework (MDIAF) (MDIAF Analysis )

Considerations to evaluate critique leverage and improve

Core Methodology: The Multi-Dimensional Impact Assessment Framework (MDIAF)

The MDIAF addresses conventional financial analysis limitations by integrating four critical dimensions:

- Financial Metrics (Beyond ROI):

- Expands traditional ROI/NPV: Incorporates circularity-driven revenue streams (e.g., second-life battery sales, recycling rebates, energy arbitrage).

- Quantifies avoided costs: Measures savings from reduced waste disposal, virgin material procurement, and carbon taxes/penalties.

- Lifecycle Costing: Evaluates costs/benefits across the entire product lifecycle (manufacturing, use, EOL, repurposing, final recycling).

- Environmental Impact Assessment:

- Carbon Footprint Reduction: Quantifies avoided emissions from battery reuse vs. new manufacturing/mining.

- Resource Conservation: Measures savings in critical raw materials (lithium, cobalt, nickel) via circular loops.

- Waste Minimization: Values the diversion of hazardous EV batteries from landfills.

- Metrics: Uses LCA (Life Cycle Assessment) data, carbon equivalencies, material flow analysis.

- Social Return Analysis:

- Job Creation: Assesses quality and quantity of jobs in refurbishment, logistics, and installation.

- Energy Access & Resilience: Values contributions to grid stability and renewable energy integration via storage.

- Community Benefits: Measures impacts on local economies and supply chain development.

- Health & Safety: Evaluates reduced pollution and safer EOL battery handling.

- Metrics: Employs SROI (Social Return on Investment) frameworks and stakeholder surveys.

- Advanced Risk Modelling:

- Multi-Layered Risks: Integrates technical (battery degradation), regulatory (evolving EOL policies), market (material price volatility), and reputational risks.

- Systemic Resilience: Assesses how circular models mitigate supply chain disruptions (e.g., reduced reliance on virgin materials).

- Tools: Uses probabilistic modelling, scenario analysis, and real options valuation.

How MDIAF Addresses Traditional Limitations

- Captures Externalities: Quantifies environmental/social costs/benefits ignored by pure financial ROI (e.g., carbon emissions, landfill avoidance).

- Reveals Hidden Value: Demonstrates profitability in projects deemed marginal by traditional methods (as seen in the EV battery case study).

- Manages Complexity: Provides tools to navigate interconnected risks in emerging circular markets.

- Enables Comparison: Standardizes evaluation of diverse circular investments (e.g., battery reuse vs. textile recycling).

The Future of MDIAF and Similar Frameworks

- AI-Augmented Analytics:

- Automated Data Integration: AI will ingest real-time data (material prices, carbon markets, policy changes) to dynamically update valuations.

- Predictive Risk Modelling: ML algorithms will forecast technical failures, regulatory shifts, and market fluctuations with greater accuracy.

- Scenario Optimization: AI will simulate thousands of scenarios to identify optimal circular business models under uncertainty.

- Regulatory & Market Drivers:

- Mandatory Reporting: Frameworks like MDIAF will underpin ESG/sustainability reporting standards (e.g., CSRD, ISSB).

- Carbon Pricing Integration: Explicit carbon costs will make environmental dimensions financially material.

- Investor Demand: ESG/sustainable finance mandates will require MDIAF-like due diligence.

- Technology Integration:

- Blockchain for Traceability: Verifies circularity claims (e.g., battery health, recycled content) feeding into impact metrics.

- IoT for Performance Data: Real-time monitoring of repurposed assets (e.g., battery health in storage systems) refines financial/environmental models.

- Digital Twins: Simulates circular systems (collection, refurbishment, reuse) to optimize logistics and value capture.

- Broader Applications:

- Beyond Batteries: Applied to solar panels, wind turbines, electronics, and building materials.

- Policy Design: Guides government incentives for high-impact circular initiatives.

- Supply Chain Finance: Rewards suppliers adopting circular practices using verified MDIAF metrics.

Challenges & Next Steps

- Data Standardization: Requires industry-wide adoption of LCA databases and impact measurement protocols.

- Dynamic Valuation: Developing robust methods to value evolving externalities (e.g., biodiversity impact).

- Integration with Financial Systems: Embedding MDIAF outputs into mainstream investment platforms and credit ratings.

- Scalability: Making advanced frameworks accessible to SMEs beyond large corporates and investors.

In essence, MDIAF represents a probable future of investment analysis: A dynamic, data-driven system where financial viability is inseparable from environmental responsibility and social value. The EV battery case study proves its practicality, and AI/tech integration will accelerate its adoption across the circular economy.