Preamble

Hair is not merely a cosmetic choice—it is identity, confidence, protection, and cultural expression. Yet the global wig and extensions market has largely evolved around speed, synthetics, and extractive supply chains, leaving comfort, dignity, and sustainability as secondary concerns.

This memo introduces a venture positioned to redefine that equation: transforming agricultural by-products and traditional fibre knowledge into premium \ mainstream or alternative , wearable hair solutions that are breathable, traceable, and design-led. What follows is not just a product concept, but the foundation of a new material category at the intersection of beauty, culture, and sustainability.

Below is a one-page investor memo looking at the Premium market. The challenge is if there is a market fit or consider alternatives the mainstream \alternative or even the Doll market.

🌿 Investor Memo

Natural Fibre Wigs & Extensions — A New Premium Category

Company (Working Name)

[Brand TBD] — Plant-based wigs, extensions, and headpieces made from banana fibre, sisal, raffia, and comfort-grade blends.

1. The Opportunity

The global wigs & hair extensions market is projected to reach ~$12–$19B by 2033 (with some broader estimates higher depending on scope), growing at ~6–9% CAGR across regions and segments.

Despite this growth, the category remains dominated by synthetic fibres and opaque human-hair supply chains, creating persistent pain points around comfort, heat, sustainability, and trust.

Gap: There is no scaled, standardized category for wearable, plant-based hair that combines comfort, aesthetics, and transparent sourcing.

2. The Problem

- Synthetic wigs: hot, itchy, plastic-based, poor end-of-life outcomes

- Human hair: supply-chain opacity, ethical scrutiny, rising costs

- Artisanal natural fibres: beautiful but inconsistent, unscalable, and uncomfortable for extended wear

Customers—especially performers, eco-fashion buyers, cultural creators, and theatres—are forced to trade off comfort vs. sustainability vs. aesthetics.

3. The Solution

A new material class:

Standardized plant-fibre wigs and extensions engineered for wearability, not just craft.

What’s novel

- Fibre-to-weft system using banana fibre, sisal, raffia (with comfort blends)

- Breathable, adjustable cap system with optional liners

- Defined QC standards (grading, softening, comfort testing)

- Transparent sourcing + “leaf-to-wig” proof-of-process storytelling

Initial products

- Art / Costume Headpieces (MVP)

- Limited-run sculptural wigs

- B2B custom work for theatres, stylists, festivals

4. Why Now

- Sustainability pressure on beauty brands (ESG, traceability, materials disclosure)

- Creator-led commerce rewards authenticity and behind-the-scenes proof

- Performance/festival markets actively seeking breathable alternatives

- Cultural shift toward identity-driven, intentional consumption

This is not a trend bet—it’s a materials + trust inflection.

5. Market Entry Strategy

Beachhead segment (12 months):

- Performance, theatre, festival, cosplay, and eco-fashion buyers

→ High tolerance for texture, strong storytelling fit, repeat B2B demand

Go-to-market

- Pre-sold D2C drops

- Theatre & stylist pilots (contracted B2B)

- Pop-ups, boutiques, curated marketplaces

- Process-led social content (TikTok/Instagram)

6. Business Model

Revenue Streams

- D2C limited drops (headpieces & wigs)

- B2B custom commissions

- Workshops / kits (secondary)

- Future licensing & collaborations

Pricing (indicative)

- Headpieces: £45–£250+

- Lifestyle wigs (Phase 2): £120–£450

- B2B custom: £300–£2,000+

7. Defensibility

- Process IP: fibre finishing, grading, and weft standards

- Operational moat: documented SOPs + trained artisan network

- Brand moat: credibility through transparency, not claims

- Category creation: early ownership of “plant-fibre wearable hair”

8. Key Risks & Mitigation

| Risk | Mitigation |

| Comfort concerns | Liners, blending, finishing standards |

| Supply variability | Multi-sourcing + fibre grading |

| “Eco” skepticism | Full material disclosure + process content |

| Scaling quality | SOPs, QC gates, small-batch discipline |

| Regulatory claims | Avoid medical/hypoallergenic claims initially |

9. Traction & Validation Plan (90 Days)

- Produce 6 prototypes (2 styles × 3 colorways)

- Pre-sell 20 units

- Secure 2 B2B pilot clients

- Track comfort score, defect rate, production time/unit

Success = repeat orders + ≥70% comfort approval

10. Use of Funds (Seed / Pre-Seed)

- Prototype refinement & material testing

- SOP documentation + artisan training

- Content & lookbook production

- Initial inventory for pre-sold drops

11. The Vision and conclusion

This is not just a wig brand. but an opportunitiy

It’s the standardization of a new sustainable material category at the intersection of identity, culture, and design—with long-term expansion into lifestyle wigs, digital fitting, and (eventually) medical adjacency. See links for visison and outline process below. Status: Stage: Validation / Pre-Seed Ask: Strategic capital + manufacturing & distribution partners Recommendation: TEST (structured validation before scale)

As usual some artifacts : Natural Fibre Wigs and hair extensions

| Name | Short summary |

| Selection Criteria and Use Case. Natural Fibre Wig and Extension | Defines a practical selection framework for plant-based fibres used in wigs and extensions, covering comfort, durability, processing, sourcing ethics, stakeholder needs, and realistic wearable use cases. |

| Fibre Wig Business Case Summary | Presents the commercial rationale for plant-fibre wigs and headpieces, outlining the problem with synthetics, target customers, differentiation through standardisation, revenue models, pricing logic, risks, and a 90-day validation plan. |

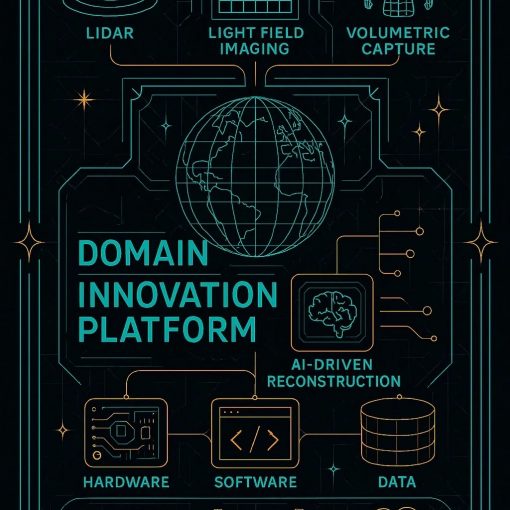

| High-Level Process Architecture. Fibre Wigs | Maps the end-to-end production process for natural fibre wigs and extensions, from raw fibre sourcing and grading through finishing, weft creation, cap construction, quality control, and packaging, designed for SOPs and scaling. |

| Market Research Report for Wigs and Hair Extensions | Provides a market overview of the global wigs and extensions industry, including size ranges, growth drivers, stakeholder analysis, competitive landscape, supply chain dependencies, regulatory considerations, and future trends. |

| Vision | Vision a new global category of wearable, plant-based hair that is breathable, culturally respectful, and transparently sourced transforming agricultural by-products into premium wigs, extensions, and headpieces for performance, fashion, and everyday expression. |

| Natural Fibre Wigs Positioning | Articulates the strategic positioning of natural fibre wigs as premium, breathable, plant-based performance and eco-fashion products, identifying defensible market wedges and outlining where the concept can win against incumbents. |