Preamble

This an article that examines. The commercial trajectory of agentic AI companies across China, Europe, and the USA over the next 5 years

· Market analysis:”Analyze the commercial trajectory of agentic AI companies across China, Europe, and the USA over the next 5 years (2025-2030). Include: Financial metrics: Revenue projections, funding trends, market size, and growth rates Commercial success factors: Market adoption, competitive positioning, and key use cases PESTLE analysis: Political, Economic, Social, Technological, Legal, and Environmental factors affecting each region SWOT analysis: Strengths, Weaknesses, Opportunities, and Threats for each regional market Compare the three regions and identify which markets are likely to lead in agentic AI commercialization.”

See: Outline Analysis

· Stakeholders: Who are the stakeholders and why see: Outline Analysis

· Ranking : Regional , funding , stakeholder functionality , and identify the top 20 companies

· The next 5 years: what is the 5-year survivability of these companies from the stakeholders perspective

This a Global Business Idea Scout inspired article.

Market overview

Over 2025–2030, agentic AI (autonomous AI agents that plan, act, and coordinate across tools and systems) is likely to grow at ~40–45% CAGR globally, from ~$7–8B in 2025 to roughly $45–50B in 2030, with:

- USA leading in commercialization, revenue and global SaaS platforms

- China leading in deployment intensity and “digital workforce” penetration, especially domestically

- Europe leading in regulated, enterprise-grade and multilingual use cases, but with more modest aggregate revenue

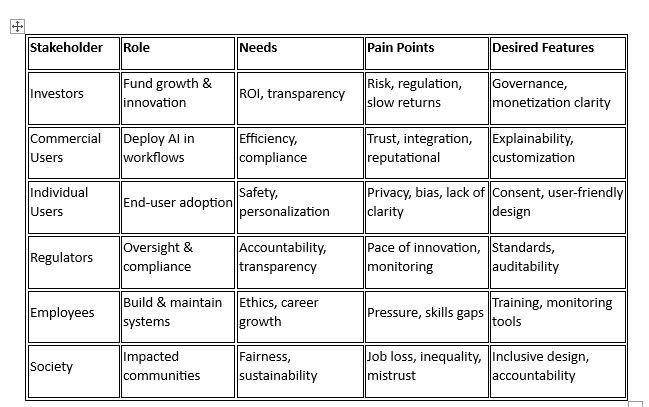

Key Stakeholders in Agentic AI Companies

Stakeholders in agentic AI companies include investors, commercial users, individual consumers, regulators, employees, partners, and society at large. Each group has distinct roles, needs, pain points, and desired features that shape how agentic AI is developed, deployed, and governed

In essence: Agentic AI companies must balance trust, transparency, and governance with innovation and profitability. Each stakeholder group brings unique expectations, and the companies that succeed will be those that design features and frameworks to meet these diverse needs McKinsey & Company KPMG IBM dainstudios.com.

Ranking

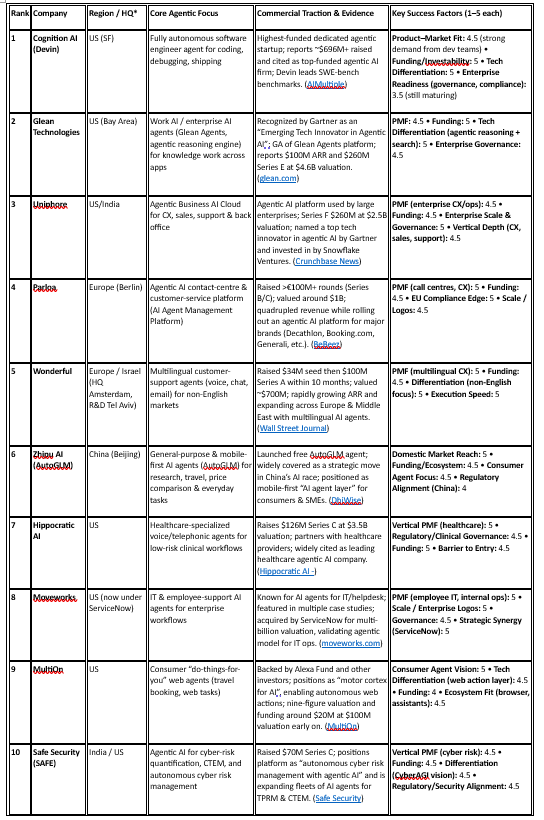

Here’s a curated, analyst-style global Top 20 list of agentic AI–focused companies (pure-play or clearly positioning themselves around AI agents), plus a quick view of their relative ranking and key success factors.

Important: there is no universally agreed “official” top-20 yet. This is a synthesized view based on:

– funding & valuation

– traction (logos, ARR, geographic reach)

– centrality of agents to the product

– tech differentiation & governance

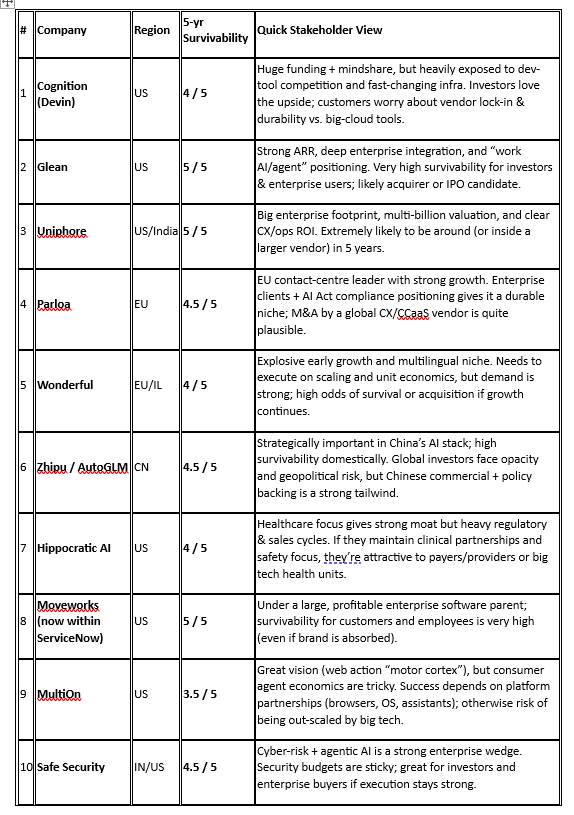

Top 20 Global Agentic AI Companies (2025 snapshot)

Scores: 1–5 for each success factor (5 = very strong today / near-term).

Rank 1-10

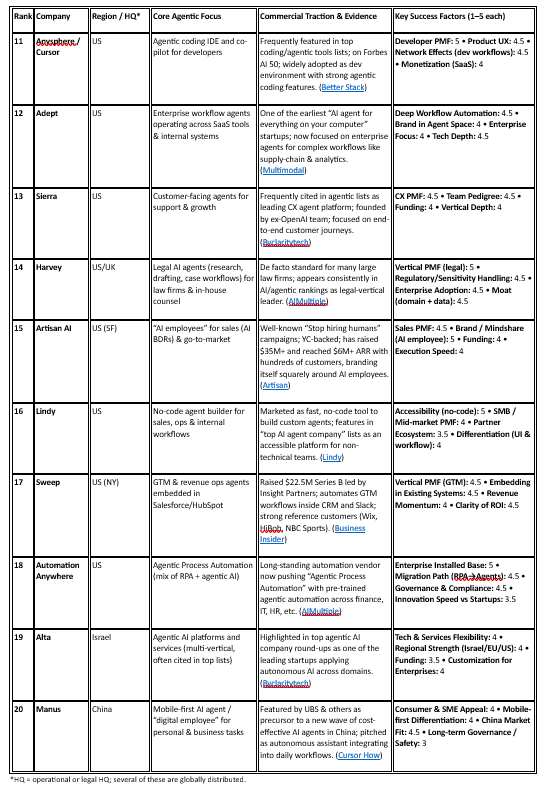

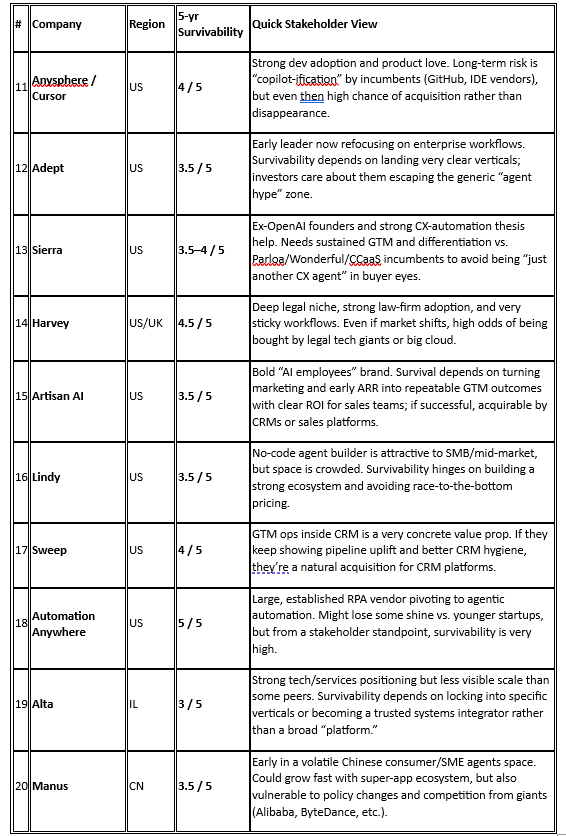

Ranks: 11-20

How to Read These Rankings

I’ve effectively ranked by combined commercial momentum + strategic position in the agentic AI stack, not just raw funding:

- Ranks 1–3 (Cognition, Glean, Uniphore)

– Deeply embedded in high-value workflows (software engineering, enterprise knowledge, CX/ops) with strong funding + Gartner / market recognition.

– They matter a lot to investors, enterprise buyers, and increasingly regulators (because of breadth and impact). - Ranks 4–7 (Parloa, Wonderful, Zhipu, Hippocratic)

– Highly specialized leaders in CX/contact center, multilingual support, China consumer agents, and healthcare.

– These are likely to dominate specific verticals/regions (EU CX, EMEA multilingual CX, China consumer/SME, US healthcare). - Ranks 8–12 (Moveworks, MultiOn, Safe, Cursor, Adept)

– Strong players at workplace & infra layer: IT/employee support, consumer execution layer (web), cyber risk, and dev workflows.

– Excellent enterprise PMF and often deep integration into existing software. - Ranks 13–20

– Still significant, but either more focused niches (legal, sales BDR, GTM, cybersecurity) or earlier-stage / fewer hard numbers available.

– Huge upside, but more execution risk.

How This Relates to Stakeholders (Investors, Users, Regulators, etc.)

Very briefly, if you map back to your stakeholder framework:

- Best aligned with Investors (clear ROI, scale, exits):

Cognition, Glean, Uniphore, Parloa, Wonderful, Hippocratic, Moveworks, Safe Security. - Best aligned with Commercial Users (orgs):

Glean, Uniphore, Parloa, Wonderful, Safe Security, Sierra, Sweep, Automation Anywhere, Glean again for IT/knowledge. - Best aligned with Individual Consumers (for now):

MultiOn, Zhipu/AutoGLM, Manus (and over time any company that exposes consumer-facing agents). - Best aligned with Regulators & Policymakers / high-risk domains:

Hippocratic (healthcare), Safe Security (cyber risk), Harvey (legal), Parloa/Wonderful (because of CX in regulated sectors), Glean/Uniphore (large enterprise footprint). - References AIMultiple ,bika.ai , AIMultiple ,Sendbird , Tidio

Survivability and Risk

Risk/survivability heat check for the next 5 years (to ~2030) for each of the 20 companies, from the perspective of your stakeholders:

- 💰 Investors

- 🏢 Commercial users

- 👤 Consumers

- ⚖️ Regulators

- 👩💻 Employees / Developers

- 🌍 Society & communities

I can’t actually predict the future, but I can give you a structured survivability score based on:

- Funding & backing

- Clarity of business model

- Depth of integration / switching costs

- Regulatory exposure

- Concentration risk (single use case, single buyer type, region, etc.)

Scale

Survivability Score (5 years):

- 5 = Very likely to be around & relevant (maybe via acquisition)

- 4 = Likely, but with meaningful risks

- 3 = Coin flip / “prove-it” phase

- 2 = High risk

- 1 = Very high risk

1. Snapshot Table – 5-Year Survivability

Interpretation: This is “will stakeholders still be able to rely on this company or its tech in 5 years?”, not necessarily “will it be independent and public.”

Rank :1-10

Rank 11-20

2. Stakeholder-Lens Commentary (High Level)

💰 Investors (Capital Providers)

- Safest bets (5/5 or close):

Glean, Uniphore, Moveworks/ServiceNow, Automation Anywhere, Safe Security, Harvey, Parloa, Zhipu

These have either:- Deep enterprise embedding (high switching costs), or

- Strong vertical moats (legal, cyber, healthcare), or

- Are already under big, profitable platforms.

- High-upside but higher risk:

Cognition, MultiOn, Artisan, Lindy, Adept, Wonderful, Sweep, Manus- Enormous TAMs and narratives (AI employees, web agents), but

- Business models & margins are still being proven, and competition from hyperscalers is intense.

🏢 Commercial Users (Organizations)

From a buyer’s risk perspective, you care about:

- “Will they be around or at least be acquired safely?”

- “Is the agent integrated into a bigger ecosystem?”

- Lowest vendor risk for enterprises:

- Glean, Uniphore, Parloa, Wonderful, Safe Security, Automation Anywhere, Harvey, Moveworks/ServiceNow

- Even if they get acquired, it’s likely by someone you already trust or integrate with (ServiceNow, large CCaaS, big cloud).

- More speculative to build mission-critical processes around (today):

- MultiOn, Manus, Alta, some of the SMB-oriented builders (Lindy, Artisan)

- Still valuable as pilots/adjacent automation, but you’d avoid putting “line-of-business critical” workflows exclusively on them until they show sustained stability.

👤 Individual Consumers

Consumers mostly care about:

- Will this product still exist and keep my data safe?

- Will my digital life break if they shut down?

- More durable consumer-facing bets (often via enterprises):

- MultiOn, Zhipu, Manus, Hippocratic (patient-facing pieces), Wonderful

- But consumer survivability is also tightly tied to platform integration:

- If they get baked into browsers, OSs, or super-apps, survivability for the experience is high even if the startup brand disappears.

⚖️ Regulators & Policymakers

Regulators worry about:

- “Can I hold someone accountable in 5 years?”

- “Is this company building auditable, controllable systems?”

- Best aligned with long-term regulatory expectations:

- Parloa, Wonderful, Uniphore, Glean, Harvey, Safe Security, Hippocratic, Automation Anywhere

- They live in regulated-stack environments (finance, telco, health, legal, cyber), so survival depends on complying with EU AI Act, HIPAA, sector rules, etc. That tends to increase survivability for compliant players.

- More exposed to changing rules:

- Cognition (code deployment), MultiOn/Manus (autonomous consumer actions), general-purpose builders like Lindy/Adept

- If they move into higher-risk actions (transactions, health, employment), regulators may impose heavier guardrails that raise costs or drive consolidation.

👩💻 Employees & Developers

For talent, survivability =:

- “Will this be a good 5-year career bet?”

- “Will the company outlive the hype cycle?”

- Strong 5-year talent bets:

- Companies with clear verticals and real customer budgets: Glean, Uniphore, Parloa, Wonderful, Safe Security, Harvey, Automation Anywhere, Zhipu.

- Even if they don’t IPO, skills here are directly transferable (CX, security, legal, enterprise AI).

- High-risk/high-reward talent bets:

- Cognition, MultiOn, Artisan, Lindy, Adept, Manus, Alta.

- Amazing learning and upside if they hit; bigger risk of restructuring, acqui-hire, or shutdown if they don’t.

🌍 Society & Communities

From the societal point of view, survivability depends on:

- Whether these companies help or hurt trust in AI.

- Whether they anchor themselves in safety, fairness, and human benefit.

- Most likely to be favoured by public institutions (and thus live longer):

- Hippocratic (healthcare), Safe Security (cyber risk), Harvey (legal, rights), Parloa/Wonderful (customer fairness & access), Glean (work productivity), Automation Anywhere (transition from RPA).

- Societal pushback risk:

- Companies branding hard around “replace humans” (e.g., “stop hiring humans”) may face more political & social pressure, even if technically viable. That can affect their long-term license to operate and thus survivability.

3. How You Can Use This

If you want to go deeper, :

- Build a matrix where each of the 20 companies gets a stakeholder-specific survivability score (e.g., “Investor survivability: 4.5”, “Enterprise buyer survivability: 3.5”) and

- Weight those scores by which stakeholder matters most for your use case (investor thesis vs. corporate partner selection vs. policy analysis).

- which lens you care about most (e.g., VC, corporate buyer, or policy-maker), and turn this into a more formal decision tool / scoring sheet