Preamble:

BrixelVerse lets you build with smart, sustainable blocks, then scan your model to create a live digital twin. AI helps you refine designs, test ideas, and turn simple builds into working vehicles, creatures, and worlds. You can export to Roblox or Minecraft, share blueprints, or 3D print parts you need. Educators get standards-aligned projects that teach spatial reasoning, coding logic, and design thinking. Parents get safe accounts, privacy controls, and real value beyond the box. Creators earn from a marketplace that rewards great builds and lesson packs

It is an answer to a question no one asked

What if we could reimagine the humble building block for the digital age?

There’s something deeply satisfying about the click of LEGO bricks snapping together. That sound has echoed through childhood bedrooms for over 90 years, building everything from simple towers to elaborate castles. But what if we told you that in 2025, with AI, AR, and a generation of digital natives, there’s never been a better time to challenge the Danish giant?

Welcome to the era of “phygital” play—where physical meets digital in ways that would make even the most imaginative child’s eyes light up.

Market segment

The global construction play market, physical and virtual, is large and growing. Physical toys dominate with an estimated 2023 size of 14.5 to 16.5 billion dollars, projected to reach 20 to 24 billion dollars by 2028 to 2030 at 5 to 7 percent CAGR. Virtual building platforms are harder to isolate, but Minecraft alone generates billions each year, and together with Roblox creation tools and similar titles the segment likely clears 5 to 10 billion dollars annually, with overlap inside broader game revenue. LEGO leads physical, with Mattel’s Mega brands, Spin Master’s Meccano, Bandai’s Nanoblock, and others competing. Minecraft, Roblox, Epic’s Fortnite Creative and LEGO Fortnite anchor virtual. Lines continue to blur through licensed IP, AR and app integrations, and UGC. STEM and STEAM positioning supports demand. The total construction ecosystem easily exceeds 20 billion dollars a year and is expanding. Further outline on Market and players is in appendices.

The Perfect Storm: Why Now?

The Tech is Finally Ready

Remember when “smart toys” meant a robot dog that could barely walk straight? Those days are over. Today’s technology stack reads like a sci-fi wishlist:

- AI that actually understands creativity: Modern AI can look at a child’s wonky tower and suggest how to make it into a rocket ship

- AR that doesn’t make you nauseous: Smooth, real-time overlay of digital elements onto physical builds

- Cloud computing that scales: Millions of kids can share and remix designs simultaneously

- Mobile cameras that see everything: Instant scanning and recognition of physical structures

Consumer Behavior Has Shifted

Today’s parents didn’t grow up with smartphones—they grew up alongside them. They’re not afraid of screen time; they’re looking for meaningful screen time. They want toys that:

- Bridge physical and digital play (67% of parents prefer “phygital” toys, according to recent surveys)

- Teach real skills while being fun

- Connect their kids to global communities of young creators

- Actually justify the price tag with ongoing value

My Usual Analysis

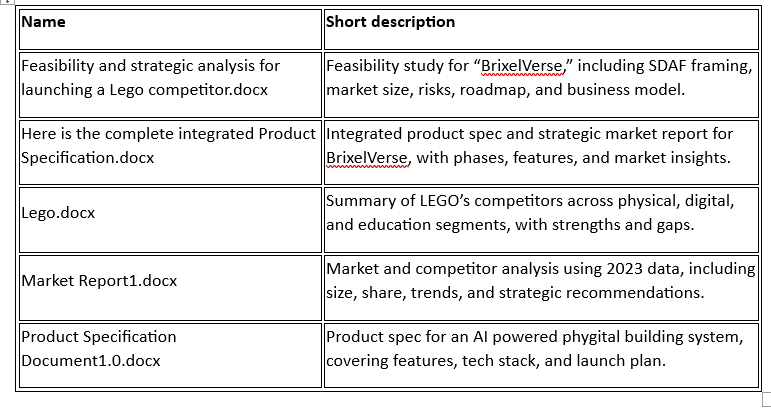

The outline analysis and outline documents on market detail and making it work is here Analysis needs a lot of work or it inspires alternative ideas.

The Sustainability Imperative

Gen Z and Millennial parents care deeply about environmental impact. They’re willing to pay premium prices for products that align with their values. A building block system made from recycled ocean plastic? That’s not just good karma—it’s good business.

Enter BrixelVerse: The “What If” That Could Work:

Complete product specification: BrixelVerse: Complete Product Specification

Imagine this: Your child builds a spaceship from sustainable smart blocks. They scan it with their tablet, and suddenly their creation comes alive in a digital universe. They can fly it through alien worlds, modify its design with AI assistance, and share it with friends across the globe. Other kids can download the blueprint, build their own version, and add their own creative twists.

This isn’t science fiction—it’s an achievable fusion of existing technologies.

The Magic Behind the Blocks

Smart Materials: Each block contains tiny RFID tags or QR codes that identify its type, color, and position. When you scan your creation, the system instantly knows what you’ve built.

AI-Powered Creativity: Natural language processing lets kids describe what they want to build. “I want a castle that can fly” becomes a suggested blueprint that respects the laws of physics (mostly).

Metaverse Integration: Built structures can be imported into popular platforms like Roblox, Minecraft, or Fortnite Creative mode. Your physical creation becomes your digital avatar’s headquarters.

3D Printing Loop: Love someone else’s design? Download it and print the parts you don’t have. Or design something purely digital and bring it into the physical world.

The Education Angle That Actually Works

Here’s where it gets interesting for parents and teachers. This isn’t just about having fun—it’s about learning skills that matter in 2025:

- Computational thinking through visual programming

- 3D spatial reasoning that translates to STEM careers

- Design thinking and iterative problem-solving

- Digital citizenship and creative collaboration

- Sustainability awareness through material choices

Unlike traditional LEGO’s educational add-ons that often feel forced, these skills emerge naturally from the play experience.

The Business Case: Why This Could Actually Work

The Numbers Don’t Lie

The global construction toy market is worth $13.2 billion, with LEGO holding a commanding 68% share. But here’s the kicker: 78% of that market is still analog. The digital-physical hybrid space is essentially wide open.

Recent market research shows:

- 42% of parents actively seek toys that combine physical and digital play

- 65% are willing to pay premium prices for sustainable materials

- Educational toy sales grew 8% annually even during the pandemic

The Competitive Landscape Has Gaps

LEGO’s Achilles’ Heel: Despite their market dominance, LEGO struggles with true digital integration. Their apps feel like afterthoughts, and their smart products (like LEGO Boost) have limited replay value.

Minecraft’s Missing Piece: While Minecraft dominates digital building, it lacks the tactile satisfaction of physical construction. Kids love the game but still crave hands-on creation.

The Roblox Opportunity: With over 200 million monthly active users, Roblox proves kids want to create and share. But current creation tools are complex and screen-only.

The Moats Are Buildable

Unlike many tech startups, a phygital building system can create real competitive advantages:

- Network effects: The more kids who use it, the more valuable the platform becomes

- Switching costs: Physical collections create investment lock-in

- Data advantages: Understanding how kids build helps improve AI suggestions

- Content moats: User-generated designs become platform-exclusive assets

The Roadmap: From Concept to Competition

Phase 1: The MVP Magic (Months 1-6)

Start simple but think big. The first version needs:

- Basic smart blocks with simple scanning

- A mobile app that recognizes common builds

- Integration with one major platform (probably Roblox)

- A small but passionate community of early adopters

Phase 2: The Education Bridge (Months 7-18)

This is where you differentiate from toys and become a tool:

- Partner with progressive schools for pilot programs

- Develop curriculum-aligned lesson plans

- Create teacher training and certification programs

- Build relationships with education technology buyers

Phase 3: The Platform Play (Months 19-36)

Now you’re not just selling toys—you’re building an ecosystem:

- Launch the user-generated content marketplace

- Enable 3D printing of community designs

- Integrate with multiple metaverse platforms

- Develop AI tools for advanced users

Phase 4: The Global Vision (Years 3-5)

Scale the magic worldwide:

- Localize for different educational systems

- Partner with governments on STEM initiatives

- Build the creator economy with real revenue sharing

- Become the standard for phygital education

The Challenges (And How to Overcome Them)

The Manufacturing Mountain

Physical products are hard. Really hard. LEGO’s precision manufacturing is legendary for good reason. But here’s the modern advantage: you don’t need to own the factories. Contract manufacturers in 2025 can produce complex, smart products at scale. The key is designing for manufacturability from day one.

The Regulatory Maze

Kids’ products face intense scrutiny, especially around data privacy. COPPA, GDPR, and various national standards create a complex compliance landscape. But this is actually a moat—once you’ve navigated it successfully, it becomes a barrier to entry for competitors.

The Chicken-and-Egg Problem

Platforms need users to be valuable, but users need content to be interested. The solution? Start with the most engaged community first. Focus on homeschooling parents, STEM educators, and maker communities. These early adopters will create the initial content that attracts mainstream users.

The Human Factor: Why This Matters

Beyond the business case and technical feasibility, there’s something deeper happening here. We’re raising a generation that will live in increasingly digital worlds, but they still need to understand how things work in the physical realm. They need to know that digital creations have real-world implications, that sustainability matters, and that the best innovations often come from combining old and new approaches.

A phygital building system isn’t just about creating a LEGO competitor—it’s about giving kids tools to understand and shape the hybrid reality they’re inheriting.

The Time Is Now

Every month we wait, the technology gets better and cheaper. Every month we wait, more kids grow up as digital natives expecting seamless integration between physical and digital worlds. Every month we wait, the sustainability crisis becomes more urgent.

The question isn’t whether someone will create a successful LEGO competitor in the AI age—it’s whether it will be a startup with vision or a tech giant with resources. The window for the former is open, but it won’t stay that way forever.

The building blocks are all here. The question is: who’s going to put them together?

Conclusion

What do you think? Are you ready to build the future, one smart brick at a time?

You can build a real alternative to LEGO by focusing on the phygital loop, verified learning outcomes, and a creator economy that pays. The market is large and concentrated, about 13.2 billion dollars with LEGO near 68 percent share, which leaves room for a focused entrant with smart blocks, instant scan to digital, and export to Roblox or Minecraft. Parents signal demand for this blend of physical and digital play, and many will pay more for sustainable materials. Educators want curriculum aligned projects that teach spatial reasoning, coding logic, and design thinking. Start with pilots in schools and maker groups, launch a simple scan and co-design experience, then grow the marketplace and partnerships. If you want to test this, join the early pilot, help shape the tools, and publish your first build and lesson.

Appendices

Outline market analysis

The global construction toy market (both physical and virtual) is a significant and growing industry, driven by factors like STEM/STEAM education focus, licensing deals, and digital innovation. Here’s a breakdown:

1. Market Size (2023-2024 Estimates):

- Physical Construction Toys: Dominates the market.

- Estimated Size: $14.5 billion to $16.5 billion USD in 2023.

- Projected Growth: Expected to reach $20 billion to $24 billion USD by 2028-2030, growing at a CAGR of 5-7%.

- Virtual Construction Toys/Games: This segment is harder to isolate perfectly but includes games/platforms centered around building (Minecraft, Roblox creation, Fortnite Creative, LEGO digital games, etc.). Its value is often captured within the broader video game market.

- Estimated Size (Specific Segment): Difficult to pinpoint precisely, but core building-centric games like Minecraft generate billions annually alone. Including Roblox UGC creation tools and similar platforms, the segment easily reaches $5 billion to $10 billion+ USD annually, though much of this overlaps with overall game revenue/subscriptions.

- Combined Market: While not simply additive due to overlaps (e.g., LEGO games), the total ecosystem for construction play (physical sets + dedicated virtual building platforms/games) is well over $20 billion USD annually and growing steadily.

2. Top Players:

Physical Construction Toys:

- The LEGO Group (Denmark): The undisputed global leader. Known for LEGO bricks, Technic, Duplo, licensed sets (Star Wars, Harry Potter, Marvel, etc.), and serious play solutions. Dominates market share.

- MGA Entertainment (USA): Primarily known for LOL Surprise! and Bratz, but a major player in construction via Little Tikes (preschool construction) and especially Nano Blocks (micro-sized bricks).

- Mattel, Inc. (USA): Leverages its Mega Brands acquisition. Key brands:

- MEGA Construx: Direct competitor to LEGO, known for Halo, Masters of the Universe, Pokémon, and licensed sets.

- Fisher-Price: Preschool construction (e.g., Mega Bloks).

- Spin Master Corp. (Canada): A major toy company with significant construction lines:

- Erector by Meccano: Focuses on metal construction, robotics, and STEM.

- Hatchimals CollEGGtibles: Smaller collectible building figures.

- Bunchems: Ball-based construction.

- Bandai Namco Holdings (Japan): Primarily known for action figures and anime, but a key player via:

- Nanoblock: Leading micro-brick brand, especially strong in Asia.

- Hasbro, Inc. (USA): While famous for Transformers and board games, it has construction plays through:

- Play-Doh: Modeling compound often used creatively like construction.

- Transformers: Combines action figures with construction/building elements.

- Kre-O (Discontinued but legacy): Was a direct LEGO competitor using Hasbro IP.

- Minecraft (Physical Sets – Multiple Licensees): While Minecraft is primarily virtual, its immense popularity fuels a large market for physical Minecraft construction sets. LEGO, Mega Construx, and others hold licenses to produce these. Revenue benefits the licensees and Microsoft/Mojang.

Virtual Construction Toys/Games & Platforms:

- Mojang Studios / Microsoft (Sweden/USA): Minecraft is the quintessential virtual construction game/platform, with massive global user base, sales, and merchandise.

- Roblox Corporation (USA): While a broader platform, Roblox is fundamentally driven by user-generated content (UGC), with a massive portion being construction/building games (“experiences”) created using Roblox Studio. A powerhouse in virtual creation.

- Epic Games (USA): Fortnite‘s “Creative Mode” and especially the new “LEGO Fortnite” mode are significant virtual construction playgrounds, leveraging both Epic’s platform and LEGO’s brand/IP.

- The LEGO Group (Denmark): Has a long history in virtual construction:

- LEGO Video Games: Developed by TT Games (Warner Bros.), covering countless themes.

- LEGO Digital Designer/Bricklink Studio: Digital building tools.

- LEGO Life / LEGO Builder’s Journey / LEGO Bricktales: Dedicated apps/games.

- Major Partnerships: LEGO Fortnite (with Epic), LEGO Worlds.

- Klei Entertainment (Canada): Don’t Starve Together features significant building/crafting elements.

- Other Sandbox/Building Games: Titles like Terraria (Re-Logic), Valheim (Iron Gate), The Sims 4 (Maxis/EA – building aspects), and countless Roblox/Fortnite Creative experiences contribute heavily to the virtual construction play segment.

Key Trends & Convergence:

- Blurring Lines: The distinction between physical and virtual is fading. LEGO sets often include app integrations (AR instructions, games). Minecraft inspires physical sets. Fortnite integrates LEGO building.

- STEM/STEAM Focus: Both physical and virtual construction toys are heavily marketed for developing spatial reasoning, creativity, engineering, and problem-solving skills.

- Licensing: Major entertainment IP (movies, games, comics) drives significant sales in both physical sets and virtual experiences.

- UGC (User-Generated Content): Platforms like Roblox and Minecraft thrive on players building and sharing their own creations, a core aspect of virtual construction play.

- Subscription Models: Common in virtual platforms (Roblox Premium, Minecraft Realms+, Xbox Game Pass providing access).

This market is dynamic, with physical toys remaining dominant but virtual experiences growing rapidly and increasingly integrated with traditional play. LEGO leads physically, while Minecraft and Roblox define much of the core virtual building space, with major players like Epic Games (Fortnite) making significant moves.