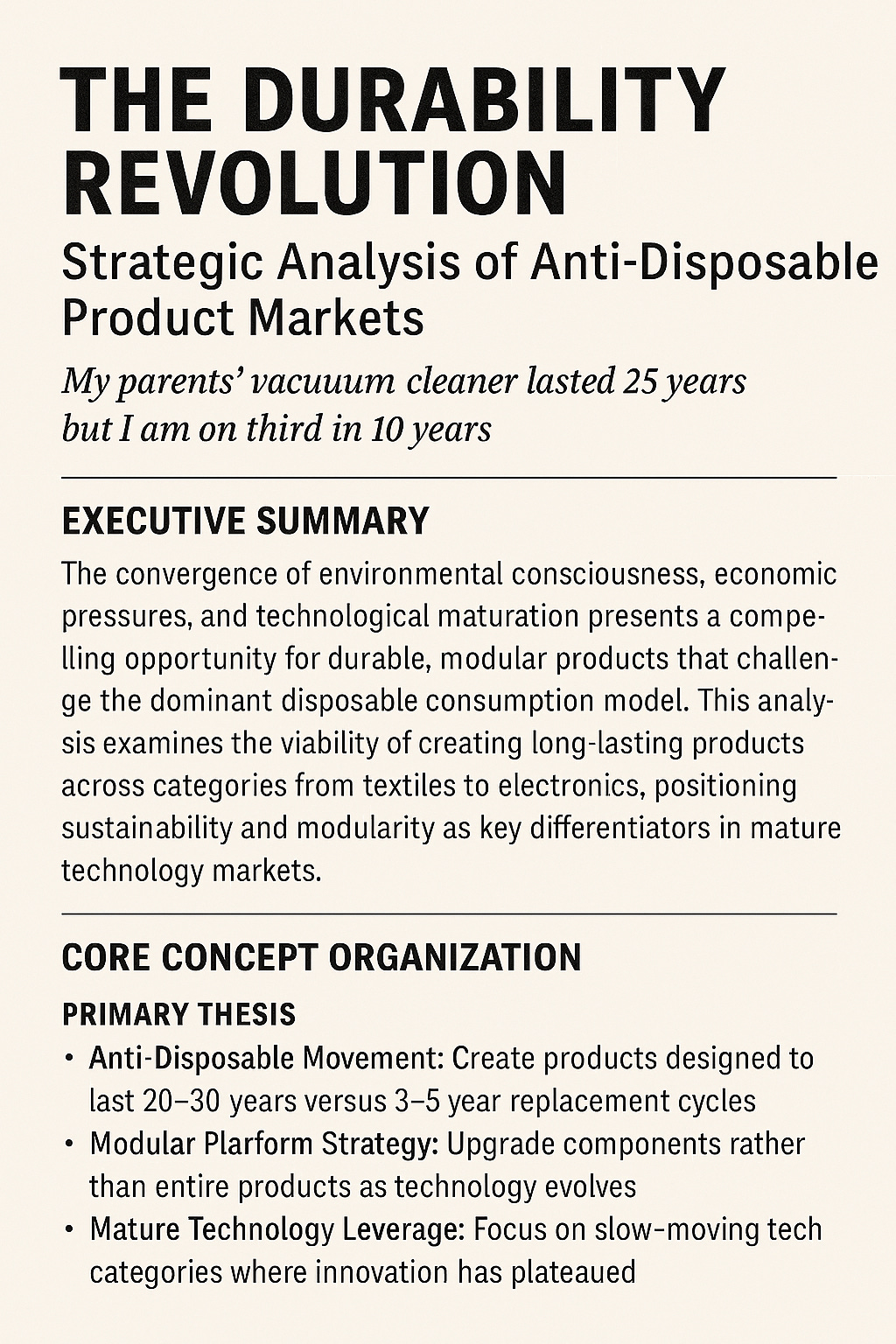

Executive Summary

The convergence of environmental consciousness, economic pressures, and technological maturation presents a compelling opportunity for durable, modular products that challenge the dominant disposable consumption model. This analysis examines the viability of creating long-lasting products across categories from textiles to electronics, positioning sustainability and modularity as key differentiators in mature technology markets. Is there an opportunity and what does it look like?

Core Concept Organization

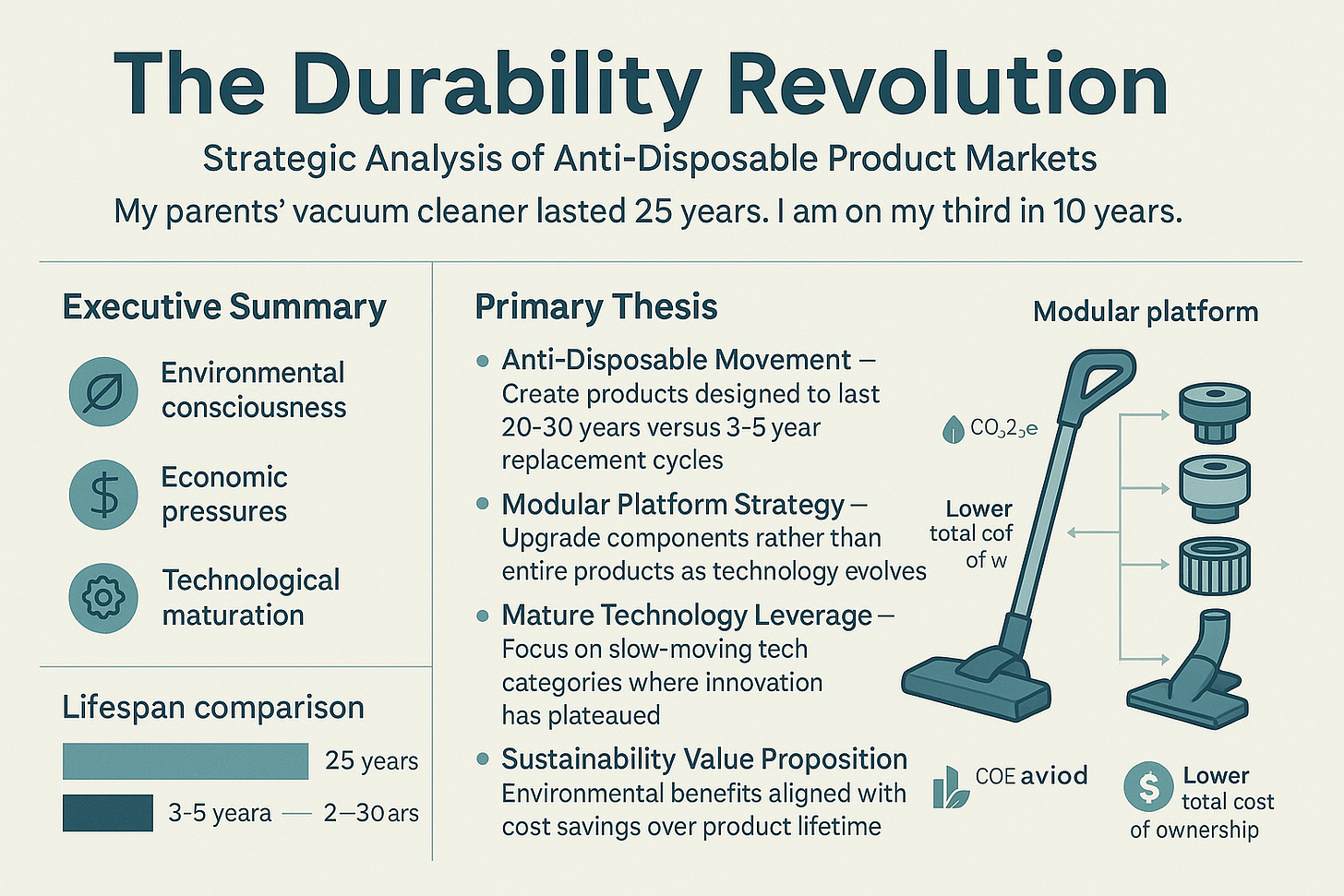

Primary Thesis

- Anti-Disposable Movement: Create products designed to last 20-30 years versus 3-5 year replacement cycles

- Modular Platform Strategy: Upgrade components rather than entire products as technology evolves

- Mature Technology Leverage: Focus on slow-moving tech categories where innovation has plateaued

- Sustainability Value Proposition: Environmental benefits aligned with cost savings over product lifetime

Target Categories Identified

- Home Appliances: Vacuum cleaners, printers, cookers, white goods

- Electronics: Audio equipment, home electronics in mature categories

- Textiles: High-quality basic garments (T-shirts as case study)

- Print Technology: Home printers with non-proprietary consumables

Market Analysis Framework

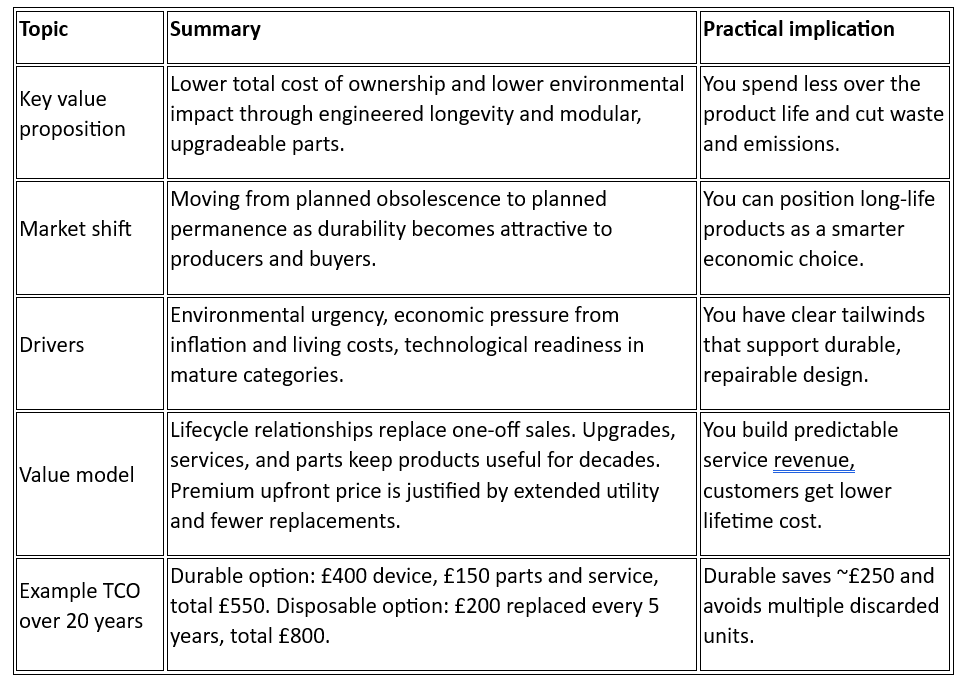

Durable, modular products deliver a lower total cost of ownership and a smaller environmental footprint by design. Are markets shifting from planned obsolescence to planned permanence as durability becomes attractive to producers and buyers. The change is driven by three forces: environmental urgency as climate risks and resource scarcity rise, economic pressure as inflation and living costs make TCO matter, and technological readiness as mature technologies enable reliable, repairable systems at viable cost. As these forces align, companies replace one-off transactions with lifecycle value relationships, using upgrades, services, and parts to keep products useful for decades. A higher upfront price becomes rational because the product avoids frequent replacements, reduces material waste, and spreads performance and maintenance costs over a longer life. It’s debateable if this model creates measurable value for customers and stable, revenue for firms, while cutting environmental impact. See The Market for Planned Permanence

1. Stakeholder Identification & Analysis

Stakeholders are individuals or groups who can affect or are affected by the achievement of the organization’s objectives. They are categorized below by their relationship to the initiative. See: Stakeholder Identification and Analysis

Internal Stakeholders

- Core internal teams

- Product design & R&D

- Supply chain & operations

Financial & Strategic Partners

- Investors & funders

- Component partners

- Material suppliers

- Specialized manufacturers

Customer Segments

- Early adopters

- B2B customers

- Mainstream consumers

Policy & Oversight

- Regulators & policymakers

- Environmental agencies

Market Landscape

- Direct competitors

- Indirect competitors

Ecosystem & Advocacy

- Advocates & influencers

- Service partners

- End-of-life partners

Some Stakeholder Considerations:

PESTLE Analysis

Political

Opportunities:

- Growing regulatory pressure on planned obsolescence (EU “Right to Repair” legislation)

- Carbon reduction targets driving sustainability mandates

- Extended producer responsibility laws increasing disposal costs

Challenges:

- Potential resistance from established manufacturers

- Complex international trade regulations for modular components

Economic

Opportunities:

- Consumer price sensitivity driving “buy once, use forever” mentset

- Total cost of ownership advantages over product lifetime

- Reduced raw material costs through longer product cycles

Challenges:

- Higher upfront costs potentially limiting market penetration

- Disruption of existing supply chains and business models

- Economic cycles affecting consumer willingness to invest long-term

Social

Opportunities:

- Rising environmental consciousness among consumers

- “Buy less, buy better” movement gaining momentum

- Generational shift toward sustainable consumption

Challenges:

- Consumer habits deeply ingrained in disposable culture

- Status signaling through frequent upgrades/replacements

- Convenience expectations may conflict with modularity complexity

Technological

Opportunities:

- Design for modularity now feasible with advanced manufacturing

- IoT enabling predictive maintenance and performance optimization

- 3D printing allowing on-demand spare part production

Challenges:

- Rapid technological change in some categories

- Standardization challenges across modular components

- Legacy technology integration issues

Legal

Opportunities:

- Intellectual property landscape more open in mature technologies

- Growing legal frameworks supporting repairability

- Consumer protection laws favoring durability claims

Challenges:

- Patent landscapes in some categories still restrictive

- Product liability considerations for long-life products

- Warranty and service obligation complexities

Environmental

Opportunities:

- Climate change urgency driving sustainable alternatives

- Circular economy initiatives gaining institutional support

- Resource scarcity making durability economically attractive

Challenges:

- Initial manufacturing footprint potentially higher

- End-of-life considerations for long-duration products

- Material selection complexity for extreme durability

Porter’s Five Forces Analysis

Threat of New Entrants: MEDIUM-HIGH

- Barriers: High initial R&D investment, consumer education requirements, supply chain complexity

- Enablers: Technology democratization, crowdfunding platforms, sustainability positioning

Bargaining Power of Suppliers: MEDIUM

- Considerations: Specialized materials for durability may limit supplier options

- Mitigation: Modular approach allows supplier diversification across components

Bargaining Power of Buyers: HIGH

- Factors: Price sensitivity, established brand loyalties, skepticism about durability claims

- Opportunity: Total cost of ownership education, lifetime value propositions

Threat of Substitute Products: HIGH

- Challenge: Existing disposable products with lower upfront costs

- Defense: Performance superiority, environmental benefits, total cost advantages

Competitive Rivalry: MEDIUM

- Current State: Few direct competitors in anti-disposable positioning

- Evolution: Likely intensification as market proves viable

SWOT Analysis

Strengths

- Differentiated Value Proposition: Clear environmental and economic benefits

- Technology Maturity: Focus on proven, stable technologies reduces R&D risk

- Modular Flexibility: Adaptability to changing needs without full replacement

- Consumer Trend Alignment: Sustainability consciousness growing rapidly

Weaknesses

- Higher Initial Costs: Potentially limiting market accessibility

- Consumer Behavior Change Required: Significant education and habit modification needed

- Complex Value Chain: Modular systems require sophisticated supply chain management

- Brand Building Challenge: Establishing credibility against entrenched competitors

Opportunities

- Regulatory Tailwinds: Right to repair and sustainability legislation

- Technology Convergence: IoT, AI, and manufacturing advances enabling new business models

- Market Gap: Few established players in anti-disposable positioning

- B2B Markets: Commercial applications may provide early adoption pathway

Threats

- Incumbent Response: Large manufacturers could launch competing durable lines

- Economic Downturns: Reduced consumer willingness to invest in higher upfront costs

- Technology Disruption: Breakthrough innovations could obsolete current product categories

- Supply Chain Vulnerabilities: Dependence on specialized components and materials

Business Model Analysis

Revenue Models

- Premium Pricing Strategy: Higher margins on durable products

- Subscription Services: Maintenance, upgrades, and consumables

- Modular Upgrade Revenue: Selling improved components over time

- Licensing Platform: Technology licensing to other manufacturers

Value Propositions

- Economic: Lower total cost of ownership over product lifetime

- Environmental: Reduced waste and resource consumption

- Performance: Superior durability and reliability

- Convenience: Reduced replacement frequency and maintenance

Key Success Factors

- Design Excellence: Products must perform significantly better than disposable alternatives

- Modular Architecture: Seamless upgrade paths without obsoleting base platforms

- Supply Chain Mastery: Reliable component sourcing and manufacturing quality

- Consumer Education: Effective communication of total value proposition

- Service Network: Comprehensive support for long-life products

Market Opportunity Sizing

Primary Target Markets

- Global Vacuum Cleaner Market: $12.3B (2023), growing 4.2% CAGR

- Home Printer Market: $8.9B (2023), mature but high consumables revenue

- Premium T-shirt Market: $4.2B subset of larger apparel market

Penetration Strategy

- Phase 1: Niche premium segments with high environmental consciousness

- Phase 2: Mainstream market expansion through cost optimization

- Phase 3: B2B markets and institutional adoption

Competitive Landscape

Direct Competitors

- Dyson: Premium vacuum cleaners with durability positioning

- Patagonia: Durable clothing with repair/reuse programs

- Fairphone: Modular smartphone concept

Indirect Competitors

- All traditional manufacturers in target categories

- Fast fashion and disposable product manufacturers

Competitive Advantages

- First-mover advantage in anti-disposable positioning

- Modular platform efficiency versus monolithic products

- Sustainability credentials as primary differentiator

- Total cost value proposition over product lifetime

Implementation Roadmap

Phase 1: Proof of Concept (Months 1-12)

- Develop heavyweight cotton T-shirt line as market test

- Establish quality standards and durability benchmarks

- Build initial consumer base and gather feedback

- Validate pricing models and customer acquisition costs

Phase 2: Category Expansion (Years 2-3)

- Launch modular vacuum cleaner platform

- Develop home printer with open consumables ecosystem

- Expand textile line to additional basic garments

- Build service and support infrastructure

Phase 3: Market Leadership (Years 4-5)

- Scale manufacturing to achieve cost competitiveness

- Expand into additional appliance categories

- Develop B2B offerings for commercial markets

- Consider licensing platform to other manufacturers

Risk Mitigation Strategies

Market Risks

- Consumer Adoption: Extensive education campaigns and trial programs

- Price Sensitivity: Financing options and lease-to-own models

- Competitive Response: Patent protection and continuous innovation

Operational Risks

- Quality Control: Rigorous testing and warranty programs

- Supply Chain: Diversified supplier base and vertical integration options

- Technology Evolution: Modular architecture enabling component updates

Financial Risks

- Cash Flow: Subscription revenue models and staged product rollouts

- Capital Requirements: Phased expansion and partnership strategies

- Market Timing: Flexible go-to-market approach based on market conditions

The Role of AI & New Technology in This Approach

The document mentions IoT and blockchain briefly. The role of AI and tech is far more profound and is a critical enabler for overcoming the model’s inherent challenges.

1. Design & Personalization:

- Generative AI for Design: Using AI to simulate stress tests, optimize modular connections, and generate designs that maximize durability and ease of disassembly.

- AI-Powered Fit Technology: (As mentioned in the T-shirt case study) AR try-on and body scanning algorithms reduce returns and ensure perfect fit—critical for a “buy once” model where satisfaction is paramount.

2. Manufacturing & Supply Chain:

- Predictive Analytics for Demand Forecasting: AI can predict demand more accurately than traditional models, which is crucial for managing a complex supply chain with longer-life products and avoiding overproduction.

- AI-Powered Quality Control: Computer vision systems can inspect components and finished goods at a superhuman level of accuracy, catching micro-fractures, stitching errors, or material flaws before they reach the customer, protecting the brand’s quality promise.

3.The Core Product Experience (IoT & AI):

- Predictive Maintenance: IoT sensors in appliances (e.g., vacuums, printers) can monitor motor health, brush wear, or ink flow. AI algorithms analyze this data to predict failures before they happen and notify the user to order a replacement module or schedule service. This transforms the value proposition from “it won’t break” to “it will never fail unexpectedly.”

- Performance Optimization: AI can optimize product performance in real-time (e.g., adjusting suction power based on floor type, managing energy consumption) to extend the product’s life and utility.

4. Circular Economy & Lifecycle Management:

- Blockchain for Transparency: As mentioned, a blockchain ledger for each product provides an immutable record of its origins, materials, carbon footprint, and repair history. This builds trust and verifies sustainability claims.

- AI for Reverse Logistics: Managing take-back programs, refurbishment, and recycling is complex. AI can optimize these logistics, sort returned items based on condition, and determine the most economically and environmentally profitable end-of-life path (resell, strip for parts, recycle).

5. Marketing, Support, & Community:

- Hyper-Personalized Education: AI chatbots and content systems can educate customers on TCO, care instructions, and repair options tailored to their specific product and usage history.

- Building the Community: AI can help identify and connect brand advocates, surface the best user-generated content, and foster a community around durability and repair, which is central to the brand’s mission.

In summary, AI and new tech are not just add-ons; they are fundamental to making the “Planned Permanence” model scalable, profitable, and superior to the disposable alternative. They mitigate key weaknesses (like higher upfront cost and complexity) by delivering a smarter, more proactive, and more personalized product experience that justifies the premium and builds a lasting relationship with the customer.

Conclusion and Recommendations

The analysis reveals a compelling opportunity for durable, modular products positioned as sustainable alternatives to disposable consumption. Key success factors include:

- Start with textiles as proof of concept due to lower technology complexity

- Focus on total cost of ownership messaging rather than just environmental benefits

- Develop modular platforms that can evolve with technology changes

- Target premium segments initially to establish brand credibility

- Build comprehensive service ecosystem to support long-life products

The convergence of regulatory pressure, consumer consciousness, and technology maturity creates a unique window of opportunity. Success requires excellence in product design, consumer education, and supply chain management, but the potential for market disruption and sustainable competitive advantage is significant.

The key insight from original thinking is worth investigating : when technology becomes ubiquitous and mature, the opportunity shifts from innovation to durability, modularity, and sustainable value creation. This represents a fundamental business model evolution from planned obsolescence to planned permanence. I still dont like the design to sell consumables model

APPENDIX A: Case Study – “PERMANENCE” T-Shirt Brand

Executive Summary

This case study outlines the creation of “PERMANENCE,” a premium T-shirt brand built on the anti-disposable philosophy. Using heavyweight cotton (240-300 gsm) and modular design principles, PERMANENCE aims to create T-shirts that last 10+ years while maintaining sustainability and affordability through total cost of ownership. See :PERMANENCE T-Shirt Brand