Why Phone-Powered Computing Failed Before and Why The Conditions For Success Have Finally Aligned

Preamble

The history of computing is written not in breakthroughs, but in convergences. The personal computer emerged when miniaturization met affordability. The smartphone arose when connectivity met mobility. Each transformation required not just invention, but the alignment of enabling conditions: technological maturity, manufacturing economics, user behaviour, and ecosystem readiness.

We stand today at another such convergence point, though its inevitability is far from obvious. For over a decade, visionaries have pursued a compelling but elusive goal: making the smartphone the sole computational brain, with laptops and tablets reduced to mere shells (displays and keyboards powered by the device in your pocket). The concept is elegant. The failures have been spectacular.

Motorola’s Atrix Lapdock promised liberation in 2011, only to disappoint users with sluggish performance and predatory pricing. ASUS’s PadFone attempted phone-tablet fusion but never escaped niche obscurity. HP’s enterprise-grade Elite X3 drowned when the Windows Phone ecosystem collapsed beneath it. Each attempt arrived with enthusiasm and departed with lessons (expensive lessons about timing, positioning, and the stubborn inertia of user expectations).

The conventional wisdom concludes that the idea itself is flawed that users will always prefer dedicated devices, that convergence is a myth told by engineers who misunderstand human behaviour. This analysis challenges that conclusion. It argues instead that these failures were not failures of vision, but failures of timing.

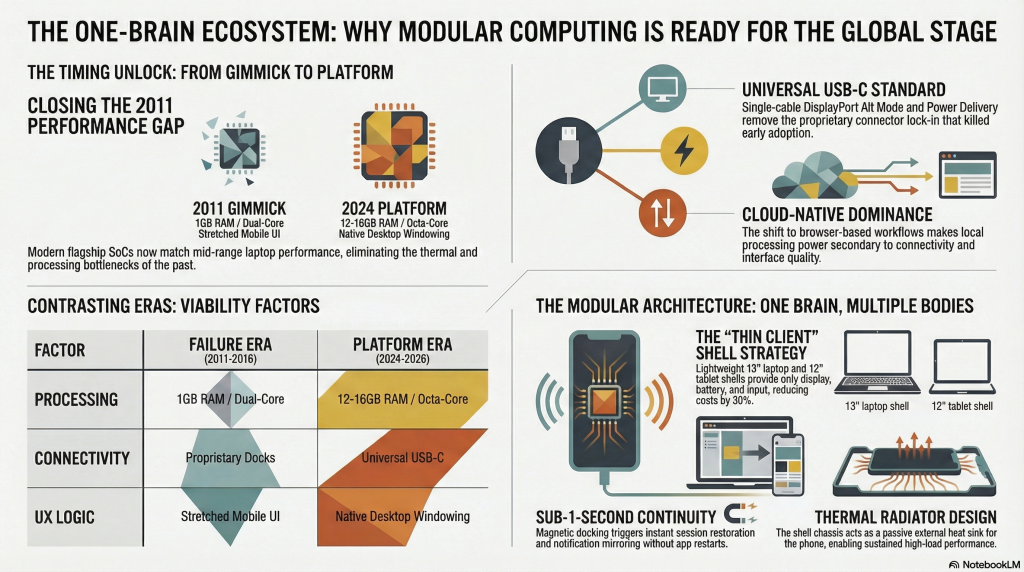

The smartphone processors of 2011 were underpowered. The desktop software environments were immature. Cloud infrastructure was nascent. USB standards were fragmented. Remote work was exceptional rather than normal. Each of these constraints has now dissolved. The question is no longer whether convergence can work, but whether the conditions that prevented it have fundamentally changed.

This document approaches that question with forensic rigor. It examines not just what failed, but why it failed (and whether those failure modes persist today). It analyzes stakeholders across education, enterprise, emerging markets, and telecommunications to identify where genuine value exists. It constructs cost models, risk assessments, and go-to-market strategies grounded in market realities rather than aspirational visions.

The thesis is simple but profound: your phone is already the most powerful, most personal, most frequently upgraded computer you own. What’s missing is not capability but infrastructure. The shells that transform a 6-inch screen into a laptop workstation or tablet canvas. The software environments that transition seamlessly between form factors. The business models that make modularity economically rational.

These elements now exist. Samsung DeX has evolved from experiment to enterprise-ready platform. USB-C has unified connectivity across manufacturers. Flagship smartphones now match mid-range laptop performance while fitting in your pocket. Cloud-native workflows have made local processing power increasingly irrelevant for most users. The remote work revolution has normalized device-switching behavior.

But enabling conditions are not sufficient conditions. The graveyard of consumer electronics is filled with products that arrived at the right time but with the wrong positioning, pricing, or partnerships. Success requires more than timing; it demands strategic discipline, realistic expectations, and ruthless focus on solving actual problems for actual users.

This analysis does not promise that phone-powered computing will succeed. It demonstrates that it can succeed, if (and only if) we learn from the failures that preceded it. The vision has not changed. The world has. Whether that change is sufficient is the question this document seeks to answer.

As Usual some artifacts The Smartphone considerations

Here’s a table summarizing the two attached documents with clear names and descriptions:

| Document Name | Description |

| Expanded Technical Deliverables | A comprehensive engineering blueprint for the modular phone-powered shell ecosystem. Includes software requirements (SRS), product requirements (PRD), hardware architecture diagrams, UX flows, thermal and battery co-design, power architecture, feature roadmap, risk model, and industrial design guidelines. Designed to support certifiable hardware, scalable accessories, and enterprise deployment. |

| Other Considerations | A strategic and behavioral deep-dive into adoption mechanics, lifecycle planning, thermal design, security architecture, UX continuity, power management, ergonomic factors, and ecosystem strategy. Focuses on psychological trust, institutional readiness, and habit formation to ensure mainstream adoption and long-term viability. |

Executive Summary

Innovation rarely follows a linear path. The concept of using a single smartphone as the computational brain for multiple form factors (docking into laptop shells, tablet slabs, or desktop stations) has cycled through the tech industry for over a decade. From Motorola’s ambitious Atrix Lapdock in 2011 to Samsung’s evolving DeX platform and Huawei’s Easy Projection, the vision has persisted despite repeated commercial failures.

Today, we stand at an inflection point. The question facing strategists is not whether these concepts failed, but why they failed and whether the fundamental conditions that caused those failures have changed. This comprehensive analysis argues that they have, and that the moment for modular, phone-powered computing has finally arrived.

I. The Core Concept: One Brain, Multiple Bodies

The Fundamental Proposition

At its essence, the modular computing vision is elegantly simple: your smartphone becomes the sole computing node, while various shells laptop, tablet, desktop provide form-factor-specific interfaces. The phone contains all processing power, memory, storage, and connectivity. The shells are essentially thin clients providing only display, input devices, battery extension, and ports.

This is not incremental innovation. It represents a fundamental rethinking of personal computing architecture, challenging the decades-old assumption that laptops and desktops must be self-contained processing units.

What the Physical Implementation Entails

Laptop Shell Configuration:

- 13-14 inch ultralight clamshell form factor

- No CPU or RAM (phone handles all computation)

- Full-size keyboard and precision trackpad

- Supplemental battery for extended runtime

- USB-C, HDMI, and audio ports

- Integrated webcam and speakers

- Target weight: 700-900 grams (without phone)

- Estimated retail price: $299-$499 depending on execution quality

Tablet Shell Configuration:

- 10-12 inch touchscreen display

- Optional keyboard folio and stylus support

- Phone docks via USB-C or magnetic rail

- Integrated kickstand

- Target weight: 400-600 grams

- Estimated retail price: $249-$349

Critically, when docked, the phone remains fully functional. Calls still come through, notifications remain active, and the camera is still accessible. This is not device switching it’s form factor extension.

II. Why Previous Attempts Failed: A Forensic Analysis

Understanding past failures is not academic exercise it’s essential strategic intelligence. Multiple well-funded attempts at phone-laptop convergence have failed over the past 15 years. Each failure offers specific lessons.

Case Study: The Motorola Atrix Lapdock (2011-2012)

The Motorola Atrix 4G and its accompanying Lapdock accessory represented the first major commercial attempt at phone-powered laptop computing. Unveiled at CES 2011 to considerable excitement, the Atrix allowed users to dock their phone into a laptop shell running Motorola’s Webtop software a custom desktop environment. Despite generating significant pre-launch buzz, the product failed spectacularly and was discontinued within 18 months.

Why It Failed:

- Catastrophic Pricing Strategy: The Lapdock was initially priced at $500, nearly as expensive as standalone laptops of the time. This violated fundamental consumer mental accounting. Users balked at paying laptop prices for what they perceived as an accessory. As one analyst noted, had Motorola priced it at $100-$150, adoption might have been substantially different.

- Insufficient Phone Performance: The Atrix 4G, while flagship-tier for 2011, had only 1GB of RAM and a dual-core processor. When tasked with powering a laptop-like experience, it suffered from thermal throttling, stuttering multitasking, and frequent slowdowns. Users felt they were using a bad laptop, not a clever phone.

- Immature Desktop Software: Motorola’s Webtop was essentially a stretched mobile UI with a custom Firefox browser. Apps didn’t resize properly, keyboard shortcuts were limited, and the experience felt like a compromised hack rather than a genuine desktop environment.

- Proprietary Connector Lock-in: The Atrix used a proprietary docking connector, meaning the Lapdock couldn’t be used with future non-Motorola phones. This created immediate obsolescence anxiety.

- Additional Tethering Fees: AT&T required users to purchase an overpriced tethering plan to use the Lapdock, adding insult to injury on top of the already-excessive hardware cost.

- Positioned as Accessory, Not System: Motorola marketed the Lapdock as an optional add-on rather than as the core value proposition. This framing doomed adoption from the start.

Other Notable Failures

ASUS PadFone Series:

ASUS attempted a phone that docked into a tablet shell. While innovative, it suffered from awkward form factors, high combined pricing, and limited market availability. The concept never escaped niche enthusiast circles.

HP Elite X3 (2016):

HP’s enterprise-focused Windows Phone with Continuum support offered excellent hardware but was killed by the collapse of Windows Phone as a platform. No matter how good the docking experience, it couldn’t overcome ecosystem extinction.

NexDock (2016-present):

As a third-party universal lapdock, NexDock has survived in the niche enthusiast market but has never achieved mainstream penetration. Priced at $229-$299 and shipping in small batches, it serves as proof-of-concept rather than mass-market validation.

The Ten Recurring Failure Patterns

Across all historical attempts, ten consistent failure modes emerge:

- Phones Were Too Weak: Flagship phones of 2011-2016 simply lacked the processing power, RAM, and thermal capacity to drive laptop-class workloads convincingly.

- Desktop Modes Were Fake Desktops: Early implementations were stretched mobile UIs, not behaviorally different desktop experiences.

- Sold as Accessories, Not Systems: Marketing treated shells as optional add-ons rather than as the primary computing paradigm.

- Pricing Violated Mental Math: Shells priced at $300-$500 competed directly with budget laptops, eliminating the economic value proposition.

- Wrong Target Users: Early attempts targeted general consumers rather than specific use cases with clear value propositions.

- Proprietary Connectors: Device-specific docks created immediate obsolescence risk and prevented ecosystem development.

- Overpromised Laptop Replacement: Setting expectations as “full laptop replacement” guaranteed disappointment when performance fell short.

- OEMs Had No Incentive: Phone manufacturers feared shells would cannibalize laptop sales from their PC divisions.

- Ignored iOS Market Dominance: In premium markets, iPhone users had no access to these solutions, immediately limiting addressable market.

- No Compelling Daily Workflow: Products asked users to believe in the future rather than delivering immediate, obvious time savings today.

The Pattern: They asked users to believe in the future instead of saving time today.

III. What Has Changed: The Timing Unlock

This idea did not fail because it was wrong. It failed because it arrived too early and was sold incorrectly. The question is whether the fundamental conditions have changed enough to make this concept viable today. The evidence suggests they have decisively changed.

1. Smartphone Processing Power Has Reached Laptop Parity

Modern flagship smartphones now match or exceed mid-range laptops in processing capability. The specifications speak for themselves:

- Flagship SoCs (Snapdragon 8 Gen 3, Apple A17 Pro, MediaTek Dimensity 9300) deliver performance comparable to Intel Core i5 processors

- 12-16GB of RAM is now standard in premium devices

- Storage speeds match NVMe SSDs (UFS 4.0 exceeds 4GB/s read speeds)

- Active cooling systems in gaming phones enable sustained performance

- Battery capacities of 5000mAh+ with fast charging support

This is not incremental improvement it’s categorical transformation. A Samsung Galaxy S25 Ultra or iPhone 15 Pro Max can genuinely power laptop-class multitasking without the stuttering and thermal throttling that plagued the Atrix.

2. Desktop Modes Are Now Mature and Usable

Samsung DeX, introduced in 2017 and continuously refined, now offers a genuinely competent desktop experience:

- Proper windowed multitasking with resizable app windows

- Full keyboard shortcut support (Alt+Tab, Ctrl+C/V, etc.)

- Desktop-class browser with tab management

- File manager with drag-and-drop functionality

- Over 70 major apps optimized for DeX mode

- Wireless DeX support via Miracast

Similarly, Huawei’s Easy Projection and Motorola’s Ready For have brought desktop modes to their respective ecosystems. What was a barely-functional gimmick in 2011 is now standard enterprise software.

3. Cloud-First Workflows Have Become Dominant

The shift to browser-based and cloud-native applications fundamentally changes the laptop performance equation:

- Google Workspace, Microsoft 365, and Notion run identically on phone or laptop processors

- Cloud IDEs (GitHub Codespaces, Replit, AWS Cloud9) enable serious development work

- Video conferencing works seamlessly via WebRTC

- Enterprise apps increasingly operate through web interfaces

- Chromebooks proved that cloud-first computing is viable for education and enterprise

In 2011, serious work required local applications Office, Photoshop, Visual Studio that mobile processors couldn’t run. In 2025, most knowledge work happens in Chrome tabs that phones handle effortlessly.

4. USB-C Has Unified The Hardware Ecosystem

The universal adoption of USB-C with DisplayPort Alt Mode and USB Power Delivery has eliminated the proprietary connector trap:

- Single cable carries video, data, and power simultaneously

- Works across manufacturers and device generations

- Regulatory mandates (EU) ensure long-term stability

- Accessories work with future phones, eliminating obsolescence fear

5. Remote Work Normalized Multi-Screen Behavior

The COVID-19 pandemic permanently shifted expectations around mobile computing. Docking at home, working from coffee shops, and switching between devices became default behavior rather than edge cases. Users are now conditioned to expect computing continuity across contexts.

6. Current Market Validation

Unlike in 2011, we now have proof-of-concept validation in the market:

- NexDock’s 6th generation device (launched December 2025) is shipping globally at $229, with improved touchscreen and trackpad. While still niche, it demonstrates sustained viability.

- UPERFECT and other manufacturers offer lapdock accessories specifically designed for Samsung DeX, indicating real market demand.

- Samsung’s continued DeX investment shows OEM commitment—the latest Galaxy S25 series maintains full DeX support with wireless connectivity.

- Enterprise adoption is occurring in healthcare, retail, and field service sectors where DeX enables simplified device management.

The Before and After: Conditions Comparison

The transformation becomes clear when comparing conditions systematically:

| Factor | 2011-2016 (Failure Era) | 2024-2026 (Current) |

| Phone Performance | 1-2GB RAM, dual-core, thermal throttling | 12-16GB RAM, octa-core, sustained performance |

| Desktop Software | Stretched mobile UI, limited functionality | Mature desktop modes with proper windowing |

| App Ecosystem | Local apps required, poor mobile optimization | Cloud-native apps dominate, 70+ DeX-optimized |

| Connectivity | Proprietary docks, fragmented standards | Universal USB-C with DP Alt Mode |

| Work Patterns | Fixed office computing, rare mobility | Remote-first, continuous device switching |

| Price Context | $500 lapdock vs $400 budget laptop | $229-$299 shell vs $600+ laptop |

Synthesis: Every fundamental barrier that killed previous attempts has been systematically dismantled. This is not speculation it’s observable market reality.

IV. Market Reality: Target Users and Stakeholder Analysis

Who This Serves (and Who It Doesn’t)

Precise market segmentation is critical. This is not a universal computing solution it’s a category killer for specific use cases. Attempting to position it as a full laptop replacement for all users guarantees failure.

Primary Target Users (Strong Fit):

- Students (Secondary and Higher Education): One device instead of phone + cheap laptop. Use cases include note-taking, research, document editing, cloud-based assignments, video lessons, and collaboration tools. The cost reduction for education institutions is substantial—approximately $650 per student over a 6-year lifecycle.

- Emerging Market Consumers: Phone-first economies where mobile penetration exceeds laptop ownership. These users need affordable computing, offline capability, local repairability, and resilience to unreliable power infrastructure. The shell strategy leverages their existing phone investment. There is a growing social media creator economy limited by mobile only affordability

- Mobile Professionals and Field Workers: Sales teams, healthcare staff, logistics workers, consultants, and inspectors who need mobility plus occasional desktop productivity. The single-device model reduces carrying burden, eliminates sync friction, and simplifies enterprise device management.

- Enterprise Deployments: Organizations seeking to reduce hardware fleet complexity, lower IT overhead, and enable hot-desking environments. Particularly strong fit for retail, healthcare, field service, and government sectors.

Secondary Users (Conditional Fit):

- Developers using cloud IDEs and terminal workflows

- Content creators focused on writing, annotation, and light design work

- Budget-conscious consumers seeking one-device simplicity

NOT a Fit (Critical to Acknowledge):

- Video editors requiring local rendering and color-accurate displays

- Gamers needing discrete GPUs and high refresh rates

- CAD/3D modeling professionals

- Data scientists running local ML training

- Software developers requiring heavy local compilation

Positioning Clarity: This does NOT replace a MacBook Pro. It replaces Chromebooks, budget Windows laptops, and secondary travel devices. It’s a category killer at the low-to-mid tier, not the high end.

Comprehensive Stakeholder Analysis

Success requires alignment across multiple stakeholder groups, each with distinct needs, pain points, and success criteria.

1. Students and Education Institutions

Core Needs:

- One affordable device per student eliminating phone-laptop duplication

- All-day battery life without anxiety

- Durable, drop-resistant hardware surviving backpack transport

- Easy IT deployment and low maintenance overhead

Critical Pain Points:

- Device fragmentation creating support nightmares

- High refresh costs every 3-4 years

- Lost or damaged institutional hardware

Cost of Ownership Analysis:

Traditional model: $2,600 per student over 6 years (phone + laptop refreshes). Shell model: $1,950 per student over 6 years. For a school district with 10,000 students, this represents $6.5 million in savings, excluding reduced IT support costs and energy consumption.

2. Mobile Professionals and Field Workers

Core Needs:

- Single secure device eliminating sync friction

- Reliable all-day runtime in the field

- Instant session resume when docking

Use Cases:

- Healthcare: Patient chart access, secure messaging, image capture

- Sales: CRM access, proposal editing, presentation delivery

- Field Service: Inspection reports, inventory management, digital signatures

3. Emerging Market Consumers

Core Needs:

- Affordable computing leveraging existing phone investment

- Low repair cost and local repairability

- Power resilience for unreliable electricity infrastructure

Ergonomic Requirements:

- Heat-tolerant and dust-resistant for tropical/arid climates

- Solar charging compatibility

- Simple docking requiring no technical expertise

4. Enterprise IT and Procurement

Core Needs:

- Standardized device fleet reducing complexity

- Secure endpoint model with hardware encryption

- Remote management and zero-touch provisioning

Cost Metrics:

Single compute node architecture reduces: inventory complexity, help desk tickets, patching overhead, device loss exposure, and replacement costs.

5. OEMs and Telcos (Critical Gatekeepers)

OEM Incentives:

- Higher average selling price (ASP) for flagship phones

- Product differentiation in saturated smartphone market

- Ecosystem lock-in and stickiness

Telco Incentives:

- Bundle opportunities increasing plan attachment rates

- Accelerated upgrade cycles as shells drive phone upgrades

- Subscriber retention through ecosystem value

V. Strategic Analysis: SWOT and Risk Assessment

SWOT Analysis

Strengths:

- Low bill of materials enabling healthy margins

- Leverages existing phone investment and compute power

- Strong product-market fit for education and emerging markets

- Sustainability narrative reducing e-waste

- Timing advantage with mature enabling technologies

Weaknesses:

- Dependent on Android OEM cooperation and commitment

- Requires behavioral shift in user mental models

- Not suitable for performance-intensive workloads

- Fragmentation risk across device manufacturers

- iOS market completely inaccessible without Apple participation

Opportunities:

- Telco bundling creating subsidized pricing models

- Government digital inclusion programs in developing nations

- Enterprise digital transformation initiatives

- AI workload emergence favoring capable mobile processors

- Sustainability mandates increasing pressure to reduce device counts

Threats:

- Apple ecosystem dominance in premium markets

- OEM cannibalization fears killing internal support

- Platform fragmentation creating poor user experience

- Chromebook price competition in education sector

VI. Conclusion and Strategic Roadmap

The Verdict: A Timing-Dependent Platform Bet

This analysis demonstrates conclusively that phone-powered modular computing is not a gimmick. It is a timing-dependent platform bet whose moment has arrived. The fundamental barriers that killed the Motorola Atrix, ASUS PadFone, and HP Elite X3 have been systematically dismantled:

- Capability Gaps (Closed): Phones now match mid-range laptop performance

- Software Maturity (Achieved): Desktop modes are genuinely usable

- Ecosystem Readiness (Validated): Cloud-first workflows dominate

- Hardware Standards (Universal): USB-C eliminated proprietary lock-in

- Behavioral Foundations (Normalized): Remote work created multi-device continuity expectations

However, success is not guaranteed. The ghosts of past failures demand strategic discipline.

Strategic Imperatives

1. Start with Tablet Dock, Not Laptop Shell

The tablet form factor is the optimal entry point. It carries lower user expectations than laptops, feels like a natural phone extension rather than a replacement device, costs less to manufacture ($130-210 COGS vs $165-270), and addresses clear pain points in education and field work. Laptop shells should be phase 2 after tablet adoption validates the behavioral model.

2. Target Narrow Segments with Clear Value Propositions

Do NOT launch as a general consumer product. Instead, pursue:

- University pilots bundling phones and tablet shells

- Emerging market education programs with government partnerships

- Enterprise field service deployments with clear ROI metrics

3. Partner Aggressively with OEMs and Telcos

This cannot succeed as a solo hardware play. Critical partnerships include:

- Samsung for DeX ecosystem leverage and co-marketing

- Xiaomi and Motorola for emerging market distribution

- Telcos for subsidized bundling that eliminates price friction

4. Position as Extension, Never Replacement

Language matters profoundly. This is not a laptop replacement it’s your phone becoming more. Marketing must reinforce: “Your phone is your computer. The shell gives you the screen you need.”

5. Solve the Battery Trust Problem

Include supplemental batteries in shells. The psychological confidence this creates outweighs the cost and weight penalties. Battery anxiety kills adoption faster than any other factor.

An optional Three-Phase Roadmap

Phase 1: Proof of Concept (12-18 months)

- Launch tablet dock in 3 targeted verticals: university programs, emerging market governments, enterprise pilots

- Establish reference design and certification program for OEM participation

- Measure habit formation: daily docking rates, battery confidence, and workflow stickiness

- Success metric: 60%+ daily docking rate among pilot users

Phase 2: Expansion (18-36 months)

- Introduce laptop shell for validated user segments

- Expand telco bundling partnerships globally

- Launch accessory ecosystem: rugged variants, pen support, premium keyboards

- Success metric: 5 million shells in active use

Phase 3: Platform Maturity (36+ months)

- Desktop dock variants for office hot-desking

- Developer SDK for dock-optimized applications

- Vertical-specific solutions (healthcare, logistics, education)

- Success metric: Position phone as default compute node for 50+ million users

Final Assessment

The modular phone-computing vision represents one of the rare instances where a repeatedly failed concept becomes viable through environmental transformation rather than product innovation. The idea hasn’t changed. The world has.

Success requires acknowledging that this is not a technology problem but a habit formation problem. Users must internalize that their phone is their computer, not a substitute for one. This mental model shift cannot be rushed or forced but must be earned through flawless execution on narrow use cases.

The strategic imperative is clear: TEST, don’t mass-launch. Start with students, emerging markets, and enterprise pilots. If daily docking becomes habitual for these segments, the platform can expand. If not, the concept should be shelved until the next wave of enabling technologies emerges.

The conditions for success now exist. Whether they will be seized depends entirely on strategic discipline, realistic positioning, and an unwavering focus on solving real problems for real users, not chasing visionary abstractions.

Appendices

Lifecycle Financial Model

This compares traditional device ownership versus modular shell model over 6 years.

Traditional Student Setup

Phone: replace every 3 years

Laptop: replace every 4 years

Year 0: phone $700 + laptop $600

Year 3: phone $700

Year 4: laptop $600

6-year total: $2,600

Modular Shell Model

Phone: flagship every 3 years

Shell: replace every 6 years

Year 0: phone $800 + shell $350

Year 3: phone $800

6-year total: $1,950

Savings: ~$650 per user

Now scale that:

10,000 students = $6.5 million savings

This excludes:

- lower repair costs

- fewer devices to manage

- reduced IT overhead

- energy savings

For enterprise fleets, the savings grow faster because management cost dominates hardware cost.