Idea Snapshots — Brief, strategic glimpses into business possibilities.

RetroAmp sits at a fascinating intersection: it’s simultaneously an app, a refurbished device kit, and a platform that challenges our relationship with technology. The core premise is deceptively simple—turn your old Android phone into a dedicated music player with 1TB of storage, AI curation, and zero distractions. But beneath that simplicity lies something more profound: a rejection of the streaming economy, a bet on ownership over access, and a sustainability play disguised as nostalgia.

This isn’t just about music. It’s about creating dedicated, single-purpose devices in an era of smartphone convergence. It’s about extending device lifecycles by 3-5 years when e-waste is accumulating at 50 million tonnes annually. And it’s about privacy-preserving AI that works entirely offline, without feeding user data to corporate servers. RetroAmp combines the tactile pleasure of iPod-era design with modern intelligence, targeting audiophiles who refuse to compromise, digital minimalists seeking escape, and institutions looking for affordable content distribution.

Is This New?

Originality Check:

- [x] Remix of existing concepts

- [x] Cross-domain adaptation

RetroAmp isn’t the first offline music player—apps like Musicolet, Poweramp, and jetAudio exist. Dedicated Digital Audio Players (DAPs) from Astell&Kern and FiiO serve audiophiles. But no one has positioned themselves as the complete solution for device transformation with sustainability as a core narrative. The white-label platform approach for education, wellness, and cultural heritage is genuinely novel. Most importantly, the three-layer product architecture (app, device kit, platform) creates defensibility that pure apps lack.

What’s different: RetroAmp is the only player combining offline-first design, on-device AI personalization, SD-card-centric architecture (supporting up to 1TB), refurbisher partnerships, and modular vertical expansions. Competitors are either expensive closed-ecosystem DAPs ($300-2000), basic apps with no platform vision, or streaming services that fundamentally oppose the ownership model.

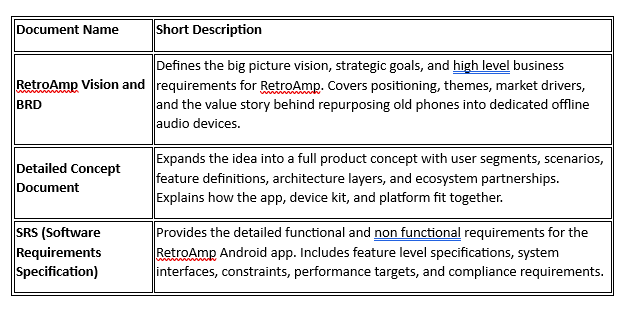

As usual some supporting documents RetroAmp

Market Position

The Landscape: The portable media player market is worth $25.7B (2023) and growing at 3.5% annually, while the refurbished smartphone market stands at $30B+ (2024) and is projected to reach $57B by 2033 with 7% CAGR. The offline music app market is valued at $13.35B (2025), projected to reach $25B by 2035. Existing solutions are fragmented: expensive audiophile DAPs serve the high end, cheap MP3 players offer poor UX, and offline music apps lack differentiation beyond features.

The Opportunity: RetroAmp occupies the intersection of three growing markets: people buying portable media players for audio quality, people buying refurbished phones for sustainability, and people seeking digital minimalism and offline experiences. The sustainability angle is particularly compelling—Europe alone collects approximately 5 million tonnes of e-waste annually, and there’s growing backlash against the attention economy. No existing competitor addresses all three pillars: sustainability + premium experience + AI intelligence.

The Scale: This is a viable middle-ground business, not a unicorn play. Total Addressable Market (TAM) of $32.7B, Serviceable Available Market (SAM) of $6.5B, and Serviceable Obtainable Market (SOM) of $150M in Year 1-3. Realistic targets: 100K users by Year 2, 15% premium conversion rate, profitability within 24 months. Success looks like a sustainable $10-25M annual revenue business with strong unit economics (5:1 LTV:CAC ratio) and measurable environmental impact (500K devices repurposed by Year 5).

Stakeholder Ecosystem

Primary User Segments:

- Audiophile Collectors (Age 25-55, $50K-150K income)

- Pain Points: Streaming lacks rare recordings/live shows/regional music; existing DAPs are expensive ($300-2000) and closed ecosystems; complex metadata management across large libraries

- Needs: Lossless playback (FLAC, ALAC, DSD), rich metadata tools, flexible EQ, gapless playback

- Willingness to Pay: $50-100 for app + device, $29/year premium

- Digital Minimalists & Focus Seekers (Age 18-45, knowledge workers)

- Pain Points: Main phone has constant notifications; streaming pushes algorithmic feeds; difficulty maintaining focus during work/study

- Needs: Physical separation from distracting smartphone, intentional listening routines, simple UI with no ads/social elements

- Willingness to Pay: $30-60 for device kit, $19/year premium

- Travelers & Commuters (Age 20-55, frequent travelers)

- Pain Points: Patchy data connectivity in transit; streaming offline modes are paywalled and limited; battery drain from using primary phone for music

- Needs: Reliable offline playback, long battery life (10+ hours), easy SD card swapping

- Willingness to Pay: $40-80 for device kit

- Parents & Children (Parents 30-50, kids 5-15)

- Pain Points: Don’t want children on fully connected smartphones; basic MP3 players are unreliable or have poor UX; need parental controls and content filtering

- Needs: Safe device for music/audiobooks, age-appropriate content, remote monitoring

- Willingness to Pay: $30-60 per device, family plan pricing

- Institutional Partners (Schools, libraries, museums, wellness centers)

- Pain Points: Expensive proprietary solutions for content distribution; low-connectivity environments limit cloud-based approaches; need durable, repairable devices with controlled content

- Needs: Distribute curated audio libraries offline, track usage engagement, build ESG narratives

- Willingness to Pay: $500-$5,000/year institutional licensing

Partner Ecosystem:

- Refurbishers & Used Phone Retailers: Need differentiation beyond price, want ESG narratives. Gain 20-30% higher margins on “Music-ready” kits, 60/40 revenue split.

- Content Distributors: Independent labels, audiobook publishers. Gain new distribution channel with higher margins, 70/30 revenue split.

- Cultural Institutions: Need affordable offline distribution. Gain new engagement tool for heritage content, custom institutional pricing.

- AI Companies & Privacy Advocates: Need credible on-device AI use cases. Gain demonstration of responsible AI implementation, research opportunities.

Product vs. Feature

The Test: RetroAmp is unquestionably a product, not a feature. While Spotify could add “offline mode improvements,” they can’t replicate the core value proposition: device transformation, sustainability narrative, refurbisher partnerships, white-label institutional deployments, and privacy-first AI architecture. The three-layer product definition (app, device kit, platform) creates structural defensibility.

The Defense: Multiple moats working together:

- Partnership Network: Pre-installation deals with refurbishers create distribution that competitors can’t easily access. 60/40 revenue split model aligns incentives.

- Platform Economics: White-label capabilities and vertical modules (education, wellness, heritage) create institutional lock-in worth $500-5000/year per client.

- Brand Positioning: First-mover advantage in the “sustainable device transformation” narrative. No competitor owns this story.

- Technical Depth: Supporting Android 6.0-14 across 1TB SD card libraries with sub-2-hour indexing times requires serious engineering. Not trivial to replicate.

- Community & Network Effects: User-generated content (device setups, playlists), forum support, and advocacy create organic growth that paid marketing can’t buy.

Core Components

What You’d Need:

- Android Development Expertise: Core team needs deep knowledge of ExoPlayer for multi-format playback, Room/SQLite for database management, TensorFlow Lite for on-device AI, and MediaStore API for SD card access across API levels 23-34.

- Refurbisher Partnership Network: Relationships with 5-15 device refurbishers willing to pre-install RetroAmp and bundle SD cards. Requires sales/BD capability and compelling margin story.

- AI/ML Capability: On-device recommendation engine using TensorFlow Lite (model under 5MB) with privacy-preserving architecture. Inference time under 5 seconds for 1000-track libraries.

- Design & UX Excellence: Retro-inspired UI that feels premium, not nostalgic kitsch. Accessibility-first design supporting screen readers, high contrast themes, and font scaling.

- Content & Community Management: Blog, video tutorials, Reddit/forum engagement, partnership marketing. This is a story-driven product that needs continuous narrative reinforcement.

First Steps:

- Build MVP (6 months): Core SD card management, multi-format playback (MP3, FLAC, ALAC, WAV, OGG, AAC), metadata extraction/repair, retro UI with click-wheel navigation, basic playlists. Target: 1TB library indexing in under 2 hours on mid-range 2018 hardware.

- Beta Testing (2 months): Launch with 100 users across audiophile forums (r/audiophile, Head-Fi), digital minimalism communities (r/digitalminimalism), and sustainability advocates. Gather performance data on 20+ device models.

- First Partnership (3 months parallel): Sign pilot deal with 1-2 small refurbishers. Offer flexible terms (60/40 split or $2-5/device licensing). Create co-marketing materials emphasizing sustainability and audio quality.

- Public Launch (Month 10): Google Play Store release, Product Hunt launch, targeted Reddit AMAs, tech blog outreach (Android Police, XDA Developers). Target: 5K-10K MAU in first quarter.

The Contrarian View

Challenge This Idea:

- Market Size Skepticism: The intersection of “audiophiles who own old Android phones” and “digital minimalists willing to dedicate a device” might be smaller than projected. Premium conversion rates could stall at 5-8% instead of 15%.

- Refurbisher Partnerships May Fail: Device refurbishers operate on thin margins and may resist revenue sharing. They might demand unrealistic terms or simply choose to compete by creating their own music player forks.

- Android Fragmentation Hell: Supporting Android 6.0-14 across hundreds of device models with varying SD card implementations could create unsustainable support burden. Testing 20+ devices per release is resource-intensive.

- Competitive Response: Spotify or YouTube Music could launch “Offline Pro” mode with similar features. Poweramp or Musicolet could add AI features and sustainability marketing. Major DAP manufacturers could drop prices.

- Sustainability Narrative Fatigue: Consumers may not care enough about e-waste to change behavior. The “nostalgia + ownership” story might appeal to a vocal minority but fail to achieve mainstream adoption.

- AI on Low-End Hardware: Running TensorFlow Lite models on 2015-era devices with 1.5GB RAM might be technically infeasible or provide poor user experience. Recommendation quality could suffer.

Why It Might Still Work:

- Market Size: Even capturing 0.5% of the refurbished smartphone market ($30B) yields $150M opportunity. Conservative projections assume only early adopters—mainstream appeal is upside, not requirement.

- Partnership Alternative: Direct-to-consumer works if refurbishers stall. Strong unit economics (5:1 LTV:CAC ratio) from organic channels mean partnerships are growth accelerators, not dependencies.

- Progressive Feature Rollout: Architecture supports degrading functionality on older devices rather than exclusion. AI features can be premium-only, core playback works everywhere. Community beta testing spreads support burden.

- Defensible Positioning: Streaming services fundamentally oppose ownership model—they’d cannibalize core business. Existing apps lack platform vision and sustainability partnerships. DAP manufacturers can’t pivot to software-first model.

- Behavior Change Thesis: Target early adopters first (audiophiles, minimalists) who already have motivation. Mainstream adoption is 3-5 year horizon via institutional partnerships (schools, libraries) and gift purchases (parents buying for kids).

- AI as Differentiator, Not Core: If on-device AI fails, the product still works. AI is premium upsell, not core value prop. Manual playlists, smart playlists, and traditional browsing remain compelling even without ML recommendations.

Cross-Domain Potential

If This Doesn’t Work Here:

- Wellness & Meditation Devices: Same technical platform, different content. Pre-load guided meditation, therapeutic audio, sleep sounds. Partner with therapy clinics, wellness retreats, corporate wellness programs. “Wellness Pod” with streak tracking and routine scheduling.

- Educational Content Distribution: Schools and NGOs in low-connectivity regions need offline content delivery. “Learning Pod” with curated lessons, language learning, audiobooks. Track completion metrics for grant reporting.

- Cultural Heritage Preservation: Museums, libraries, and archives need distribution for oral histories and local music. “Heritage Pod” with timeline browsing, thematic tours, multi-language support. Grant-funded deployments in underserved communities.

- Podcast-Only Device: Pivot from music to long-form audio. Target commuters and knowledge workers who want podcast focus without smartphone distractions. Simpler than music (no metadata complexity), but smaller market.

- Voice Memo/Journaling Device: Flip the paradigm—instead of playback, focus on recording. Old phones become dedicated voice journals, therapy recording devices, or field recording equipment for journalists/researchers.

- Kids’ Storytelling Device: Pre-loaded fairy tales, bedtime stories, educational content. Parental controls native to platform. Compete with Yoto Player and Toniebox at fraction of the cost using refurbished hardware.

- Enterprise Training Devices: Corporate L&D departments distribute devices with training content. Track completion rates, quiz performance. White-label for company branding. Offline-first for factory floors, retail locations, field workers.

Next Steps for Builders

If you wanted to pursue this:

- Week 1: Validation Sprint

- Interview 20 potential users across segments (audiophiles, minimalists, parents)

- Survey r/audiophile, r/digitalminimalism, r/Android for pain points and willingness to pay

- Contact 5 refurbishers to gauge partnership interest (cold emails, LinkedIn outreach)

- Build clickable Figma prototype of core flows (onboarding, now playing, library browse)

- Month 1: Technical Proof of Concept

- Build SD card indexing prototype: traverse 100GB library, extract metadata, populate SQLite database. Benchmark on 2018 mid-range device (target: under 30 minutes)

- Implement basic ExoPlayer integration with gapless playback for MP3/FLAC

- Test on 5 different Android devices (API 23, 28, 34) to surface compatibility issues early

- User test prototype with 10 people—measure time to first playback, playlist creation

- Quarter 1: MVP Launch

- Complete core features: SD card management, multi-format playback, metadata system, retro UI, basic playlists. Google Play Store release

- Beta program with 100 users via r/audiophile, Head-Fi forums, Product Hunt

- Sign first partnership agreement with 1 refurbisher (flexible terms to derisk)

- Content marketing: “How to Turn Your Old Android into a $2000 DAP” blog post, setup tutorial videos

- Target metrics: 5K downloads, 4.0+ Play Store rating, 300 premium conversions (6%)

Resources to explore:

- Development: ExoPlayer documentation, TensorFlow Lite Android guides, Room Persistence Library tutorials, Android MediaStore API for SD card access

- Market Research: Grand View Research portable media player reports, Back Market refurbisher model analysis, Musicolet/Poweramp user reviews for pain points

- Community: r/audiophile, r/Android, r/digitalminimalism, Head-Fi forums, XDA Developers for beta testers and feedback

- Inspiration: Roon’s metadata-rich approach (but offline), Yoto Player’s kid-safe content model, iFixit’s sustainability narrative, Anker Soundcore’s affordable audio positioning

Final Thoughts

RetroAmp represents something increasingly rare in tech: a product that succeeds by doing less, not more. In an era of infinite streaming catalogs and algorithmic curation, it offers the radical simplicity of ownership. In a world of converged devices that demand constant attention, it provides focused single-purpose utility. In an age of planned obsolescence, it extends device lifecycles and reduces waste.

The business model is refreshingly grounded—not a venture-scale moonshot, but a sustainable middle-ground opportunity with multiple revenue streams and clear unit economics. The product architecture is defensible through partnerships, platform capabilities, and brand positioning rather than just features. And the stakeholder ecosystem creates genuine value for all parties: users get ownership and privacy, refurbishers get differentiation, institutions get affordable distribution, and the planet gets measurably reduced e-waste.

What’s most compelling is the optionality. If music doesn’t achieve mainstream adoption, the same platform works for wellness, education, cultural heritage, or corporate training. If consumer sales stall, institutional licensing provides a different path to profitability. If refurbisher partnerships fail, direct-to-consumer channels remain viable.

The contrarian view raises legitimate concerns about market size, competitive response, and technical complexity. But the bear case still yields a viable $5-10M annual revenue business serving a passionate niche. The bull case—mainstream adoption of device transformation plus successful platform expansion—could reach $25-50M annually within 5 years.

For builders: this is a real product requiring serious technical execution, not a feature-thin app or vaporware concept. Success demands Android expertise, design excellence, partnership savvy, and community building. But the opportunity is tangible, the market is growing, and the mission is meaningful.

Novel Ideas & Additional Considerations

Unexplored Angles:

- “Digital Will” Feature: Let users designate library transfer on death. Music collections as inheritable digital assets. Emotional resonance + practical estate planning. Partner with legal services for digital asset management.

- Collaborative Family Libraries: Multi-device mesh sync without cloud. Families share libraries across devices using local WiFi or Bluetooth mesh. Sidesteps cloud infrastructure costs while enabling sharing.

- “Music Swap Meets” Events: Physical gatherings where RetroAmp users trade SD cards with curated collections. Hyperlocal, community-driven discovery that scales organically. Partner with record stores, coffee shops.

- Blockchain-Based Provenance: Optional feature proving legal ownership for music upgrade services. Timestamped proof-of-ownership without centralized database. Appeals to crypto-curious audiophiles.

- Artist Royalty Direct Distribution: Partner with independent artists to distribute music via RetroAmp with direct payment splits. Bypass streaming platforms entirely. 90/10 artist/RetroAmp split vs. 70/30 on Spotify.

- “Library Archaeology” AI: AI analyzes forgotten tracks in user libraries and surfaces hidden gems. “You haven’t played this in 5 years, but it matches your current mood.” Emotional nostalgia trigger.

- Therapeutic Audio for Dementia Patients: Partner with care facilities to distribute devices with personalized music from patient’s past. Music therapy proven effective for memory and mood. Institutional licensing with health outcome tracking.

- Field Recording Companion App: RetroAmp for playback, separate app for high-quality recording. Old phones as stereo field recorders for nature sounds, street interviews, ambient music. Export to RetroAmp for playback.

- “Gen Z Time Capsule” Mode: Curate playlists locked until specific future dates. Emotional time-delayed messages via music. Weddings, graduations, milestone birthdays. Viral social media potential.

- Carbon Credit Integration: Quantify CO₂ saved per device repurposed (manufacturing emissions avoided). Sell carbon credits to corporate ESG buyers. Additional revenue stream while reinforcing sustainability mission.

Technical Innovations:

- Adaptive Indexing Algorithm: Machine learning that optimizes scan patterns based on folder structure and past performance. Reduces initial indexing time by 30-50% after first scan.

- Distributed AI Training: Optional opt-in where anonymized listening patterns improve recommendation models across user base without centralized data collection. Federated learning approach.

- “Freeze Frame” Backups: Instant SD card snapshots that capture exact library state. Roll back to previous states after accidental deletions or corrupted metadata.

Go-to-Market Pivots:

- B2B2C Through Therapists/Coaches: Wellness professionals prescribe RetroAmp as “digital detox” homework. Professional endorsement drives consumer adoption. Revenue share on referrals.

- University Partnerships: Distribute to incoming freshmen as “focus device” during orientation. Studies show correlation between device usage and academic performance. University pays licensing fee, students get free device.

- Airport Retail Kiosks: Target business travelers in airport electronics stores. “Forget your charger? Buy a RetroAmp instead and save your phone battery.” Impulse purchase positioning.

Alternative Business Models:

- Freemium with Local Expert Network: Free app, premium unlocks, but also charge $50-200 for “concierge setup service” where local experts (think Geek Squad) configure devices for non-technical users. 70/30 split with experts.

- Subscription Content Bundles: $5/month for curated content packs (new release albums, audiobooks, educational content). Recurring revenue beyond premium subscriptions.

- Patent + Licensing Play: File patents on SD card profile management, on-device AI personalization, multi-card instant recognition. License technology to DAP manufacturers and car audio systems.

References:

- Grand View Research: Portable Media Player Market Analysis (2023-2030)

- Verified Market Reports: Portable Audio Player Market (2024-2033)

- Market Growth Reports: Refurbished and Used Mobile Phones Market (2024-2033)

- European Commission: E-Waste Statistics and Sustainability Impact

This is part of Ideas Snapshots — a collection of lightweight business blueprints, strategic outlines, and entrepreneurial prompts. Not every idea needs to be built. Some are meant to inspire, remix, or adapt.

What would you do differently with this idea? How would you adapt RetroAmp for a different vertical or market? Reply or share your take.