Preamble:

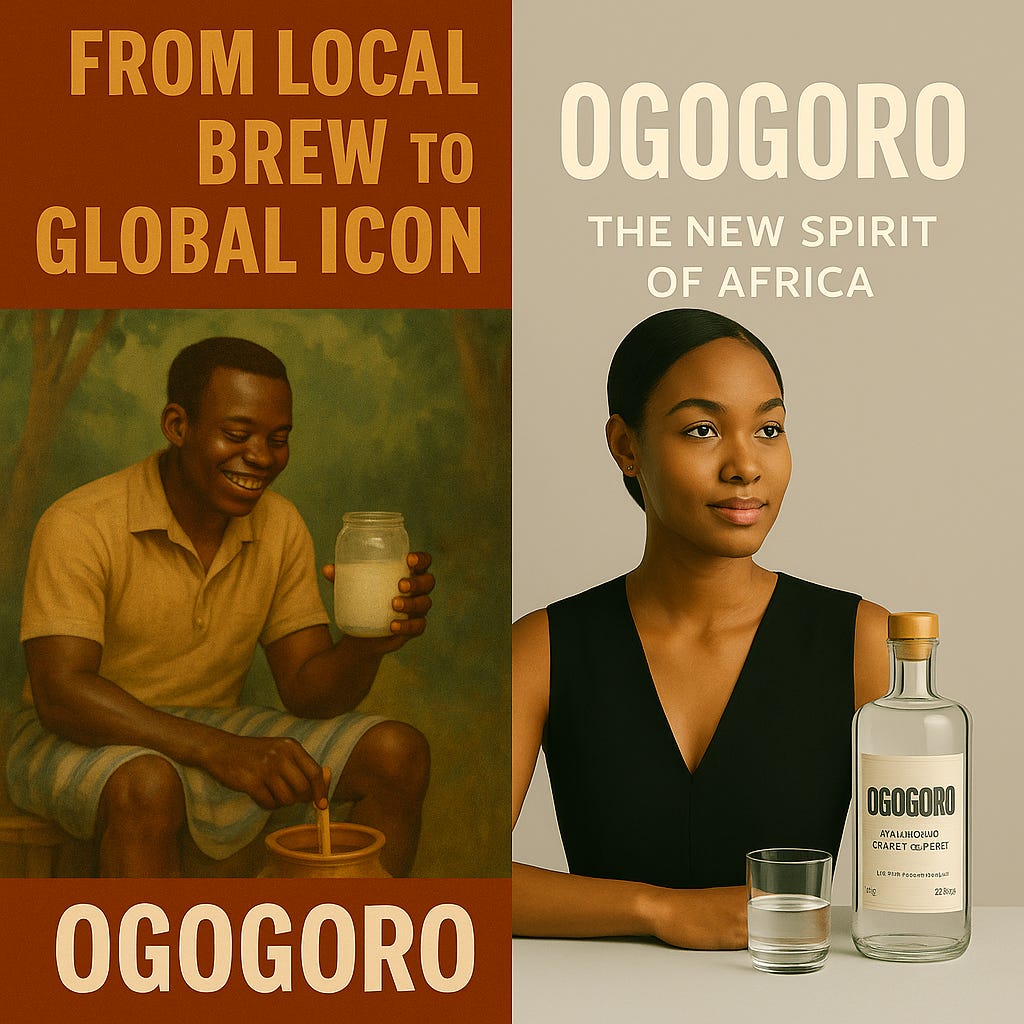

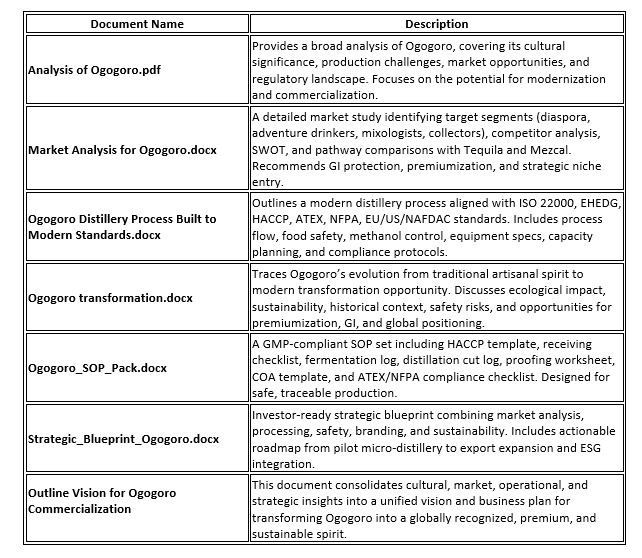

Building on the framework established in Building the Future of Food Part 1: A Global Superfood & Herbal Knowledge Platform, this second part shifts focus from food to beverage, presenting a comprehensive commercial strategy for Ogogoro. Known by many names across West Africa: Kai-kai, Sapele Water, Akpeteshie (Ghana), Sodabi (Benin) this traditional palm spirit represents a profound opportunity for economic development, cultural export, and market innovation. This document synthesizes a full suite of analytical and operational plans from market analysis and modern distillery design to safety protocols and strategic branding into a unified, actionable framework for transforming Ogogoro from a local informal product into a respected global spirit. The attached analysis provides the foundational roadmap for this transformation. Regard this post as a case study there are dozens of drinks listed below in Candidates: Spirits, wines and beers

As usual my stuff Ogogoro Artifacts

Market Size & Growth Potential:

- Global Craft Spirits Market: Valued at over $15 billion in 2022, with a CAGR of over 20%. This indicates a strong appetite for non-mainstream, artisanal spirits.

- African Spirits Market: Experiencing rapid growth, driven by a rising middle class and increasing disposable income.

- Ogogoro’s Current State: The formal, commercial market for exported, premium Ogogoro is virtually non-existent the 2-5 brands are at a nascent stage in comparison to probable market size . This represents a significant blue ocean opportunity. The entire challenge and potential lie in moving the product from the informal, local market to the formal, global stage.

- Outline marketing brief: Introducing Ogogoro

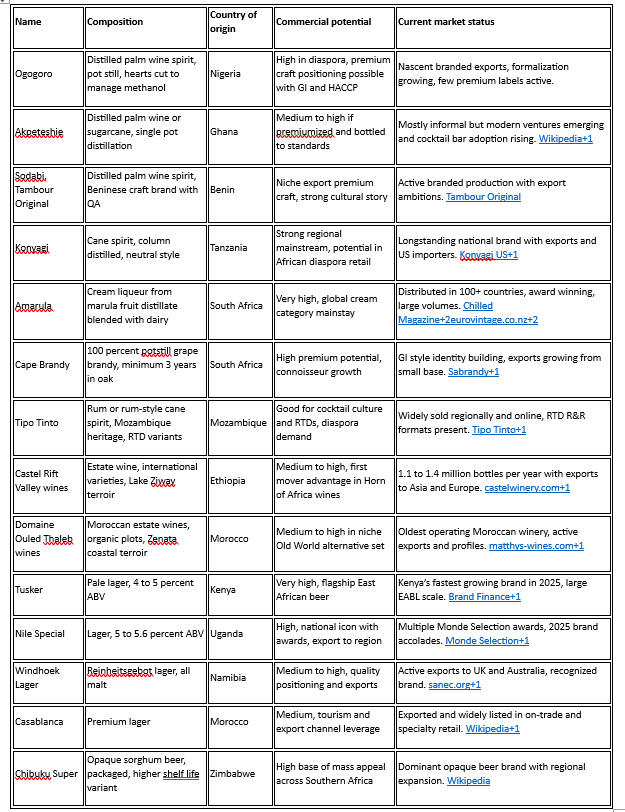

Candidates: Spirits, wines and beers

I have chosen Ogogoro but there is plethora of candidates this is a non-exhaustive list Outline wines spirit beer

Spirits

- Ogogoro, Nigeria. Distilled palm wine or sugarcane.

- Akpeteshie, Ghana. Distilled palm wine or sugarcane.

- Waragi, Uganda. Distilled banana, sugarcane, or grain. Local “banana gin.”

- Konyagi, Tanzania. Sugarcane spirit.

- Sodabi, Benin and Togo. Distilled palm wine.

- Lotoko, DRC. Distilled palm wine or maize.

- Kachasu, Zambia, Malawi, Mozambique, Zimbabwe. Distilled maize, sorghum, or fruit.

- Araki / Katikala, Ethiopia. Distilled from tella or other fermented grains, often with gesho.

- Boukha, Tunisia. Fig brandy.

- Mahia, Morocco. Fig or date spirit, often with anise.

- Mampoer, South Africa. Fruit brandy, often peach or apricot.

- Witblits, South Africa. Grape spirit, local grappa style.

- Amarula Cream, South Africa. Cream liqueur flavored with marula fruit, spirit base is local.

Wines and Honey Wines

- Tej, Ethiopia. Honey wine, flavored with gesho leaves or stems.

- Muratina, Kenya. Fermented drink from sausage tree fruit, often with honey or sugarcane.

- Date wine, North Africa and Sahel. Fermented dates.

- Banana wine (Tonto), Uganda and East Africa. Fermented ripe bananas.

- Palm wine (names include Emu, Mnazi, Toddy), West, Central, and East Africa. Fermented sap of palm trees.

Beers and Traditional Ferments

- Umqombothi, South Africa. Sorghum and maize beer.

- Burukutu, Nigeria and West Africa. Sorghum beer.

- Pito, Ghana and northern Nigeria. Millet or sorghum beer.

- Chibuku / Opaque beer, Zimbabwe, Botswana, Zambia. Sorghum or maize beer, commercially packaged.

- Dolo, Burkina Faso and West Africa. Millet beer.

- Merisa, Sudan. Sorghum beer.

- Tella, Ethiopia. Grain beer with gesho, home brewed.

- Bili-bili, Chad and CAR. Sorghum beer.

- Urwagwa, Rwanda and Burundi. Banana beer.

- Pombe, Tanzania and coastal East Africa. Banana or millet beer, local variants.

- Bouza, Egypt and Sudan. Ancient style grain beer, still found in local forms.

Semi developed

Unified Framework for the Commercialization of Ogogoro

1. Market Identification & Growth Analysis

Target Segments

- Diaspora consumers: Nigerians and West Africans abroad seeking cultural reconnection.

- Craft spirit explorers: Consumers of mezcal, baijiu, rum, or artisanal gins who prize novelty and heritage.

- Cultural mixologists: Bartenders and premium bars in Lagos, London, New York, and Johannesburg.

- Luxury collectors: Premium buyers who treat Ogogoro as a rare artisanal collectible.

Market Trends

- Global craft spirits valued at $15B (2022) with >20% CAGR.

- African spirits market growing with rising middle class demand.

- Tourism/hospitality in Nigeria and across Afro-fusion restaurants abroad presents experiential market entry.

Strategic Moves

- Establish Geographical Indication (GI) for “Nigerian Ogogoro” to protect origin and ensure authenticity.

- Adopt Tequila/Mezcal premiumization models with tiered offerings:

- Heritage Ogogoro (unaged, pure).

- Premium Aged (iroko or oak barrels).

- Limited Editions (single-village, infused).

2. Processing & Quality Assurance

Palm Sap Collection

- Source primarily from Raphia hookeri palms, using sustainable tapping that balances yield with forest regeneration.

- Introduce controlled farmer–distiller agreements to improve traceability.

Fermentation

- Use controlled yeast strains (Saccharomyces cerevisiae) in closed fermentation tanks with temperature regulation for consistency.

Distillation

- Replace unsafe lead-pipe setups with copper or stainless-steel alembic/pot stills.

- Apply fractional distillation to isolate heads, hearts, and tails.

- Standardize ABV at 40–50% to align with international spirits.

Finishing

- Activated carbon filtration for impurities.

- Optional barrel aging (local iroko, oak) to enhance flavor complexity.

3. Health & Safety Standards

Hazard Elimination

- Ban toxic additives (detergent, potash, chalk, bark).

- Phase out lead pipes, adopt food-grade materials throughout the process.

Regulatory Compliance

- Align with NAFDAC, Codex Alimentarius, EU and US FDA standards.

- Implement ISO 22000 / HACCP protocols for hygiene and traceability.

Testing

- Routine lab analysis of methanol, heavy metals, and microbial contaminants.

- Certification and third-party audits to build export credibility.

4. Marketing & Branding Strategy

Narrative Anchors

- Heritage: “The Spirit of the Palm” rooted in Nigerian tradition.

- Craftsmanship: Artisanal tapping, fermentation, and distillation.

- Taste: Tropical fruit, herbal, and woody undertones.

- Identity: Position Ogogoro alongside mezcal, cachaça, and rum in global premium categories.

Brand Tactics

- Premium packaging: Embossed bottles with cultural motifs.

- Storytelling campaigns: Tie into Nigerian music, arts, Nollywood, and festivals.

- Mixologist partnerships: Signature Ogogoro cocktails in elite bars.

- Tiered product lines: Heritage, Premium Aged, Infused (herbal/fruit).

Market Entry

- Begin with niche, high-end channels: Afro-fusion restaurants, premium cocktail bars, cultural festivals.

- Educate bartenders and spirits writers via tastings and ambassador programs.

5. Circularity & Sustainability Integration

Agroforestry & Regeneration

- Promote raffia palm cultivation in community-based agroforestry.

- Implement selective tapping to maintain palm regeneration.

Waste Valorization

- Use spent palm mash as animal feed or compost.

- Treat wastewater for irrigation reuse.

Energy

- Transition from firewood to biogas or agro-waste briquettes.

Community Benefit

- Adopt cooperative profit-sharing models with palm tappers and local farmers.

- Align supply chains with UN SDGs to attract impact investors.

6. Actionable Roadmap

- Pilot Micro-Distillery

- 500–1000L batch, copper stills, HACCP certified, export-ready.

- Certification & Protection

- Secure GI for Nigerian Ogogoro.

- Obtain NAFDAC, HACCP, ISO 22000, Fair Trade certifications.

- Flagship Brand Launch

- One premium Ogogoro SKU with heritage-driven packaging.

- Supported by mixology collaborations and storytelling campaigns.

- Scale & Diversify

- Expand to aged and infused lines.

- Partner with diaspora retailers in UK/US first, then global craft spirits distributors.

- Sustainability & Impact

- Implement community co-op models.

- Report ESG impact to attract global investors.

Conclusion:

The journey to commercialise Ogogoro is not merely a business venture; it is a project of cultural reclamation, quality elevation, and sustainable community development. By meticulously following the strategic blueprint outlined from securing Geographical Indication and implementing ISO 22000/HACCP-compliant production to launching a premium brand narrative and integrating circular economy principles stakeholders can successfully navigate the pathway to market pioneered by spirits like Tequila and Mezcal. This approach ensures that Ogogoro enters the global arena not as a novelty, but as a sophisticated, authentic, and competitive category in the premium craft spirits market. The ultimate goal is clear: to build a sustainable, high-value industry that honours tradition, ensures safety, commands premium prices, and shares its benefits with the communities at its heart, thereby building a true future for this iconic African spirit