Idea Snapshots — Brief, strategic glimpses into business possibilities. The social media landscape is fragmented: TikTok dominates short-form, YouTube owns depth, Spotify controls audio, and Pinterest curates visually. But what if one platform could seamlessly merge creation, discovery, and learning into a unified AI-powered ecosystem? Synapse reimagines social media not as an algorithm that feeds you content, but as an intelligent co-creation partner that adapts to your interests, personas, and creative aspirations. Instead of scrolling passively, users engage with ideas themselves following topics, remixing narratives across formats, and evolving from consumers into creators. Should the algorithm tell you the why of you FYP? I advice you chop this post up and extract value.

This isn’t about replacing TikTok. It’s about building what comes after: a platform where entertainment, education, and expression converge through AI-native architecture, ethical data ownership, and multi-sensory interfaces that reward curiosity over virality.

Is This New?

Originality Check:

· [X] Remix of existing concepts

· [X] Cross-domain adaptation

· [ ] Completely novel

· [ ] Niche specialization

Short-form video platforms, AI recommendation engines, and content creation tools all exist independently. What makes Synapse different is the synthesis: combining TikTok’s immediacy, YouTube’s depth, Spotify’s emotional sequencing, Pinterest’s visual curation, and conversational AI discovery into one adaptive ecosystem. The novelty lies in the AI Persona Feed (multiple contextual identities per user), Cross-Media Threads (remixable narrative chains across video, audio, text, and images), and Knowledge Graph Mode (visual mapping of content relationships)

Platforms like Instagram Reels, YouTube Shorts, Lemon8, and Triller compete in short-form video, but they’re feature additions to existing ecosystems—not purpose-built AI-native environments. Synapse positions as a category creator rather than a feature competitor, similar to how TikTok wasn’t just “another video app” but redefined engagement through algorithmic feeds.

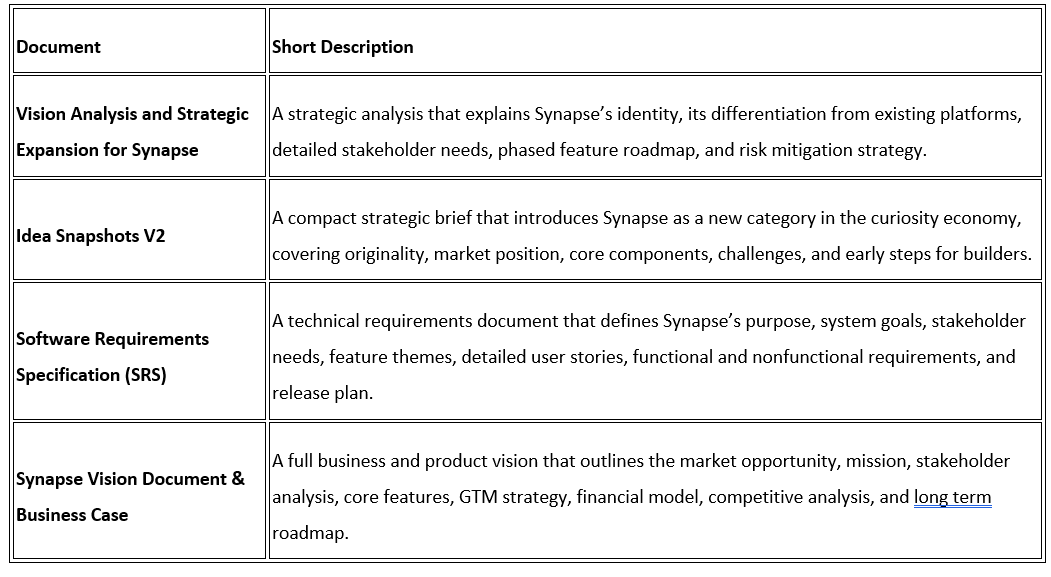

As usual outline documents see: Synapse

Here is a table that lists each document with a short, direct description of what it contains

Market Position

The Landscape

The global social media market reached $208.08 billion in 2025 and is projected to grow to $341.7 billion by 2029 at a 13.2% CAGR, driven by e-commerce integration, AR/VR adoption, short-form video dominance, and AI-powered personalization. With 5.44 billion social media users globally spending an average of 2 hours 21 minutes daily on platforms, the market is consolidated around Meta (Facebook, Instagram, WhatsApp), Google (YouTube), ByteDance (TikTok), and Snap.

TikTok’s ad reach stands at 1.56 billion users, with algorithmic feeds maintaining 2 hours 23 minutes average daily usage—unmatched by other formats. AI-powered recommendations now drive over 80% of content discovery, fundamentally reshaping user engagement. Competitors include Instagram Reels, YouTube Shorts, RedNote, Lemon8, Triller, Snapchat Spotlight, Clapper, and Kuaishou, each carving niche positions.

The Opportunity

The market is consolidated but fragmenting by use case. Users bounce between platforms: TikTok for entertainment, YouTube for depth, Spotify for audio, Pinterest for curation. This creates friction and cognitive load. Synapse enters as a unified experience layer that eliminates platform-hopping while introducing AI co-creation, ethical data ownership, and interest-based (not just people-based) discovery.

Key white spaces include:

· AI-assisted co-creation rooms for real-time collaborative editing

· Adaptive monetization rewarding education and influence, not just views

· Transparent data governance addressing privacy concerns that plague incumbents

· Cross-media narrative threading enabling remixable storytelling across formats

Virtual goods and gifting are expanding at 27.2% CAGR, outpacing traditional advertising, signaling opportunity for diversified revenue models.

The Scale

This doesn’t need to be a “TikTok killer” to succeed. A viable path targets 50-100 million active users within 3-5 years, capturing 2-3% of the AI-native Gen Z/Alpha demographic and knowledge-creator segment. Success looks like:

· $500M-$1B annual revenue from diversified streams: creator subscriptions, brand partnerships, virtual goods, data services, and API access

· Industry positioning as the ethical AI entertainment leader, attracting regulatory goodwill and ESG-focused investors

· Category definition rather than market share dominance—becoming synonymous with “AI-powered creation ecosystems”

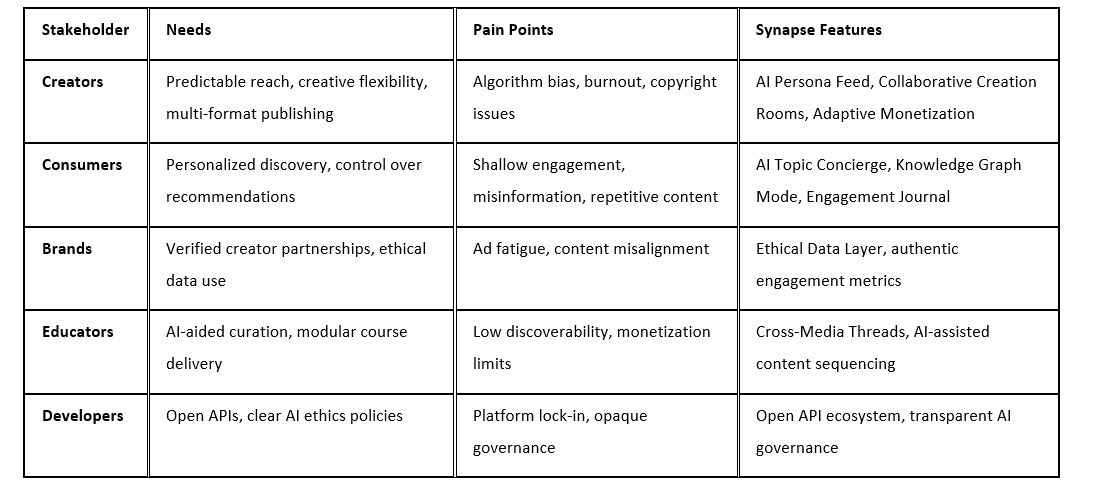

Stakeholder Ecosystem

References: TikTok (1.56B ad reach), Instagram Reels (largest competitor), YouTube Shorts (creator-friendly), Lemon8 (Pinterest-TikTok hybrid), Triller (AI editing tools), Clapper (17+ mature content), RedNote, Kuaishou

Product vs. Feature

The Test

This can stand alone as a product. While individual components (short-form video, AI recommendations, audio playlists) exist as features elsewhere, Synapse’s value proposition is the integrated architecture: AI Persona Feeds, Cross-Media Threads, Knowledge Graph Mode, and Collaborative Creation Rooms create a cohesive system that can’t be replicated by bolting features onto existing platforms.

Instagram Reels and YouTube Shorts prove that short-form video is easily copied as a feature. But Synapse’s differentiation lies in AI-native design from the ground up, not retrofitted algorithms on legacy architectures.

The Defense

Specialization: Position as the AI co-creation platform, not a content feed.[2]

Network effects: Knowledge Graph Mode creates interconnected content ecosystems that deepen with usage.

Community ownership: Ethical Data Layer and transparent monetization build trust and loyalty incumbents can’t match.

Speed: First-mover advantage in unified AI-powered creation ecosystems before Meta or Google can pivot legacy systems.

Positioning: Own the “post-TikTok” narrative as social media evolves from consumption to co-creation.

Core Components

What You’d Need

· AI/ML Infrastructure: Scalable recommendation engines, persona modeling systems, conversational AI (GPT-4/Claude-class), knowledge graph databases, real-time collaborative editing ML models

· Content Delivery Network: Global CDN for video/audio streaming, edge computing for low-latency co-creation, multi-format transcoding pipelines, adaptive bitrate streaming

· Product Team: AI engineers, UX designers (accessibility-first), video/audio codec specialists, community moderation systems, data privacy/compliance experts[2]

· Creator Ecosystem: Seed community of 1,000+ early adopters (educators, storytellers, AI artists), partnerships with music libraries and stock media, verified brand partnerships

· Capital: $20-50M Series A for infrastructure buildout, $100-200M Series B for market expansion and creator incentives

First Steps

1. Build MVP focused on AI Persona Feed and Cross-Media Threads — validate core differentiation before adding full feature set

2. Launch closed beta with 5,000 creators across 5 verticals (education, music, comedy, lifestyle, tech) to stress-test engagement models

3. Establish ethical data governance framework and publish transparency reports differentiate early on trust

4. Secure music licensing and media partnerships to avoid TikTok’s early content rights battles

5. Develop API ecosystem and partner onboarding for third-party tool integrations

The Contrarian View

Challenge This Idea

Network effects favor incumbents. Meta has 3 billion+ users across Facebook, Instagram, and WhatsApp; ByteDance has TikTok’s algorithmic moat; Google owns YouTube’s creator economy. Why would users abandon platforms where their audiences already exist? Platform fatigue is real—users are overwhelmed, not underserved. Adding another app increases cognitive load.[

Infrastructure costs are prohibitive. AI compute, video streaming, and content moderation at scale require hundreds of millions in capital before reaching profitability. Regulatory complexity is accelerating. GDPR, the EU AI Act, and data localization laws create compliance nightmares for global platforms. Creator monetization is unproven. Adaptive revenue sharing sounds appealing, but creators prioritize predictable income, not experimental models.

The “unified platform” premise may be flawed. Users might prefer specialized tools—TikTok for entertainment, Notion for knowledge management, Spotify for audio—rather than one generalist app. AI co-creation tools could cannibalize human creativity, raising ethical concerns and creator backlash.

Why It Might Still Work

Network effects can be overcome with superior product. TikTok proved this by outmaneuvering Facebook and Instagram despite their billion-user head starts. The key is 10x better engagement, not incremental improvement. AI Persona Feeds and Knowledge Graph Mode create qualitatively different experiences.

Platform fatigue creates switching opportunities. Instagram users already fragment across Reels, Stories, and Feed; TikTok users complain about algorithmic unpredictability. Synapse consolidates fragmented behaviors into one coherent environment, reducing cognitive load.

Infrastructure costs are dropping. Cloud AI compute is commoditizing; video CDNs are affordable at scale. Virtual goods revenue (27.2% CAGR) and creator subscriptions diversify income early. Regulatory positioning as “ethical AI” attracts investment and regulatory goodwill, offsetting compliance costs.[

Creators crave alternatives to algorithmic unpredictability. Adaptive monetization, transparent reach metrics, and AI co-creation tools address the #1 pain point: control. Early adopters will evangelize if the platform demonstrably solves creator frustrations.

Specialization is viable, but integration is higher-order value. Users tolerate platform-hopping because no alternative exists. If Synapse executes seamlessly, the convenience premium outweighs fragmentation. Think Notion replacing Word + Excel + Trello.

Cross-Domain Potential

If This Doesn’t Work Here

Enterprise knowledge management: Repackage AI Persona Feeds and Knowledge Graph Mode as internal tools for large organizations managing documentation, training content, and institutional knowledge.

Education technology: Focus exclusively on educators and learners, competing with Coursera/Udemy by adding social engagement and AI tutoring.

Healthcare/mental wellness: Adapt Cross-Media Threads for therapeutic journaling, guided meditation, and patient education with clinician oversight.

Nonprofit/activism: Build for mission-driven communities needing ethical data governance, transparent engagement metrics, and collaborative campaign tools.

B2B content marketing: Sell the platform architecture to enterprises wanting branded creator ecosystems (think Nike or Red Bull hosting internal creator communities).

Next Steps for Builders

If You Wanted to Pursue This

· Week 1: Conduct 50 interviews with creators, consumers, and educators across TikTok, YouTube, and emerging platforms to validate pain points; prototype wireframes for AI Persona Feed UX

· Month 1: Build functional MVP with one AI persona, basic video upload/playback, and simple recommendation engine; recruit 100 alpha testers from niche communities (AI artists, micro-educators)

· Quarter 1: Launch closed beta with 5,000 users; implement Cross-Media Threads and Engagement Journal; establish partnerships with 3 music libraries and 10 seed brands; publish ethical data framework

Resources to Explore

· Technical: OpenAI API (conversational discovery), Mux (video infrastructure), Neo4j (knowledge graph database), Cloudflare Stream (global CDN), Hugging Face (open-source ML models)

· Market research: ByteDance’s algorithmic feed patents, TikTok Creator Fund economics, Instagram Reels monetization reports, Spotify’s personalization research papers

· Case studies: Discord (community-first growth), Substack (creator-owned monetization), Notion (unified workspace adoption), BeReal (anti-algorithmic virality)

· Competitive intelligence: Track Lemon8’s U.S. expansion, Triller’s ex-TikTok executive moves, YouTube Shorts’ creator incentive programs, Instagram’s AI experiments

Regulatory and Ethical Considerations

Data sovereignty and localization: GDPR (EU), CCPA (California), and China’s Personal Information Protection Law require region-specific data handling, increasing operational complexity but offering differentiation through transparent compliance.[2]

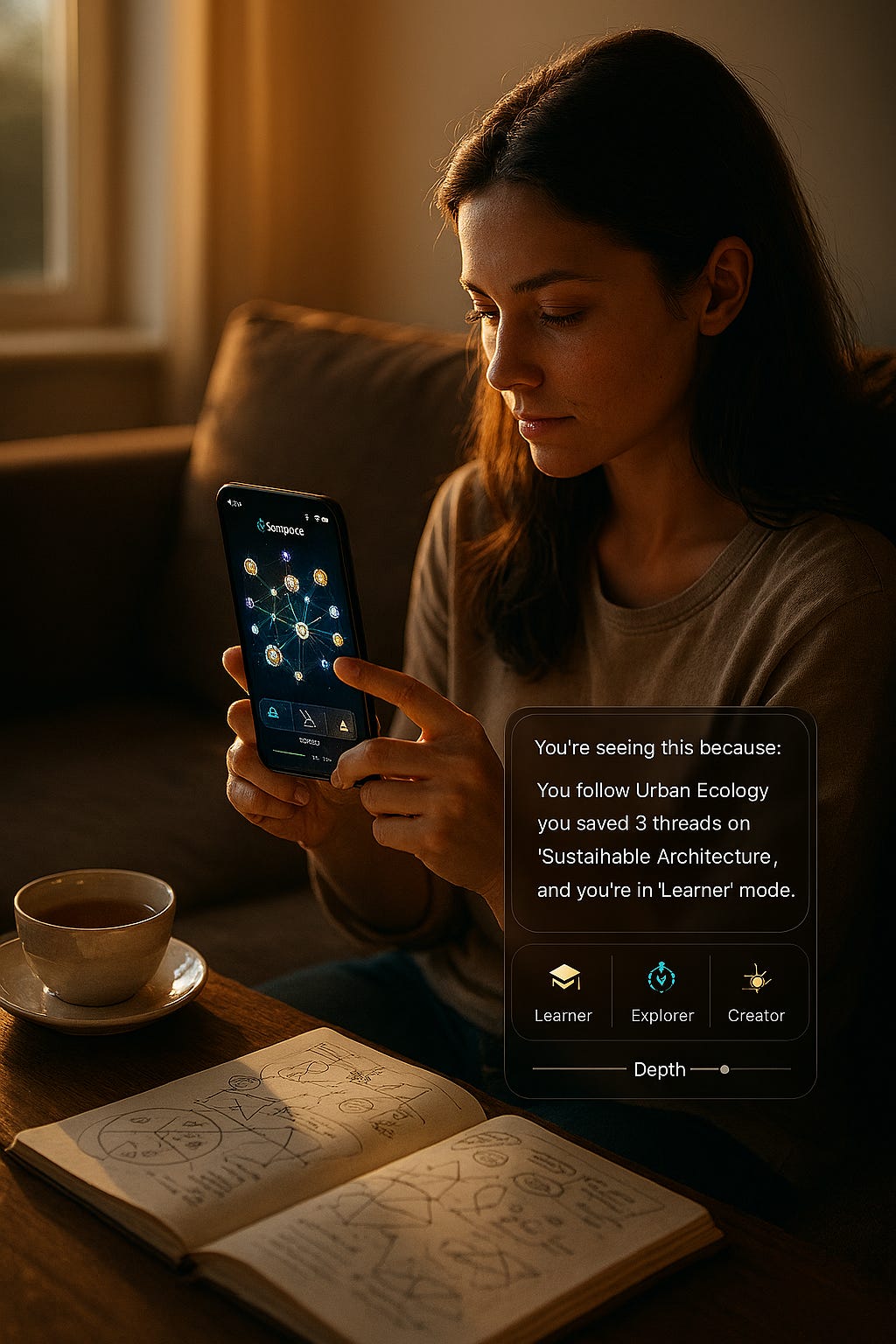

AI ethics and algorithmic accountability: The EU AI Act classifies social media recommendation systems as “high-risk,” mandating explainability, bias audits, and human oversight. Synapse’s Ethical Data Layer positions early compliance as a feature, not a burden.[8][2]

Content moderation at scale: AI-powered moderation reduces costs but raises accuracy concerns; hybrid human-AI systems balance safety and free expression. Community-driven reporting and transparent appeals processes build trust.

Intellectual property and creator rights: Music licensing, copyright strikes, and AI-generated content ownership require proactive legal frameworks. Adaptive Monetization tied to verified content provenance mitigates disputes.

Technical Architecture and Scalability

Microservices design: Separate services for video processing, recommendation engines, knowledge graph updates, and real-time collaboration enable independent scaling and feature iteration.

Edge computing for co-creation: Deploying compute closer to users reduces latency in Collaborative Creation Rooms, critical for real-time editing and haptic feedback.

Federated learning for privacy: Train recommendation models on-device where possible, syncing only anonymized gradients to central servers enhancing privacy while maintaining personalization quality.[

Multi-modal AI pipelines: Unified models processing video, audio, text, and image simultaneously (e.g., OpenAI’s GPT-4V, Google’s Gemini) enable seamless Cross-Media Thread generation without format silos.

Go-to-Market Strategy

Phase 1 (Months 1-6): Niche Domination — Target AI artists, micro-educators, and knowledge curators dissatisfied with TikTok’s entertainment focus and YouTube’s legacy interface. Build word-of-mouth through hyper-responsive product development.

Phase 2 (Months 7-12): Creator Incentives — Launch invite-only creator fund with transparent revenue sharing (50/50 split vs. TikTok’s opaque model). Partner with 50 mid-tier influencers (100K-1M followers) for cross-promotion.

Phase 3 (Year 2): Viral Moments — Engineer shareable “Knowledge Graph” visualizations showing content ecosystems; enable remixing of Cross-Media Threads to drive network effects. Secure tentpole partnerships (e.g., education nonprofits, indie music labels).

Phase 4 (Year 3+): Platform Maturity — Open API ecosystem for third-party developers; introduce premium tiers (ad-free, advanced analytics, priority support); explore white-label licensing for enterprises.

Financial Projections and Unit Economics

Revenue streams (Year 3 target):

· Creator subscriptions (20% of revenue): $1-10/month tiers for analytics, priority support, AI compute credits

· Brand partnerships (35% of revenue): Native integrations, sponsored AI personas, branded creation rooms

· Virtual goods and gifting (25% of revenue): Tipping, badges, exclusive content unlocks

· Data services (10% of revenue): Anonymized insights, trend forecasting, API access for researchers

· Advertising (10% of revenue): Non-intrusive contextual ads, ethical targeting

Cost structure:

· Infrastructure (40%): AI compute, CDN, storage, edge computing

· Personnel (35%): Engineering, moderation, community management

· Marketing (15%): Creator incentives, partnerships, brand awareness

· Compliance (10%): Legal, data privacy, content rights

Break-even: 20-30 million active users at 2-3% conversion to paid tiers, achievable by Year 4 with $150-250M total capital raised.[

Final Thoughts

Synapse represents a bet on post-algorithmic social media—where platforms don’t just feed content but co-create it alongside users, rewarding curiosity and depth over virality and dopamine loops. The technical components exist today; the challenge is integration and timing. If TikTok taught us that algorithmic feeds could redefine engagement, Synapse asks: what if algorithms became collaborators, not gatekeepers?

The market is ripe. Social media is consolidating yet fragmenting, users are fatigued yet addicted, creators are empowered yet exploited. A platform that solves for control, transparency, and co-creation doesn’t need to beat TikTok—it needs to build what TikTok can’t.

Alternative takes:

· Enterprise-first pivot: Launch internally for Fortune 500 knowledge management before consumer rollout

· Nonprofit/activism focus: Build exclusively for mission-driven communities with grant funding, avoiding VC pressures

· Decentralized/Web3 version: Use blockchain for creator ownership and transparent revenue sharing, though adds complexity and regulatory risk

· Niche vertical: Focus solely on education tech or indie music, dominating one category before expanding

This is part of Ideas Snapshots — a collection of lightweight business blueprints, strategic outlines, and entrepreneurial prompts. Not every idea needs to be built. Some are meant to inspire, remix, or adapt.

What would you do differently with this idea? Reply or share your take.