Preamble

Imagine the potential to reimagine underused malls and town centres as vibrant hubs for immersive technology—powered by AI, AR, and VR. These spaces could host experiential environments, collaborative labs, and social tech lounges that spark curiosity and early adoption.

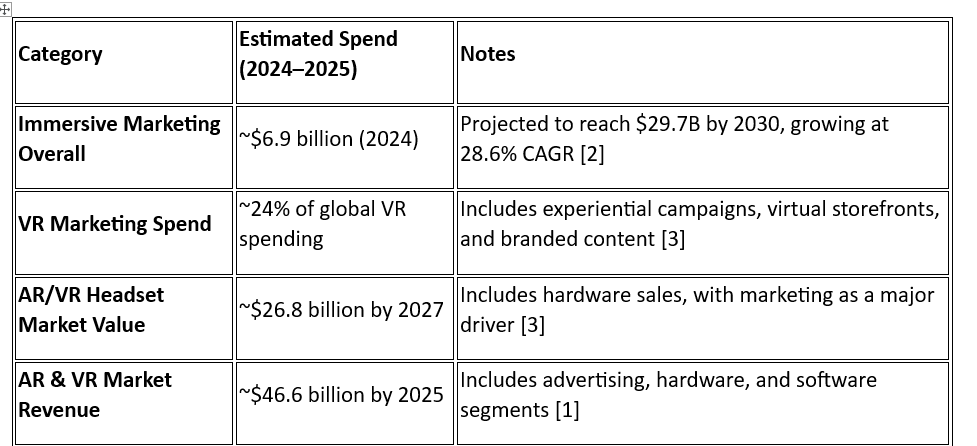

While history reminds us of the limited lifespan of cyber cafés, what if we approached this differently? If just 5–10% of the estimated global marketing spend on AR/VR headsets and environments were redirected toward building these physical tech playgrounds, could we shift the narrative?

This modest investment could catalyse:

- New business models rooted in experiential retail, education, and entertainment

- Community engagement through localized immersive content

- Creator economies with rentable studios and AI-enhanced production tools

- Global tech trials that connect users with innovators in real time

By anchoring innovation in tangible, human-scaled environments (as prequel to home adoption) , we might not only accelerate adoption but also uncover new commercial and cultural value in spaces once considered obsolete. This is a short to medium term strategy. I have written a Vision and Business Case for the New Immersive Shared Tech Spaces in this post. Allocating a portion of marketing budgets offers a compelling model for other tech producers to engage with new emerging spaces, whether through direct investment, pooled resources, usability testing, in-person feedback, collaborative initiatives, branding, or sponsorship. The return on this targeted spend could be tracked through new, tangible performance indicators.

A 5-Year Spend with Peak, Reuse, and Transformation: Is It Worth It?

Why It Could Be Worthwhile

- Early Adoption Advantage: Captures the curiosity and momentum of emerging tech (AI, AR, VR) while it’s still novel.

- Brand & Community Building: Creates memorable experiences that build loyalty, especially in underserved or culturally rich areas.

- Multi-use Flexibility: Spaces can evolve—from immersive gaming to creator studios, pop-up retail, or educational labs.

- Proof-of-Concept for Future Models: Even if the space doesn’t last forever, it can validate new formats for tech engagement and experiential commerce.

Risks & Realities

- Tech Obsolescence: Hardware and platforms evolve fast—what’s cutting-edge today may feel dated in 3 years.

- Cultural Shifts: Social habits change; what draws crowds now may not later (as seen with cyber cafés).

- Operational Costs: Staffing, maintenance, and content refreshes can eat into ROI if not carefully managed.

How to Make It Sustainable

- Design for Modularity: Spaces that can be reconfigured for different uses—concerts, esports, education, retail—extend lifespan.

- Localisation & Seasonal Programming: Tailor content to local culture and rotate themes to stay fresh.

- Data-Driven Iteration: Use AI to track engagement and adapt offerings in real time.

- Exit Strategy Built-In: Plan for transformation into co-working, creator hubs, or resale spaces after peak use.

If you divert 5–10% of global AR/VR marketing spend (roughly $350M–$700M over 5 years), even a fraction of that could seed dozens of pilot spaces globally. The key is not permanence—but impact, adaptability, and legacy

Estimated Marketing Spend on AR/VR Headsets & Environments

Key Insights

- Immersive marketing—which includes AR/VR campaigns, branded experiences, and interactive ads—is growing rapidly, especially in retail, fashion, and entertainment.

- Hardware marketing (for headsets and glasses) accounts for nearly half of immersive marketing spend, driven by product launches and experiential demos.

- Social media platforms with AR filters and influencer-led VR content are fueling growth, making marketing spend more distributed across channels.

- Experiential environments like pop-ups, esports lounges, and virtual concerts are increasingly used as marketing tools, blending product promotion with immersive storytelling.

Sources & References

1. Statista – AR & VR Market Forecast (Worldwide)

o Projects global AR/VR market revenue to reach $46.6 billion by 2025, with significant portions allocated to advertising and immersive content.

2. Grand View Research – Immersive Marketing Market Report (2024–2030)

o Estimates immersive marketing spend at $6.9 billion in 2024, projected to grow to $29.68 billion by 2030 at a CAGR of 28.6%.

o Highlights hardware (headsets, glasses) as the largest segment, accounting for over 48% of spend.

3. Social Peak Media – AR/VR Marketing Guide (2025)

o Details how brands use AR/VR for virtual try-ons, immersive tours, and interactive campaigns.

o Emphasizes the role of social media, influencer content, and experiential marketing in driving adoption.

What was the short history and current state of cyber cafes and gaming spaces ( The Rise and Fall of the Cyber Café ) and The Typology of Future Immersive Space Archetypes (non-exhaustive list)

Here is a mapped-out typology of future immersive space archetypes.

1. Tourism Labs

Purpose: Provide immersive cultural travel and heritage experiences.

Features

- Location-based VR/AR with local storytelling (heritage VR in Nigeria, anime VR in Japan).

- Hybrid travel booking + demo centers (try the tour in VR before booking).

- Partner with museums, tourism boards, and airlines.

Revenue Model - Pay-per-experience.

- Brand sponsorship from tourism boards and airlines.

- Retail add-ons: local crafts, food popups.

2. Performance Hubs

Purpose: Serve as the new arena for concerts, esports, and hybrid cultural events.

Features

- Immersive concerts with holographic performers.

- Esports arenas with multiplayer rigs and live streaming.

- Event broadcasting + VIP lounges.

Revenue Model - Ticketing (physical + virtual attendance).

- Food and beverage.

- Sponsorships (brands, game publishers, artists).

- Hybrid memberships (access to live + digital streams).

3. Co-Play Cafés

Purpose: Social hubs blending gaming, casual entertainment, and community gathering.

Features

- Mixed zones: console lounges, tabletop + digital integration, streaming booths.

- Nightclub-style immersive events (global socialisation).

- Food and drink as core revenue complement.

Revenue Model - Hourly PC/console rentals.

- Membership packages with discounts and loyalty perks.

- Food and beverage.

- Group packages (birthdays, school events).

4. Creative Testbeds

Purpose: Environments for creators, startups, and learners to test emerging tech.

Features

- Studios for AI-augmented short films, immersive portraiture, VR/AR production.

- Hire robotics + AV personnel on demand.

- Flexible studio hire (hourly or project basis).

Revenue Model - Studio hire fees.

- Service bundles (recording, editing, post-production).

- Partnerships with schools, incubators, and NGOs.

- Sponsorship from tech firms to showcase devices.

5. Tech Trial Arenas

Purpose: Spaces for testing, launching, and showcasing new technology.

Features

- Popups for product demos (phones, wearables, XR rigs).

- Interactive consumer feedback labs.

- Integration with brand experience lounges.

- User experience hubs to test new or use new tech see : China is living in the future – WORLD’S most advanced city . This might be useful for other countries tech companies to showcase their tech between trade fairs and product launches.

Revenue Model - Sponsorship from tech firms.

- Pay-to-demo events.

- Data partnerships (feedback analytics).

6. Hybrid Service Hubs

Purpose: Carry forward the “utility” role of cyber cafés.

Features

- Printing, scanning, digital services alongside immersive pods.

- Co-working booths for remote workers.

- Secure short-term access for travelers and migrants.

Revenue Model - Service fees (per page, per session).

- Subscriptions (remote work passes).

- Ancillary fintech services (bill pay, money transfers).

Business Model Design: Lessons from Cyber Café History

- Don’t compete on access alone

Access is abundant via personal devices. Value must come from experience, immersion, and community. - Diversify revenue streams

Successful cyber cafés stacked revenue (services, gaming, food, fintech). Modern spaces must do the same with events, memberships, F&B, sponsorships, studio hire, merchandise. - Design for modularity and short lifecycles

Tech obsolescence is fast. Spaces should be modular, upgradeable, and adaptable to 3–5 year maturity cycles. - Anchor in local culture

Localization drives adoption. Anime VR in Japan, football AR in Brazil, Nollywood VR in Nigeria—spaces resonate more when themed with local identity. - Community as moat

Unlike hardware, communities cannot be easily replicated. Events, leagues, learning cohorts, and creative residencies keep loyalty high. - Blend consumption and creation

Cyber cafés were consumption-heavy. Future hubs succeed by letting users both experience and create—film shorts, immersive portraits, AI co-productions. - Hybrid physical–digital reach

Extend the space through apps and cloud services (AI-assisted learning, streaming of events) to scale reach beyond physical footfall.

Vision and Business Case: New Immersive Shared Tech Spaces

1. Vision and Scope

The project explores whether shared immersive technology environments (VR/AR/holographic suites, hybrid AI-enabled labs, collective co-experience hubs) can become the new cybercafés of the 21st century.

Scope

- Create spaces where people access technologies not yet common at home (VR, AR, holographic rooms, AI collaborative tools).

- Serve as transitionary infrastructure that accelerates adoption, builds culture, and tests commercial viability.

- Operate on 3–5 year cycles, matching tech maturity curves, before obsolescence or consolidation.

- Blend entertainment, learning, and brand experience.

2. Stakeholders, Features, Needs

Primary Stakeholders

- Early adopters: Gamers, creators, innovators seeking frontier experiences.

- Brands: Tech firms (Meta, Apple, Sony) needing adoption environments.

- Educators/NGOs: Schools, universities, NGOs needing shared access for training.

- Tourists/Travelers: Looking for unique immersive experiences.

- Investors/Entrepreneurs: Seeking short-cycle, high-return ventures.

Features and Needs

- Novel uses: Immersive tourism, hybrid concerts, esports, collaborative AI-driven learning labs.

- Watching old media: Small spaces for viewing old films and media in an immersive environment beyond 3d augmented by AI surround

- AI Integration: Smart user matching, adaptive learning, auto-generated immersive content.

- Localisation: Tailoring spaces across countries (anime-themed VR in Japan, football-themed AR in Brazil, heritage VR in Nigeria).

- Cross-over uses: Retail (immersive product launches), healthcare (rehab VR), education (STEM labs).

- Software capability: Use templates to auto-generate business docs (SRS, financial models, specs).

- Socialisation: immersive experience attending event around the world with services such as attending a night club or event in another country but you have space , interaction with other attendees, services e.g. drink beverages etc and is human scaled .

- Tech launching, testing and trials : a place to trial all type of new tech and also talk to creators and interaction worldwide

- Creator environment: learning environment of new tech and Space for short term hire with resources: People , AI and robotics as AV personnel for setup recording and for post production that can be hire for an hour or longer as the studio of tomorrow with custom programable immersive environments.

- Immersive environment personal film and portraiture: people can walk off the street an take photo immersive environment or select location etc taken with latest high resolution sent to mobile app or email with different backgrounds and formats.

· Short film creation: if you have a script using the environment you can create sort ai augmented shorts which might be difficult at home or expensive

· The pop up: enable the ability to create popup with immersive environments, food clothes etc.

3. Use Cases

- Immersive Cinema Pods – Shared 4D/5D experiences.

- VR/AR Arenas – Multiplayer, esports-grade hybrid arenas.

- AI-Enabled Labs – Co-working, design, and training hubs with AI copilots.

- Brand Experience Labs – Sponsored access to devices and holographic rooms.

- Cross-industry pilots – Tourism + retail (VR shopping), education + gaming (STEM esports).

4. Market and Competitor Research

Competitors

- Esports arenas (focused only on gaming).

- VR arcades (often underfunded, single-use entertainment).

- Co-working hubs (productivity focus, not immersive).

Gap: Few hybrid models integrate entertainment, work, and cultural adoption with AI and localisation.

Market Drivers

- Rising VR/AR spending (global XR market > $100B by 2030).

- Brand push for adoption (Meta, Apple, Samsung).

- Cultural appetite for immersive experiences.

5. Strategic Analyses

SWOT

- Strengths: Novelty, collective experience, brand sponsorship.

- Weaknesses: High CapEx, short shelf life, rapid obsolescence.

- Opportunities: Early adopter culture, cross-industry demand, localisation.

- Threats: Cheaper home devices, cultural rejection, high opex.

PESTLE

- Political: Local licensing, KYC rules for gaming.

- Economic: High upfront costs, but tourism and brand sponsorship mitigate.

- Social: Collective experiences vs isolation.

- Technological: VR/AR/holographic maturity curves.

- Legal: IP for immersive content, copyright in AI-generated media.

- Environmental: Energy use and e-waste management.

Porter’s Five Forces

- High supplier power (device makers).

- Moderate buyer power (consumers sensitive to price).

- Threat of substitutes high (home VR, consoles).

- Low barriers for niche VR arcades, but scale hubs need more capital.

- Rivalry moderate; differentiation possible through localisation and hybrid models.

6. Financial Model (Illustrative)

CapEx

- 20 VR rigs + furniture + networking: $100K.

- Holographic suite: $150K.

- Fit-out + branding: $50K.

OpEx (monthly)

- Rent: $5K.

- Staff: $8K.

- Internet + utilities: $2K.

- Maintenance + consumables: $2K.

- Total: ~$17K.

Revenue Streams

- Memberships ($50–100/month).

- Hourly fees ($5–20 depending on device).

- Sponsored labs (brands).

- Events and tournaments.

- Ancillary sales (snacks, peripherals).

ROI

- Break-even in 24–30 months with 60% seat occupancy.

7. Risk Profile and Mitigation

- Obsolescence: Design modular spaces; lease instead of buy hardware.

- Regulation/IP: Early legal reviews of AI-generated and immersive content.

- Adoption gap: Secure brand sponsorship to subsidize initial adoption.

- Cultural mismatch: Localise content and themes.

- Financial risk: Use flexible leases, partnerships with malls/universities.

8. Contrarian and Gap Analysis

Contrarian View

- People already own devices; why travel to a hub?

- Answer: Only collective immersion and professional-grade tools justify leaving home.

Gap

- Lack of integrated AI-matching (users to content, skills, events).

- Few models treat hubs as short-term transitionary infrastructure instead of permanent businesses.

9. Implementation Roadmap

Phase 1: Pilot (6–12 months)

- One urban location.

- Focus on immersive cinema + VR arenas.

- Collect user adoption data.

Phase 2: Scale (2–3 years)

- Expand to 5–10 cities.

- Add AI-driven user matching and training.

- Build cross-country cultural hubs.

Phase 3: Consolidate (3–5 years)

- Transition from physical hubs to hybrid physical-digital services.

- Sell or pivot as tech adoption moves home.

10. Human Factors and Usability

- Accessibility (wheelchair-friendly immersive pods).

- Multi-language support for global users.

- AI onboarding to reduce cognitive load.

- Consider health (motion sickness, sensory overload).

11. Intellectual Property

- AI-generated immersive content may have copyright ambiguity.

- Need contracts clarifying ownership of co-created experiences.

- Protect branding and unique localisation templates.

12. Investment and Locality Search Criteria

- High youth density, strong gaming/tech culture (Seoul, Lagos, São Paulo, London).

- Anchor near schools, universities, and malls.

- Use localised themes (anime, K-pop, football, Nollywood).

13. Conclusion

The “New Spaces” concept is not a long-term infrastructure play but a frontier business opportunity with short to medium shelf life. If executed with AI integration, localisation, and brand partnerships, these hubs can:

- Accelerate immersive tech adoption.

- Build cultural rituals around new technologies.

- Deliver strong but time-bound ROI.